- China

- /

- Healthtech

- /

- SZSE:300451

Exploring Three High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings and AI competition concerns, the technology sector has experienced notable volatility, with indices like the Nasdaq Composite seeing significant shifts. In this dynamic environment, identifying high-growth tech stocks involves focusing on companies that demonstrate resilience and adaptability to technological advancements and competitive pressures.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Beijing ConST Instruments Technology (SZSE:300445)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing ConST Instruments Technology Inc. is engaged in the research, development, manufacturing, and sale of digital testing instruments and equipment both in China and internationally, with a market cap of CN¥3.60 billion.

Operations: ConST Instruments focuses on producing digital testing instruments and equipment, serving both domestic and international markets. The company's revenue model emphasizes the sale of these products, with a notable gross profit margin trend that reflects its operational efficiency.

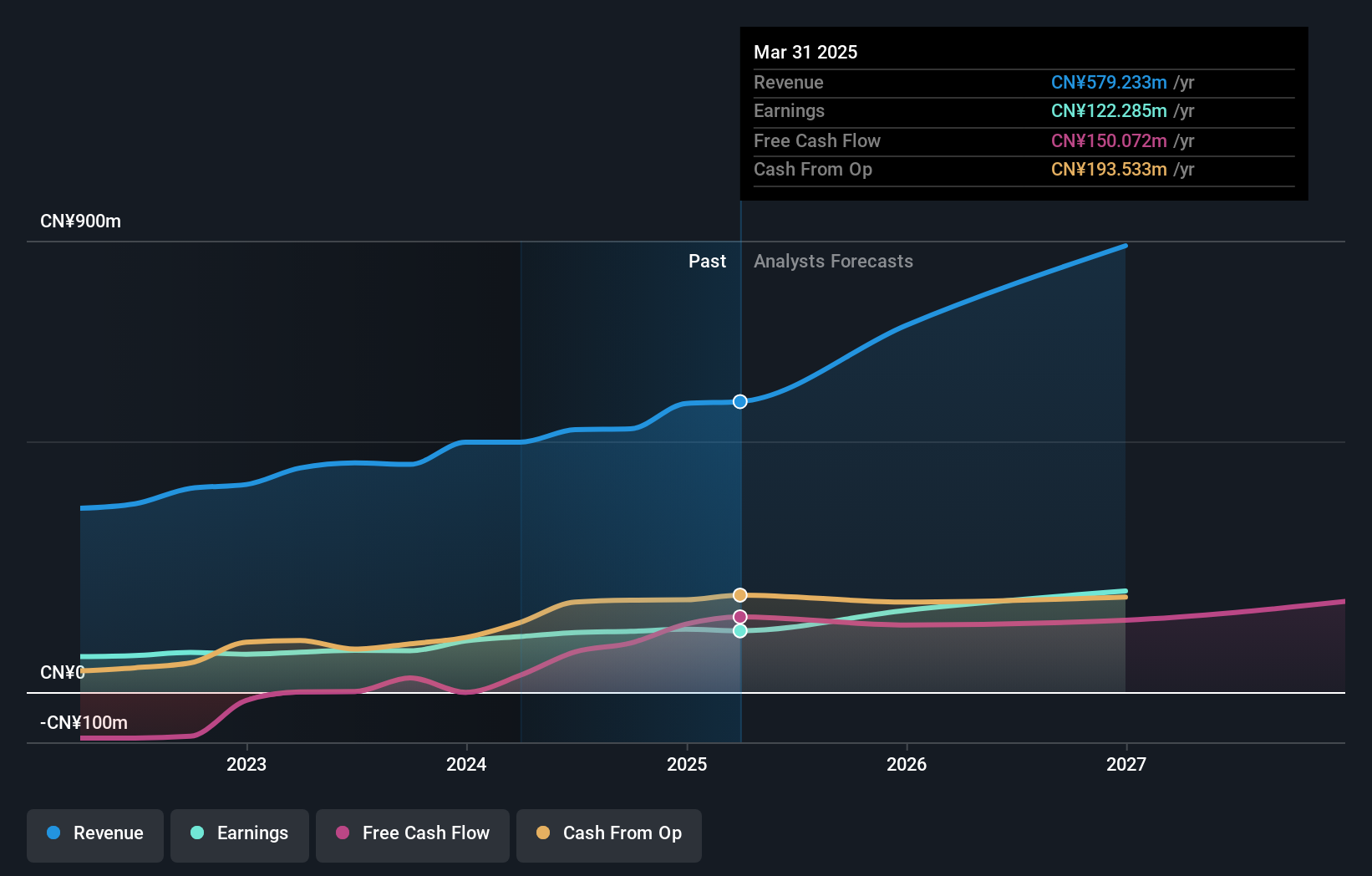

Beijing ConST Instruments Technology has demonstrated robust performance in the high-tech sector, with earnings growth last year reaching 47%, surpassing the electronic industry's average of 2.3%. This growth trajectory is supported by a strong forecast of annual revenue increases at 21.7%, significantly outpacing the broader Chinese market's expectation of 13.3%. The company’s commitment to innovation is evident from its R&D investments, crucial for sustaining its competitive edge in a rapidly evolving industry. Moreover, with earnings expected to grow by 24.4% annually, Beijing ConST is strategically positioned to capitalize on market opportunities and expand its technological footprint further.

- Click here to discover the nuances of Beijing ConST Instruments Technology with our detailed analytical health report.

Understand Beijing ConST Instruments Technology's track record by examining our Past report.

B-SOFTLtd (SZSE:300451)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: B-SOFT Co., Ltd. is a company engaged in the medical and health informatization industry in China with a market capitalization of CN¥6.27 billion.

Operations: B-SOFT Ltd. focuses on providing informatization solutions within the medical and health sector in China. The company's business model centers around developing software and systems aimed at enhancing healthcare management and operations efficiency.

