3 Asian Growth Companies With High Insider Ownership Expecting Up To 46% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and economic uncertainties, Asia's stock markets have been capturing attention with their unique growth narratives. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong alignment between management and shareholder interests, which is crucial when anticipating substantial earnings growth.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.8% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's explore several standout options from the results in the screener.

Shanghai Daimay Automotive Interior (SHSE:603730)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Daimay Automotive Interior Co., Ltd focuses on the research, development, and sale of passenger car components both in China and internationally, with a market cap of CN¥17.62 billion.

Operations: Shanghai Daimay Automotive Interior Co., Ltd generates revenue through the research, development, and sale of passenger car components for both domestic and international markets.

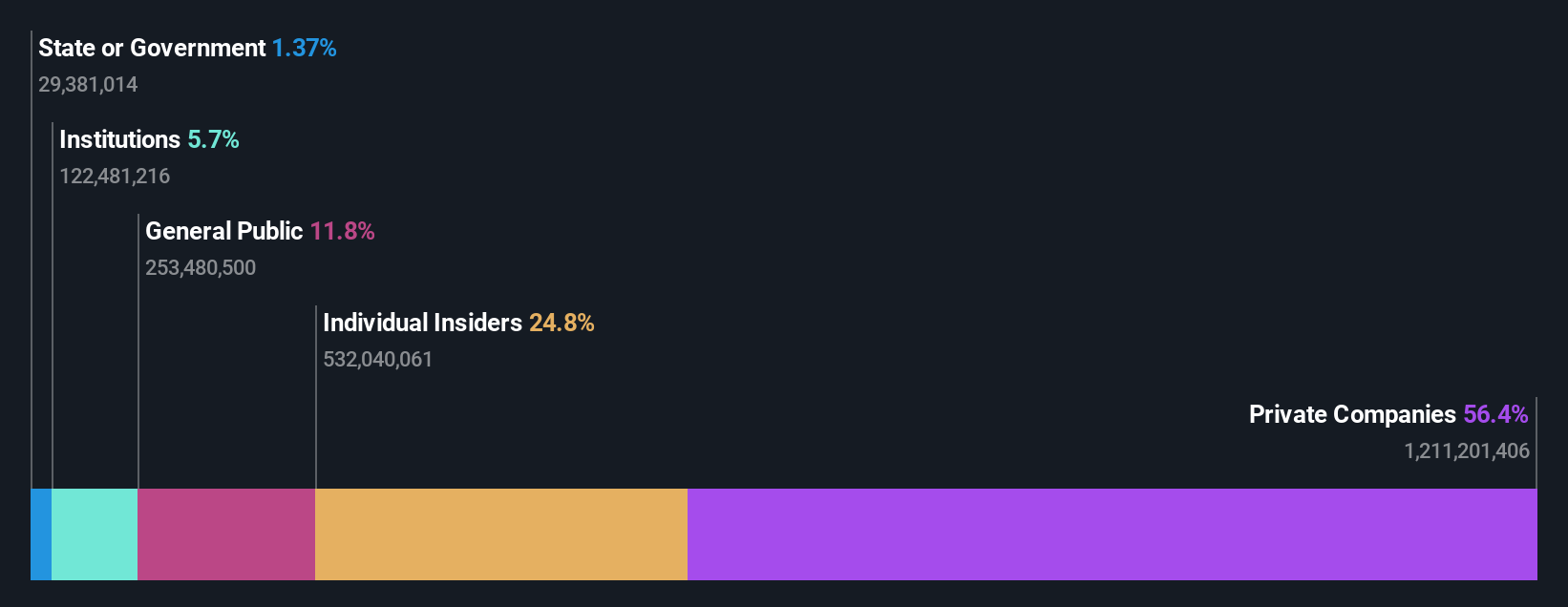

Insider Ownership: 24.8%

Earnings Growth Forecast: 25.1% p.a.

Shanghai Daimay Automotive Interior has high insider ownership, which aligns with its growth potential. Despite recent earnings showing a decline in net income to CNY 444.7 million for the first nine months of 2025, the company's earnings are forecasted to grow significantly at 25.09% annually over the next three years. While revenue growth is slower than some peers, it still surpasses the Chinese market average. The price-to-earnings ratio of 28.2x suggests it's valued below market norms despite profitability challenges.

- Dive into the specifics of Shanghai Daimay Automotive Interior here with our thorough growth forecast report.

- Our valuation report here indicates Shanghai Daimay Automotive Interior may be overvalued.

Inner Mongolia Furui Medical Science (SZSE:300049)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Inner Mongolia Furui Medical Science Co., Ltd. operates in the medical science sector and has a market capitalization of approximately CN¥19.23 billion.

Operations: Inner Mongolia Furui Medical Science Co., Ltd. does not have specified revenue segments provided in the available text.

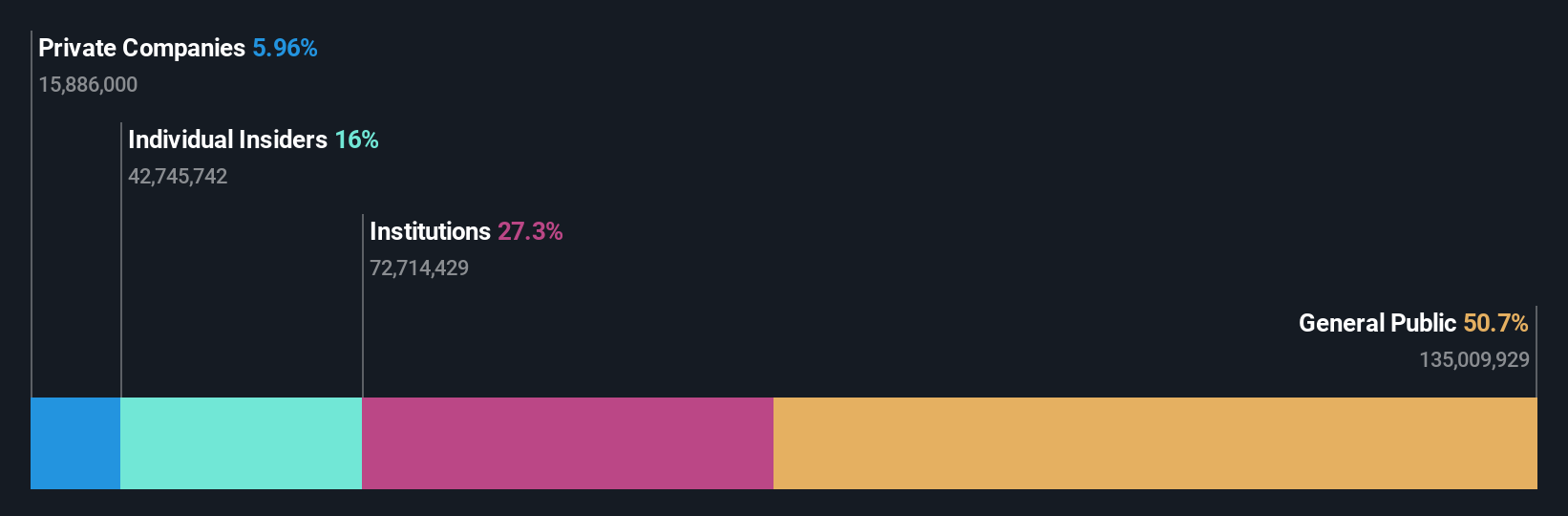

Insider Ownership: 15.9%

Earnings Growth Forecast: 46% p.a.

Inner Mongolia Furui Medical Science demonstrates growth potential with high insider ownership, reporting CNY 1.10 billion in revenue for the first nine months of 2025, up from CNY 979.86 million a year ago. Earnings are forecasted to grow significantly at 46% annually, outpacing the Chinese market's average growth rate of 27.2%. Despite a low return on equity forecast at 17.5%, revenue is expected to increase by 22.6% per year, exceeding market averages without substantial recent insider trading activity noted.

- Click to explore a detailed breakdown of our findings in Inner Mongolia Furui Medical Science's earnings growth report.

- Our comprehensive valuation report raises the possibility that Inner Mongolia Furui Medical Science is priced higher than what may be justified by its financials.

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

Overview: Eoptolink Technology Inc., Ltd. is involved in the research, development, production, and sale of optical modules for optical communication applications both in China and internationally, with a market cap of CN¥422.24 billion.

Operations: The company's revenue segment is primarily composed of Optical Communication Equipment, generating CN¥20.02 billion.

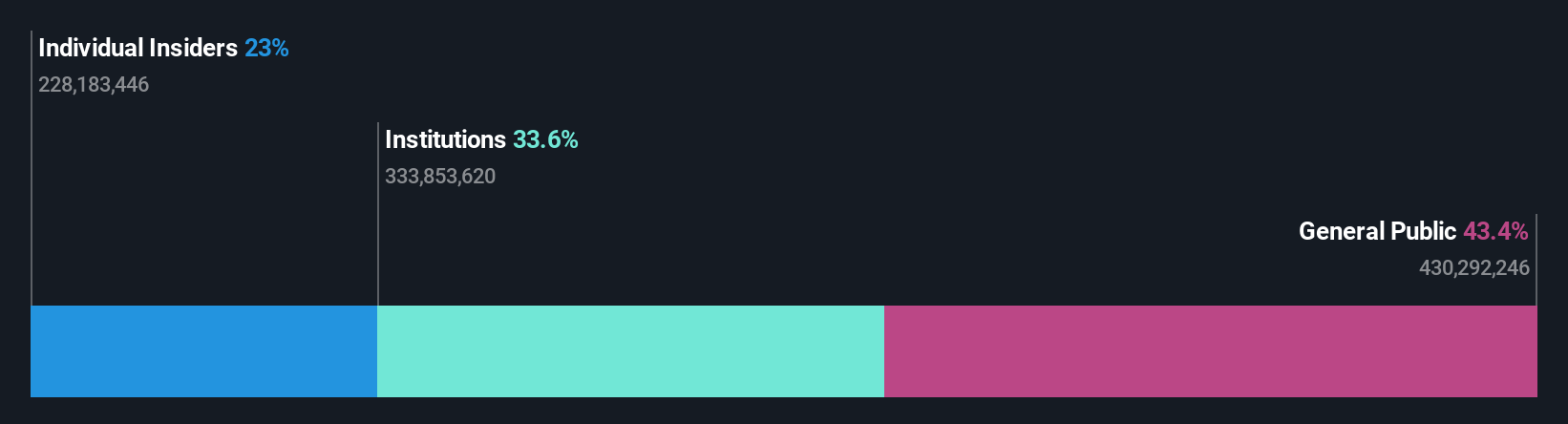

Insider Ownership: 23%

Earnings Growth Forecast: 40.4% p.a.

Eoptolink Technology, with substantial insider ownership, showcases strong growth potential. Its revenue for the first nine months of 2025 surged to CNY 16.50 billion from CNY 5.13 billion a year ago, and net income rose to CNY 6.33 billion from CNY 1.65 billion. Forecasts indicate revenue growth at a very high rate of 42.9% annually and earnings growth at 40.4%, both surpassing market averages despite recent share price volatility and no significant insider trading activity reported recently.

- Delve into the full analysis future growth report here for a deeper understanding of Eoptolink Technology.

- In light of our recent valuation report, it seems possible that Eoptolink Technology is trading beyond its estimated value.

Make It Happen

- Click this link to deep-dive into the 633 companies within our Fast Growing Asian Companies With High Insider Ownership screener.

- Ready To Venture Into Other Investment Styles? Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300049

Inner Mongolia Furui Medical Science

Inner Mongolia Furui Medical Science Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion