- China

- /

- Interactive Media and Services

- /

- SZSE:002315

Focus Technology And 2 Other Dividend Stocks From Chinese Markets To Boost Your Income

Reviewed by Simply Wall St

As Chinese equities experience a boost with the central bank's supportive measures amid persistent deflationary pressures, investors are increasingly looking towards dividend stocks as a way to enhance income in this evolving market landscape. In such conditions, selecting stocks that not only offer reliable dividends but also demonstrate resilience and potential for growth can be crucial for building a steady income stream.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 4.00% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.18% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.27% | ★★★★★★ |

| Kweichow Moutai (SHSE:600519) | 3.24% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.16% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.55% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.30% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.73% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.14% | ★★★★★★ |

Click here to see the full list of 204 stocks from our Top Chinese Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

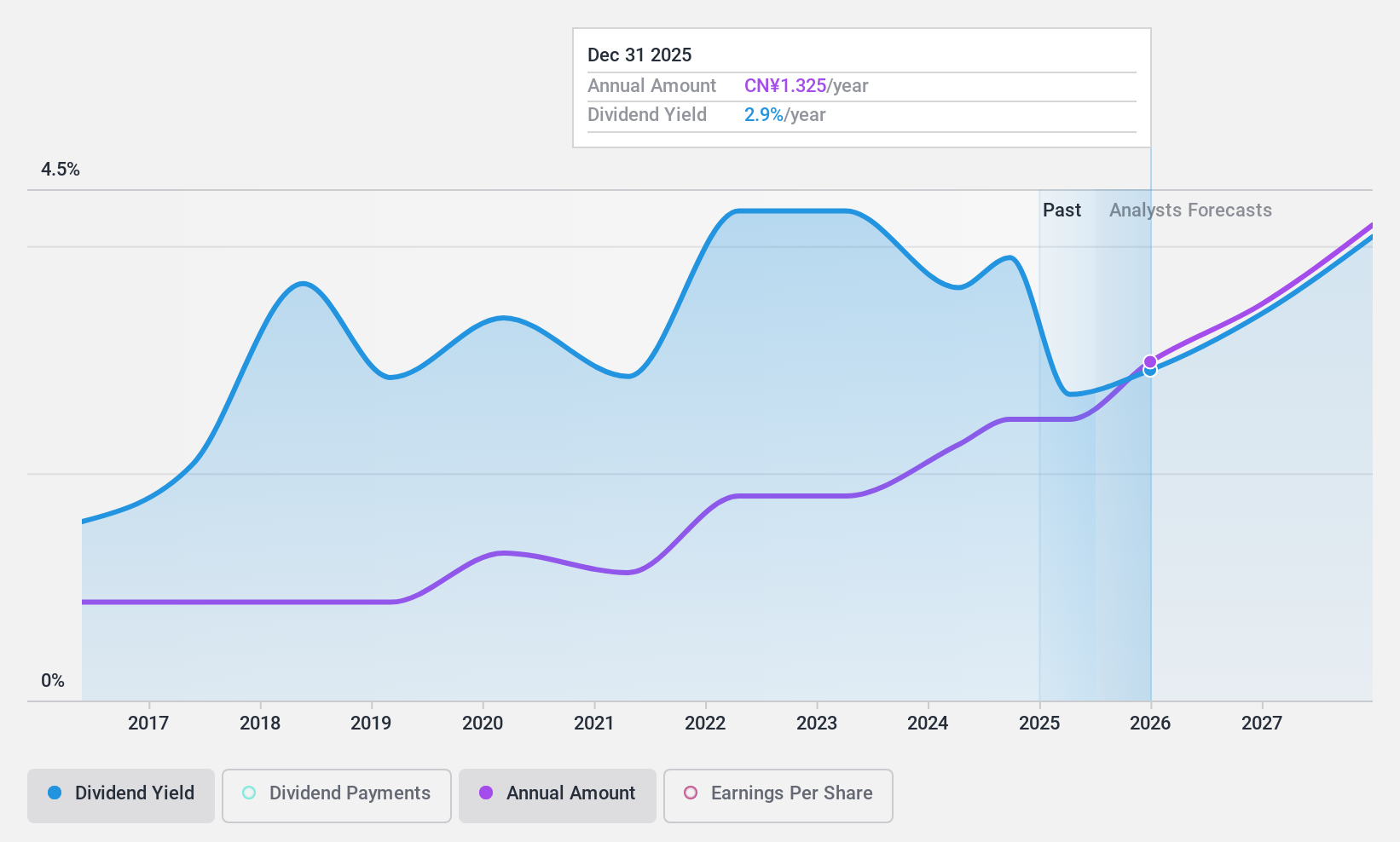

Focus Technology (SZSE:002315)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Focus Technology Co., Ltd. operates e-commerce platforms both in China and internationally, with a market cap of CN¥9.39 billion.

Operations: Focus Technology Co., Ltd. generates revenue through its e-commerce platforms serving both domestic and international markets.

Dividend Yield: 3.7%

Focus Technology's dividend yield of 3.72% ranks in the top 25% of CN market payers, but its sustainability is questionable due to a high payout ratio (115.4%) not covered by earnings, though cash flows cover it at 58.8%. Dividend payments have grown over the past decade despite volatility and unreliability issues, with recent affirmation of an interim cash dividend per ten shares at CNY 5.50 approved on September 18, 2024.

- Click to explore a detailed breakdown of our findings in Focus Technology's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Focus Technology shares in the market.

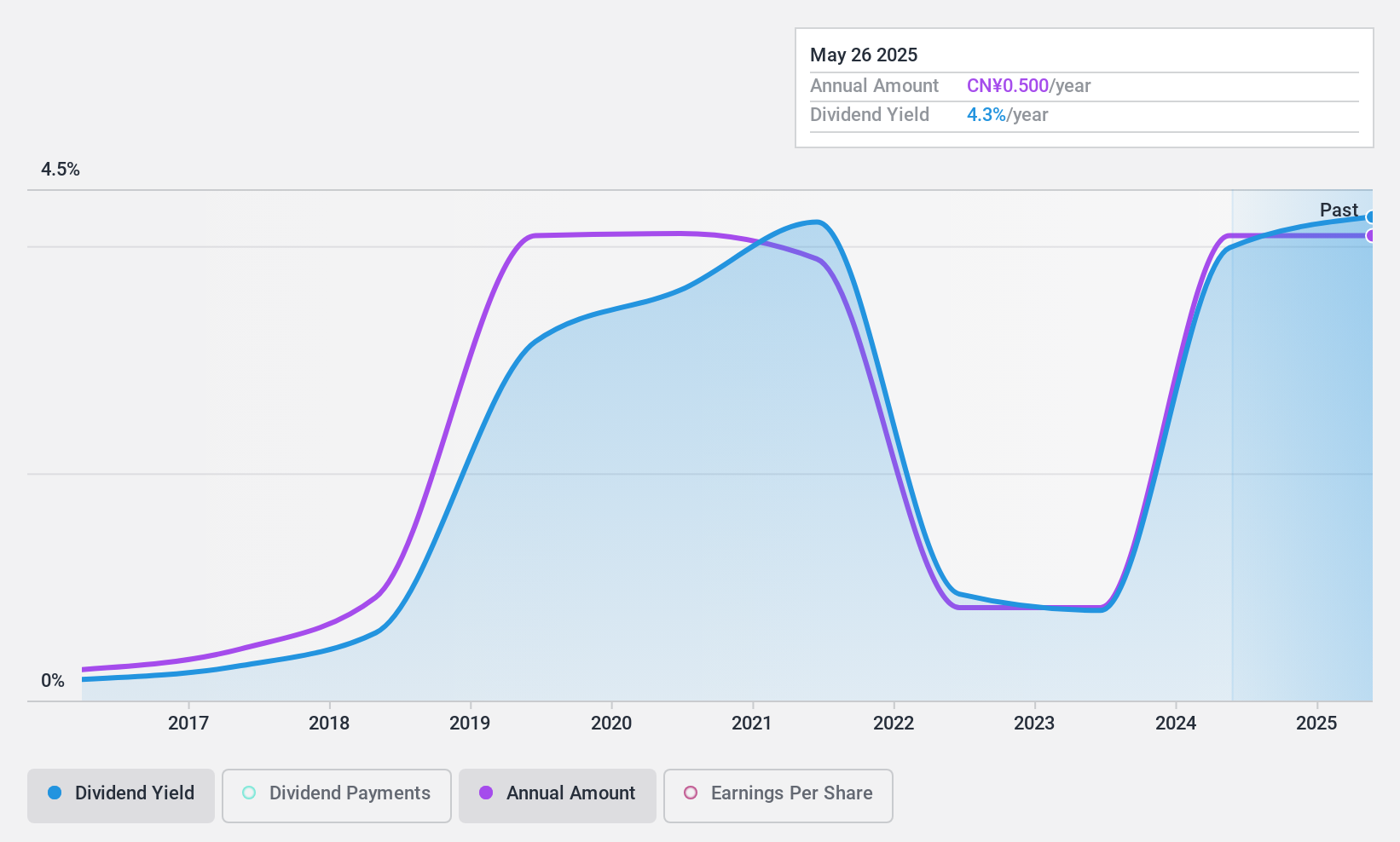

Goldcard Smart Group (SZSE:300349)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Goldcard Smart Group Co., Ltd. is a utility digitalization solution provider specializing in smart gas, smart water, and hydrogen metering in China, with a market cap of CN¥5.91 billion.

Operations: Goldcard Smart Group Co., Ltd. generates revenue through its offerings in smart gas, smart water, and hydrogen metering solutions.

Dividend Yield: 3.5%

Goldcard Smart Group's dividend yield of 3.48% is among the top 25% in China, though its sustainability is a concern due to a high cash payout ratio (11508.9%), indicating dividends aren't well covered by cash flows despite a reasonable earnings payout ratio (48.5%). While dividends have increased over the past decade, their reliability has been inconsistent. The company's recent inclusion in the S&P Global BMI Index highlights its market recognition despite these challenges.

- Delve into the full analysis dividend report here for a deeper understanding of Goldcard Smart Group.

- According our valuation report, there's an indication that Goldcard Smart Group's share price might be on the cheaper side.

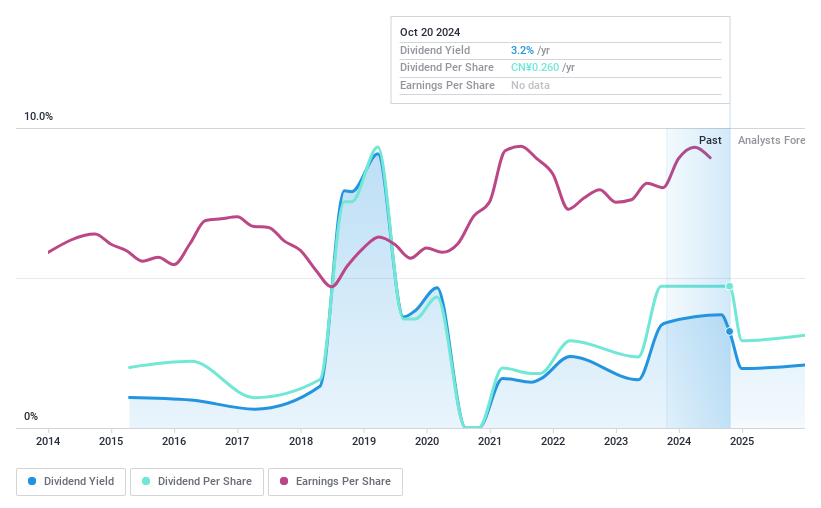

Hanyu Group (SZSE:300403)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanyu Group Joint-Stock Co., Ltd. focuses on the research, development, production, and sale of drainage pumps for household appliances in China, with a market cap of CN¥4.87 billion.

Operations: Revenue Segments (in millions of CN¥):

Dividend Yield: 3.2%

Hanyu Group's dividend yield of 3.22% places it in the top 25% of Chinese dividend payers, supported by a cash payout ratio of 80.2%, indicating coverage by cash flows. However, earnings don't fully cover this yield, raising sustainability concerns. Dividends have increased over the past decade but remain volatile and unreliable due to historical fluctuations exceeding 20%. Recent profit distribution affirms ongoing payouts despite these challenges, with CNY 0.13 per share paid in September 2024.

- Dive into the specifics of Hanyu Group here with our thorough dividend report.

- The valuation report we've compiled suggests that Hanyu Group's current price could be inflated.

Taking Advantage

- Investigate our full lineup of 204 Top Chinese Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002315

Focus Technology

Operates e-commerce platforms in the People’s Republic of China and internationally.

Flawless balance sheet, good value and pays a dividend.