- Sweden

- /

- Healthcare Services

- /

- OM:ATT

Top Growth Stocks With High Insider Ownership In February 2025

Reviewed by Simply Wall St

As global markets navigate a volatile landscape marked by fluctuating interest rates and competitive pressures in technology, investors are increasingly focused on finding resilient growth opportunities. In this environment, companies with high insider ownership can be particularly appealing, as they often signal strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.4% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Let's uncover some gems from our specialized screener.

Attendo (OM:ATT)

Simply Wall St Growth Rating: ★★★★☆☆

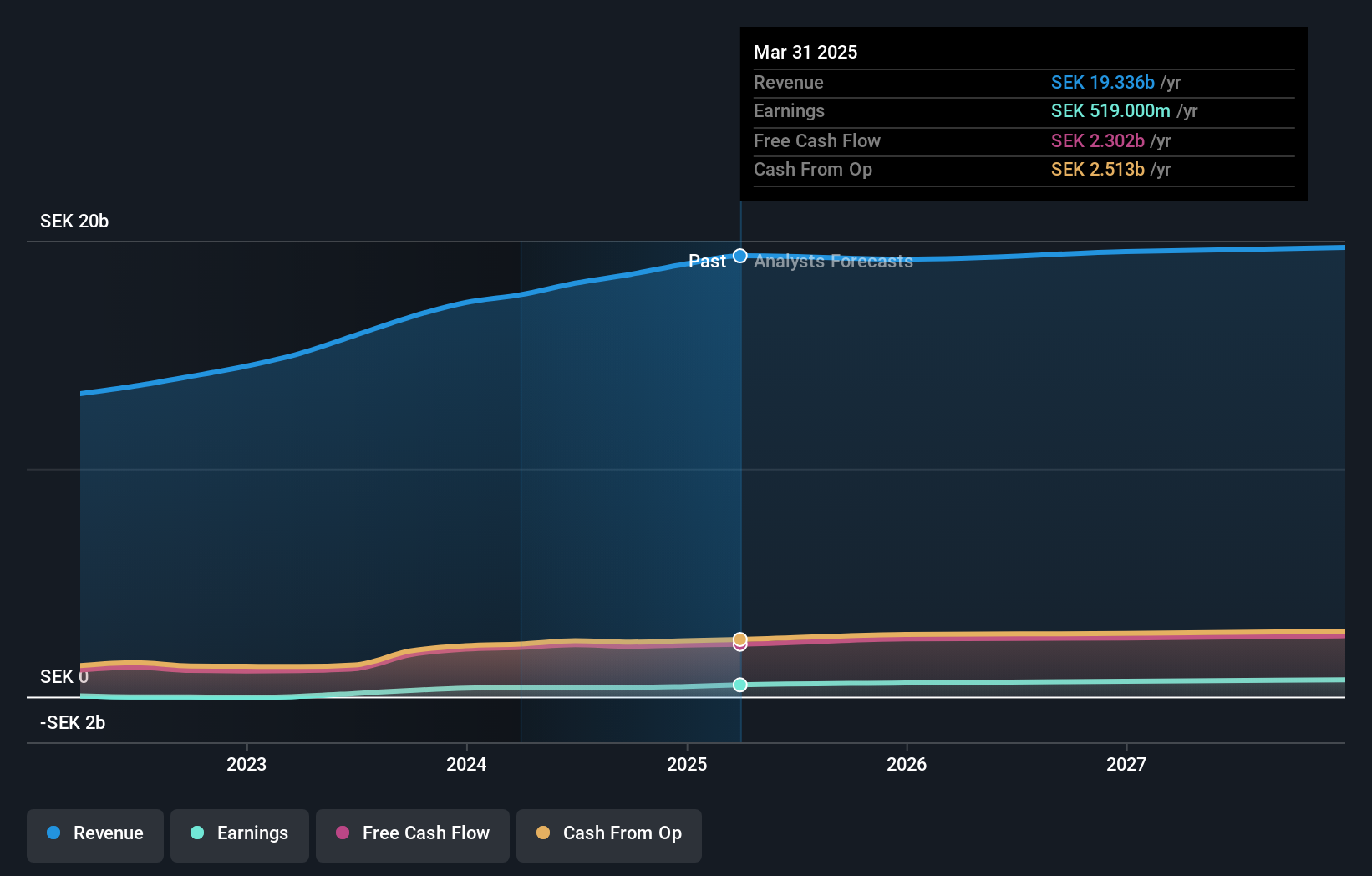

Overview: Attendo AB (publ) operates in Scandinavia and Finland, offering health and care services, with a market cap of SEK7.91 billion.

Operations: The company generates revenue of SEK18.52 billion from its Care and Health Care Services segment in Scandinavia and Finland.

Insider Ownership: 15.5%

Earnings Growth Forecast: 20.2% p.a.

Attendo's earnings are forecast to grow significantly at 20.21% annually, surpassing the Swedish market's growth rate of 13.4%. Despite this, revenue growth is expected to be moderate at 4.8% per year, though still faster than the market average of 1.1%. The company trades substantially below its estimated fair value but faces challenges with interest coverage from earnings and an unstable dividend history. Recent leadership changes include Malin Fredgardh Huber as Business Area Director for Scandinavia.

- Click here to discover the nuances of Attendo with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Attendo is trading behind its estimated value.

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

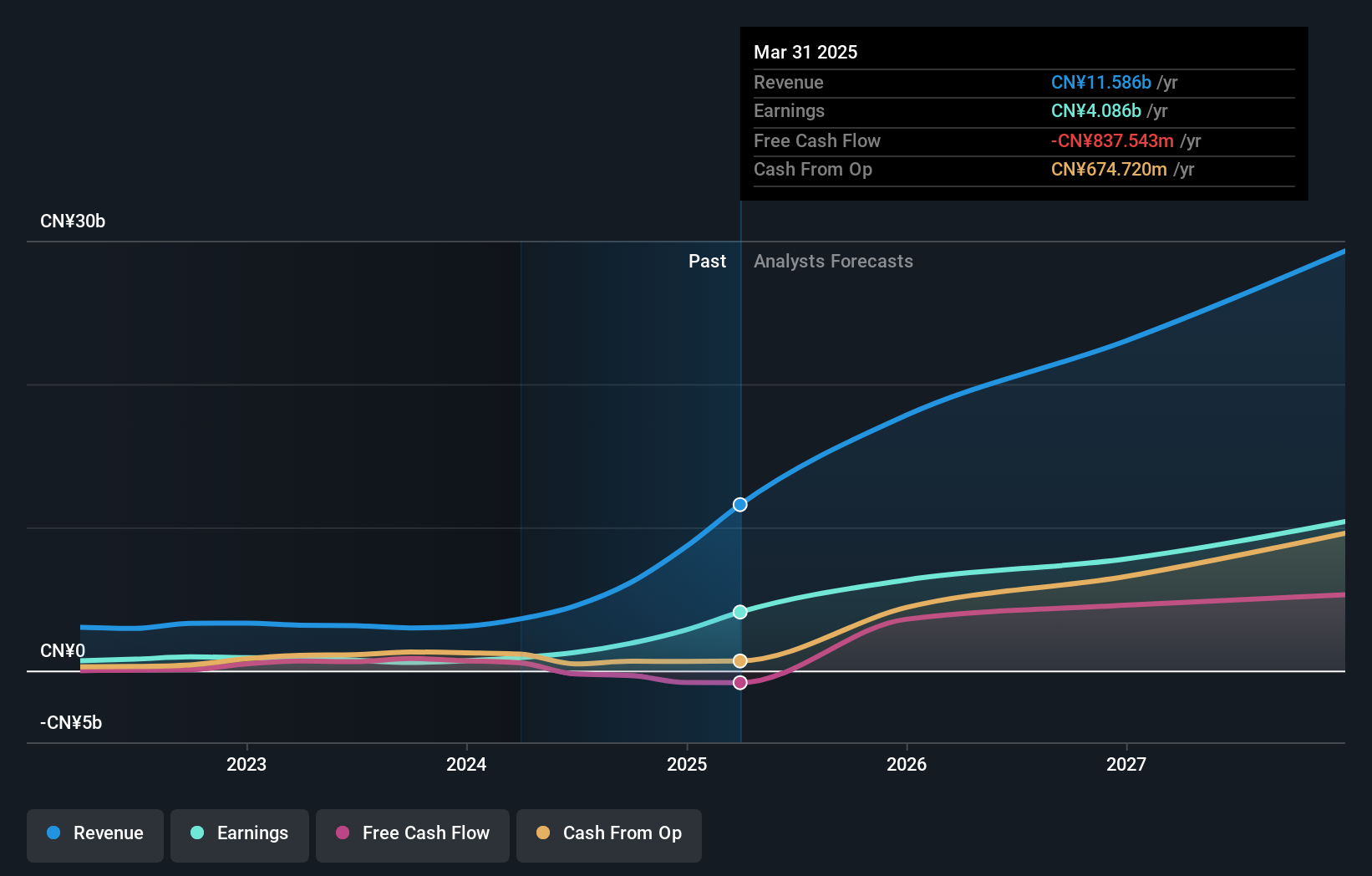

Overview: Eoptolink Technology Inc., Ltd. is involved in the research, development, manufacture, and sale of optical transceivers both in China and internationally, with a market cap of CN¥89.15 billion.

Operations: The company's revenue is primarily derived from its Optical Communication Equipment segment, which generated CN¥6.14 billion.

Insider Ownership: 23%

Earnings Growth Forecast: 36.6% p.a.

Eoptolink Technology's earnings are forecast to grow significantly at 36.6% annually, outpacing the CN market's 25.1% growth rate, with revenue expected to rise by 41.6% per year. The company's price-to-earnings ratio of 46.8x is slightly below the Electronic industry average of 47.6x, indicating reasonable valuation within its sector despite high growth prospects and substantial past earnings growth of over twofold last year.

- Click to explore a detailed breakdown of our findings in Eoptolink Technology's earnings growth report.

- According our valuation report, there's an indication that Eoptolink Technology's share price might be on the expensive side.

Advanced Fiber Resources (Zhuhai) (SZSE:300620)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Advanced Fiber Resources (Zhuhai), Ltd. designs and manufactures passive optical components in China and internationally, with a market cap of CN¥11.75 billion.

Operations: The company's revenue segment includes Optoelectronic Devices and Other Electronic Devices, amounting to CN¥924.78 million.

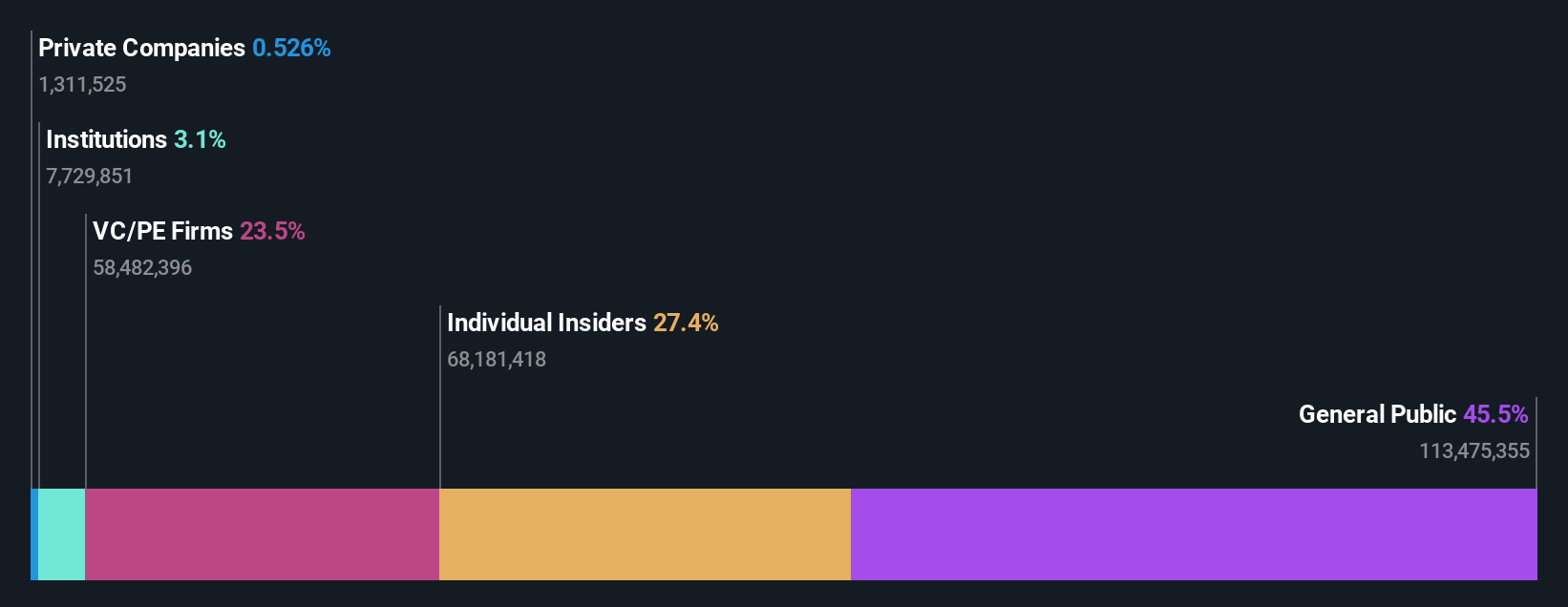

Insider Ownership: 32.1%

Earnings Growth Forecast: 42% p.a.

Advanced Fiber Resources (Zhuhai) is poised for significant growth, with earnings projected to increase by 42% annually, surpassing the CN market's 25.1% growth rate. Revenue is expected to grow at 23.7% per year, outpacing the market average of 13.3%. Despite a decline in profit margins from last year's 11.1% to the current 7.4%, insider ownership remains strong with no substantial insider trading activity reported recently.

- Click here and access our complete growth analysis report to understand the dynamics of Advanced Fiber Resources (Zhuhai).

- Our comprehensive valuation report raises the possibility that Advanced Fiber Resources (Zhuhai) is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1478 Fast Growing Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ATT

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives