- China

- /

- Electronic Equipment and Components

- /

- SZSE:300567

High Growth Tech Stocks To Consider In February 2025

Reviewed by Simply Wall St

In the global markets, recent developments have seen the European Central Bank reduce rates while the Federal Reserve maintains its stance, amidst a backdrop of volatile U.S. stock performance influenced by AI competition fears and mixed corporate earnings. As investors navigate these shifting economic landscapes, identifying high growth tech stocks that can weather such volatility and capitalize on technological advancements becomes crucial for those considering investment opportunities in February 2025.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1232 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Wuhan Jingce Electronic GroupLtd (SZSE:300567)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Jingce Electronic Group Co., Ltd specializes in the research, development, production, and sale of display, semiconductor, and new energy detection systems with a market cap of CN¥15.84 billion.

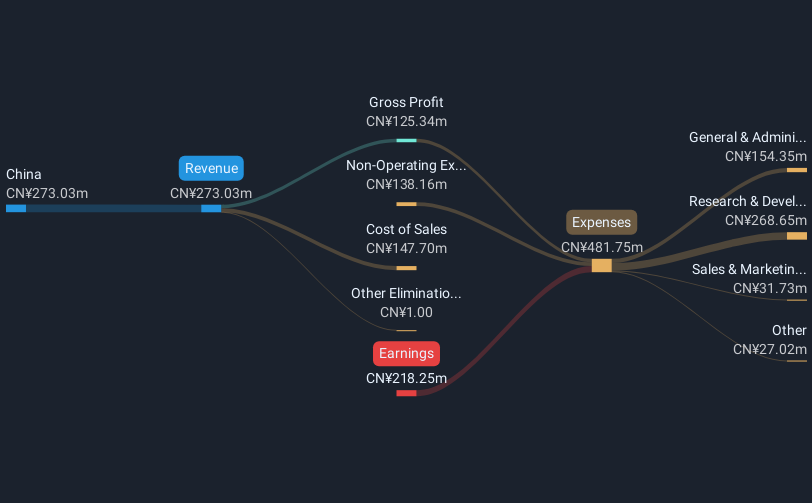

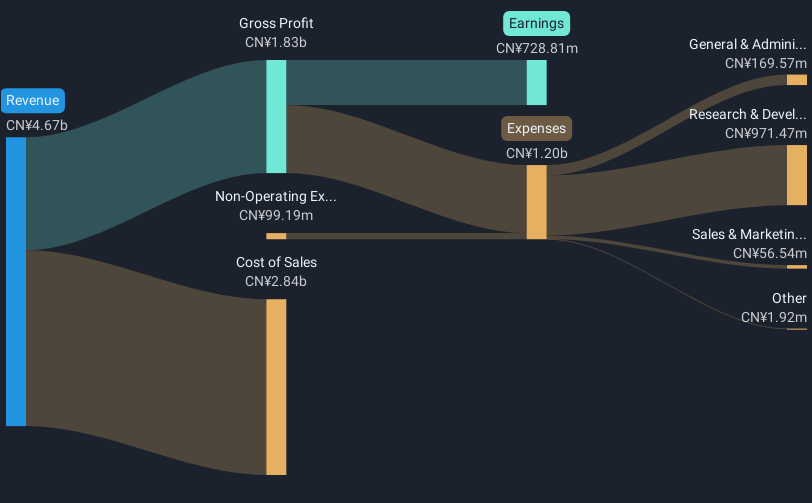

Operations: Jingce Electronic's primary revenue stream is from its electron product segment, generating CN¥2.72 billion. The company focuses on the development and sale of advanced detection systems across display, semiconductor, and new energy sectors.

