- China

- /

- Electronic Equipment and Components

- /

- SZSE:300389

Not Many Are Piling Into Shenzhen Absen Optoelectronic Co.,Ltd. (SZSE:300389) Stock Yet As It Plummets 26%

Shenzhen Absen Optoelectronic Co.,Ltd. (SZSE:300389) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 17% in that time.

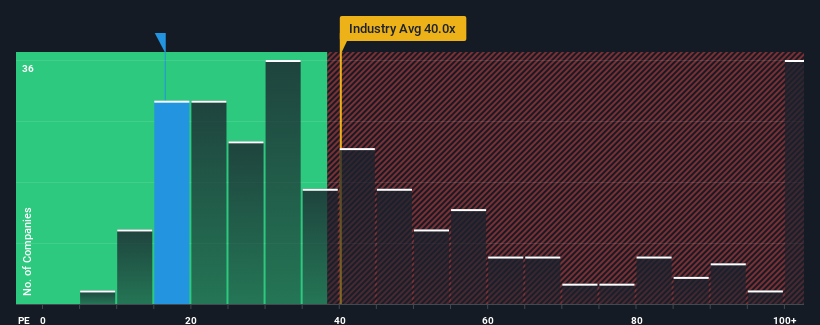

Since its price has dipped substantially, Shenzhen Absen OptoelectronicLtd's price-to-earnings (or "P/E") ratio of 16.4x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 32x and even P/E's above 58x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Shenzhen Absen OptoelectronicLtd certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Shenzhen Absen OptoelectronicLtd

How Is Shenzhen Absen OptoelectronicLtd's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Shenzhen Absen OptoelectronicLtd's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 49% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 54% over the next year. With the market only predicted to deliver 36%, the company is positioned for a stronger earnings result.

With this information, we find it odd that Shenzhen Absen OptoelectronicLtd is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Shenzhen Absen OptoelectronicLtd's P/E has taken a tumble along with its share price. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shenzhen Absen OptoelectronicLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You always need to take note of risks, for example - Shenzhen Absen OptoelectronicLtd has 1 warning sign we think you should be aware of.

You might be able to find a better investment than Shenzhen Absen OptoelectronicLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300389

Shenzhen Absen OptoelectronicLtd

Engages in the research and development, production, sales, and service of LED application products in China.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026