- Sweden

- /

- Healthcare Services

- /

- OM:ATT

3 Growth Companies Insiders Are Betting On

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are closely monitoring policy shifts that could impact growth and inflation expectations. Amidst this backdrop of economic optimism and uncertainty, companies with high insider ownership often attract attention as insiders' confidence in their own businesses can signal potential resilience and growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 32% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

Attendo (OM:ATT)

Simply Wall St Growth Rating: ★★★★☆☆

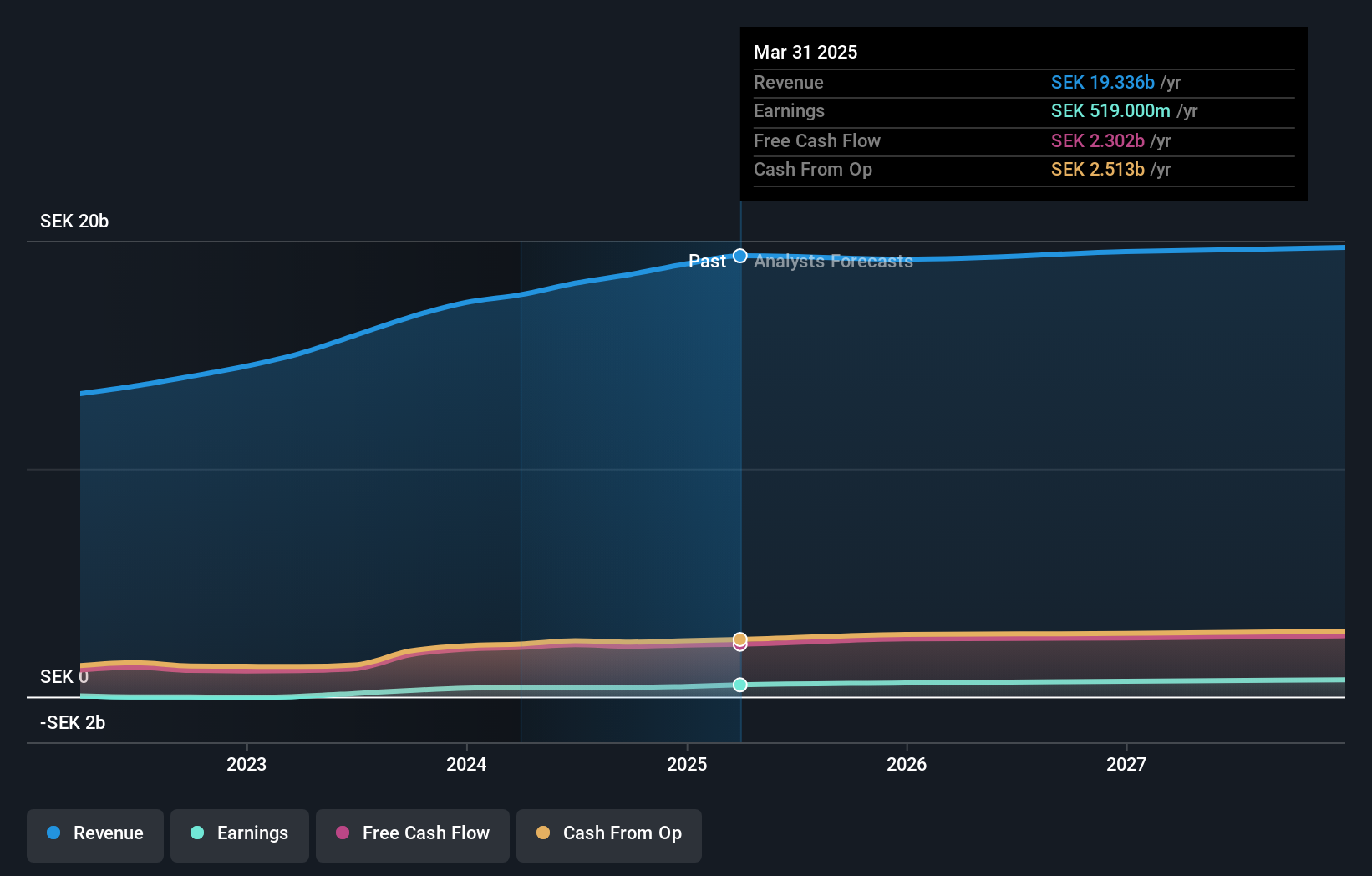

Overview: Attendo AB (publ) offers health and care services across Scandinavia and Finland, with a market cap of SEK7.65 billion.

Operations: The company's revenue segment is Care and Health Care Services, generating SEK18.52 billion.

Insider Ownership: 15.3%

Earnings Growth Forecast: 25.4% p.a.

Attendo's earnings are forecast to grow significantly at 25.4% annually, outpacing the Swedish market's 15.6%. Despite this, revenue growth is slower at 5.7% per year but still above the market average of 0.07%. Recent insider trading shows more shares bought than sold, though not substantially. The company's stock trades well below its estimated fair value, yet it struggles with interest coverage and has an unstable dividend history.

- Click here and access our complete growth analysis report to understand the dynamics of Attendo.

- In light of our recent valuation report, it seems possible that Attendo is trading behind its estimated value.

Shenzhen LihexingLtd (SZSE:301013)

Simply Wall St Growth Rating: ★★★★★☆

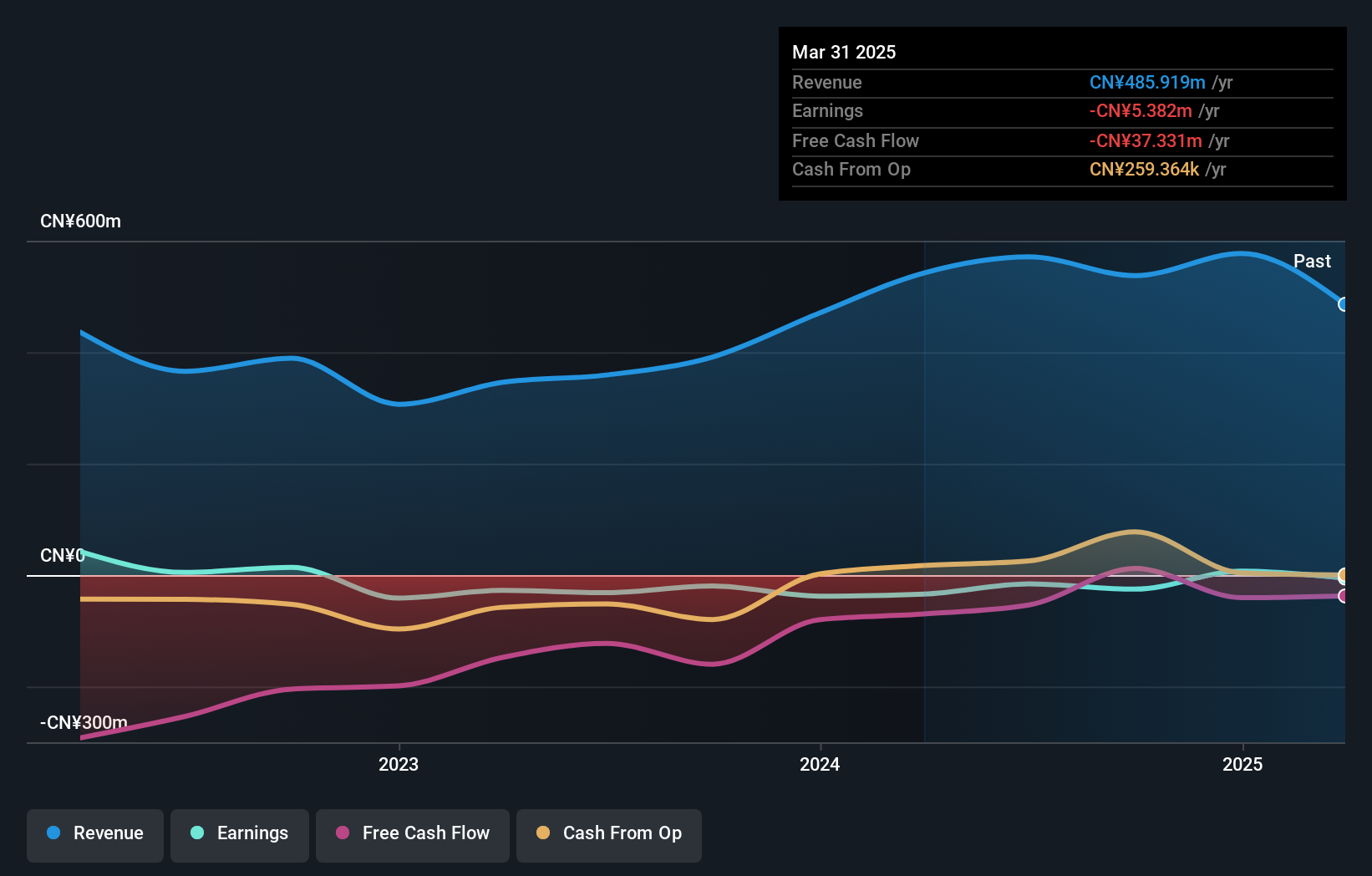

Overview: Shenzhen Lihexing Co., Ltd. focuses on the research, development, production, and sale of automation and intelligent equipment for the information and communication technology industry in China, with a market cap of CN¥3.25 billion.

Operations: Shenzhen Lihexing Co., Ltd. generates its revenue primarily from the research, development, production, and sale of automation and intelligent equipment within the information and communication technology sector in China.

Insider Ownership: 25.7%

Earnings Growth Forecast: 67.6% p.a.

Shenzhen Lihexing Ltd. is poised for substantial growth, with earnings forecasted to increase by 67.56% annually and revenue expected to rise 33.6% per year, surpassing the Chinese market's average growth rate of 14%. Recent financial results show a significant improvement, with net income reaching CNY 15.32 million for the first nine months of 2024 compared to CNY 2.88 million last year. However, its debt coverage remains inadequate and share price volatility persists.

- Delve into the full analysis future growth report here for a deeper understanding of Shenzhen LihexingLtd.

- In light of our recent valuation report, it seems possible that Shenzhen LihexingLtd is trading beyond its estimated value.

GuangDong Suqun New MaterialLtd (SZSE:301489)

Simply Wall St Growth Rating: ★★★★★☆

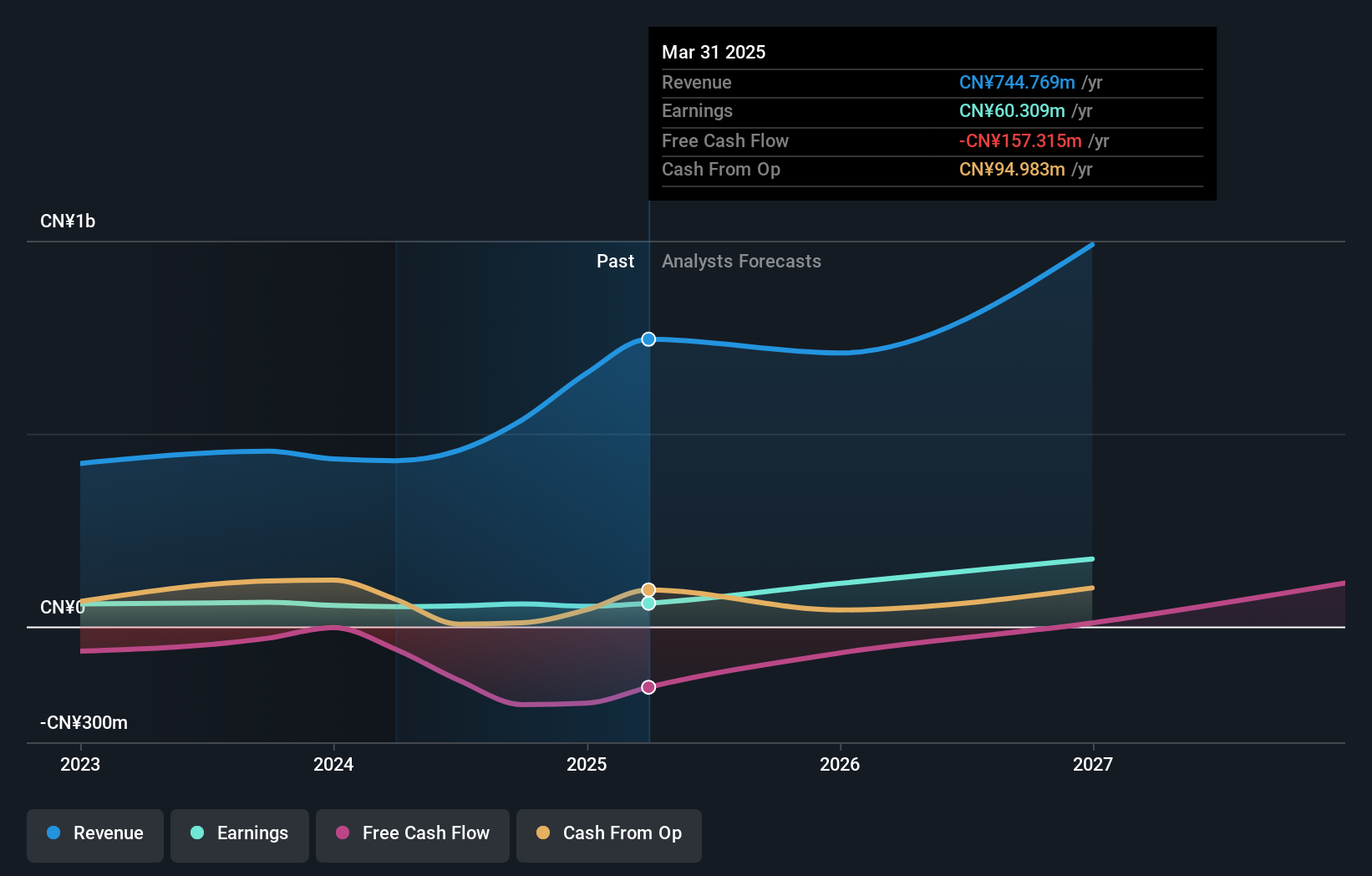

Overview: GuangDong Suqun New Material Co., Ltd. is involved in the research, development, production, and sale of functional materials in China with a market cap of CN¥3.84 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 37.9%

Earnings Growth Forecast: 47.1% p.a.

GuangDong Suqun New Material Ltd. is positioned for robust growth, with earnings projected to increase by 47.1% annually, outpacing the Chinese market's average of 26.4%. Revenue is also expected to grow significantly at 31.5% per year. Despite trading slightly below its estimated fair value, recent earnings reports show mixed results; nine-month revenue rose to CNY 424.52 million from CNY 322.57 million, but net income saw only a modest increase and EPS declined slightly compared to last year.

- Navigate through the intricacies of GuangDong Suqun New MaterialLtd with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report GuangDong Suqun New MaterialLtd implies its share price may be too high.

Next Steps

- Unlock our comprehensive list of 1522 Fast Growing Companies With High Insider Ownership by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Attendo, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ATT

Good value with reasonable growth potential.