- China

- /

- Personal Products

- /

- SHSE:603193

3 Global Growth Companies With High Insider Ownership Expecting Up To 27% Revenue Growth

Reviewed by Simply Wall St

In recent weeks, global markets have shown signs of optimism as trade tensions between the U.S. and China appear to be easing, boosting U.S. equities and leading to gains in major indices such as the Nasdaq Composite. Amid this backdrop of cautious economic recovery, investors often look for growth companies with strong insider ownership, as these stocks can offer insights into management's confidence in their business trajectory and potential resilience against market uncertainties.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| AcrelLtd (SZSE:300286) | 34.2% | 34.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

Let's take a closer look at a couple of our picks from the screened companies.

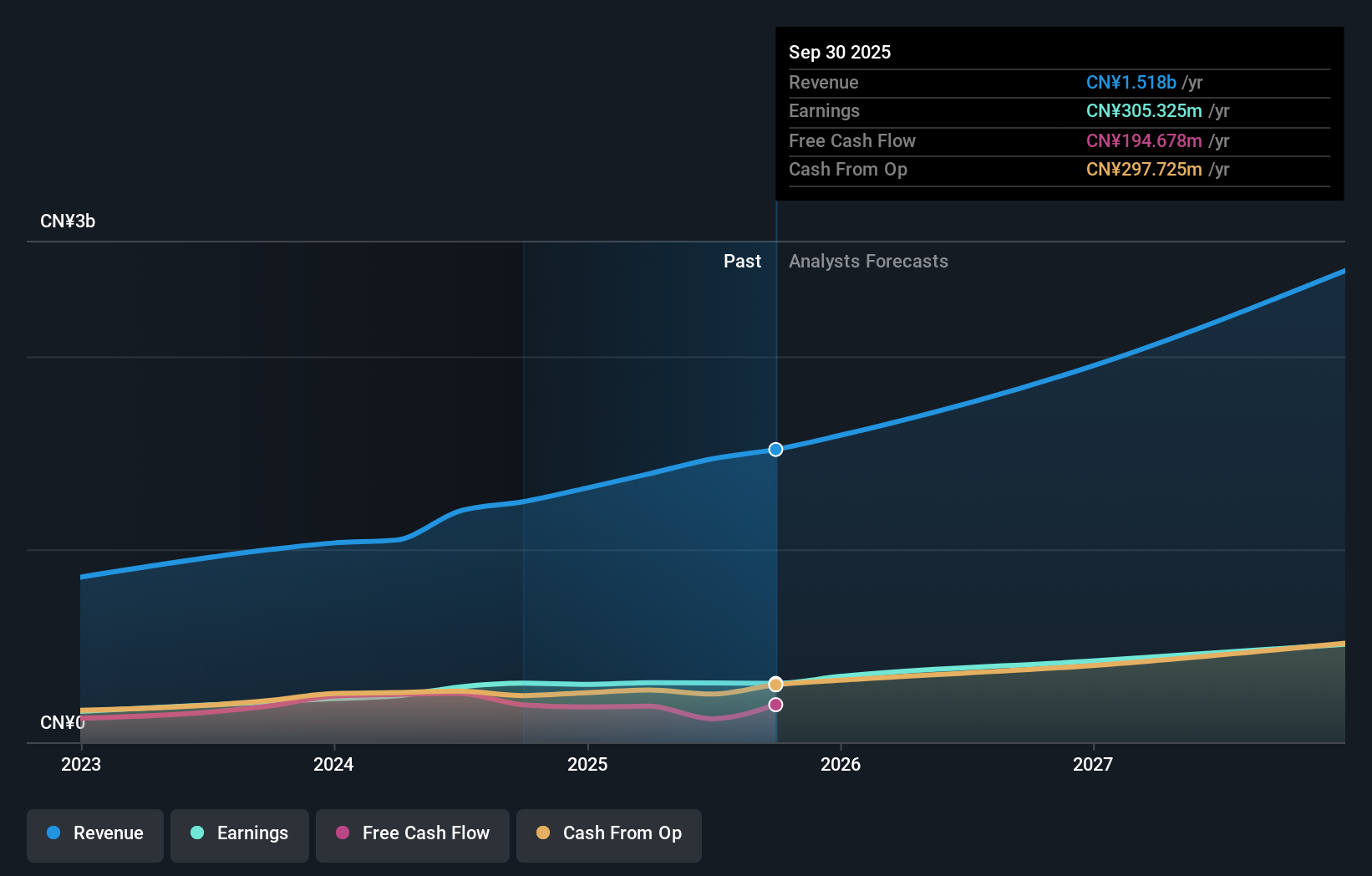

Runben Biotechnology (SHSE:603193)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Runben Biotechnology Co., Ltd. focuses on the research, production, and sale of mosquito repellent products, baby care products, and essential oil products with a market cap of CN¥14.35 billion.

Operations: The company's revenue is primarily derived from its personal products segment, which generated CN¥1.39 billion.

Insider Ownership: 29.6%

Revenue Growth Forecast: 23% p.a.

Runben Biotechnology's revenue is forecast to grow 23% annually, outpacing the broader CN market. Despite a lower-than-benchmark expected ROE of 17.8%, its earnings growth remains significant at 23.5% per year, although slightly below the market average. Recent Q1 results showed strong performance with sales rising to CNY 240.03 million from CNY 166.68 million year-over-year and net income increasing to CNY 44.2 million, reflecting robust operational momentum without substantial insider trading activity reported recently.

- Unlock comprehensive insights into our analysis of Runben Biotechnology stock in this growth report.

- The analysis detailed in our Runben Biotechnology valuation report hints at an inflated share price compared to its estimated value.

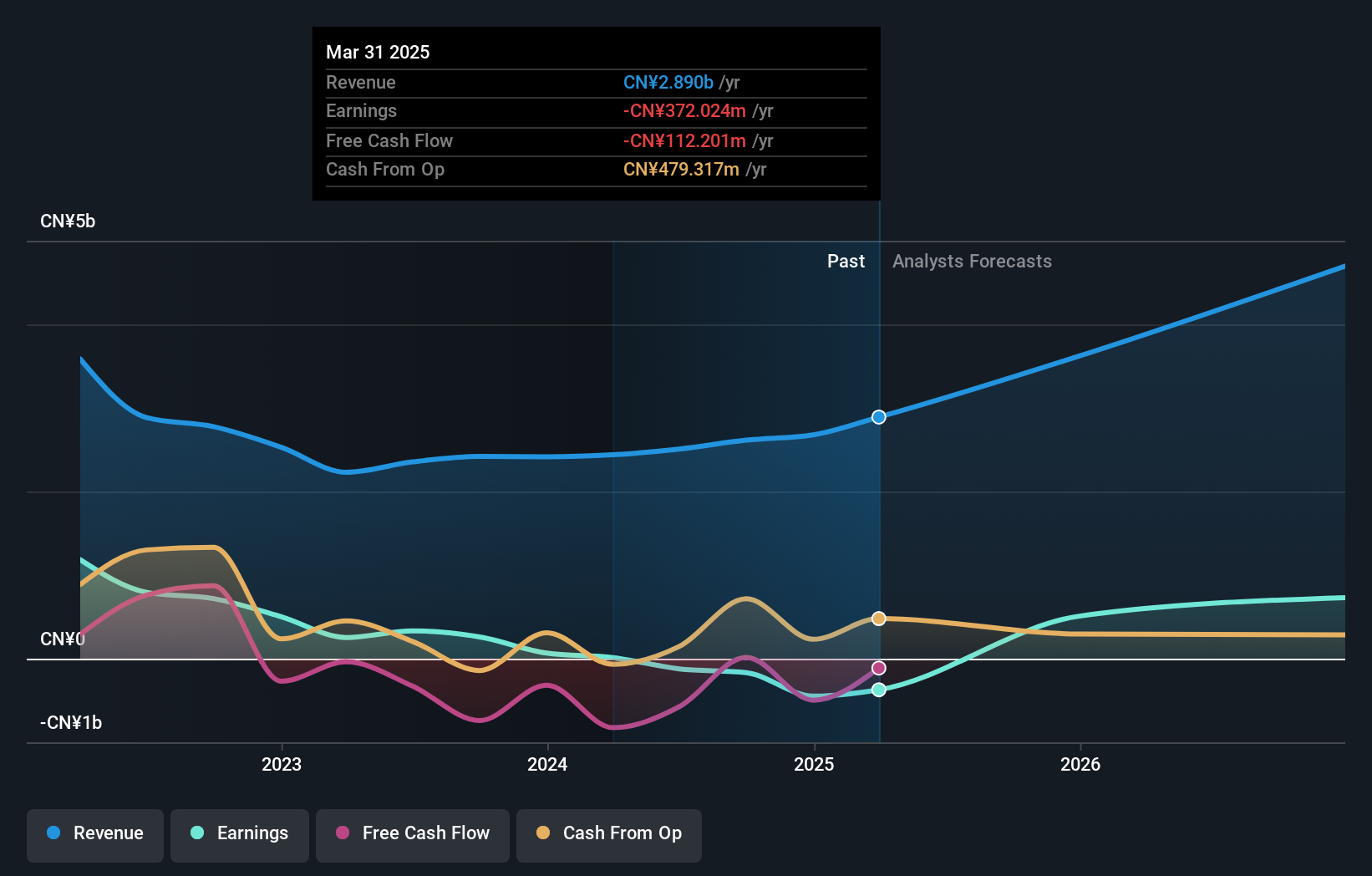

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Guide Infrared Co., Ltd. focuses on the research, development, production, and sale of infrared thermal imaging technology in Asia with a market cap of CN¥32.24 billion.

Operations: The company generates revenue primarily from Other Electronic Equipment Manufacturing, amounting to CN¥2.62 billion, and Technical Service Industry, contributing CN¥42.78 million.

Insider Ownership: 27.1%

Revenue Growth Forecast: 27.6% p.a.

Wuhan Guide Infrared's revenue is projected to grow 27.6% annually, surpassing the broader CN market growth rate. Despite a low forecasted ROE of 9.5%, the company is expected to achieve profitability within three years, indicating above-average market profit growth potential. Recent Q1 results demonstrated significant improvement, with sales increasing to CNY 680.76 million from CNY 467.97 million and net income rising sharply to CNY 83.55 million, with no substantial insider trading activity reported recently.

- Delve into the full analysis future growth report here for a deeper understanding of Wuhan Guide Infrared.

- Our valuation report here indicates Wuhan Guide Infrared may be overvalued.

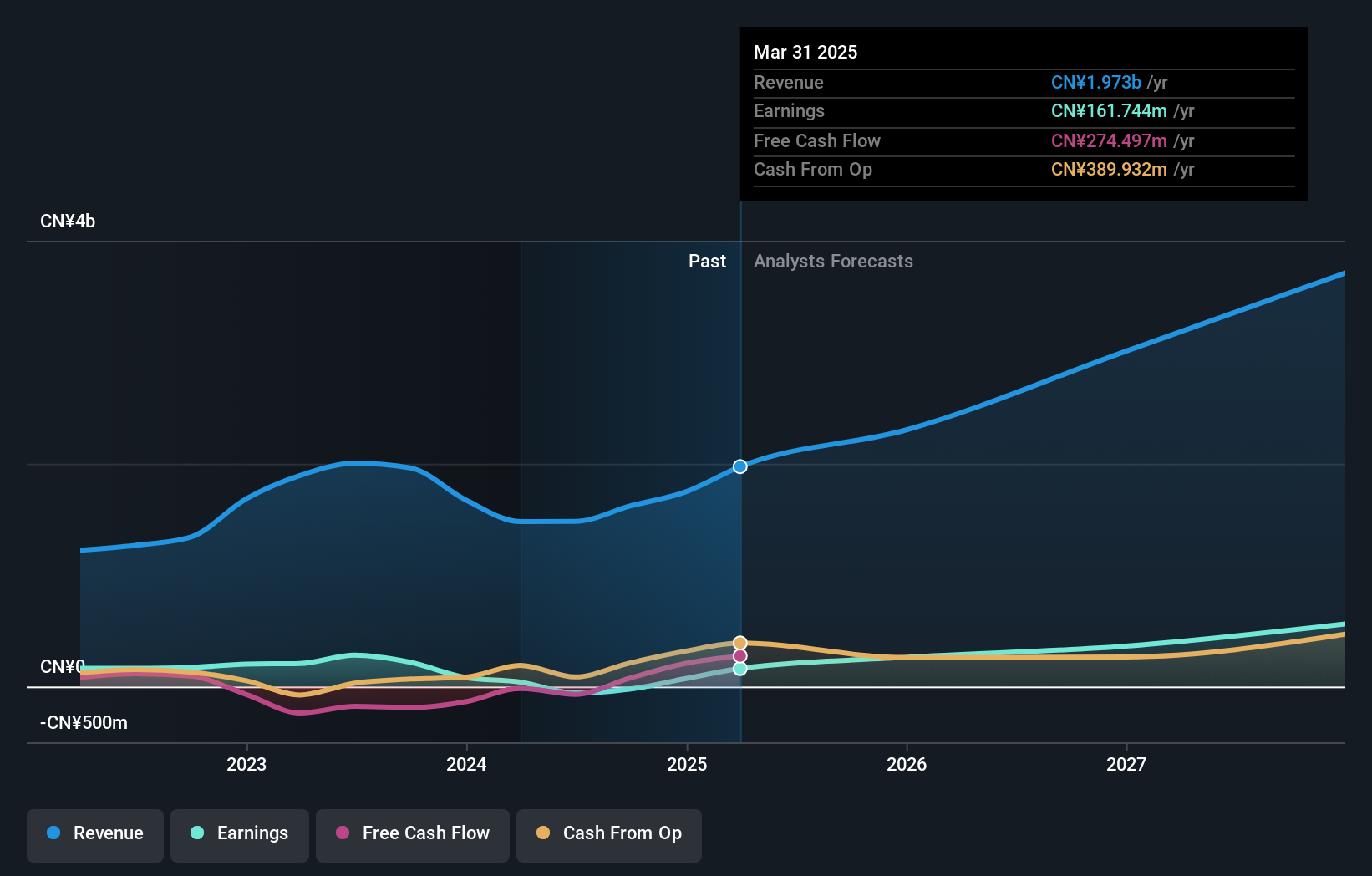

Broadex Technologies (SZSE:300548)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Broadex Technologies Co., Ltd. engages in the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market cap of CN¥10.65 billion.

Operations: The company's revenue segments include CN¥669.68 million from the Telecom Market and CN¥1.07 billion from Data communications, consumer and industrial interconnection.

Insider Ownership: 11.5%

Revenue Growth Forecast: 21.6% p.a.

Broadex Technologies is forecasted to see revenue growth of 21.6% annually, outpacing the CN market's 12.6% growth rate, with earnings expected to grow significantly at 42.4% per year. Despite trading at a substantial discount to its estimated fair value and experiencing share price volatility, Broadex reported full-year sales of CNY 1.75 billion for 2024, up from CNY 1.68 billion in the previous year, though net income decreased slightly to CNY 72.07 million from CNY 81.47 million.

- Dive into the specifics of Broadex Technologies here with our thorough growth forecast report.

- According our valuation report, there's an indication that Broadex Technologies' share price might be on the expensive side.

Seize The Opportunity

- Explore the 856 names from our Fast Growing Global Companies With High Insider Ownership screener here.

- Want To Explore Some Alternatives? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 23 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603193

Runben Biotechnology

Engages in the research, production, and sale of mosquito repellent products, baby care products, and essential oil products.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives