- China

- /

- Communications

- /

- SZSE:300628

Discover Banco Bilbao Vizcaya Argentaria And 2 More Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and mixed economic signals, investors are keeping a close eye on indices like the Nasdaq Composite, which recently hit a new milestone despite broader market declines. In this environment of fluctuating rates and economic uncertainty, dividend stocks can offer stability through regular income streams, making them an attractive option for those seeking to balance risk with potential returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.70% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.55% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

Click here to see the full list of 1858 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

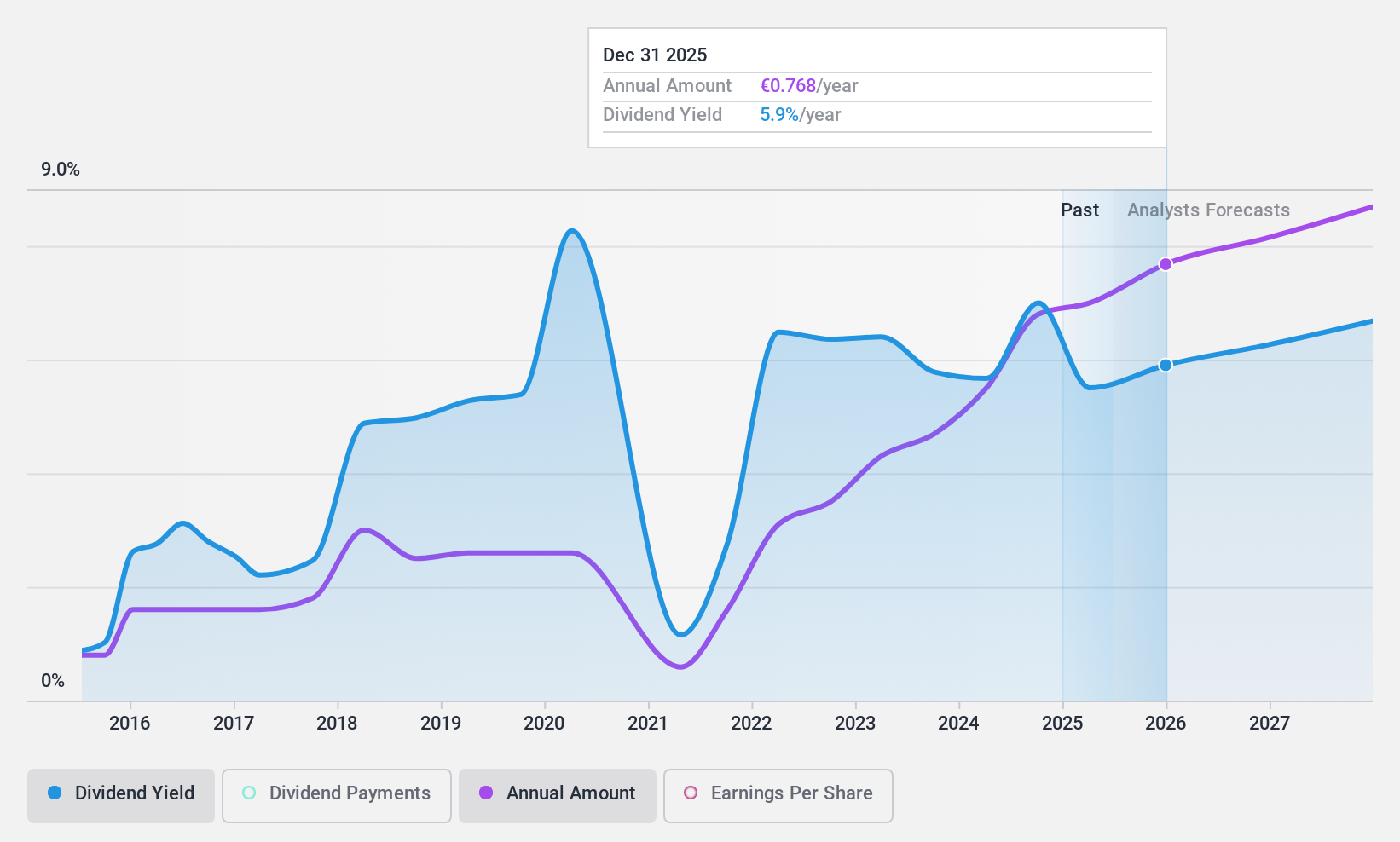

Banco Bilbao Vizcaya Argentaria (BME:BBVA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banco Bilbao Vizcaya Argentaria, S.A. is a financial institution offering retail banking, wholesale banking, and asset management services across the United States, Spain, Mexico, Turkey, South America, and internationally with a market cap of €55.10 billion.

Operations: Banco Bilbao Vizcaya Argentaria, S.A.'s revenue segments include €14.90 billion from Mexico, €3.26 billion from Turkey, €4.43 billion from South America, and €9.06 billion from Spain (including non-core real estate).

Dividend Yield: 7.1%

Banco Bilbao Vizcaya Argentaria's dividend yield is among the top 25% in Spain, supported by a low payout ratio of 42.2%, indicating coverage by earnings. Despite its attractive yield, the dividend history is volatile and unreliable over the past decade. Recent net income growth to €7.62 billion suggests financial strength, but concerns remain due to high non-performing loans at 3.4% and a low allowance for bad loans at 77%.

- Dive into the specifics of Banco Bilbao Vizcaya Argentaria here with our thorough dividend report.

- Upon reviewing our latest valuation report, Banco Bilbao Vizcaya Argentaria's share price might be too pessimistic.

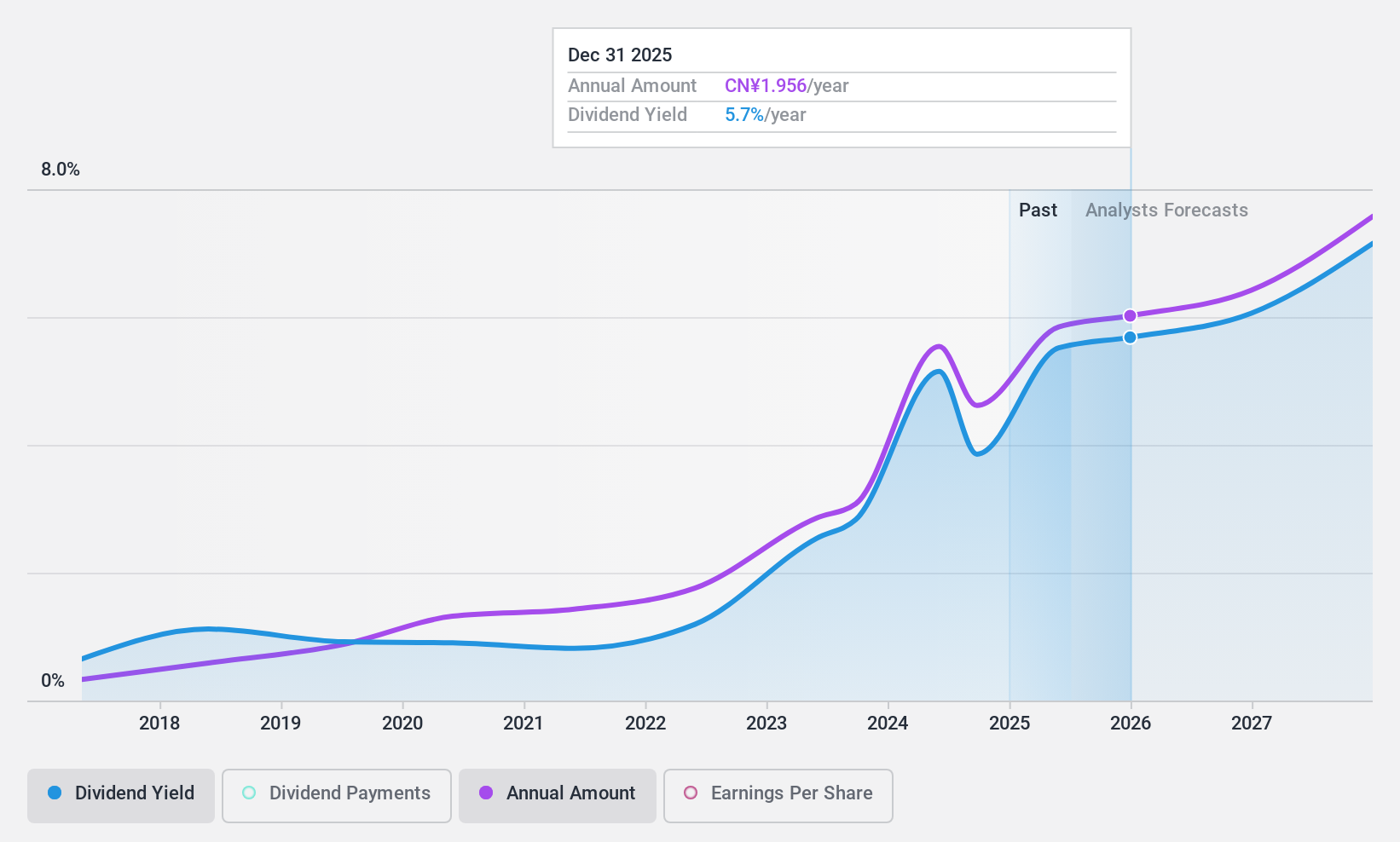

Yealink Network Technology (SZSE:300628)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yealink Network Technology Co., Ltd. offers voice conferencing, voice communications, and collaboration solutions globally with a market cap of CN¥49.11 billion.

Operations: Yealink Network Technology Co., Ltd.'s revenue primarily comes from its Internet Telephone segment, which generated CN¥5.23 billion.

Dividend Yield: 3.9%

Yealink Network Technology offers a dividend yield in the top 25% of the CN market, with current payments covered by both earnings and cash flows (77% payout ratio). However, its dividend history is volatile and unreliable over eight years. Recent earnings growth of 22.4% year-on-year supports financial stability, with net income reaching CNY 2.06 billion for the first nine months of 2024, indicating potential for sustained payouts despite past inconsistencies.

- Get an in-depth perspective on Yealink Network Technology's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Yealink Network Technology's current price could be quite moderate.

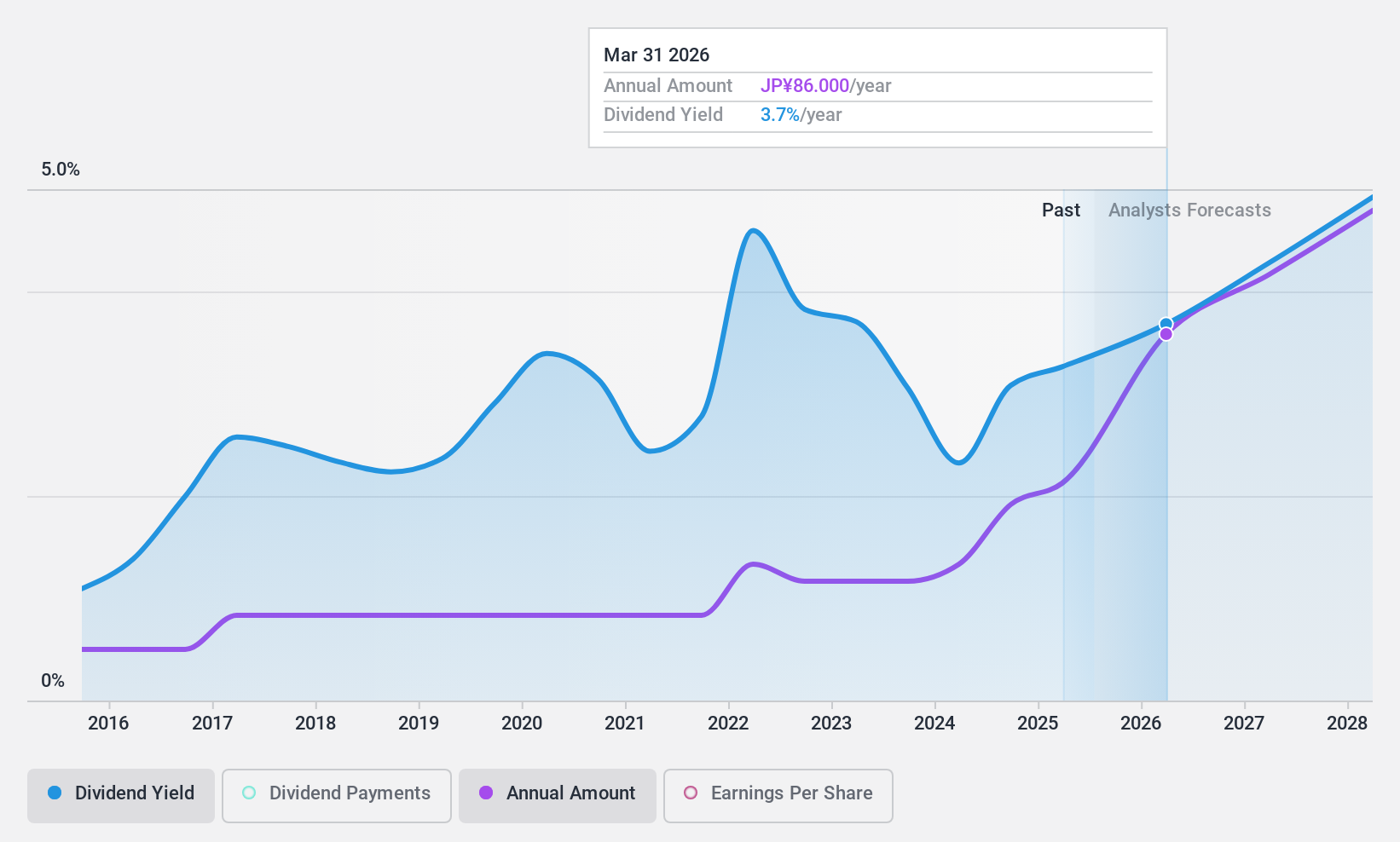

Yurtec (TSE:1934)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yurtec Corporation is a facility engineering company operating in Japan and internationally, with a market cap of ¥97.57 billion.

Operations: Yurtec Corporation generates revenue primarily through its facility engineering services in Japan and international markets.

Dividend Yield: 3.6%

Yurtec's dividend yield is slightly below the top 25% of the JP market, yet its payout ratio of 34.6% indicates dividends are well covered by earnings, though cash flow coverage is tighter at an 84.3% cash payout ratio. Despite a volatile and unreliable dividend history over ten years, recent increases in payouts suggest improvement. The company completed a share buyback program worth ¥4.51 billion to enhance shareholder value, indicating a focus on capital efficiency and profit distribution.

- Delve into the full analysis dividend report here for a deeper understanding of Yurtec.

- The valuation report we've compiled suggests that Yurtec's current price could be inflated.

Taking Advantage

- Navigate through the entire inventory of 1858 Top Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300628

Yealink Network Technology

Provides voice conferencing, voice communications, and collaboration solutions worldwide.

Very undervalued with outstanding track record and pays a dividend.