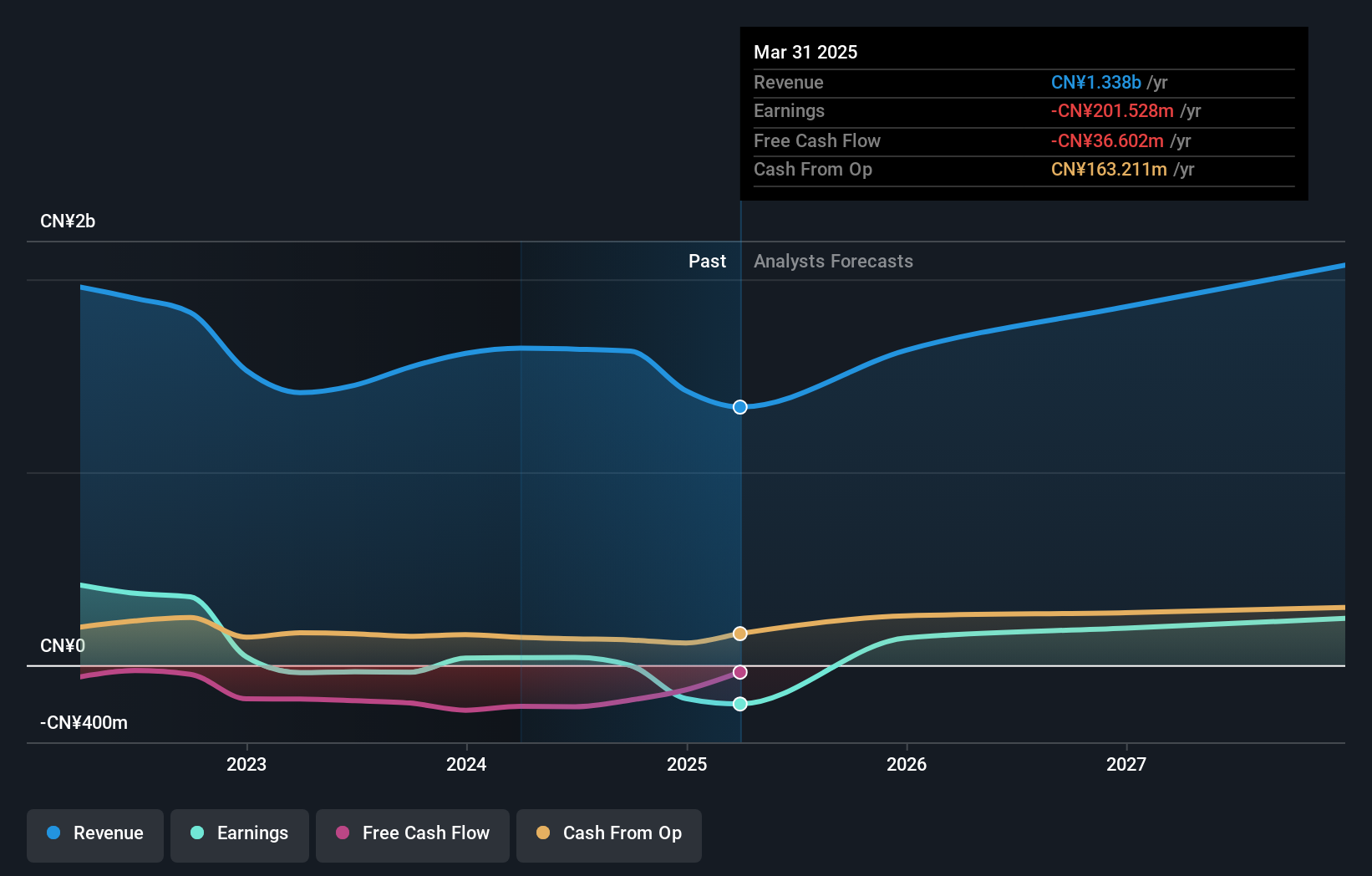

B-SOFTLtd, amid a challenging landscape for unprofitable tech firms, shows promising signs with its revenue projected to grow by 16.5% annually. This growth rate outstrips the broader CN market's average of 13.3%, positioning it favorably against industry norms. Despite current unprofitability, earnings are expected to surge by approximately 66.6% per year, signaling potential for significant financial improvement. The company’s aggressive investment in R&D is pivotal; however, specifics on expenditure were not disclosed but align with sector trends where innovation drives competitiveness and market share gains.

- Dive into the specifics of B-SOFTLtd here with our thorough health report.

Examine B-SOFTLtd's past performance report to understand how it has performed in the past.

Queclink Wireless Solutions (SZSE:300590)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Queclink Wireless Solutions Co., Ltd. provides IoT solutions globally and has a market cap of CN¥6.69 billion.

Operations: Queclink Wireless Solutions Co., Ltd. specializes in providing IoT solutions on a global scale, focusing on innovative technologies to enhance connectivity and data management. The company leverages its expertise in IoT to develop products that cater to various industries, aiming to improve operational efficiency and decision-making through advanced data analytics and real-time monitoring capabilities.

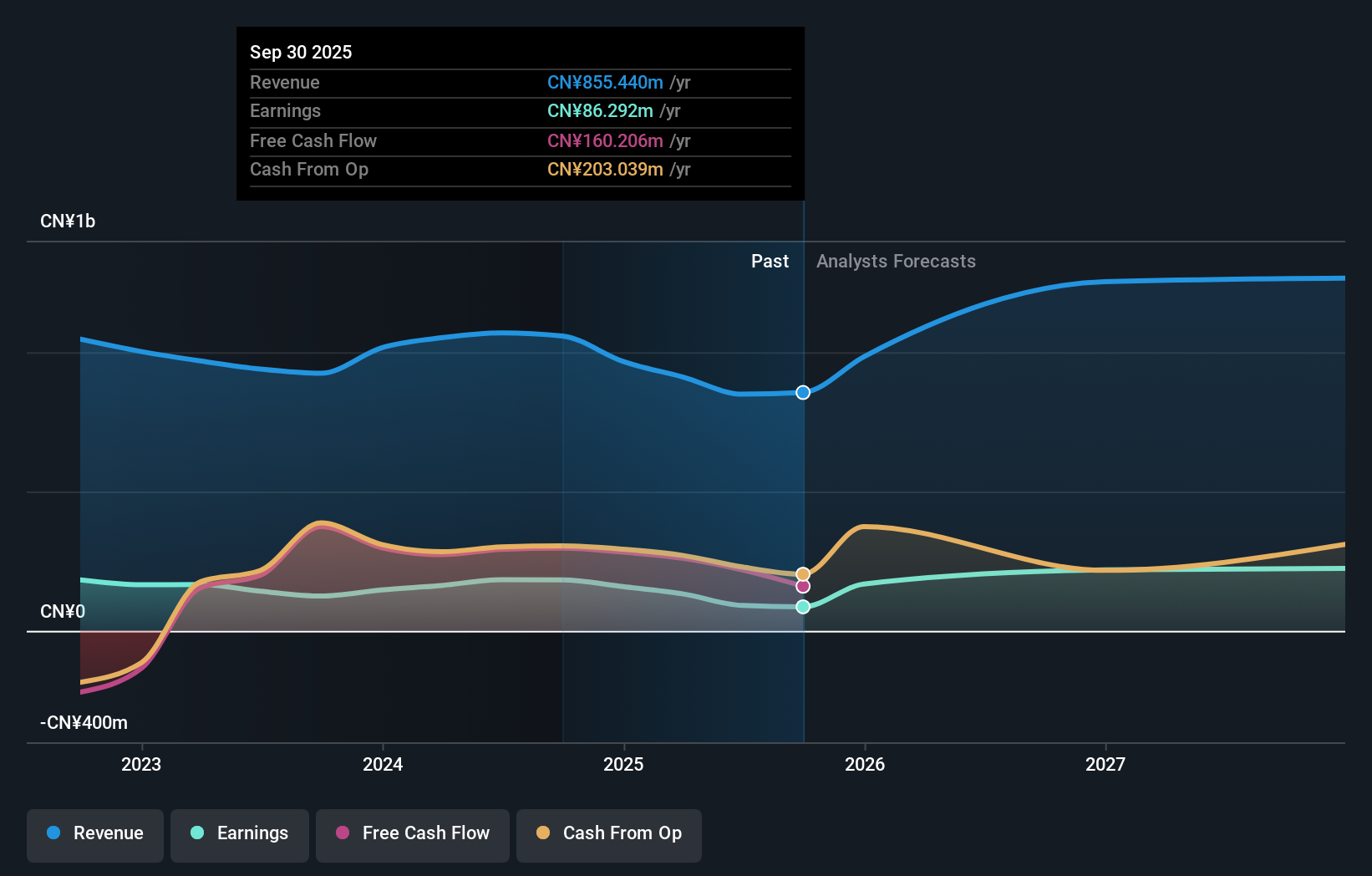

Queclink Wireless Solutions stands out in the high-growth tech sector, showcasing a robust annual revenue increase of 23%, significantly outpacing the broader market's growth. The company's commitment to innovation is evident from its R&D expenditure, which is notably aligned with its revenue surge. Recent product launches like the GL533CG asset tracker highlight Queclink’s focus on advanced technology solutions, featuring LTE Cat 1 and BLE technology for superior asset tracking and security across diverse industries. This strategic direction not only enhances Queclink's product offerings but also solidifies its position in competitive tech markets, promising continued growth and industry relevance.

- Click to explore a detailed breakdown of our findings in Queclink Wireless Solutions' health report.

Gain insights into Queclink Wireless Solutions' past trends and performance with our Past report.

Key Takeaways

- Click through to start exploring the rest of the 1227 High Growth Tech and AI Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if B-SOFTLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300451

B-SOFTLtd

Operates in the medical and health informatization industry in China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives