- China

- /

- Hospitality

- /

- SZSE:002707

3 Chinese Stocks With High Insider Ownership Boasting 40% Earnings Growth

Reviewed by Simply Wall St

As China's central bank introduces more support measures to address deflationary pressures, Chinese equities have shown resilience with notable gains in the Shanghai Composite Index. In this evolving economic landscape, companies with high insider ownership and robust earnings growth are often seen as attractive investments due to their potential alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 17.9% | 28.7% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 38.9% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 83.7% |

| Sineng ElectricLtd (SZSE:300827) | 36.3% | 41.7% |

| UTour Group (SZSE:002707) | 22.8% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

We're going to check out a few of the best picks from our screener tool.

Venustech Group (SZSE:002439)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services globally, with a market cap of CN¥20.60 billion.

Operations: The company's revenue primarily comes from its Information Network Security segment, which generated CN¥4.53 billion.

Insider Ownership: 22.4%

Earnings Growth Forecast: 28.5% p.a.

Venustech Group, with significant insider ownership, reported a net loss of CNY 182.25 million for the half year ending June 2024, contrasting with a net income of CNY 184.84 million previously. Despite this setback and past shareholder dilution, the company is trading below its estimated fair value and is projected to achieve higher-than-market revenue growth at 16.3% annually. Earnings are expected to grow significantly by over 28% per year in the coming years.

- Dive into the specifics of Venustech Group here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Venustech Group is priced lower than what may be justified by its financials.

UTour Group (SZSE:002707)

Simply Wall St Growth Rating: ★★★★★★

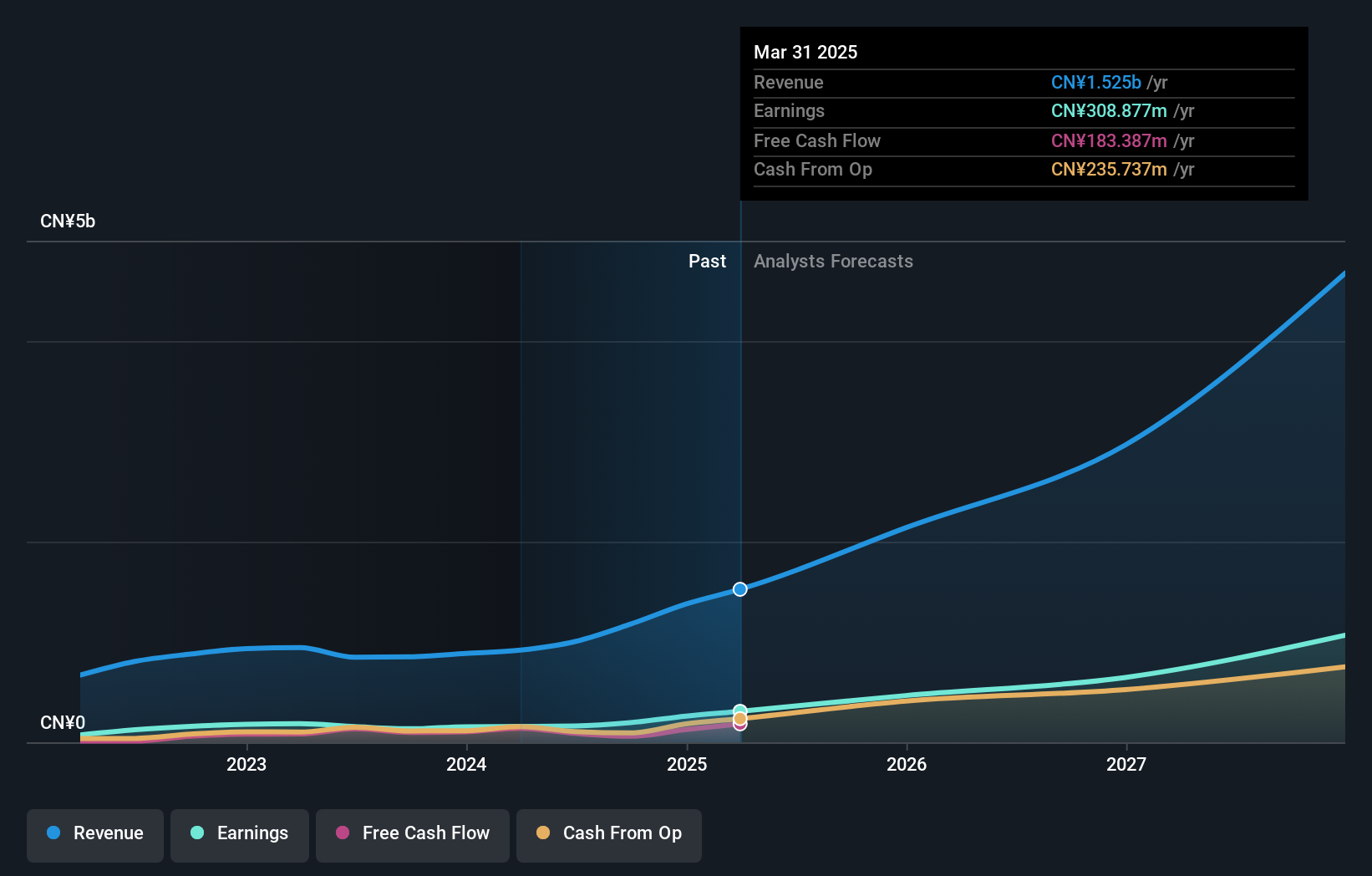

Overview: UTour Group Co., Ltd. operates in the outbound tourism wholesale and retail sector both within China and internationally, with a market cap of CN¥7.57 billion.

Operations: The company's revenue is primarily generated from its outbound tourism wholesale and retail operations in China and abroad.

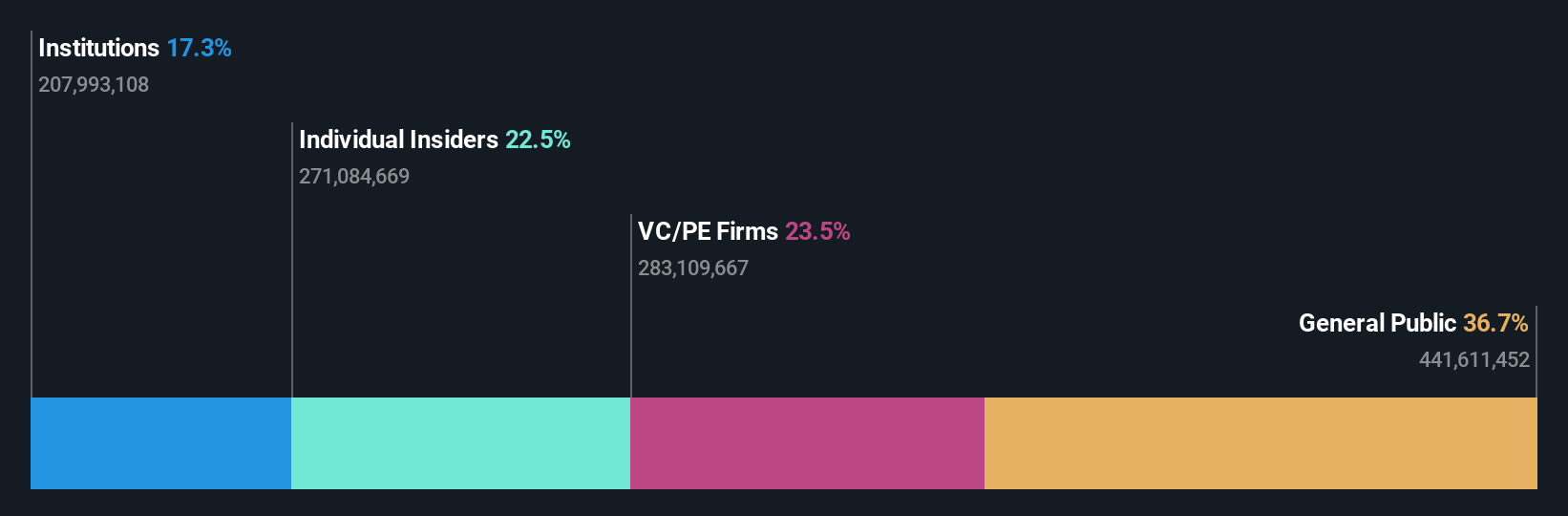

Insider Ownership: 22.8%

Earnings Growth Forecast: 28.7% p.a.

UTour Group, with substantial insider ownership, has shown impressive growth by becoming profitable this year. Its revenue for the first half of 2024 reached ¥2.62 billion, a significant increase from ¥792.44 million the previous year. Earnings are forecast to grow at 28.68% annually, outpacing the Chinese market's average growth rate of 23.7%. The company trades well below its estimated fair value and anticipates robust revenue growth at 32.8% per year.

- Take a closer look at UTour Group's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that UTour Group is priced higher than what may be justified by its financials.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

Overview: T&S Communications Co., Ltd. develops, manufactures, and sells fiber optics communication products in the People’s Republic of China with a market cap of CN¥8.74 billion.

Operations: The company generates its revenue primarily from Optical Communication Components, amounting to CN¥999 million.

Insider Ownership: 24.9%

Earnings Growth Forecast: 40.8% p.a.

T&S Communications Ltd., with significant insider ownership, is experiencing strong growth prospects. Its revenue and earnings are forecast to grow at 34.7% and 40.8% annually, respectively, surpassing the Chinese market averages. Despite recent share price volatility, the company reported increased half-year sales of ¥509.25 million compared to ¥390.08 million last year and was recently added to the S&P Global BMI Index—highlighting its potential in the growth sector despite a low dividend coverage by free cash flows.

- Click here to discover the nuances of T&S CommunicationsLtd with our detailed analytical future growth report.

- The valuation report we've compiled suggests that T&S CommunicationsLtd's current price could be inflated.

Turning Ideas Into Actions

- Delve into our full catalog of 379 Fast Growing Chinese Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002707

UTour Group

Engages in outbound tourism wholesale and retail business in China and internationally.

Exceptional growth potential with adequate balance sheet.