- China

- /

- Energy Services

- /

- SZSE:300164

Uncovering Opportunities: Commercial Bank International P.S.C And 2 More Promising Penny Stocks

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets experienced some volatility, with major indexes like the Nasdaq Composite and S&P 500 seeing fluctuations. Amidst these broader market movements, investors often turn their attention to smaller segments of the market, such as penny stocks, which can offer unique opportunities for growth. Though the term 'penny stock' might sound like a relic of past trading days, it still highlights smaller or less-established companies that can offer great value when backed by solid financials and growth potential. In this article, we will explore three penny stocks that may present promising opportunities for those looking to uncover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR351.85M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$514.18M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.795 | MYR126.45M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$143.12M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR295.43M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.47 | £347M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.00 | MYR2.07B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.94 | £397.82M | ★★★★☆☆ |

Click here to see the full list of 5,801 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

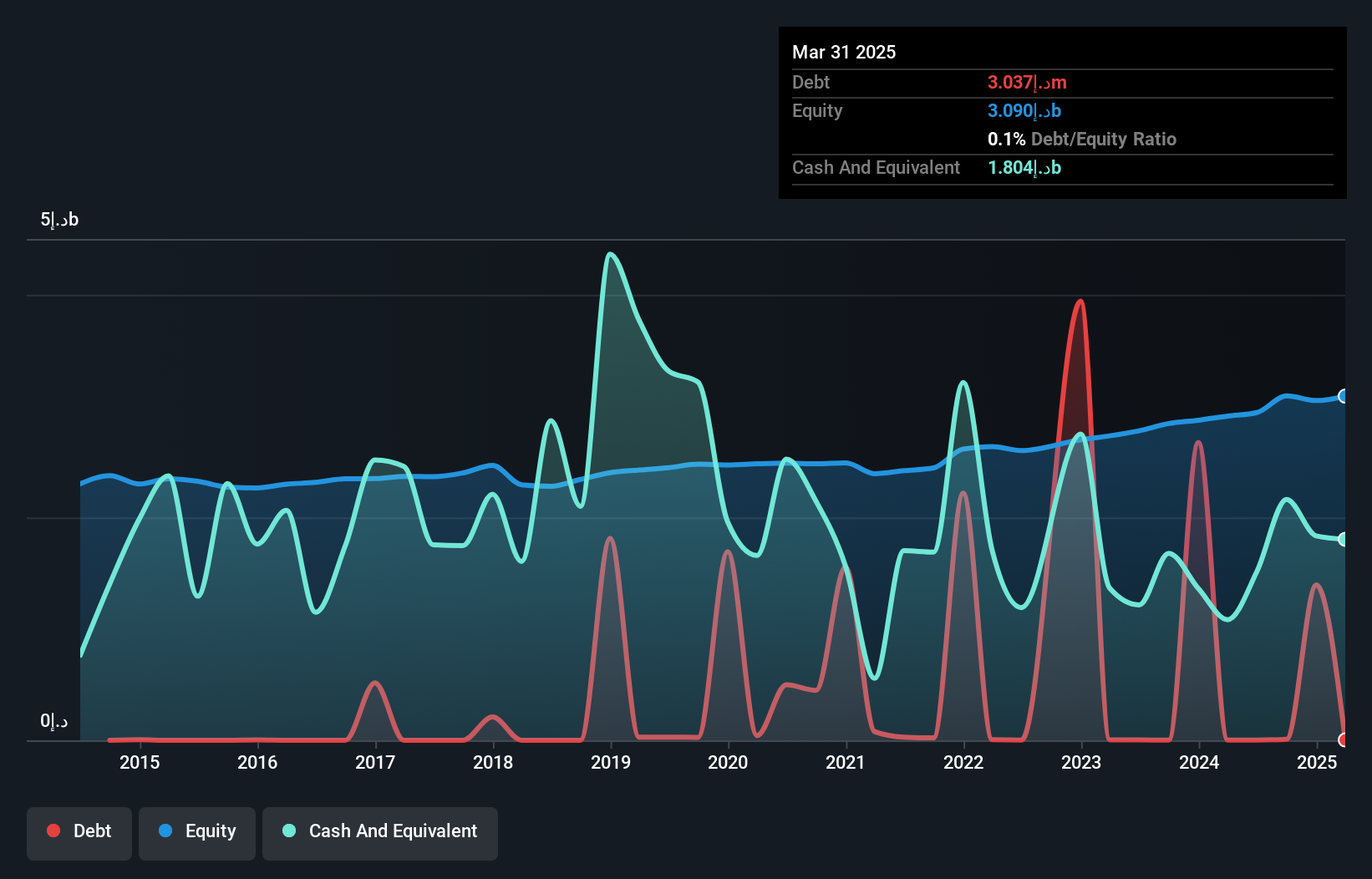

Commercial Bank International P.S.C (ADX:CBI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Commercial Bank International P.S.C. offers a range of banking products and services to individuals and businesses in the United Arab Emirates, with a market capitalization of AED1.55 billion.

Operations: The company's revenue is primarily derived from its Wholesale Banking segment at AED392.60 million, followed by Real Estate at AED148.07 million, Retail Banking at AED60.95 million, and Treasury operations contributing AED29.84 million.

Market Cap: AED1.55B

Commercial Bank International P.S.C. has demonstrated strong financial performance, with a significant increase in net income for the third quarter of 2024 to AED149.24 million from AED46.5 million a year ago, and earnings per share rising to AED0.086 from AED0.027. The bank's net profit margins have improved, reaching 39.6%, while maintaining an appropriate loans-to-deposits ratio of 81%. Despite having high-quality earnings and stable weekly volatility at 4%, CBI faces challenges with a high level of bad loans at 16.1%. Its price-to-earnings ratio of 6.3x suggests it is valued below the market average in the UAE.

- Click here and access our complete financial health analysis report to understand the dynamics of Commercial Bank International P.S.C.

- Assess Commercial Bank International P.S.C's previous results with our detailed historical performance reports.

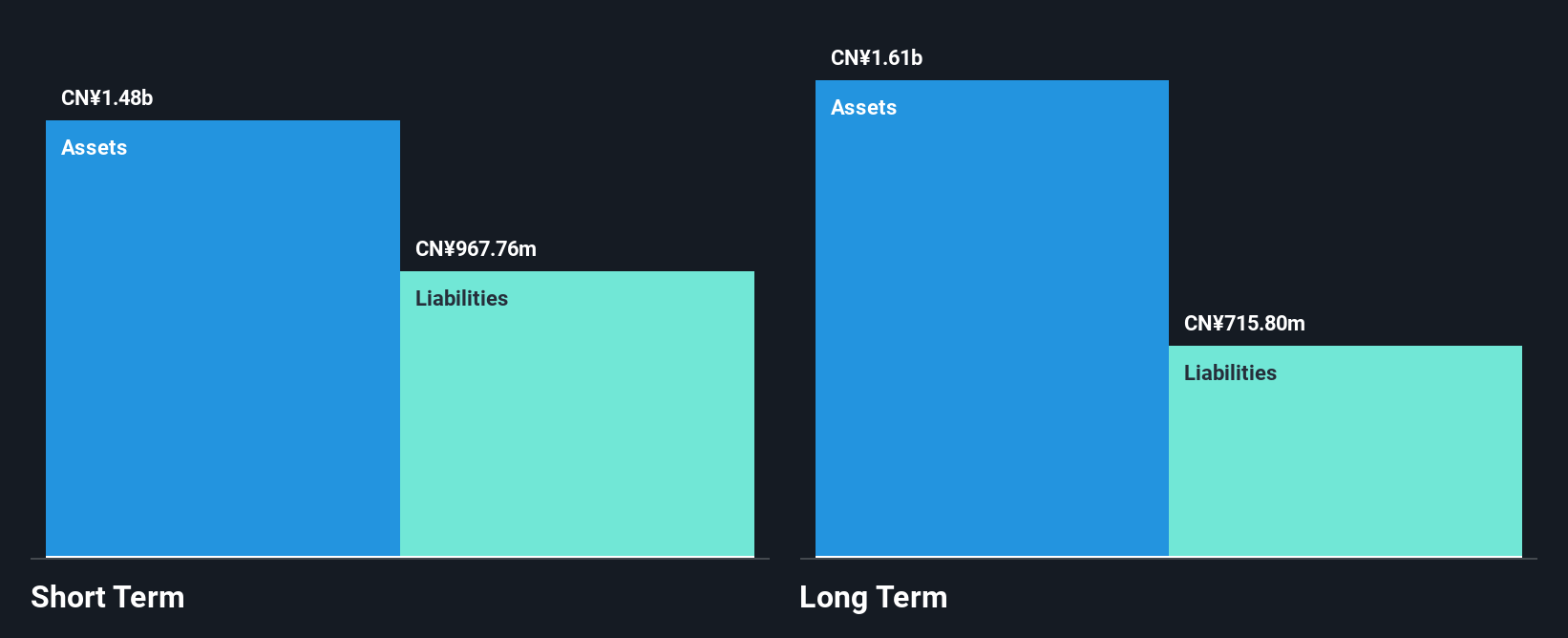

Beijing Jingcheng Machinery Electric (SEHK:187)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beijing Jingcheng Machinery Electric Company Limited manufactures and sells gas storage and transportation equipment in China and internationally, with a market cap of HK$4.92 billion.

Operations: No specific revenue segments are reported for Beijing Jingcheng Machinery Electric Company Limited.

Market Cap: HK$4.92B

Beijing Jingcheng Machinery Electric has shown improvement in reducing losses, with a net loss of CN¥16.07 million for the first nine months of 2024, down from CN¥49.81 million last year. The company reported sales of CN¥1.11 billion for the same period, indicating revenue growth despite ongoing unprofitability and negative return on equity at -1.76%. Its financial position is strengthened by short-term assets exceeding both short- and long-term liabilities, while its debt-to-equity ratio has improved significantly over five years to 21.8%. However, share price volatility remains high compared to local market peers.

- Click to explore a detailed breakdown of our findings in Beijing Jingcheng Machinery Electric's financial health report.

- Gain insights into Beijing Jingcheng Machinery Electric's past trends and performance with our report on the company's historical track record.

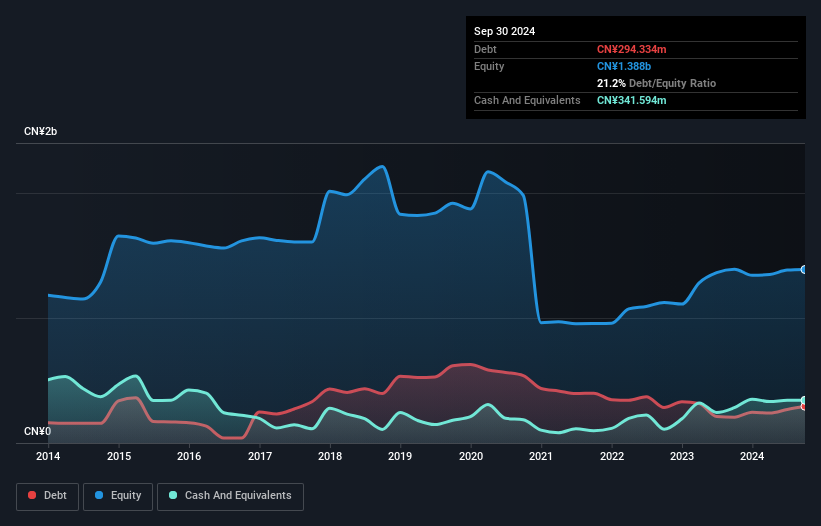

Tong Petrotech (SZSE:300164)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tong Petrotech Corp. specializes in providing perforation technology services to oilfield clients both in China and abroad, with a market cap of CN¥2.64 billion.

Operations: The company generates revenue from its Petroleum Exploration Development segment, amounting to CN¥1.11 billion.

Market Cap: CN¥2.64B

Tong Petrotech Corp. has demonstrated revenue growth with CN¥866.67 million reported for the first nine months of 2024, up from CN¥790.21 million a year prior, though net income decreased to CN¥48.12 million from CN¥90.72 million. The company's financial health is supported by short-term assets exceeding both short- and long-term liabilities and having more cash than total debt, indicating strong liquidity management. Despite this, profit margins have contracted significantly to 0.7% from 9.2% last year due to large one-off items impacting results, and earnings growth has been negative over the past year amidst stable share price volatility.

- Take a closer look at Tong Petrotech's potential here in our financial health report.

- Examine Tong Petrotech's past performance report to understand how it has performed in prior years.

Key Takeaways

- Navigate through the entire inventory of 5,801 Penny Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tong Petrotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300164

Tong Petrotech

Develops and offers perforation technology services to oilfield customers in China and internationally.

Flawless balance sheet and slightly overvalued.