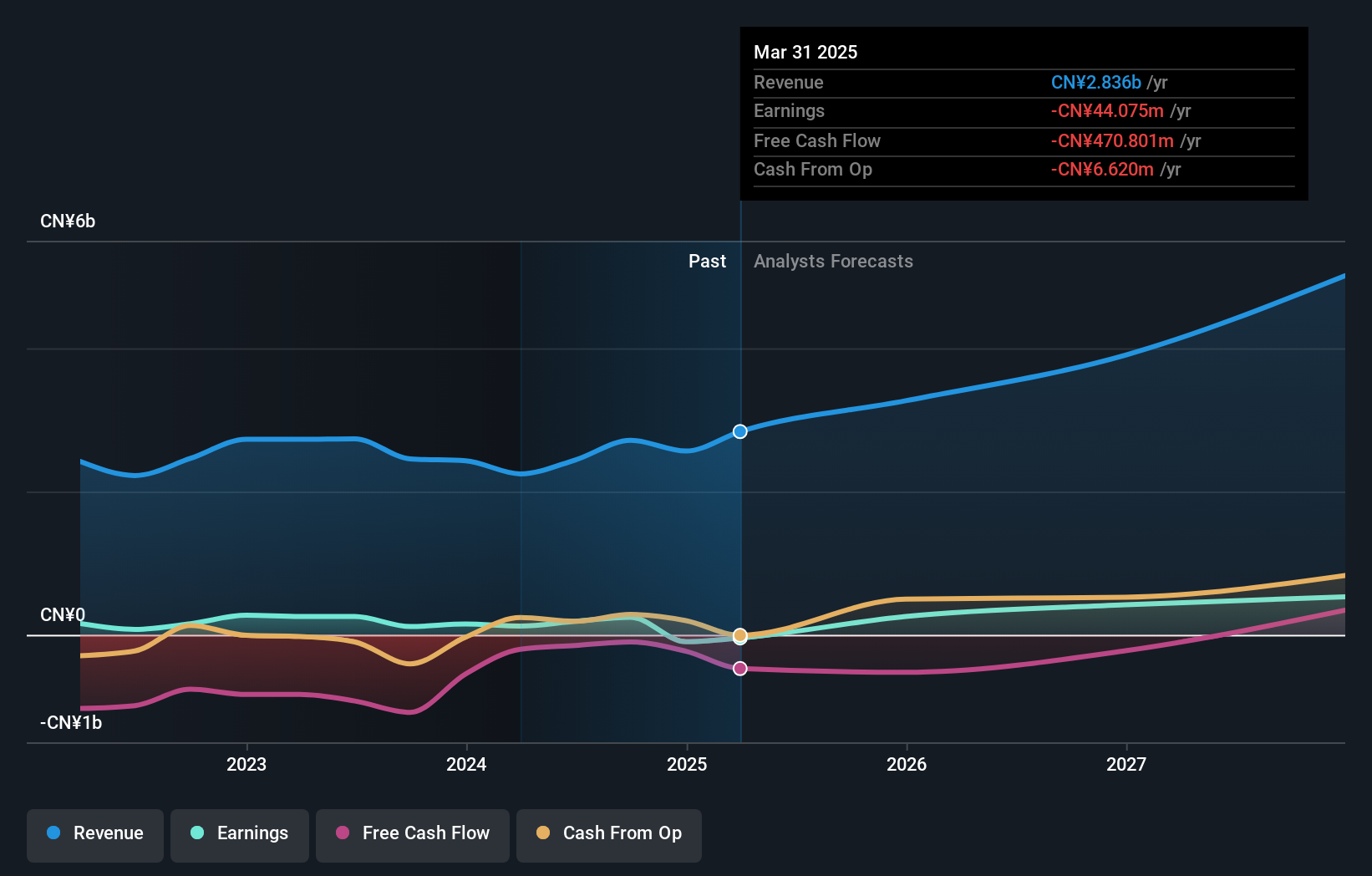

Wuhan Jingce Electronic GroupLtd's financial trajectory showcases robust growth, with revenue and earnings expanding by 21.9% and 35.5% annually, respectively, outpacing the broader Chinese market averages of 13.3% and 25%. This performance is further highlighted by a significant one-off gain of CN¥289.8 million in the last fiscal year, underscoring impactful but non-recurring boosts to its financials. Despite these strong growth indicators, challenges such as a highly volatile share price and earnings heavily influenced by one-time gains suggest potential risks in stability and predictability. Moreover, with R&D expenses not adequately covered by operating cash flow, there's an evident gap in funding innovation sustainably which might affect long-term competitiveness in the fast-evolving tech landscape.

Jushri Technologies (SZSE:300762)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jushri Technologies, INC. specializes in the development, production, and after-sales service of communication equipment with a market capitalization of CN¥12.97 billion.

Operations: The company generates revenue primarily from the sale of communication equipment. It focuses on development, production, and after-sales service to support its product offerings.

Jushri Technologies stands out in the tech sector with its impressive annual revenue growth of 61.9%, significantly surpassing the broader market's 13.3%. This growth is complemented by an anticipated earnings surge of 102.6% per year, positioning the firm well above industry norms. However, it's worth noting that despite these strong growth metrics, Jushri remains unprofitable with a highly volatile share price that could concern risk-averse investors. The company's commitment to innovation is evident from its R&D spending trends, crucial for sustaining long-term competitiveness in a rapidly evolving industry landscape.

- Click to explore a detailed breakdown of our findings in Jushri Technologies' health report.

Evaluate Jushri Technologies' historical performance by accessing our past performance report.

Maxscend Microelectronics (SZSE:300782)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Maxscend Microelectronics Company Limited focuses on the research, development, production, and sale of radio frequency integrated circuits in China with a market capitalization of CN¥41.88 billion.

Operations: Maxscend Microelectronics specializes in developing and manufacturing radio frequency integrated circuits, catering primarily to the Chinese market. The company has achieved a notable net profit margin of 25%, reflecting its efficiency in managing operational costs relative to revenue.

Maxscend Microelectronics is navigating the competitive tech landscape with a strategic focus on expanding its market share, underscored by a recent CNY 3.5 billion private placement aimed at fueling further growth. Despite experiencing a profit margin contraction from 24.2% to 15.6% last year, the company's revenue growth rate of 17.4% outpaces the Chinese market average of 13.3%. This growth is supported by robust R&D investments, crucial for maintaining its edge in innovation and technology development in an industry where staying ahead technologically is vital for survival and success. However, it's important to note that Maxscend has faced challenges with negative earnings growth (-19.3%) over the past year, which could impact investor confidence despite forecasts of significant earnings improvements (26.4% annually) over the next three years.

Summing It All Up

- Investigate our full lineup of 1232 High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Jingce Electronic GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300567

Wuhan Jingce Electronic GroupLtd

Researches, develops, produces, and sells display, semiconductor, and new energy detection systems.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives