Three Chinese Stocks Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

As Chinese equities experience a modest rise, bolstered by the central bank's supportive measures amid entrenched deflationary pressures, investors are increasingly focusing on stocks that may be trading below their intrinsic value. In this environment, identifying undervalued stocks involves assessing companies with strong fundamentals and growth potential that have been overlooked or underappreciated by the market.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HangzhouS MedTech (SHSE:688581) | CN¥58.12 | CN¥108.82 | 46.6% |

| Beijing Konruns PharmaceuticalLtd (SHSE:603590) | CN¥23.34 | CN¥46.03 | 49.3% |

| Wuhan Keqian BiologyLtd (SHSE:688526) | CN¥13.81 | CN¥25.45 | 45.7% |

| Neusoft (SHSE:600718) | CN¥10.11 | CN¥19.29 | 47.6% |

| Guangdong Skychem Technology (SHSE:688603) | CN¥87.40 | CN¥170.04 | 48.6% |

| Crystal Growth & Energy EquipmentLtd (SHSE:688478) | CN¥29.56 | CN¥55.99 | 47.2% |

| Seres GroupLtd (SHSE:601127) | CN¥90.82 | CN¥172.07 | 47.2% |

| Yangmei ChemicalLtd (SHSE:600691) | CN¥2.03 | CN¥3.92 | 48.3% |

| Ningbo Jifeng Auto Parts (SHSE:603997) | CN¥13.54 | CN¥26.00 | 47.9% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥10.25 | CN¥19.19 | 46.6% |

Here's a peek at a few of the choices from the screener.

Xiamen Amoytop Biotech (SHSE:688278)

Overview: Xiamen Amoytop Biotech Co., Ltd. is involved in the manufacture, marketing, and sale of recombinant protein drugs in China with a market cap of CN¥33.85 billion.

Operations: The company's revenue is primarily generated from its biologics segment, amounting to CN¥2.39 billion.

Estimated Discount To Fair Value: 33.9%

Xiamen Amoytop Biotech shows potential as an undervalued stock based on cash flows, trading at CN¥83.2, below its estimated fair value of CN¥125.92. Its earnings are expected to grow significantly at 30.8% annually, outpacing the Chinese market average. Recent half-year results showed strong revenue and net income growth compared to the previous year, while strategic alliances like the collaboration with Aligos Therapeutics enhance its clinical research capabilities in hepatitis B treatments.

- Our growth report here indicates Xiamen Amoytop Biotech may be poised for an improving outlook.

- Take a closer look at Xiamen Amoytop Biotech's balance sheet health here in our report.

Range Intelligent Computing Technology Group (SZSE:300442)

Overview: Range Intelligent Computing Technology Group Company Limited develops data centers and other technology campuses, with a market cap of CN¥56.78 billion.

Operations: The company's revenue segment includes IDC Services, generating CN¥6.24 billion.

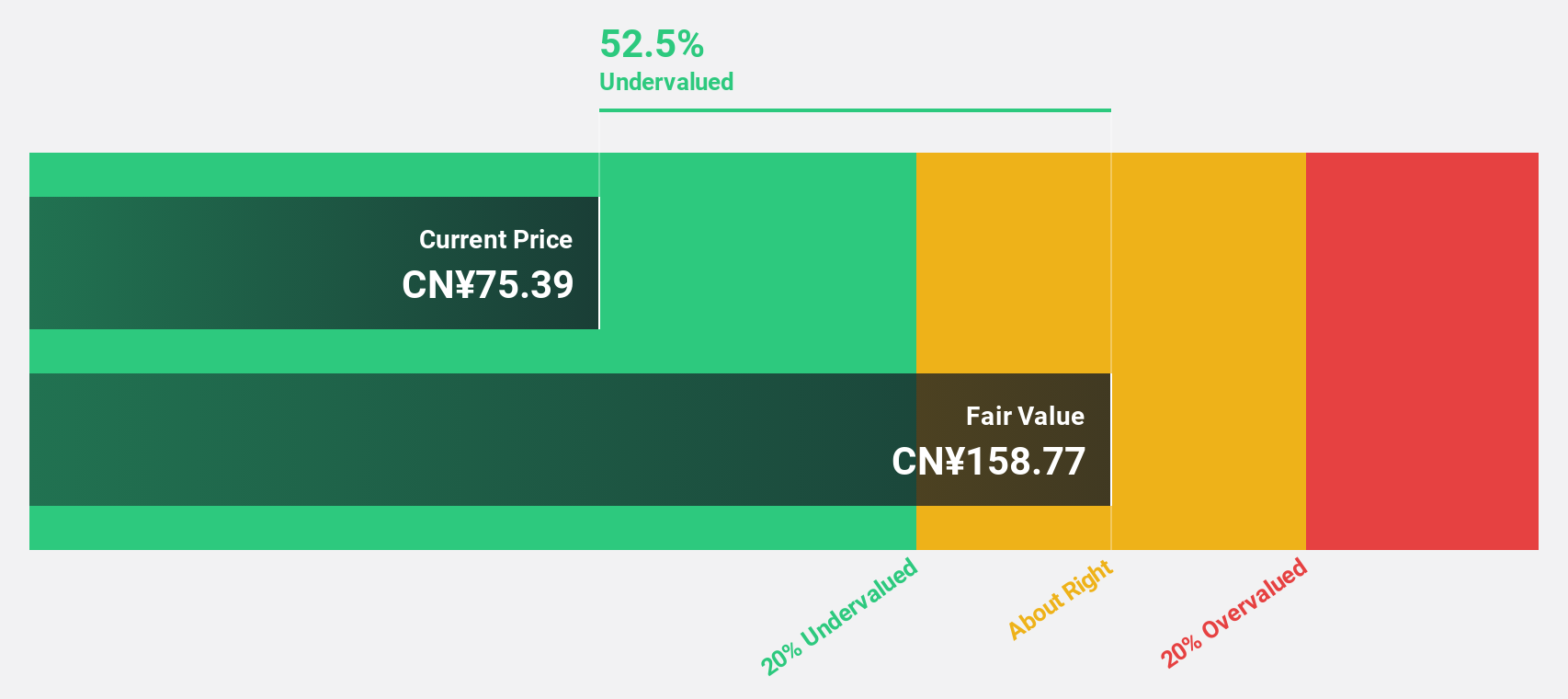

Estimated Discount To Fair Value: 44.1%

Range Intelligent Computing Technology Group is trading at CN¥33, significantly below its estimated fair value of CN¥59.06, highlighting its potential as an undervalued stock based on cash flows. Despite a volatile share price, the company reported substantial revenue and net income growth for the first half of 2024. However, dividends are not well covered by free cash flows and debt coverage by operating cash flow remains inadequate, suggesting areas for financial improvement.

- The growth report we've compiled suggests that Range Intelligent Computing Technology Group's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Range Intelligent Computing Technology Group.

Imeik Technology DevelopmentLtd (SZSE:300896)

Overview: Imeik Technology Development Co., Ltd. focuses on the research, development, production, and transformation of biomedical soft tissue repair materials in China with a market cap of approximately CN¥66.38 billion.

Operations: Imeik Technology Development Co., Ltd. generates its revenue primarily from the Surgical & Medical Equipment segment, which accounts for CN¥3.07 billion.

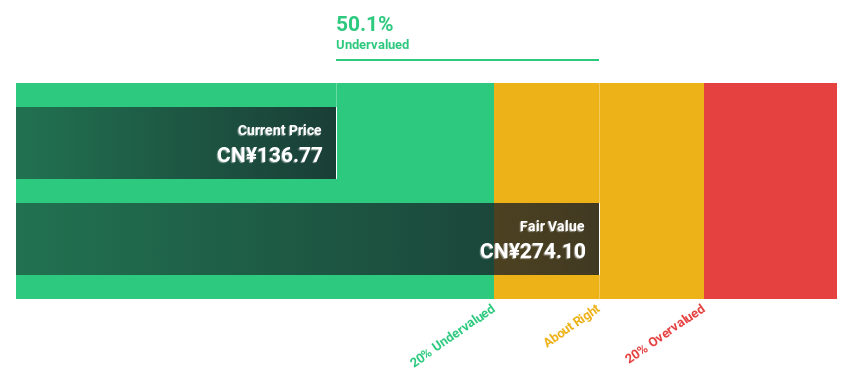

Estimated Discount To Fair Value: 20.3%

Imeik Technology Development Ltd. is trading at CN¥220.33, below its estimated fair value of CN¥276.33, suggesting it may be undervalued based on cash flows. The company reported robust revenue and net income growth for the first half of 2024, with earnings rising by 22.8% over the past year. Despite a volatile share price recently, its forecasted revenue growth surpasses market expectations, although earnings are expected to grow slightly slower than the market average.

- Our comprehensive growth report raises the possibility that Imeik Technology DevelopmentLtd is poised for substantial financial growth.

- Click here to discover the nuances of Imeik Technology DevelopmentLtd with our detailed financial health report.

Turning Ideas Into Actions

- Access the full spectrum of 98 Undervalued Chinese Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688278

Xiamen Amoytop Biotech

Engages in the manufacture, marketing, and sale of recombinant protein drugs in China.

Exceptional growth potential with flawless balance sheet.