- China

- /

- Electronic Equipment and Components

- /

- SZSE:301266

Exploring None High Growth Tech Stocks For Potential Expansion

Reviewed by Simply Wall St

Amidst a backdrop of record highs for major U.S. indices and optimism surrounding potential trade deals, growth stocks have recently outperformed value shares, reflecting investor enthusiasm for sectors like artificial intelligence. In this environment, identifying high-growth tech stocks that are well-positioned to leverage AI advancements and navigate the evolving economic landscape can be crucial for investors seeking potential expansion opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

CASTECH (SZSE:002222)

Simply Wall St Growth Rating: ★★★★★☆

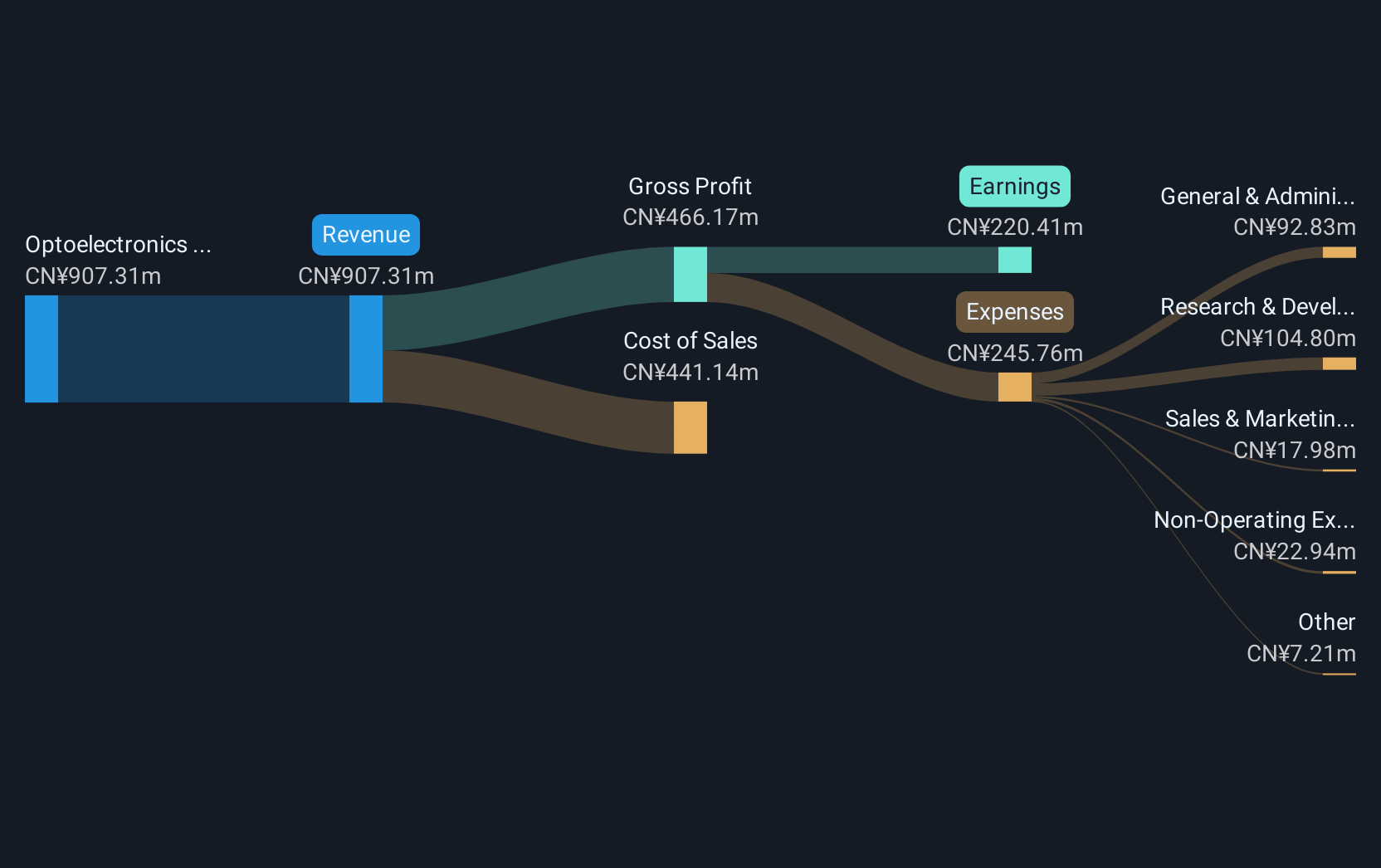

Overview: CASTECH Inc. focuses on the research and development, production, and sale of crystal components, precision optical components, and laser devices mainly in China with a market cap of CN¥15.61 billion.

Operations: The company generates revenue primarily from the optoelectronics industry, amounting to CN¥851 million. The business involves producing crystal components, precision optical components, and laser devices.

CASTECH has demonstrated robust financial growth, with annual revenue and earnings expansions of 25.1% and 29.5%, respectively, outpacing both the Chinese market and its industry peers. This performance is underpinned by significant R&D investments, which have totaled CNY 50 million in the latest fiscal year, equating to approximately 7.5% of their total revenue—a clear indicator of their commitment to innovation and staying ahead in competitive tech landscapes. Recent strategic moves include a shareholder meeting to discuss an audit firm change, suggesting proactive governance adjustments amidst this growth phase. Moreover, consistent dividends reflect a stable cash flow position, reinforcing investor confidence in their operational execution and future prospects.

- Dive into the specifics of CASTECH here with our thorough health report.

Explore historical data to track CASTECH's performance over time in our Past section.

Jones Tech (SZSE:300684)

Simply Wall St Growth Rating: ★★★★★☆

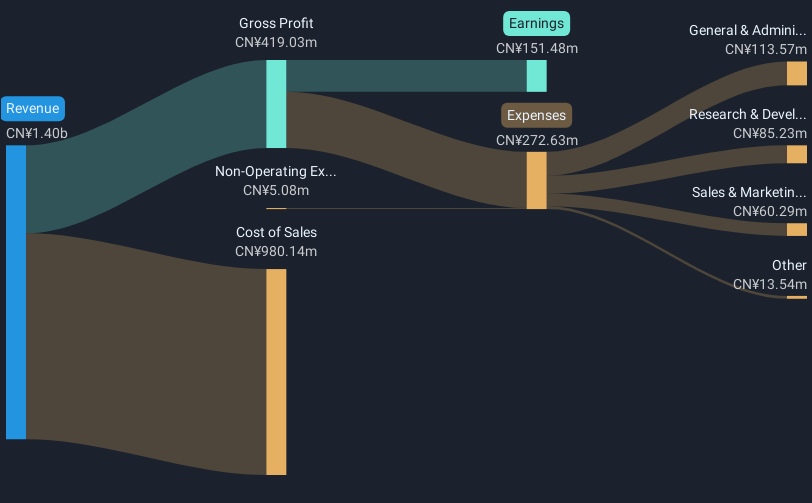

Overview: Jones Tech PLC offers materials solutions for intelligent electronic equipment across Asia, Europe, and America, with a market capitalization of CN¥7.67 billion.

Operations: Jones Tech PLC generates revenue by providing materials solutions for intelligent electronic equipment across various regions, including Asia, Europe, and America. The company's operations are focused on delivering specialized materials that support the functionality and efficiency of electronic devices.

Jones Tech is carving a niche in the high-growth tech sector, evidenced by its impressive annual revenue growth rate of 26.3% and earnings expansion at 37.5%. These figures not only surpass the broader Chinese market's averages but also highlight the company's aggressive pursuit of innovation through substantial R&D investments, totaling 7.5% of their revenue. Recent governance enhancements and executive board reshuffling underscore a strategic alignment towards scalability and market responsiveness, positioning Jones Tech favorably amidst evolving technological demands.

- Get an in-depth perspective on Jones Tech's performance by reading our health report here.

Examine Jones Tech's past performance report to understand how it has performed in the past.

Suzhou YourBest New-type MaterialsLtd (SZSE:301266)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suzhou YourBest New-type Materials Co. Ltd. is a company involved in the production and development of advanced materials, with a market capitalization of CN¥3.52 billion.

Operations: Suzhou YourBest New-type Materials Co. Ltd. focuses on producing and developing advanced materials, generating revenue primarily through its innovative product lines. The company operates with a market capitalization of CN¥3.52 billion, reflecting its significant presence in the advanced materials sector.

Suzhou YourBest New-type MaterialsLtd. stands out in the tech landscape with an impressive annual revenue growth rate of 18.8% and an even more remarkable earnings growth forecast at 48.4% per year, signaling robust potential despite recent volatility, including its drop from the S&P Global BMI Index. The company's commitment to innovation is evident from its R&D spending, which is strategically allocated to enhance product offerings and competitive edge in new materials technology—a sector critical for advancements in various high-tech industries. This strategic focus combined with recent governance reforms aimed at improving operational efficiency positions Suzhou YourBest for impactful industry contributions and future growth prospects.

Where To Now?

- Delve into our full catalog of 1225 High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301266

Suzhou YourBest New-type MaterialsLtd

Suzhou YourBest New-type Materials Co. Ltd.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives