- Taiwan

- /

- Semiconductors

- /

- TPEX:3374

Undiscovered Gems with Promising Potential in February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rate cuts from the ECB and SNB, and expectations of further easing by the Fed, small-cap stocks have faced challenges with the Russell 2000 Index underperforming against larger indices. Despite this backdrop, opportunities may exist for discerning investors to identify promising small-cap stocks that are undervalued or overlooked within these turbulent conditions. In such an environment, a good stock might be characterized by strong fundamentals and potential for growth that isn't yet fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Nestlé Pakistan | 40.95% | 14.04% | 17.18% | ★★★★★☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

CNTEE Transelectrica (BVB:TEL)

Simply Wall St Value Rating: ★★★★★★

Overview: CNTEE Transelectrica SA operates as the transmission and system operator of Romania's national power system, with a market cap of RON3.25 billion.

Operations: Transelectrica generates revenue primarily from its Transmission and Dispatch segment, amounting to RON7.59 billion.

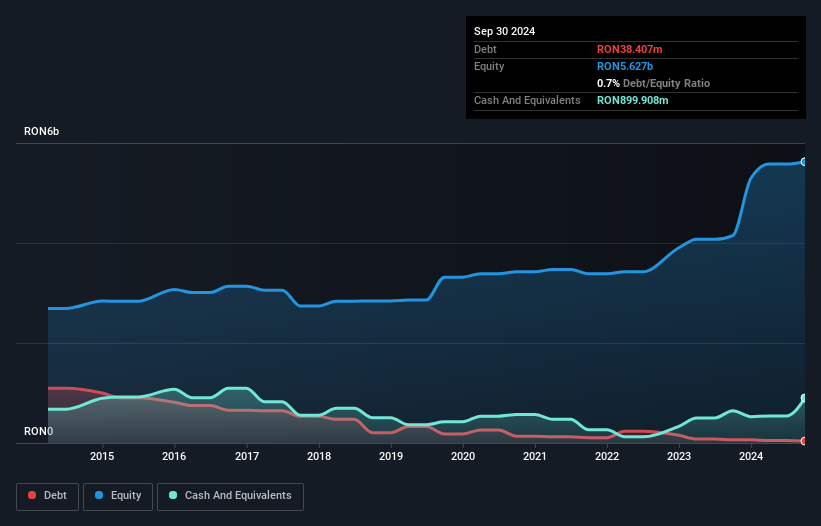

Transelectrica, a notable player in the electric utilities sector, has shown impressive financial resilience. Earnings have surged by 35.9% over the past year, outpacing an industry that saw a 6.3% downturn. The company's debt-to-equity ratio significantly improved from 5.5 to 0.7 over five years, indicating robust financial management. Recent earnings reports highlight substantial growth with third-quarter revenue reaching RON 1,485 million and net income at RON 147 million compared to last year's figures of RON 1,109 million and RON 45 million respectively. With more cash than total debt and high-quality earnings, Transelectrica appears well-positioned financially.

- Get an in-depth perspective on CNTEE Transelectrica's performance by reading our health report here.

Explore historical data to track CNTEE Transelectrica's performance over time in our Past section.

Hangzhou Seck Intelligent Technology (SZSE:300897)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou Seck Intelligent Technology Co., Ltd. is a company specializing in intelligent instrumentation manufacturing with a market cap of approximately CN¥2.36 billion.

Operations: The primary revenue stream for Hangzhou Seck comes from the intelligent instrumentation manufacturing industry, generating approximately CN¥678.10 million.

Hangzhou Seck Intelligent Technology stands out with a price-to-earnings ratio of 26.7x, well below the CN market average of 37.1x, suggesting it might be undervalued. Over the past year, earnings have grown by 10.6%, outpacing the electronic industry's average growth of 3%. The company is debt-free now compared to five years ago when its debt-to-equity ratio was at 4.4%, indicating improved financial health and flexibility in operations. In recent developments, they completed a share buyback program repurchasing over one million shares for CNY22.2 million, which could signal confidence in their future prospects or an effort to enhance shareholder value.

- Click to explore a detailed breakdown of our findings in Hangzhou Seck Intelligent Technology's health report.

Learn about Hangzhou Seck Intelligent Technology's historical performance.

Xintec (TPEX:3374)

Simply Wall St Value Rating: ★★★★★★

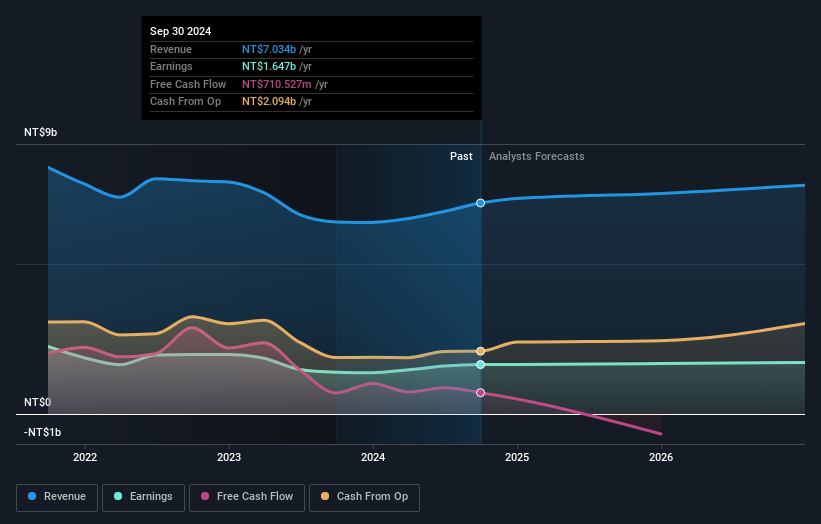

Overview: Xintec Inc. is a company specializing in wafer level chip scale packaging with operations across Asia, the United States, and Europe, and has a market capitalization of NT$48.85 billion.

Operations: Xintec generates revenue primarily from its Semiconductor Equipment and Services segment, amounting to NT$7.03 billion.

Xintec, a player in the semiconductor industry, has seen its debt to equity ratio significantly improve from 66% to 10.3% over five years, indicating stronger financial health. The company boasts high-quality earnings and an impressive earnings growth of 18.1% last year, outpacing the industry's 5.9%. Its free cash flow remains positive, suggesting robust operational efficiency despite recent share price volatility. Xintec's strategic focus on revising its Articles of Incorporation at the upcoming shareholders' meeting could signal plans for future expansion or restructuring as it eyes a forecasted annual earnings growth of over 31%.

- Click here and access our complete health analysis report to understand the dynamics of Xintec.

Gain insights into Xintec's past trends and performance with our Past report.

Summing It All Up

- Reveal the 4710 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3374

Xintec

Operates as a wafer level chip scale packaging company in Asia, the United States, and Europe.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives