- China

- /

- Household Products

- /

- SHSE:600651

Discovering None's Hidden Opportunities With 3 Promising Small Caps

Reviewed by Simply Wall St

As global markets edge toward record highs, small-cap stocks have been trailing behind their larger counterparts, with the Russell 2000 Index lagging the S&P 500 by a notable margin. Amidst rising inflation and volatile Treasury yields, investors are increasingly seeking opportunities in smaller companies that may offer unique growth potential despite broader market uncertainties. In this environment, identifying promising small caps involves looking for those with strong fundamentals and resilience to navigate economic fluctuations effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Wema Bank | 45.02% | 36.14% | 60.04% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Malam - Team | 102.85% | 10.82% | -10.47% | ★★★★☆☆ |

| Konya Kagit Sanayi ve Ticaret | 0.67% | 24.97% | 7.82% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Shanghai Feilo AcousticsLtd (SHSE:600651)

Simply Wall St Value Rating: ★★★★☆☆

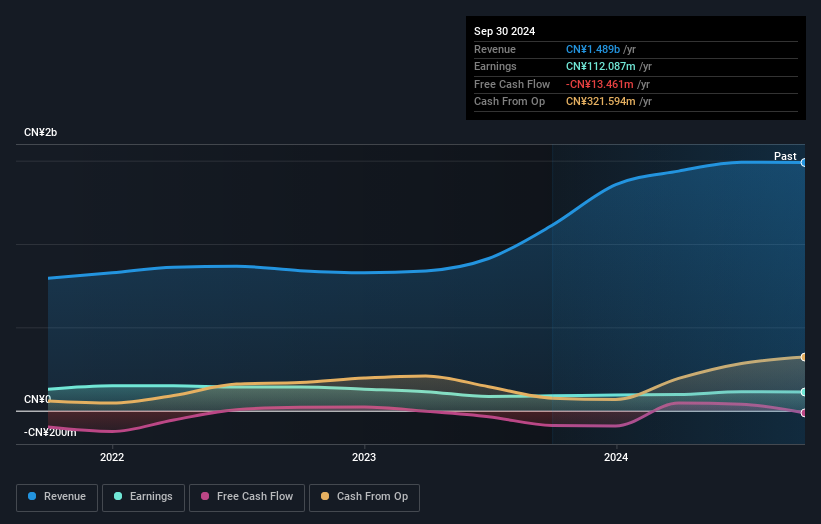

Overview: Shanghai Feilo Acoustics Co., Ltd is engaged in the lighting, automotive electronics, and module packaging and chip testing service sectors both within China and internationally, with a market capitalization of approximately CN¥11.01 billion.

Operations: Feilo Acoustics generates revenue through its operations in lighting, automotive electronics, and module packaging and chip testing services. It reported a gross profit margin of 20.5%.

Feilo Acoustics, a smaller player in the market, showcases an intriguing financial landscape. The company has more cash than its total debt and has turned around from negative shareholder equity five years ago to a positive stance now. Its earnings growth of 309.8% over the past year outpaces the Household Products industry average of -6.7%, indicating robust performance despite large one-off gains like CN¥75.9M impacting results recently. Trading at 7.9% below estimated fair value, Feilo seems undervalued with potential for further exploration in its sector as it navigates these financial dynamics confidently.

- Unlock comprehensive insights into our analysis of Shanghai Feilo AcousticsLtd stock in this health report.

Gain insights into Shanghai Feilo AcousticsLtd's past trends and performance with our Past report.

Hefei Chipmore TechnologyLtd (SHSE:688352)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hefei Chipmore Technology Co., Ltd. operates as a packaging and testing service provider for integrated circuits with a market cap of CN¥14 billion.

Operations: Chipmore generates revenue primarily from its semiconductor segment, amounting to CN¥1.92 billion.

Chipmore, a nimble player in the semiconductor space, shows promise with its earnings growth of 17.9% outpacing the industry's 12.9%. Despite not being free cash flow positive, it has high-quality earnings and covers its interest obligations comfortably. The price-to-earnings ratio of 40.6x offers better value compared to the industry average of 67.4x, indicating potential for investors seeking undervalued opportunities in this sector. With more cash than debt on hand, Chipmore seems financially sound despite recent fluctuations in levered free cash flow and capital expenditures reaching US$1 billion as of September 2024.

Shenzhen Hui Chuang Da Technology (SZSE:300909)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Hui Chuang Da Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥4.55 billion.

Operations: The company generates revenue primarily from its technology-related operations. It has a market capitalization of CN¥4.55 billion.

Shenzhen Hui Chuang Da Technology, a smaller player in the electronics sector, has shown impressive earnings growth of 26.1% over the past year, outpacing the industry average of 1.9%. Its price-to-earnings ratio stands at 42.1x, which is below the industry average of 52.9x, suggesting potential value for investors. Despite an increase in its debt to equity ratio from 5.4% to 7.5% over five years, its interest payments are well covered by EBIT at a robust 32.6x coverage level. The company remains profitable with high-quality earnings but is not currently generating positive free cash flow.

- Dive into the specifics of Shenzhen Hui Chuang Da Technology here with our thorough health report.

Learn about Shenzhen Hui Chuang Da Technology's historical performance.

Where To Now?

- Embark on your investment journey to our 4746 Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600651

Shanghai Feilo AcousticsLtd

Operates in lighting, automotive electronics, and module packaging and chip testing service businesses in China and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives