- China

- /

- Electronic Equipment and Components

- /

- SZSE:300726

Zhuzhou Hongda Electronics Corp.,Ltd.'s (SZSE:300726) 33% Share Price Surge Not Quite Adding Up

Zhuzhou Hongda Electronics Corp.,Ltd. (SZSE:300726) shares have continued their recent momentum with a 33% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 14% in the last twelve months.

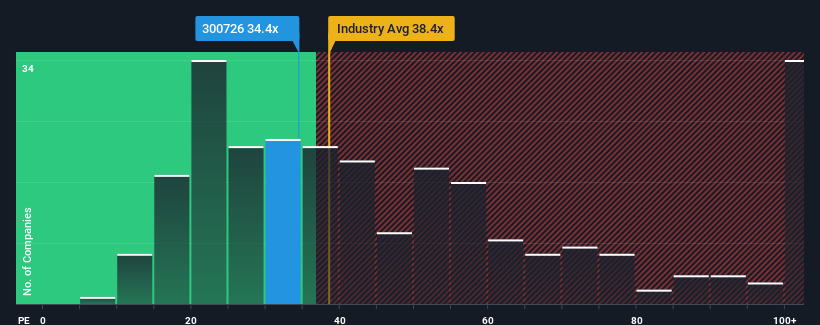

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Zhuzhou Hongda ElectronicsLtd as a stock to potentially avoid with its 34.4x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Zhuzhou Hongda ElectronicsLtd as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Zhuzhou Hongda ElectronicsLtd

How Is Zhuzhou Hongda ElectronicsLtd's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Zhuzhou Hongda ElectronicsLtd's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 46%. The last three years don't look nice either as the company has shrunk EPS by 48% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 37% as estimated by the sole analyst watching the company. That's shaping up to be similar to the 36% growth forecast for the broader market.

With this information, we find it interesting that Zhuzhou Hongda ElectronicsLtd is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Zhuzhou Hongda ElectronicsLtd's P/E is getting right up there since its shares have risen strongly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Zhuzhou Hongda ElectronicsLtd's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Zhuzhou Hongda ElectronicsLtd (1 makes us a bit uncomfortable!) that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Zhuzhou Hongda ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300726

Zhuzhou Hongda ElectronicsLtd

Engages in the research and development, manufacturing, sale, and servicing of electronic components and circuit modules in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026