- China

- /

- Electronic Equipment and Components

- /

- SZSE:300561

The one-year returns have been enviable for SGSG Science&Technology Zhuhai (SZSE:300561) shareholders despite underlying losses increasing

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. While not every stock performs well, when investors win, they can win big. For example, the SGSG Science&Technology Co., Ltd. Zhuhai (SZSE:300561) share price is up a whopping 608% in the last 1 year, a handsome return in a single year. It's also good to see the share price up 95% over the last quarter. And shareholders have also done well over the long term, with an increase of 284% in the last three years. We love happy stories like this one. The company should be really proud of that performance!

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Check out our latest analysis for SGSG Science&Technology Zhuhai

Given that SGSG Science&Technology Zhuhai didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year SGSG Science&Technology Zhuhai saw its revenue shrink by 35%. So it's very confusing to see that the share price gained a whopping 608%. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. To us, a gain like this looks like speculation, but there might be historical trends to back it up.

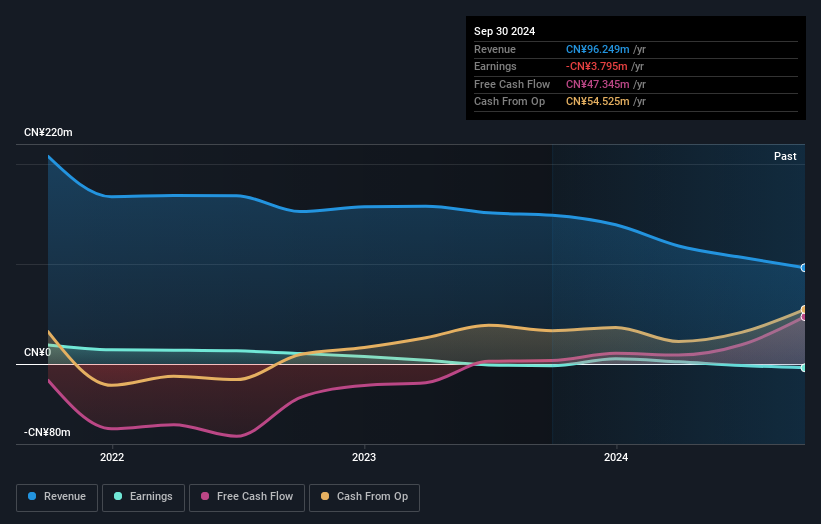

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on SGSG Science&Technology Zhuhai's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for SGSG Science&Technology Zhuhai the TSR over the last 1 year was 611%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that SGSG Science&Technology Zhuhai shareholders have received a total shareholder return of 611% over the last year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 37%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand SGSG Science&Technology Zhuhai better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with SGSG Science&Technology Zhuhai , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300561

SGSG Science&Technology Zhuhai

Engages in software designing, system integration, installation and debugging, technical support, and training services in Mainland China.

Flawless balance sheet very low.

Market Insights

Community Narratives