- China

- /

- Consumer Finance

- /

- SHSE:600830

Discovering November 2024's Undiscovered Gems with Growth Potential

Reviewed by Simply Wall St

In a week marked by significant economic data and earnings reports, global markets experienced mixed results, with small-cap stocks demonstrating resilience amid broader market volatility. As investors navigate these uncertain times, identifying stocks with strong fundamentals and potential for growth becomes crucial. In this context, uncovering undiscovered gems—those companies that are often overlooked but possess solid growth prospects—can offer unique opportunities in the current market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Padma Oil | 0.87% | -0.90% | 3.72% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 20.47% | -3.86% | -2.71% | ★★★★★☆ |

| Jetwell Computer | 57.20% | 6.93% | 24.36% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Sunny Loan TopLtd (SHSE:600830)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sunny Loan Top Co., Ltd. offers investment and financing services both in China and internationally, with a market capitalization of CN¥5.09 billion.

Operations: Sunny Loan Top Co., Ltd. generates revenue primarily through its investment and financing services, with a market capitalization of CN¥5.09 billion. It is important to note that the company's financial performance can be influenced by various factors affecting its revenue streams and cost structures.

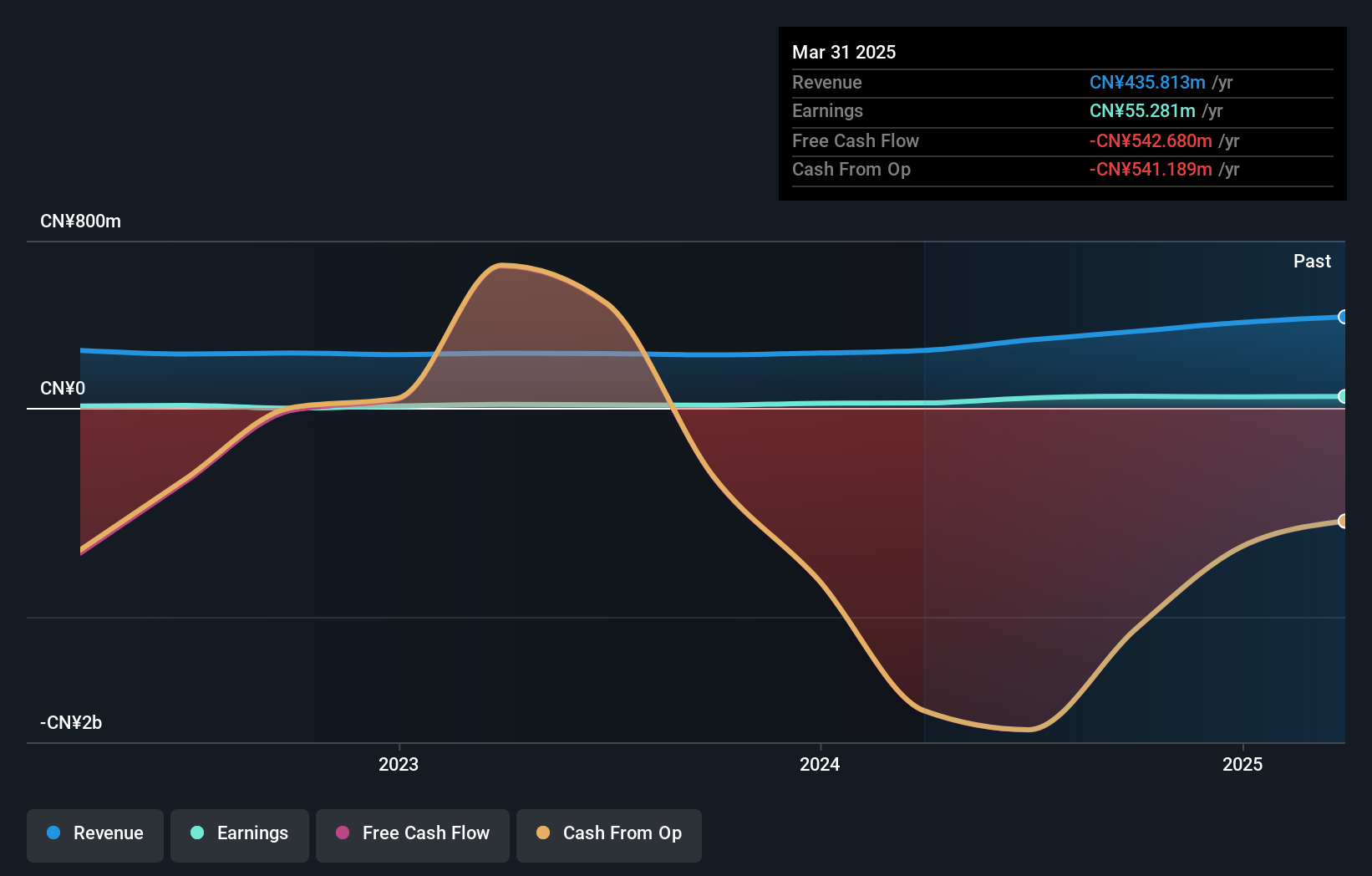

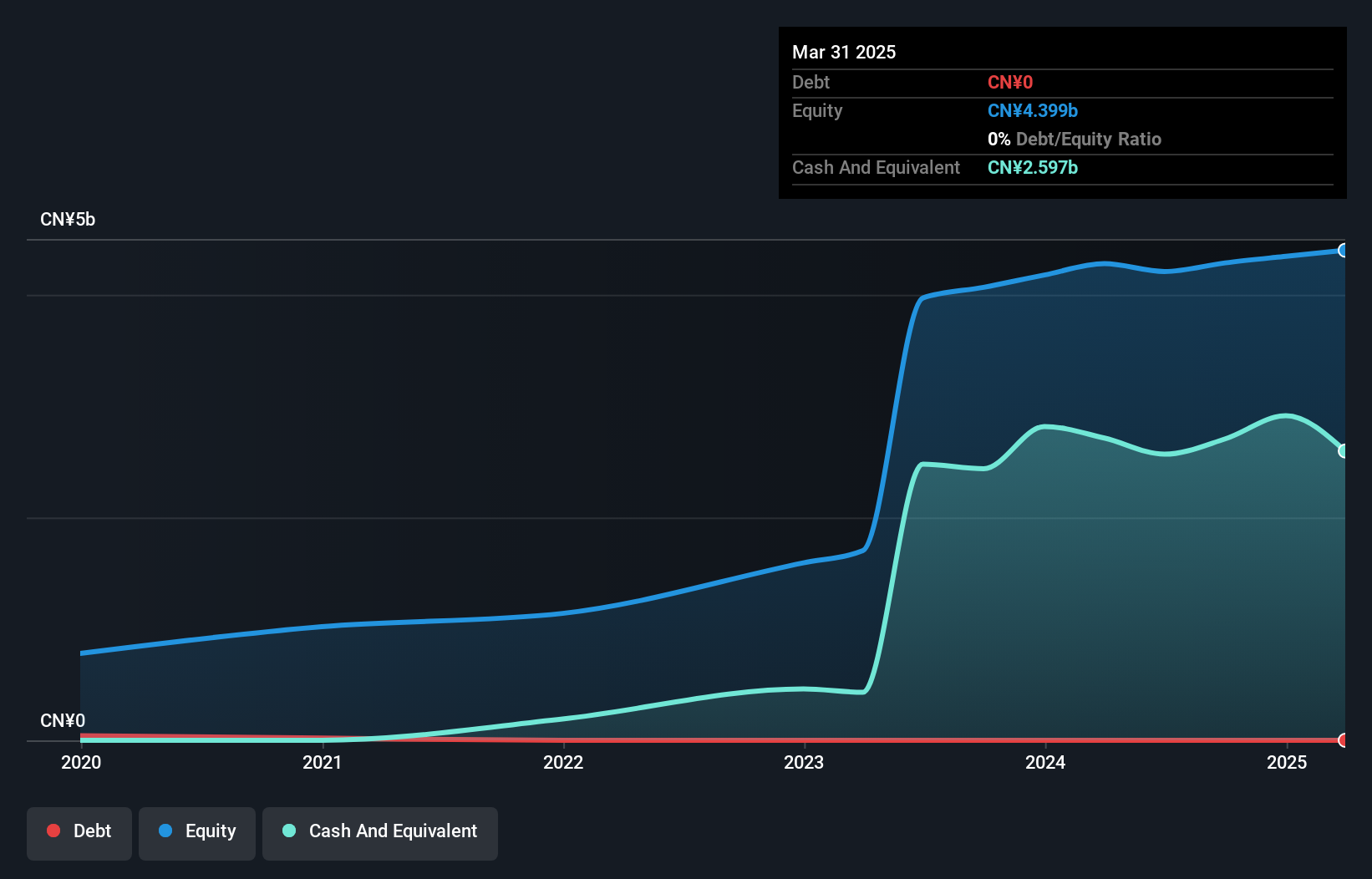

Sunny Loan Top Ltd. shows promising growth, with earnings surging by 335% over the past year, outpacing the Consumer Finance industry's 14.8%. The company reported nine-month sales of CNY 240.3 million, a significant increase from CNY 142.92 million last year, while net income rose to CNY 57.28 million from CNY 23.65 million previously. Despite a rise in debt to equity ratio from 0% to 36% over five years, their net debt to equity remains satisfactory at about 5%. High levels of non-cash earnings and strong interest coverage further underscore its financial health amidst expanding revenue streams.

- Take a closer look at Sunny Loan TopLtd's potential here in our health report.

Gain insights into Sunny Loan TopLtd's past trends and performance with our Past report.

Beijing Tianma Intelligent Control Technology (SHSE:688570)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Tianma Intelligent Control Technology Co., Ltd. specializes in the development and production of intelligent control systems for construction machinery, with a market cap of CN¥8.69 billion.

Operations: The company generates revenue primarily from its Construction Machinery & Equipment segment, totaling CN¥1.88 billion. The focus on this segment highlights its significance in the company's overall financial structure.

Beijing Tianma Intelligent Control Technology, a nimble player in the machinery sector, is currently trading at 49.4% below its estimated fair value, suggesting potential undervaluation. Despite being debt-free for over five years and boasting high-quality past earnings, it faces challenges with a negative earnings growth of 10.3% compared to the industry average of 0.4%. Recent financials reveal sales of CNY 1,214.97 million and net income of CNY 280.33 million for the nine months ending September 2024, down from CNY 1,542.22 million and CNY 313.4 million respectively from the previous year—a sign to watch closely as it navigates market dynamics.

Sichuan Shudao Equipment & TechnologyLtd (SZSE:300540)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sichuan Shudao Equipment & Technology Co., Ltd. operates in the equipment and technology sector with a market cap of CN¥4 billion.

Operations: Shudao Equipment & Technology generates revenue primarily from its operations in the equipment and technology sector. The company's financial performance is reflected in its market capitalization of CN¥4 billion.

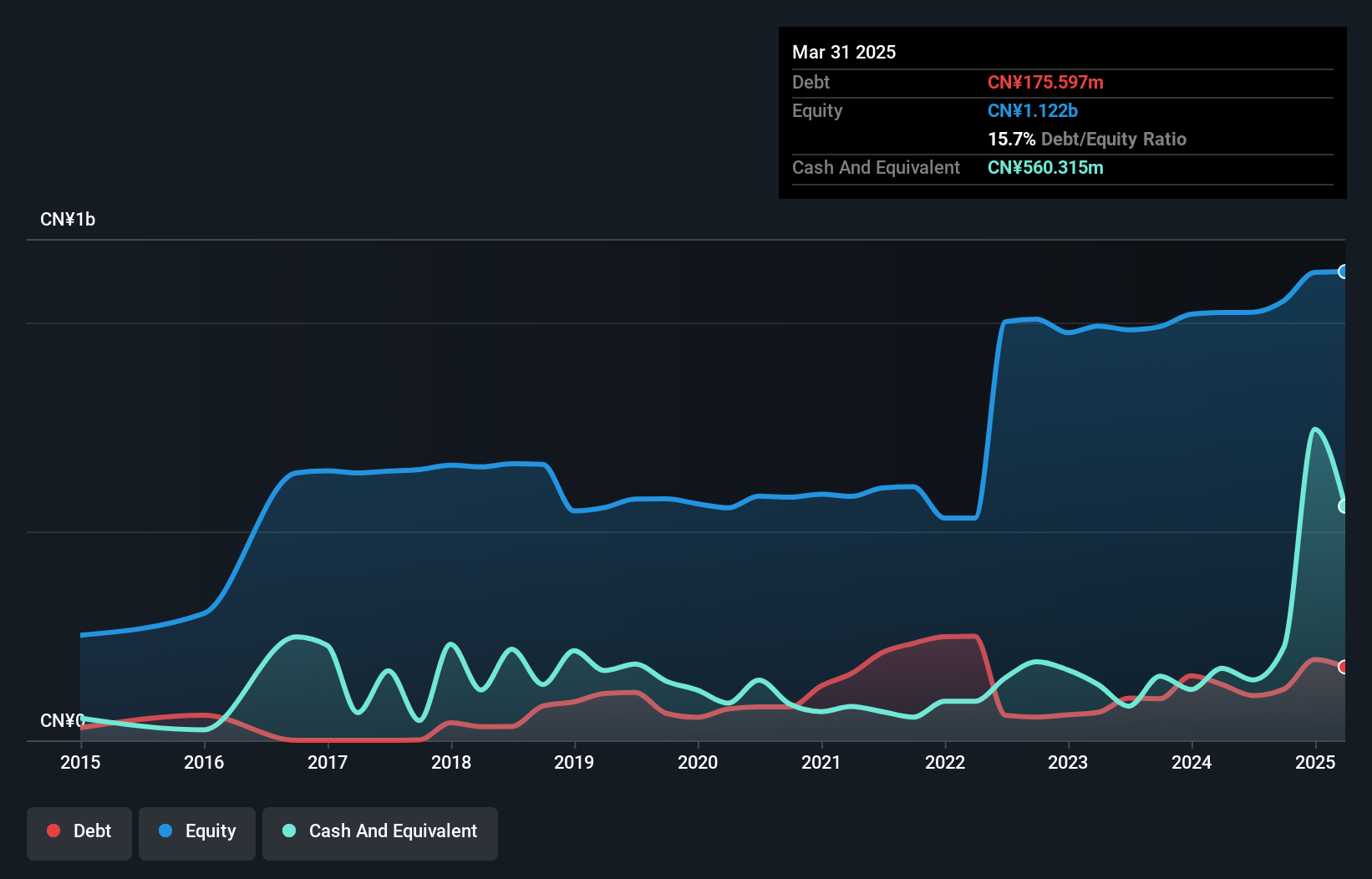

Sichuan Shudao Equipment & Technology, a smaller player in the machinery sector, has shown promising signs of growth. Over the past year, it reported sales of CNY 496.7 million for nine months ending September 2024, up from CNY 346.98 million in the previous period. Net income rose to CNY 23.19 million from CNY 13.87 million a year earlier, indicating improved profitability despite market volatility. The company has reduced its debt-to-equity ratio significantly over five years from 19.8% to 10.5%, and forecasts suggest earnings could grow by nearly 42% annually, highlighting its potential as an emerging contender in its industry.

Taking Advantage

- Explore the 4733 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600830

Sunny Loan TopLtd

Provides investment and financing services in China and internationally.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives