- Hong Kong

- /

- Life Sciences

- /

- SEHK:1873

Discover December 2024's Top Penny Stocks

Reviewed by Simply Wall St

Global markets have recently experienced a series of gains, with major indices such as the Dow Jones Industrial Average and S&P 500 Index reaching record intraday highs, despite geopolitical tensions and domestic policy shifts influencing investor sentiment. Amid these developments, the concept of penny stocks—often associated with smaller or newer companies—continues to capture interest due to their affordability and potential for growth. While the term may seem outdated, these stocks can offer intriguing opportunities when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$146.79M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.19 | £825.11M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$44.6B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$64.47M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.275 | £425.17M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.69 | £70.37M | ★★★★☆☆ |

Click here to see the full list of 5,702 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Viva Biotech Holdings (SEHK:1873)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viva Biotech Holdings is an investment holding company that provides structure-based drug discovery services to biotechnology and pharmaceutical clients globally, with a market cap of HK$1.91 billion.

Operations: The company's revenue is derived from Drug Discovery Services, which generated CN¥780.09 million, and Contract Development Manufacture Organisation (CDMO) and Commercialisation Services, contributing CN¥1.21 billion.

Market Cap: HK$1.91B

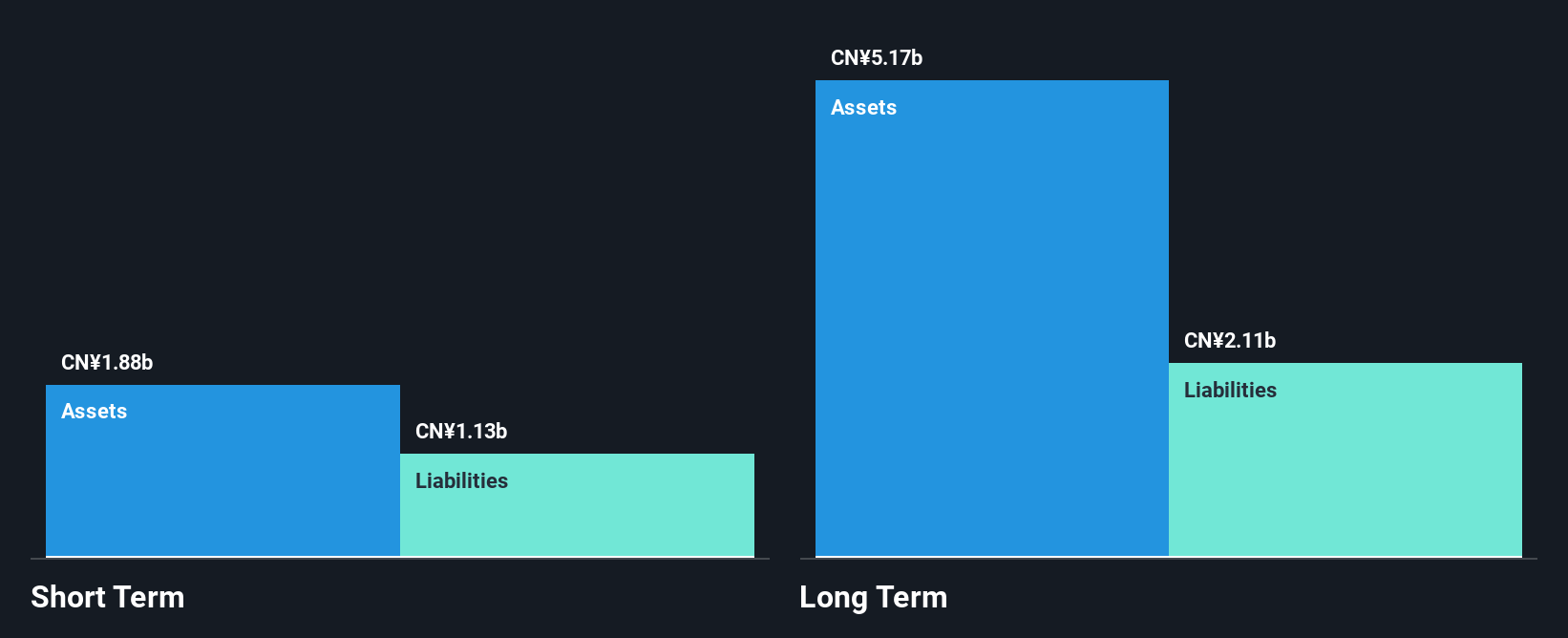

Viva Biotech Holdings, with a market cap of HK$1.91 billion, faces challenges due to its unprofitability and increased debt-to-equity ratio over five years. Its short-term assets of CN¥1.9 billion exceed liabilities, but long-term liabilities remain uncovered. Despite losses growing at 23.5% annually over the past five years, the company maintains a cash runway exceeding three years due to positive free cash flow growth of 22.3%. Recent strategic moves include share buybacks aimed at enhancing net asset value per share and earnings per share, funded by internal resources amidst executive changes in financial leadership roles.

- Navigate through the intricacies of Viva Biotech Holdings with our comprehensive balance sheet health report here.

- Gain insights into Viva Biotech Holdings' historical outcomes by reviewing our past performance report.

Ming Yuan Cloud Group Holdings (SEHK:909)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ming Yuan Cloud Group Holdings Limited is an investment holding company that offers software solutions for property developers in China, with a market cap of HK$4.85 billion.

Operations: The company's revenue is generated from two main segments: Cloud Services, contributing CN¥1.32 billion, and On-premise Software and Services, which accounts for CN¥281.71 million.

Market Cap: HK$4.85B

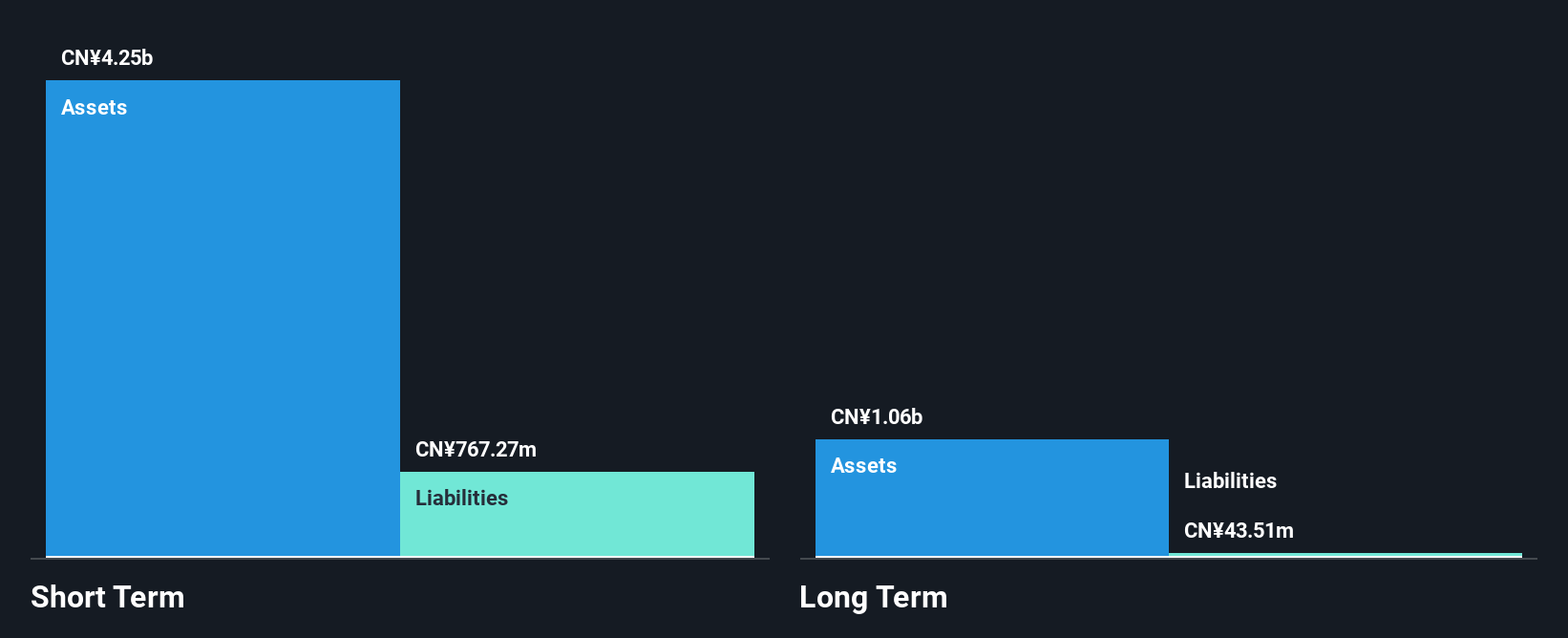

Ming Yuan Cloud Group Holdings, with a market cap of HK$4.85 billion, operates within the software solutions sector for property developers in China. The company is currently unprofitable but has no debt and maintains strong liquidity, with CN¥4.3 billion in short-term assets covering both its short-term and long-term liabilities. Despite increased losses over the past five years, earnings are forecast to grow significantly at 72.93% annually. Recent board changes include appointing Ms. WEN Hongmei as an independent non-executive director and chairperson of the Audit Committee, potentially strengthening financial oversight amid high share price volatility.

- Click to explore a detailed breakdown of our findings in Ming Yuan Cloud Group Holdings' financial health report.

- Gain insights into Ming Yuan Cloud Group Holdings' outlook and expected performance with our report on the company's earnings estimates.

Hebei Huijin Group (SZSE:300368)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hebei Huijin Group Co., Ltd. operates in manufacturing, information system integration, information data center, and supply chain sectors both within China and internationally, with a market cap of CN¥2.42 billion.

Operations: Revenue segments for Hebei Huijin Group Co., Ltd. are not reported.

Market Cap: CN¥2.42B

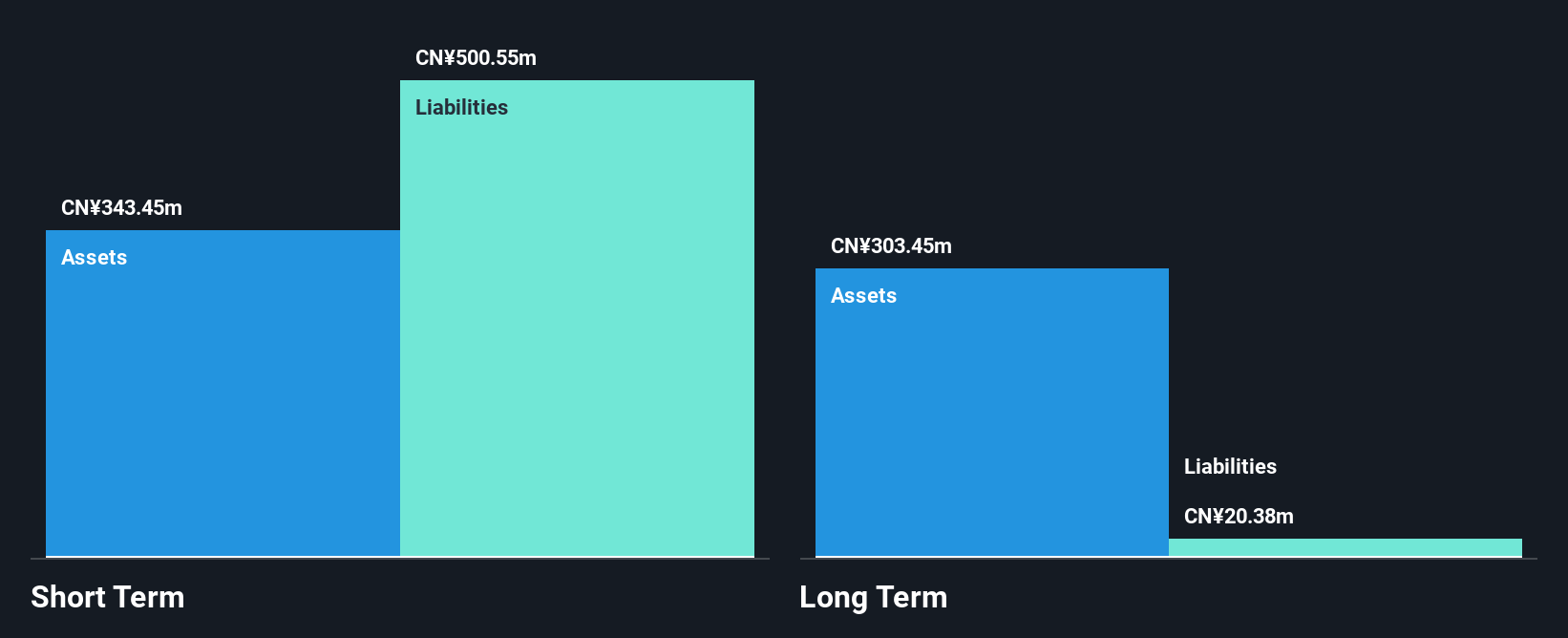

Hebei Huijin Group, with a market cap of CN¥2.42 billion, operates across manufacturing and information sectors. Despite being unprofitable, the company reduced its net loss to CN¥29.11 million for the first nine months of 2024 from CN¥53.52 million a year earlier, indicating some financial improvement. Short-term assets (CN¥567.2M) exceed long-term liabilities (CN¥35M), though they fall short of covering short-term liabilities (CN¥593M). The company's debt level is satisfactory with a net debt to equity ratio of 27.9%. Recent board elections may influence strategic direction amid ongoing high share price volatility and an inexperienced board tenure averaging 2.3 years.

- Get an in-depth perspective on Hebei Huijin Group's performance by reading our balance sheet health report here.

- Evaluate Hebei Huijin Group's historical performance by accessing our past performance report.

Key Takeaways

- Take a closer look at our Penny Stocks list of 5,702 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1873

Viva Biotech Holdings

An investment holding company, engages in the provision of structure-based drug discovery services to biotechnology and pharmaceutical customers worldwide.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives