- China

- /

- Auto Components

- /

- SZSE:300969

Unveiling 3 Hidden Small Caps with Strong Potential

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, small-cap stocks have shown resilience compared to their large-cap counterparts, even as major indices like the S&P 500 and Nasdaq Composite faced declines. With manufacturing activity subdued and labor market signals mixed, investors are increasingly looking towards small-cap companies that can navigate these uncertain times with strong fundamentals and growth potential. Identifying promising small caps often involves assessing their ability to withstand market volatility while capitalizing on niche opportunities within their industries.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Padma Oil | 0.87% | -0.90% | 3.72% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 20.47% | -3.86% | -2.71% | ★★★★★☆ |

| Jetwell Computer | 57.20% | 6.93% | 24.36% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Hanyu Group (SZSE:300403)

Simply Wall St Value Rating: ★★★★★★

Overview: Hanyu Group Joint-Stock Co., Ltd. focuses on the research, development, production, and sale of drainage pumps for household appliances in China, with a market capitalization of CN¥5.42 billion.

Operations: Hanyu Group generates revenue primarily through the sale of drainage pumps for household appliances. The company's financial performance is influenced by its production efficiency and cost management strategies, which impact its gross profit margin.

Hanyu Group's recent performance paints an intriguing picture, with earnings for the nine months ended September 2024 reaching CNY 178.34 million, slightly up from CNY 177.53 million last year. The company seems to manage its debt well, as evidenced by a reduction in the debt-to-equity ratio from 5% to 3% over five years and more cash than total debt. Despite a volatile share price recently, Hanyu's high-quality earnings and a price-to-earnings ratio of 24x suggest it offers good value compared to the CN market average of 34.4x, positioning it as an interesting prospect in its industry context.

- Get an in-depth perspective on Hanyu Group's performance by reading our health report here.

Gain insights into Hanyu Group's past trends and performance with our Past report.

NINGBO HENGSHUAI (SZSE:300969)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Hengshuai Co., Ltd. is engaged in the global manufacturing and sale of automotive micro-motors and components, with a market cap of CN¥6.16 billion.

Operations: Ningbo Hengshuai generates revenue primarily from the sale of automotive micro-motors and components. The company's financial performance includes a notable net profit margin trend, reflecting its ability to manage costs effectively relative to its revenue.

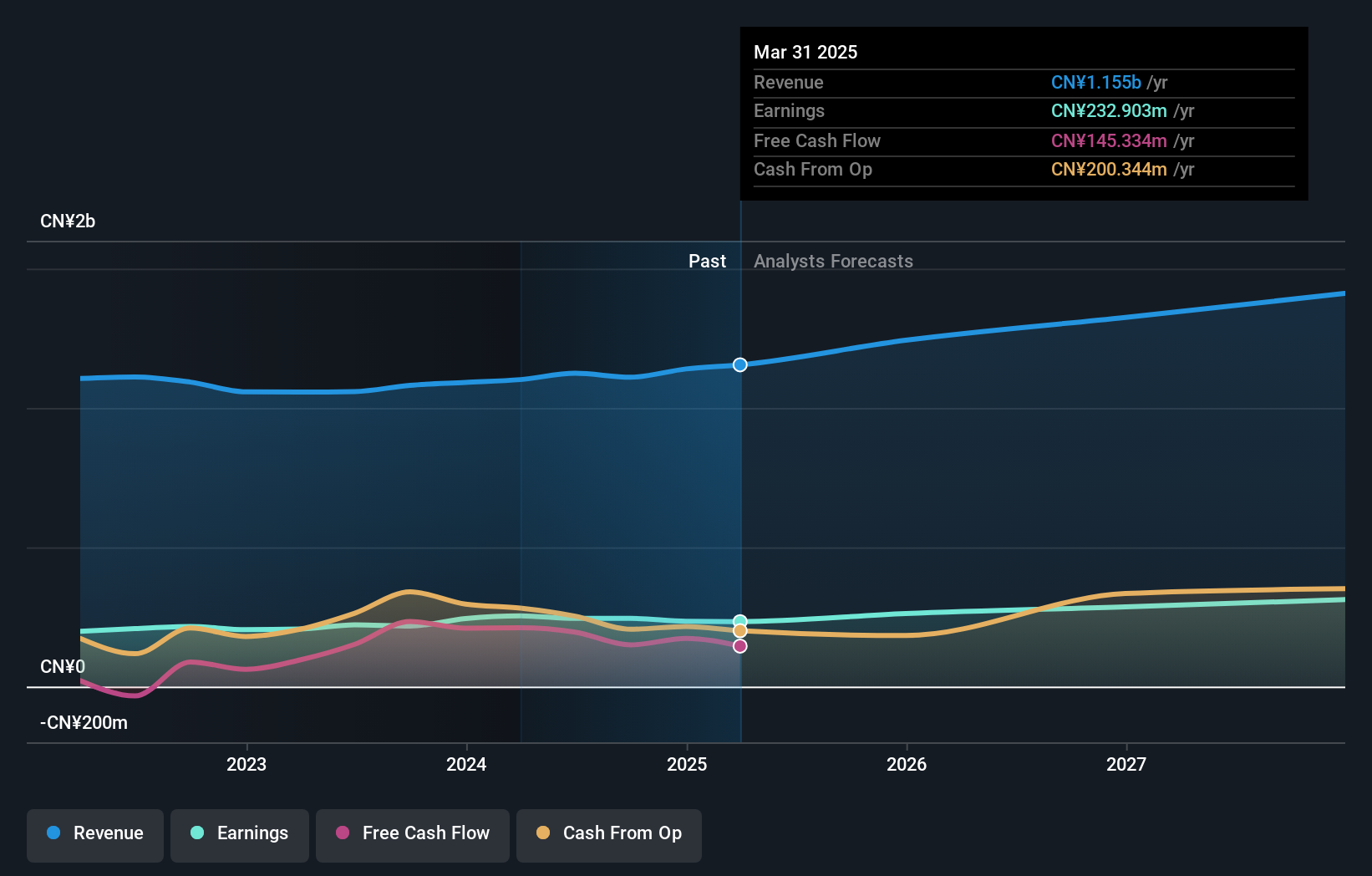

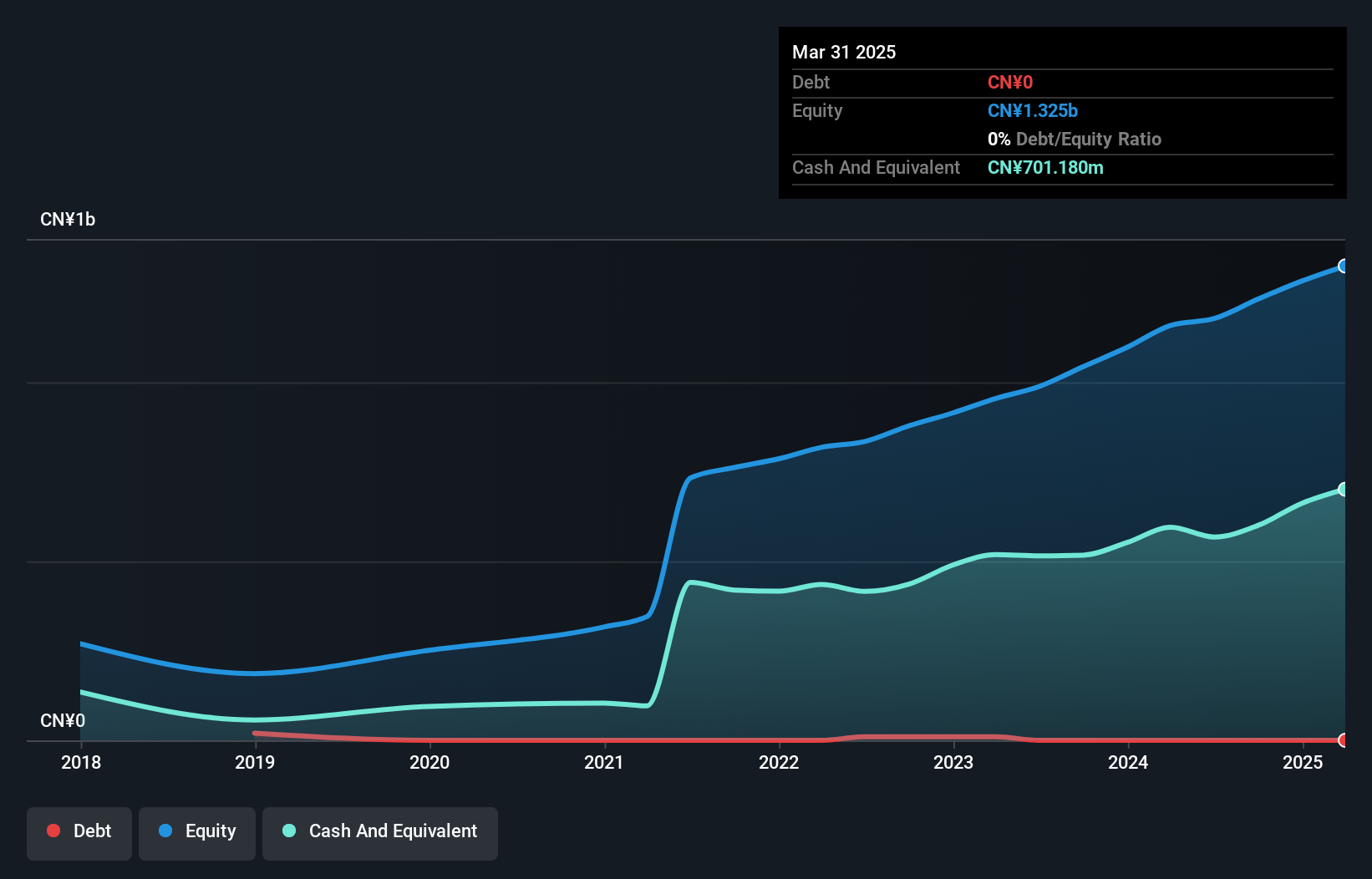

Hengshuai, a notable player in the auto components sector, has shown impressive growth with earnings increasing by 14.7% over the past year, surpassing the industry's 10.1%. The company's debt to equity ratio has significantly improved from 2.1% to just 0.03% over five years, highlighting effective financial management. Recent reports indicate sales reached CNY 704 million for nine months ending September 2024, up from CNY 662 million last year, while net income rose to CNY 163 million from CNY 150 million. With a price-to-earnings ratio of 29x below the market average and high-quality earnings reported, Hengshuai presents an intriguing investment case amidst its volatility challenges.

Beijing China Sciences Runyu Environmental Technology (SZSE:301175)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijing China Sciences Runyu Environmental Technology Co., Ltd. specializes in providing environmental technology solutions and has a market capitalization of CN¥8.33 billion.

Operations: The company derives its revenue primarily from environmental technology solutions. It has a market capitalization of CN¥8.33 billion.

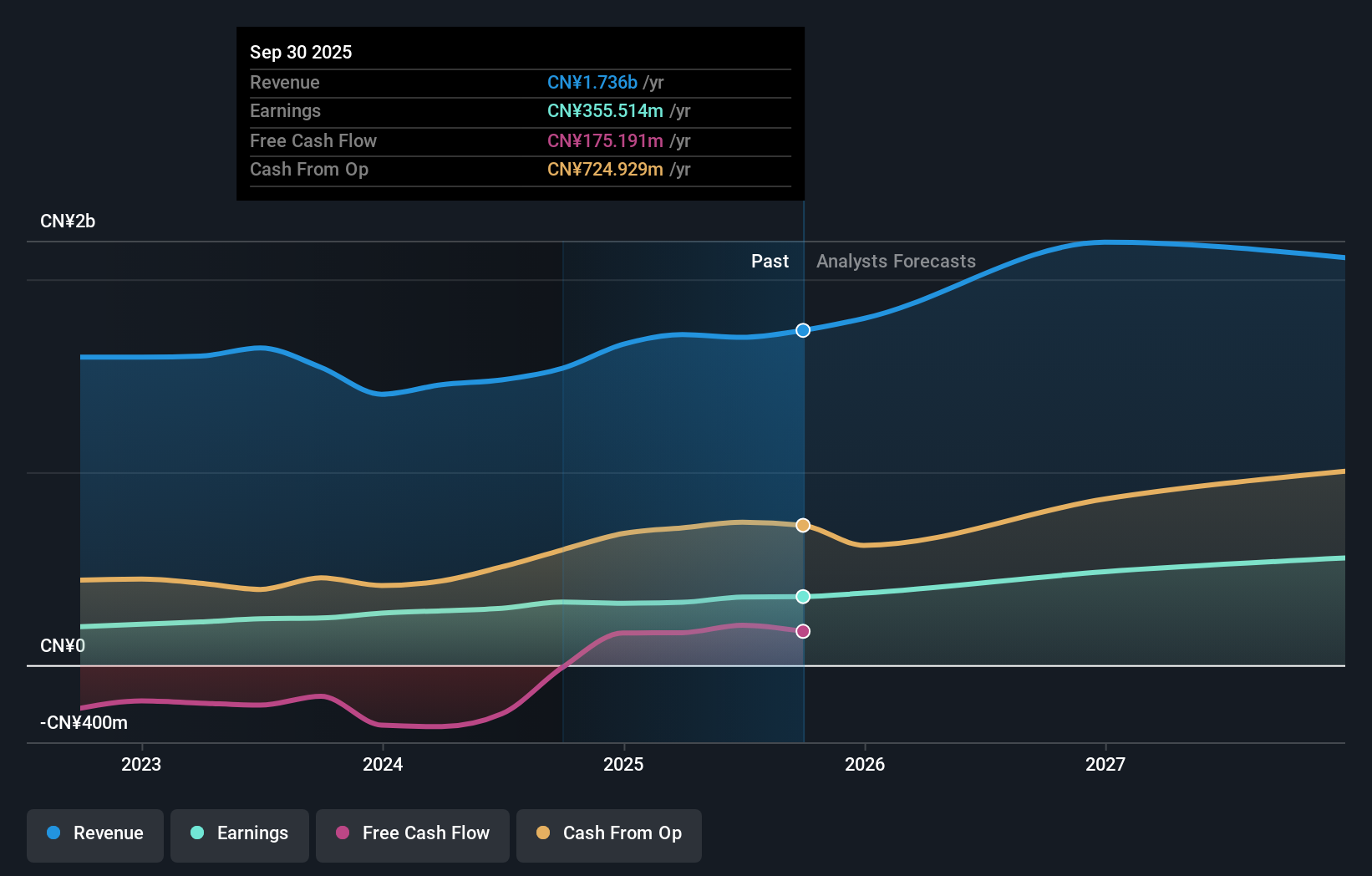

Beijing China Sciences Runyu Environmental Technology, a smaller player in the market, has shown notable financial progress. Over the past five years, its debt to equity ratio impressively decreased from 107.8% to 64.6%, suggesting improved financial health. The company's earnings growth of 33.7% outpaced the industry average of 0.9%, indicating robust performance within its sector. Recent earnings results for nine months ending September 2024 reported sales at CNY 1,199 million and net income at CNY 263 million, reflecting solid profitability with high-quality earnings and well-covered interest payments by EBIT at a coverage ratio of 6.3x.

Next Steps

- Gain an insight into the universe of 4733 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NINGBO HENGSHUAI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300969

NINGBO HENGSHUAI

Ningbo Hengshuai Co., Ltd. manufactures and sells automotive micro-motors and components worldwide.

Flawless balance sheet with reasonable growth potential.