- China

- /

- Electronic Equipment and Components

- /

- SZSE:300433

Lens Technology Co., Ltd. (SZSE:300433) Looks Just Right With A 54% Price Jump

Lens Technology Co., Ltd. (SZSE:300433) shares have had a really impressive month, gaining 54% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 88%.

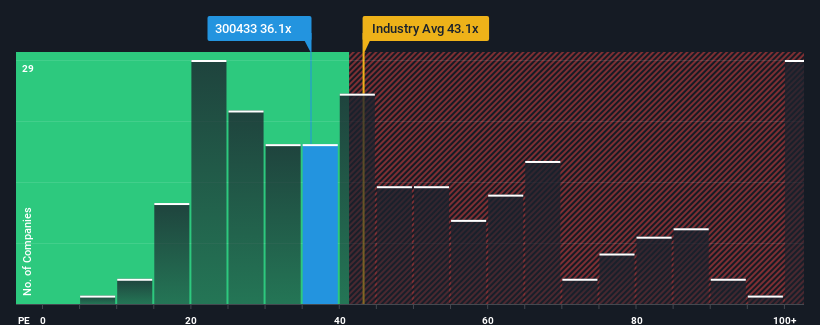

In spite of the firm bounce in price, it's still not a stretch to say that Lens Technology's price-to-earnings (or "P/E") ratio of 36.1x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 34x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Lens Technology certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Lens Technology

Does Growth Match The P/E?

Lens Technology's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with earnings down 40% overall from three years ago. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 21% per year during the coming three years according to the analysts following the company. That's shaping up to be similar to the 19% per year growth forecast for the broader market.

In light of this, it's understandable that Lens Technology's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Lens Technology's P/E

Lens Technology's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Lens Technology's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Lens Technology that you need to be mindful of.

If you're unsure about the strength of Lens Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300433

Lens Technology

Engages in the research and development, production, and sale of supporting services such as structural parts, functional modules, and complete machine, R&D, production and sales of structural parts, functional modules, complete machine assembly and other supporting services in China.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives