Exploring Three High Growth Tech Stocks with Global Potential

Reviewed by Simply Wall St

As global markets show signs of easing trade tensions and U.S. equities experience a rebound, small- and mid-cap stocks have posted gains for the third consecutive week, driven by positive corporate earnings reports. In this environment, identifying high-growth tech stocks with global potential involves looking for companies that can navigate economic uncertainties while leveraging innovation to capture expanding market opportunities.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 70.39% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Arabian Contracting Services | 21.29% | 30.65% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

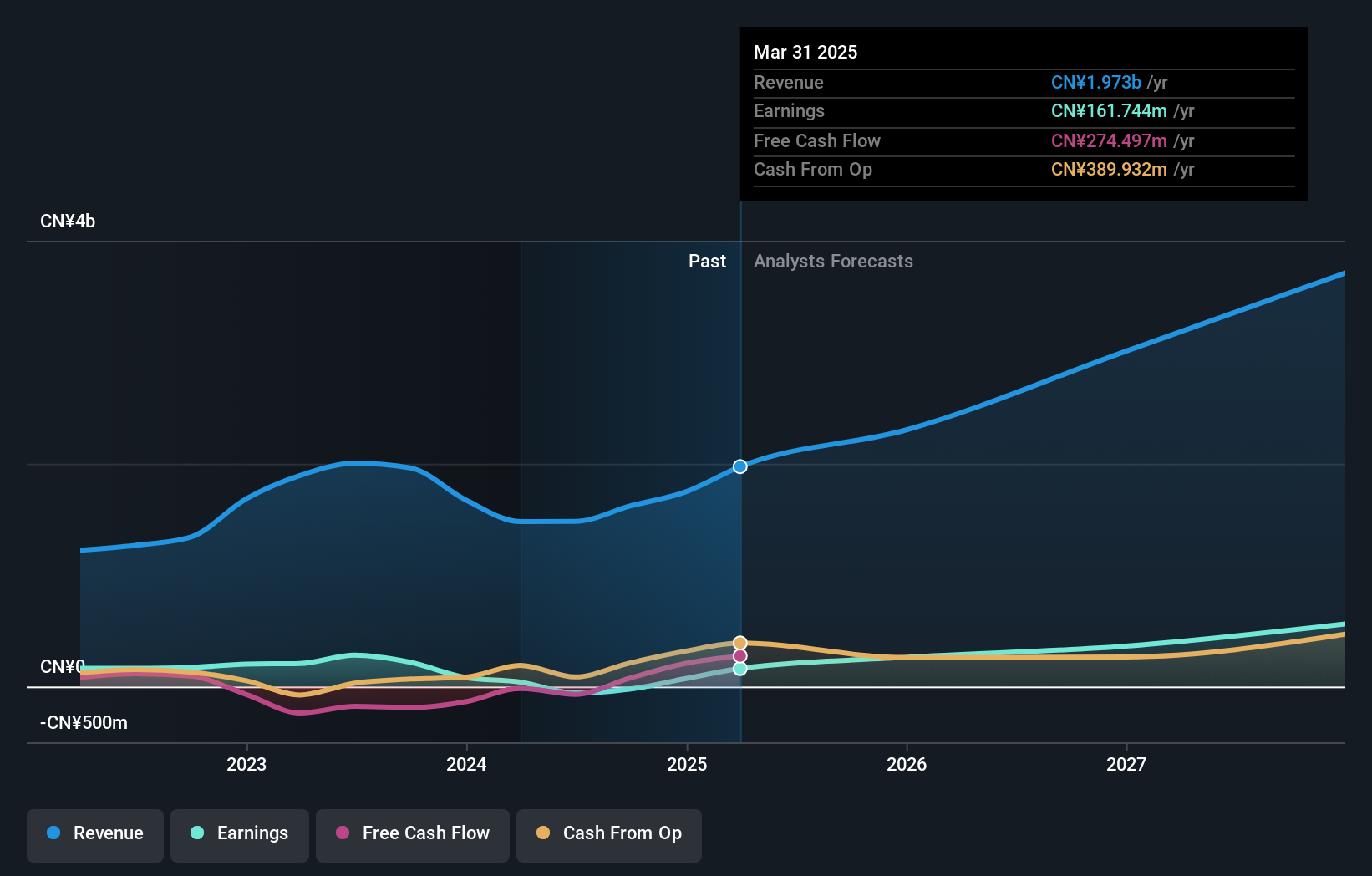

Broadex Technologies (SZSE:300548)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Broadex Technologies Co., Ltd. is engaged in the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market cap of CN¥10.65 billion.

Operations: The company generates revenue primarily from the data communications, consumer, and industrial interconnection segment (CN¥1.07 billion) and the telecom market (CN¥669.68 million). The focus on integrated optoelectronic devices positions it within the optical communications sector both domestically and internationally.

Broadex Technologies, amid a volatile market, demonstrates robust potential with its projected annual revenue growth of 21.6% and earnings surge at 42.4%, significantly outpacing the CN market averages of 12.6% and 23.8%, respectively. This growth is underpinned by substantial R&D investment, aligning with industry shifts towards advanced tech solutions in communications where innovation is critical for maintaining competitive edges. Recent affirmations of a CNY 0.80 per share dividend and positive Q1 projections underscore their financial health and commitment to shareholder returns despite recent earnings dips from CNY 81.47 million to CNY 72.07 million year-over-year, reflecting strategic reinvestments back into core technological advancements.

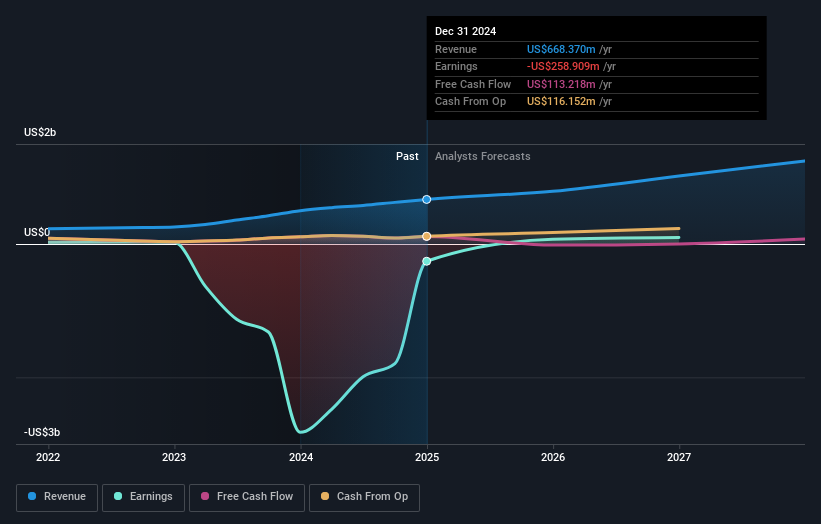

Lumine Group (TSXV:LMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lumine Group Inc. is a global provider specializing in the development, installation, and customization of software solutions, with a market capitalization of CA$11.42 billion.

Operations: The company generates revenue primarily from its communications software segment, which accounts for CA$668.37 million.

Lumine Group, amid a challenging fiscal landscape, has shown promising signs with its revenue climbing to USD 668.37 million from USD 499.67 million year-over-year, marking a substantial increase of 33.7%. This growth is supported by an aggressive R&D strategy that aligns with evolving market demands in software technology. Despite facing a significant net loss reduction from USD 2.83 billion to USD 258.91 million, the company's trajectory suggests potential for profitability within the next three years, reflecting an anticipated annual profit growth well above market averages. With CEO David Nyland resuming leadership, Lumine's strategic direction appears poised for refinement and advancement in high-growth tech sectors.

- Click here to discover the nuances of Lumine Group with our detailed analytical health report.

Assess Lumine Group's past performance with our detailed historical performance reports.

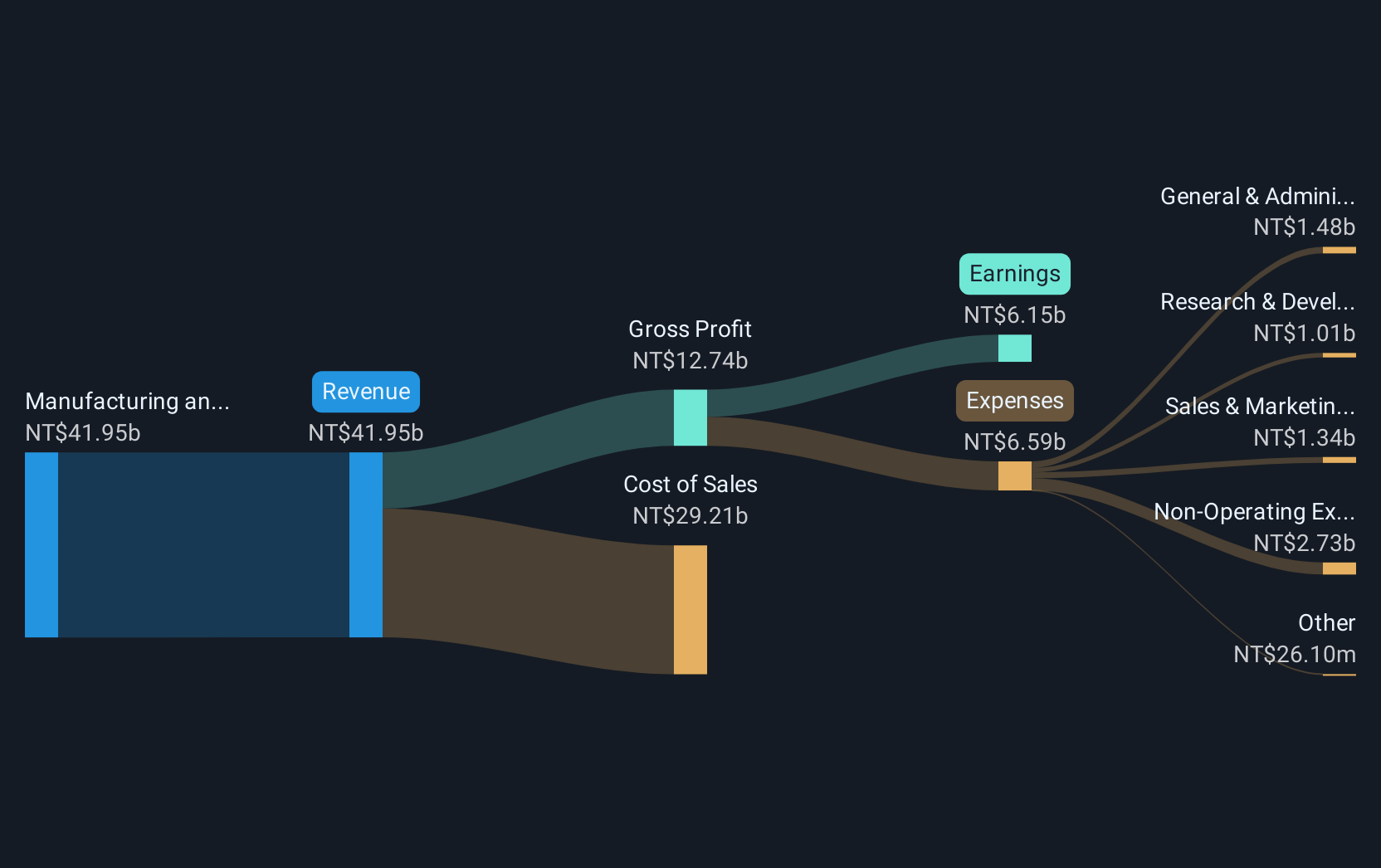

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gold Circuit Electronics Ltd. specializes in the design, manufacturing, processing, and distribution of multilayer printed circuit boards in Taiwan with a market capitalization of approximately NT$93.69 billion.

Operations: Gold Circuit Electronics Ltd. generates revenue primarily from the manufacturing and sales of printed circuit boards, amounting to NT$38.95 billion.

Gold Circuit Electronics, with a robust performance in the recent fiscal year, showcased a significant revenue increase to TWD 38.95 billion from TWD 30.04 billion previously, marking a growth of about 29.6%. This surge is complemented by an impressive rise in net income from TWD 3.53 billion to TWD 5.62 billion and an earnings per share increase from TWD 7.25 to TWD 11.54, reflecting strong operational efficiency and market positioning. The company's strategic presentations at key tech conferences and proposed amendments to its Articles of Incorporation underline its proactive stance in governance and industry engagement. With earnings projected to grow by an annual rate of 22.2%, significantly above Taiwan's market average of 14.2%, Gold Circuit is not just riding the tech wave but actively shaping its trajectory through strategic expansions and R&D investments.

Summing It All Up

- Get an in-depth perspective on all 744 Global High Growth Tech and AI Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Lumine Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LMN

Lumine Group

Offers develops, installs, and customizes of software worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives