- China

- /

- Electronic Equipment and Components

- /

- SZSE:301589

High Growth Tech Stocks To Watch This November 2024

Reviewed by Simply Wall St

In a week marked by economic uncertainties and mixed earnings reports, global markets saw major indices like the Nasdaq Composite and S&P MidCap 400 hit record intraday highs before retreating, while small-cap stocks showed resilience compared to their larger counterparts. As growth stocks generally lagged behind value shares amid cautious sentiment, investors are keeping a close eye on high-growth tech stocks that demonstrate strong fundamentals and potential for innovation in navigating these dynamic market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| TG Therapeutics | 34.69% | 57.41% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.17% | 70.49% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 71.73% | ★★★★★★ |

Click here to see the full list of 1291 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Chengdu Zhimingda Electronics (SHSE:688636)

Simply Wall St Growth Rating: ★★★★★☆

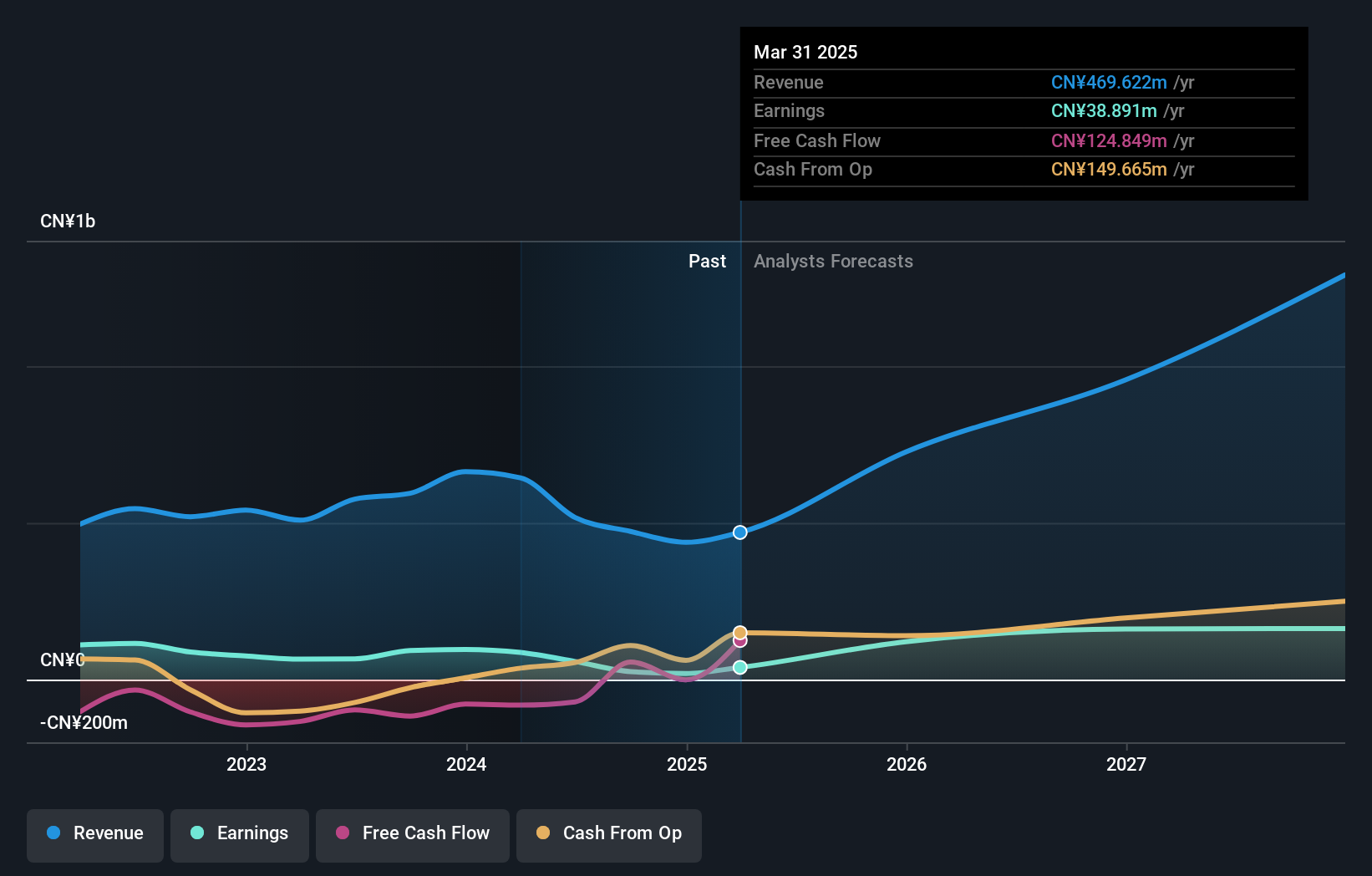

Overview: Chengdu Zhimingda Electronics Co., Ltd. focuses on the research, development, production, and sale of military embedded computer module products in China with a market capitalization of CN¥2.99 billion.

Operations: Zhimingda Electronics primarily generates revenue from its aerospace and defense segment, amounting to CN¥472.61 million. The company's focus is on military embedded computer module products within China.

Chengdu Zhimingda Electronics, amidst a challenging backdrop with a net loss of CN¥9.16 million for the nine months ending September 2024, still projects robust future growth. With an anticipated revenue surge of 32.3% per year, outpacing the broader Chinese market's 14% growth rate, and earnings expected to climb by 57.4% annually, the firm is poised for significant expansion despite recent financial setbacks. This optimism is tempered by a highly volatile share price and a substantial one-off gain of CN¥16.1M that skews past earnings quality, presenting a mixed financial landscape as it moves forward.

DongHua Testing Technology (SZSE:300354)

Simply Wall St Growth Rating: ★★★★★★

Overview: DongHua Testing Technology Co., Ltd. specializes in providing structural mechanical property testing services in China with a market capitalization of approximately CN¥4.57 billion.

Operations: The primary revenue stream for DongHua Testing Technology comes from its Instrumentation Testing segment, generating approximately CN¥426.74 million.

DongHua Testing Technology has demonstrated a strong financial trajectory, with revenue growth of 35.6% and earnings expansion at 41.0% annually, outstripping the broader Chinese market's growth rates. This performance is underpinned by substantial R&D investment, crucial for sustaining innovation and competitive edge in the tech sector. Despite previous negative earnings growth, recent reports show a rebound with net income rising to CN¥99.04 million from CN¥82.33 million year-over-year, reflecting robust operational improvements and effective market strategies. These figures suggest DongHua is navigating its challenges well, positioning it as a noteworthy contender in the high-growth tech landscape moving forward.

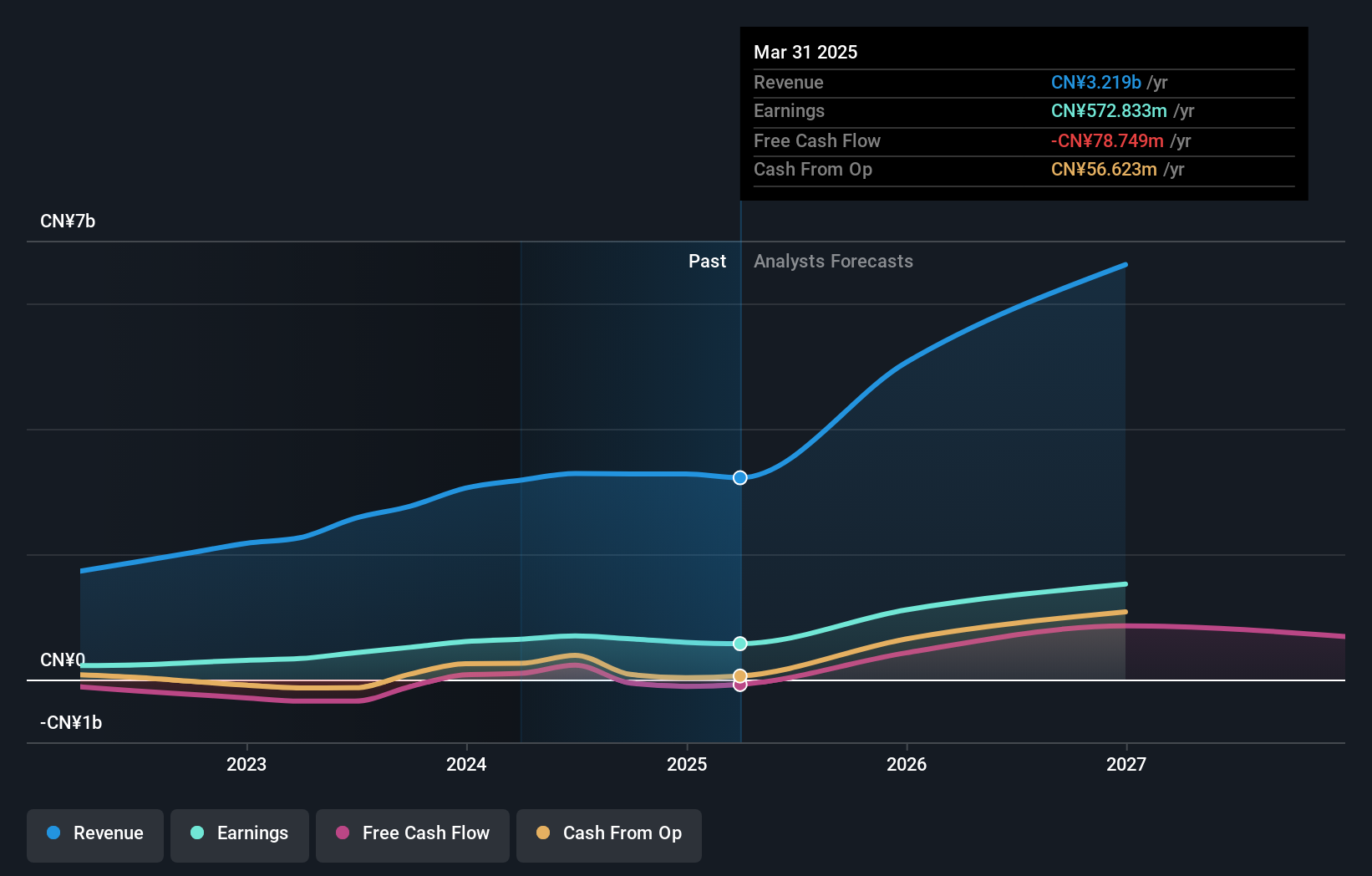

Xi'an NovaStar Tech (SZSE:301589)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xi'an NovaStar Tech Co., Ltd. specializes in providing LED display control solutions in China and has a market cap of CN¥17.37 billion.

Operations: NovaStar Tech generates revenue primarily through its electronic components and parts segment, contributing CN¥3.28 billion. The company focuses on LED display control solutions within the Chinese market.

Xi'an NovaStar Tech is capitalizing on robust market dynamics, evidenced by a 30.2% annual revenue growth projection, surpassing the broader Chinese market's forecast of 14%. This growth trajectory is further supported by an aggressive R&D strategy, with expenses aimed at fostering innovation and securing competitive advantages in tech. Recently, the company initiated a share repurchase program valued at CNY 150 million to buy back up to 535,714 shares, underscoring confidence in its financial health and commitment to shareholder value. Additionally, earnings are expected to surge by 35.3% annually over the next three years, highlighting its potential for sustained profitability amidst evolving industry demands.

- Unlock comprehensive insights into our analysis of Xi'an NovaStar Tech stock in this health report.

Evaluate Xi'an NovaStar Tech's historical performance by accessing our past performance report.

Key Takeaways

- Navigate through the entire inventory of 1291 High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301589

Exceptional growth potential and undervalued.