Exploring None And Two Other High Growth Tech Stocks For Your Portfolio

Reviewed by Simply Wall St

In a week where most major stock indexes ended lower, the technology-heavy Nasdaq Composite stood out by hitting a new record high, reflecting the continued strength of growth stocks even as broader market sentiment remained cautious. As investors navigate these dynamic conditions marked by rate cuts and inflation concerns, identifying high-growth tech stocks with strong fundamentals and innovative potential can be key to building a resilient portfolio.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1249 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Cafe24 (KOSDAQ:A042000)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cafe24 Corp. operates a global e-commerce platform and has a market capitalization of approximately ₩947.78 billion.

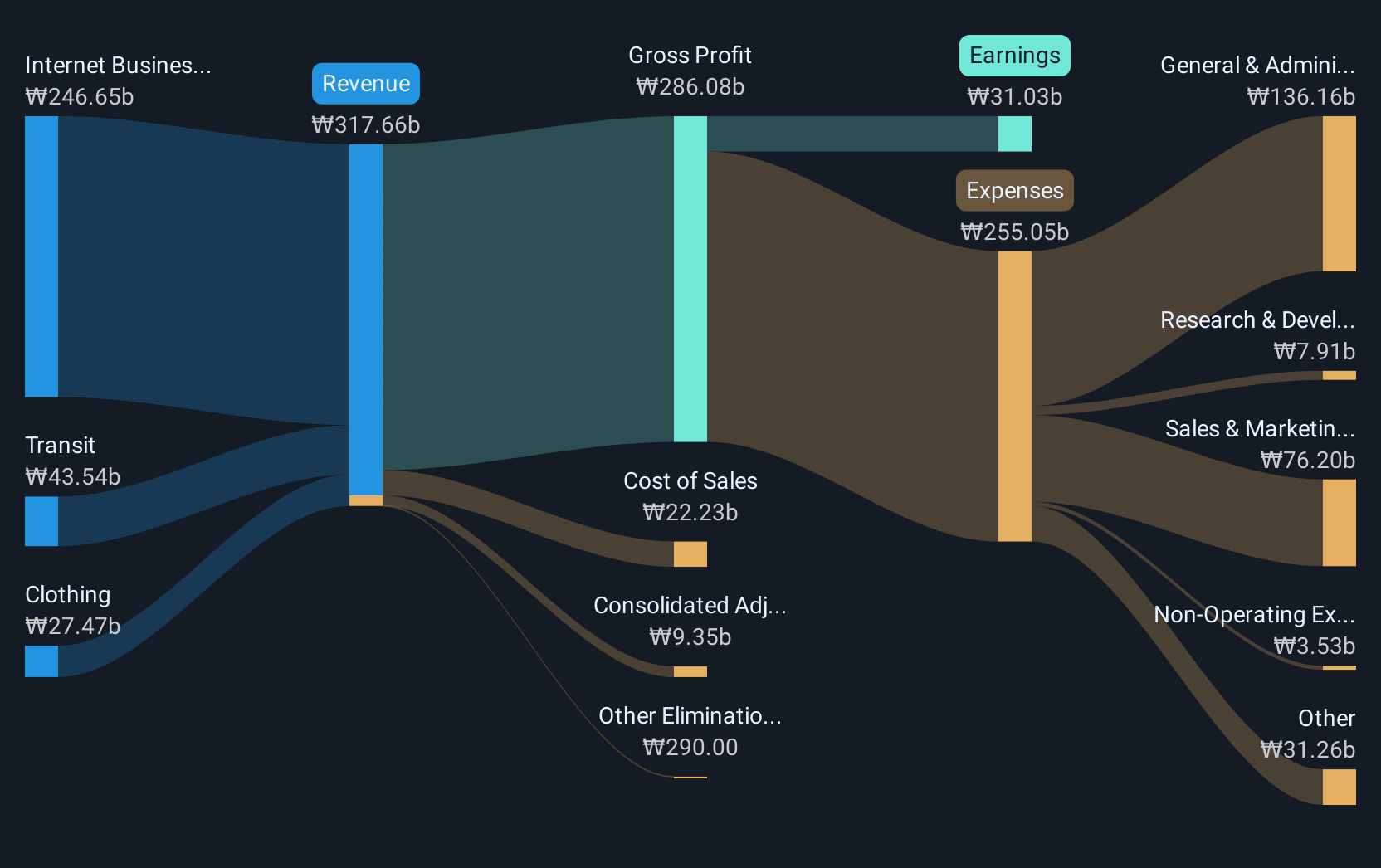

Operations: The company generates revenue primarily from its Internet Business Solution segment, contributing ₩237.10 billion, followed by the Transit and Clothing segments at ₩44.06 billion and ₩22.16 billion, respectively.

Cafe24, amidst a dynamic tech landscape, demonstrates robust financial health with an annualized revenue growth of 11.3% and earnings expected to surge by 35.5% annually. Notably, the company's commitment to innovation is evident from its R&D spending trends which have consistently aligned with revenue increases, showcasing a strategic reinvestment into its core capabilities. This focus on research has not only fortified its market position but also catalyzed advancements in e-commerce solutions, making it a critical player despite slower industry-wide growth rates. As Cafe24 continues to evolve, its trajectory suggests a sustained potential for market influence and technological contributions that resonate well beyond its current standings.

- Get an in-depth perspective on Cafe24's performance by reading our health report here.

Gain insights into Cafe24's past trends and performance with our Past report.

Range Intelligent Computing Technology Group (SZSE:300442)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Range Intelligent Computing Technology Group Company Limited focuses on developing data centers and other technology campuses, with a market cap of CN¥78.47 billion.

Operations: The company generates revenue primarily through its IDC Services, amounting to CN¥8.08 billion.

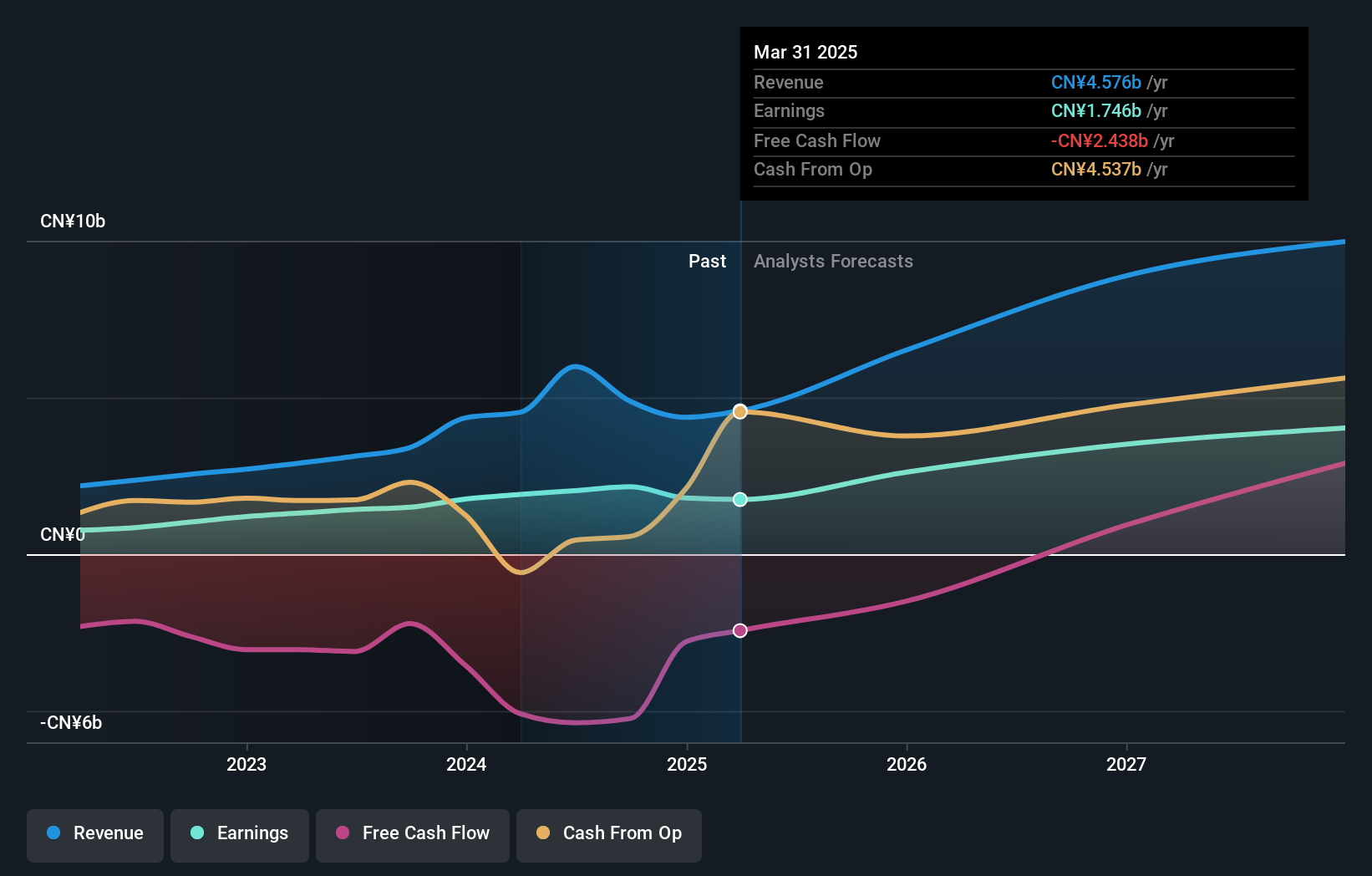

Range Intelligent Computing Technology Group has demonstrated a remarkable financial trajectory, with revenue and earnings growth outpacing the broader Chinese market. The company's revenue has surged by 17.8% annually, significantly above the market average of 13.7%, while its earnings have expanded by an impressive 30.6% per year. This growth is underpinned by substantial investments in R&D, which not only fuel innovation but also enhance competitive positioning in the rapidly evolving tech landscape. Despite a volatile share price over the past three months and a decrease in net profit margins from last year’s 44% to 26.7%, Range's strategic focus on developing cutting-edge technologies and maintaining robust revenue growth highlights its potential to shape industry trends and drive future expansions.

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

Overview: Eoptolink Technology Inc., Ltd. specializes in the research, development, manufacture, and sale of optical transceivers both in China and globally, with a market cap of CN¥93.69 billion.

Operations: Eoptolink Technology Inc., Ltd. generates its revenue primarily from the sale of optical communication equipment, amounting to CN¥6.14 billion.

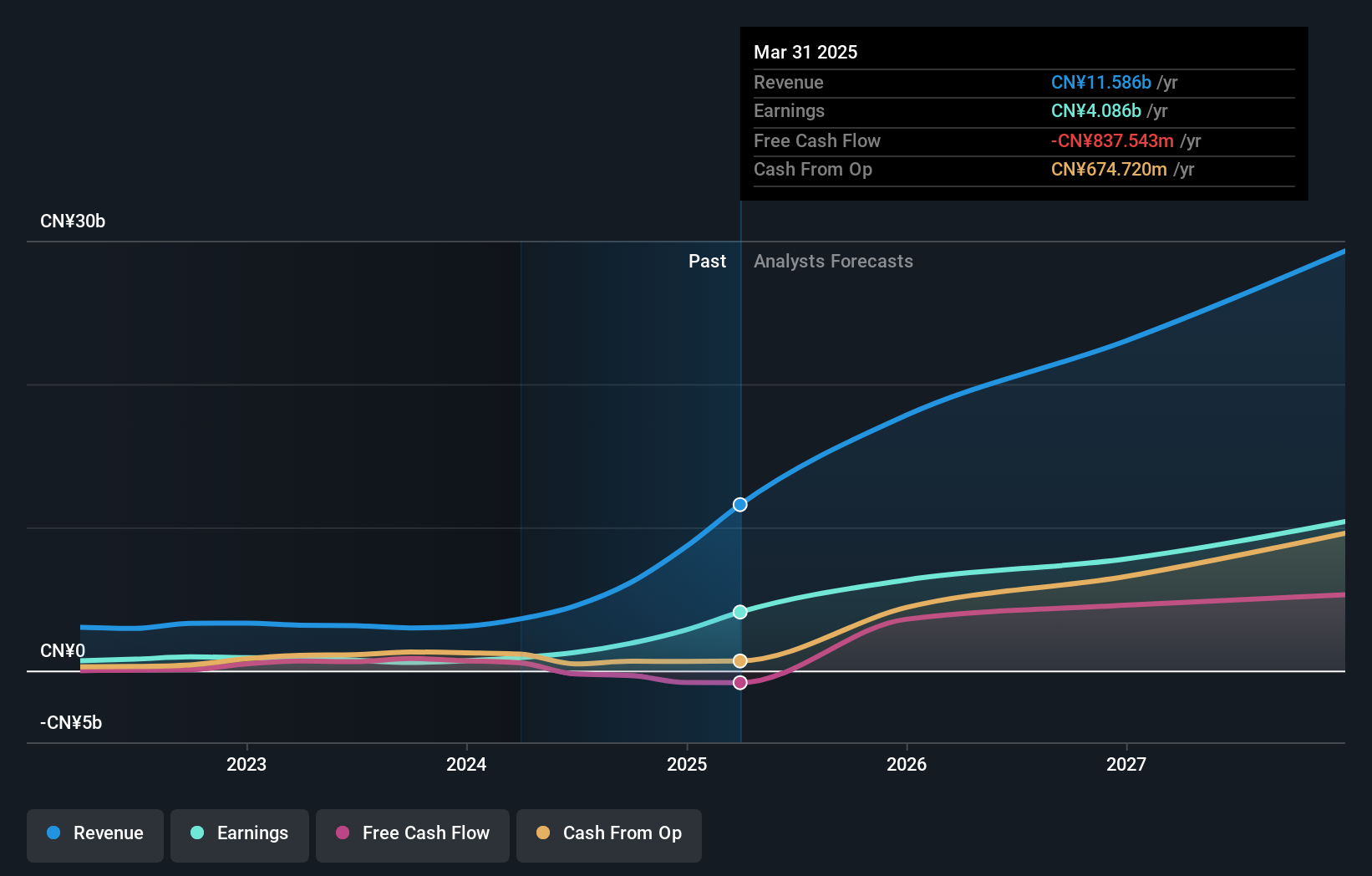

Eoptolink Technology has surged with a revenue increase to CNY 5.13 billion, up from CNY 2.09 billion last year, reflecting a robust annual growth of 41.7%. This growth is complemented by an earnings spike from CNY 430 million to CNY 1.65 billion, marking a substantial rise in profitability by 36.7% annually. The company's commitment to innovation is evident in its R&D investments, crucial for sustaining its competitive edge in the high-stakes tech arena. Despite recent volatility in share prices and the strategic changes like auditor shifts highlighted in their latest shareholder meeting, Eoptolink's aggressive expansion and solid financial performance position it well within the high-growth tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Eoptolink Technology.

Understand Eoptolink Technology's track record by examining our Past report.

Key Takeaways

- Gain an insight into the universe of 1249 High Growth Tech and AI Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300442

Range Intelligent Computing Technology Group

Provides server hosting services to internet companies and large cloud vendors in China.

Exceptional growth potential and good value.

Market Insights

Community Narratives