- China

- /

- Communications

- /

- SZSE:300559

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions and consumer spending concerns, the U.S. Services PMI has entered contraction territory, contributing to a cautious sentiment that saw major indexes like the S&P 500 experience sharp losses despite record highs earlier in the week. In this environment of uncertainty, investors often look for high growth tech stocks that demonstrate resilience through innovation and adaptability, qualities that can be particularly valuable when broader market conditions are volatile.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.86% | 26.17% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.67% | 58.73% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1187 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Beijing Vastdata Technology (SHSE:603138)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Vastdata Technology Co., Ltd. offers data technology services in China and has a market cap of CN¥4.85 billion.

Operations: Vastdata focuses on software and information technology services, generating revenue of CN¥365.24 million. The company's operations are centered in China, catering to the data technology sector.

Beijing Vastdata Technology, despite recent challenges including being dropped from the S&P Global BMI Index, showcases robust potential with a forecasted revenue growth of 41.8% per year and an impressive earnings surge expected at 119.67% annually. This growth trajectory is significantly higher than the broader CN market's average of 13.4%. However, the company faces hurdles with its current unprofitability and highly volatile share price. Investing in R&D remains pivotal for Vastdata; although specific figures are not provided, enhancing this area could be crucial for sustaining innovation and competitiveness in the rapidly evolving tech landscape. As it strides towards profitability within three years, these developments could shape its role in the tech industry significantly.

Chengdu Jiafaantai Education TechnologyLtd (SZSE:300559)

Simply Wall St Growth Rating: ★★★★★☆

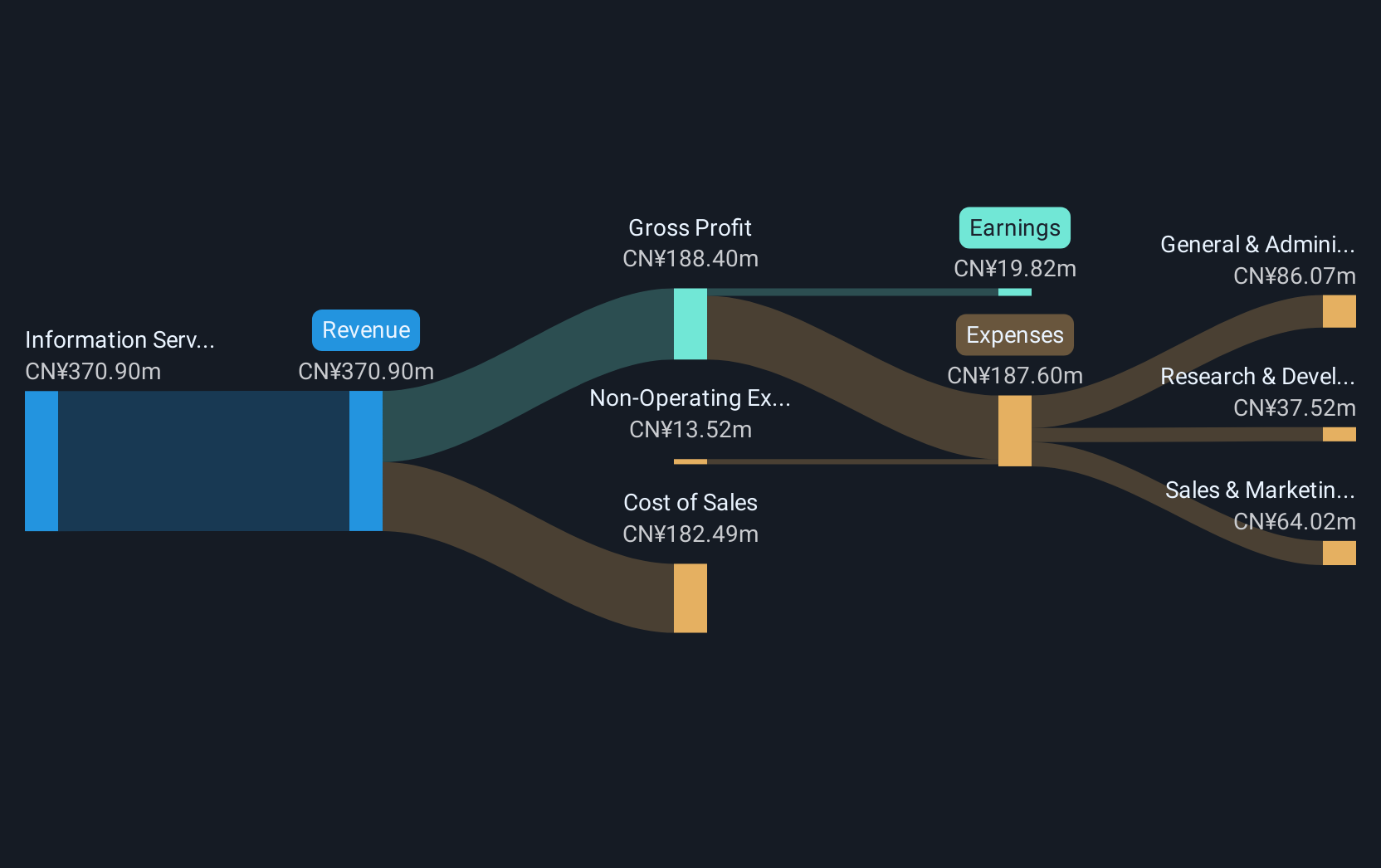

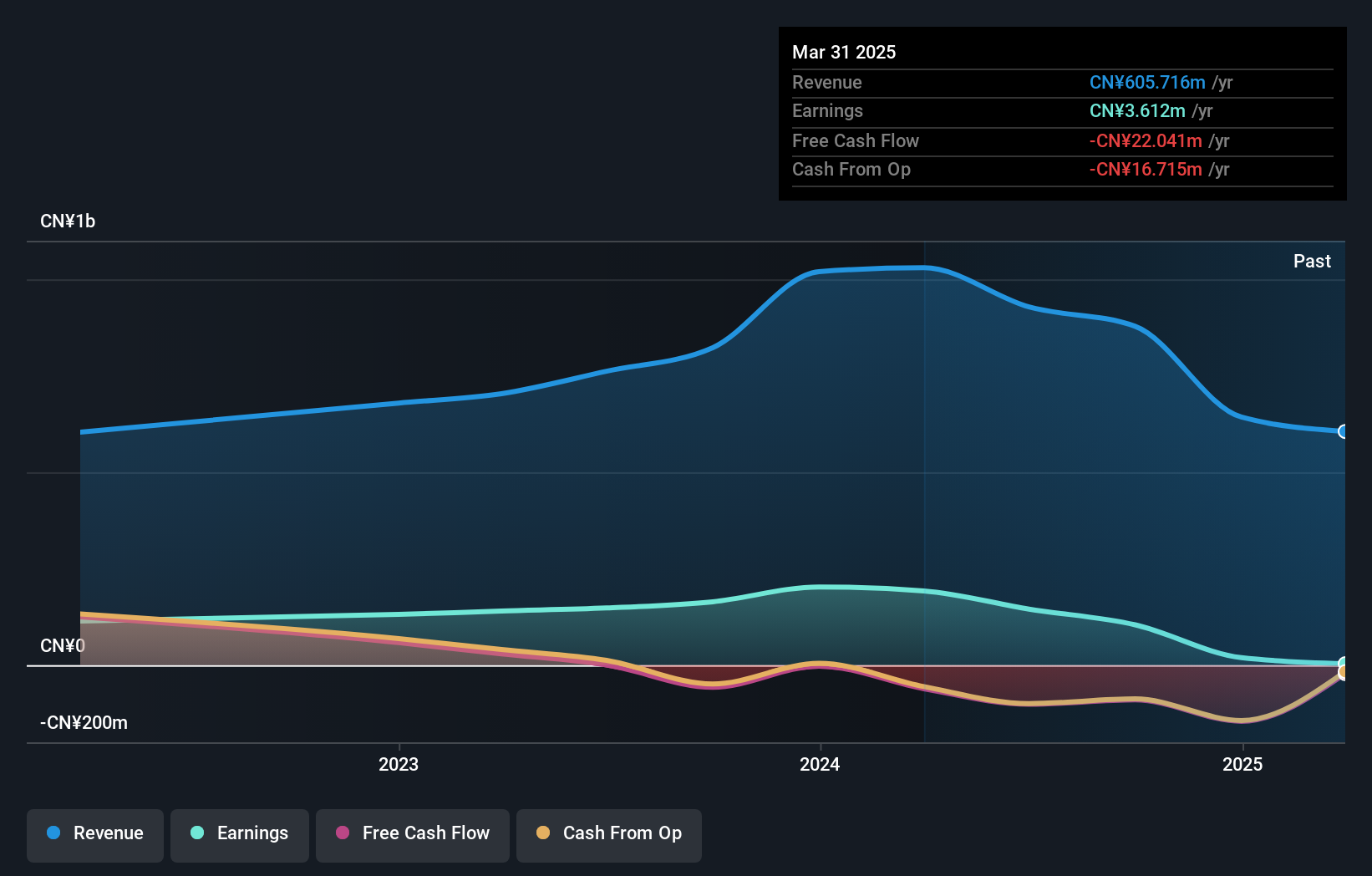

Overview: Chengdu Jiafaantai Education Technology Co., Ltd. engages in the provision of education technology services and solutions, with a market capitalization of approximately CN¥5.25 billion.

Operations: The company generates revenue primarily from its Information Services - Computer Applications segment, which contributed CN¥506.40 million.

Chengdu Jiafaantai Education TechnologyLtd, recently removed from the S&P Global BMI Index, is navigating challenges with resilience. The company's revenue growth is projected at 27.7% annually, outpacing the CN market average of 13.4%. Despite a significant earnings contraction of 31.3% last year, future forecasts are more optimistic with an expected annual earnings increase of 42.5%. This growth is underpinned by substantial investments in R&D to foster innovation and maintain competitiveness in the dynamic tech education sector.

Colorlight Cloud Tech (SZSE:301391)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Colorlight Cloud Tech Ltd is involved in the R&D, manufacturing, and sale of LED display control systems and related equipment globally, with a market cap of CN¥3.79 billion.

Operations: The company generates revenue primarily from the sale of LED display control system equipment, amounting to CN¥878.11 million.

Colorlight Cloud Tech's recent strategic maneuvers, including a CNY 100 million share repurchase program, underscore its commitment to enhancing shareholder value and investing in its workforce through equity incentive plans. Despite being dropped from the S&P Global BMI Index, the company's robust revenue growth at 55.6% annually outstrips the Chinese market average of 13.4%. However, it faces challenges with profit margins declining to 11.9% from last year’s 19.9%. This juxtaposition of aggressive revenue growth against shrinking margins highlights a critical phase in its operational strategy, where future prospects hinge on balancing expansion with profitability enhancements.

Turning Ideas Into Actions

- Dive into all 1187 of the High Growth Tech and AI Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300559

Chengdu Jiafaantai Education TechnologyLtd

Chengdu Jiafaantai Education Technology Co.,Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives