Discovering Hidden Potential China Resources and EnvironmentLtd Alongside 2 Promising Small Caps

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have demonstrated resilience, holding up better than their large-cap counterparts amid a busy earnings season and mixed economic signals. As investors seek opportunities beyond the mainstream indices, discovering stocks with hidden potential becomes increasingly appealing, especially when they show promise in navigating economic uncertainties and capitalizing on growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Padma Oil | 0.87% | -0.90% | 3.72% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 20.47% | -3.86% | -2.71% | ★★★★★☆ |

| Jetwell Computer | 57.20% | 6.93% | 24.36% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

China Resources and EnvironmentLtd (SHSE:600217)

Simply Wall St Value Rating: ★★★★☆☆

Overview: China Resources and Environment Co., Ltd. focuses on the recycling and dismantling of waste electrical and electronic products in China, with a market cap of CN¥11.50 billion.

Operations: The company generates revenue primarily from recycling and dismantling waste electrical and electronic products. The net profit margin has shown a notable trend, reflecting the company's efficiency in managing its costs relative to its revenue streams.

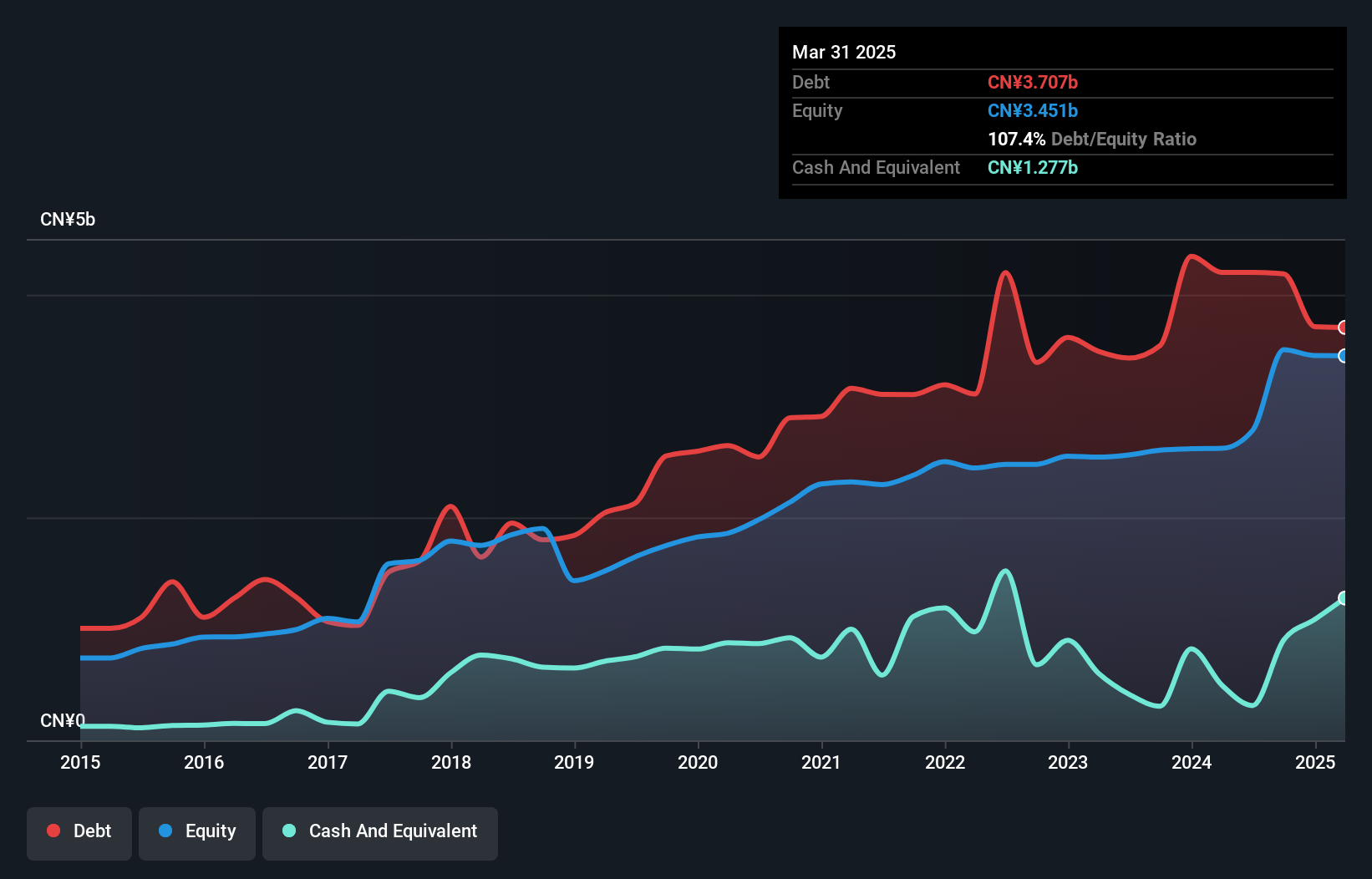

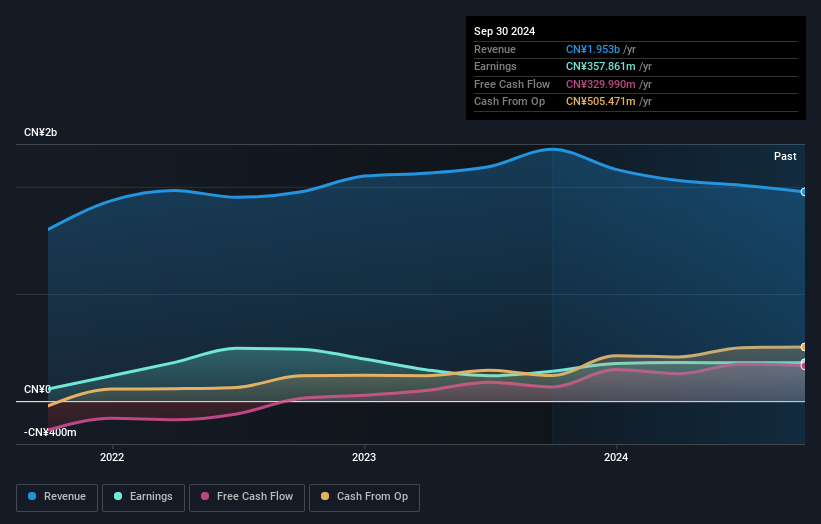

China Resources and Environment Co., Ltd. has been making waves with a notable earnings growth of 41.3% over the past year, outpacing its industry peers significantly. Despite a high net debt to equity ratio of 93.7%, the company has managed to reduce its overall debt from 146% to 119.5% in five years, showing an improvement in financial management. Recent earnings reports highlight sales reaching CNY 2,899 million for nine months ending September 2024, up from CNY 2,735 million last year, with net income climbing to CNY 63 million from CNY 54 million previously. However, shareholders experienced dilution recently and free cash flow remains negative.

- Delve into the full analysis health report here for a deeper understanding of China Resources and EnvironmentLtd.

Understand China Resources and EnvironmentLtd's track record by examining our Past report.

Xiangtan Electrochemical ScientificLtd (SZSE:002125)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiangtan Electrochemical Scientific Co., Ltd focuses on the research, development, production, and sale of battery materials with a market cap of CN¥6.86 billion.

Operations: The company generates revenue primarily from the sale of battery materials. It has a market cap of CN¥6.86 billion.

Xiangtan Electrochemical Scientific Ltd. has shown a robust performance with earnings growth of 27.8% over the past year, outpacing the broader Chemicals industry average of -3.8%. This company is trading at 75.5% below its estimated fair value, suggesting potential undervaluation in the market. The net debt to equity ratio stands at a satisfactory 33.6%, down from 120.9% five years ago, indicating improved financial health and reduced leverage risk. Recent earnings for nine months ending September 2024 reported net income of CNY 244 million, slightly up from CNY 239 million last year, reflecting steady profitability amidst declining sales figures.

Zhejiang Changsheng Sliding Bearings (SZSE:300718)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Changsheng Sliding Bearings Co., Ltd. specializes in the production and sale of sliding bearings and related components, with a market cap of CN¥5.22 billion.

Operations: The company generates revenue primarily from the sale of sliding bearings and related components.

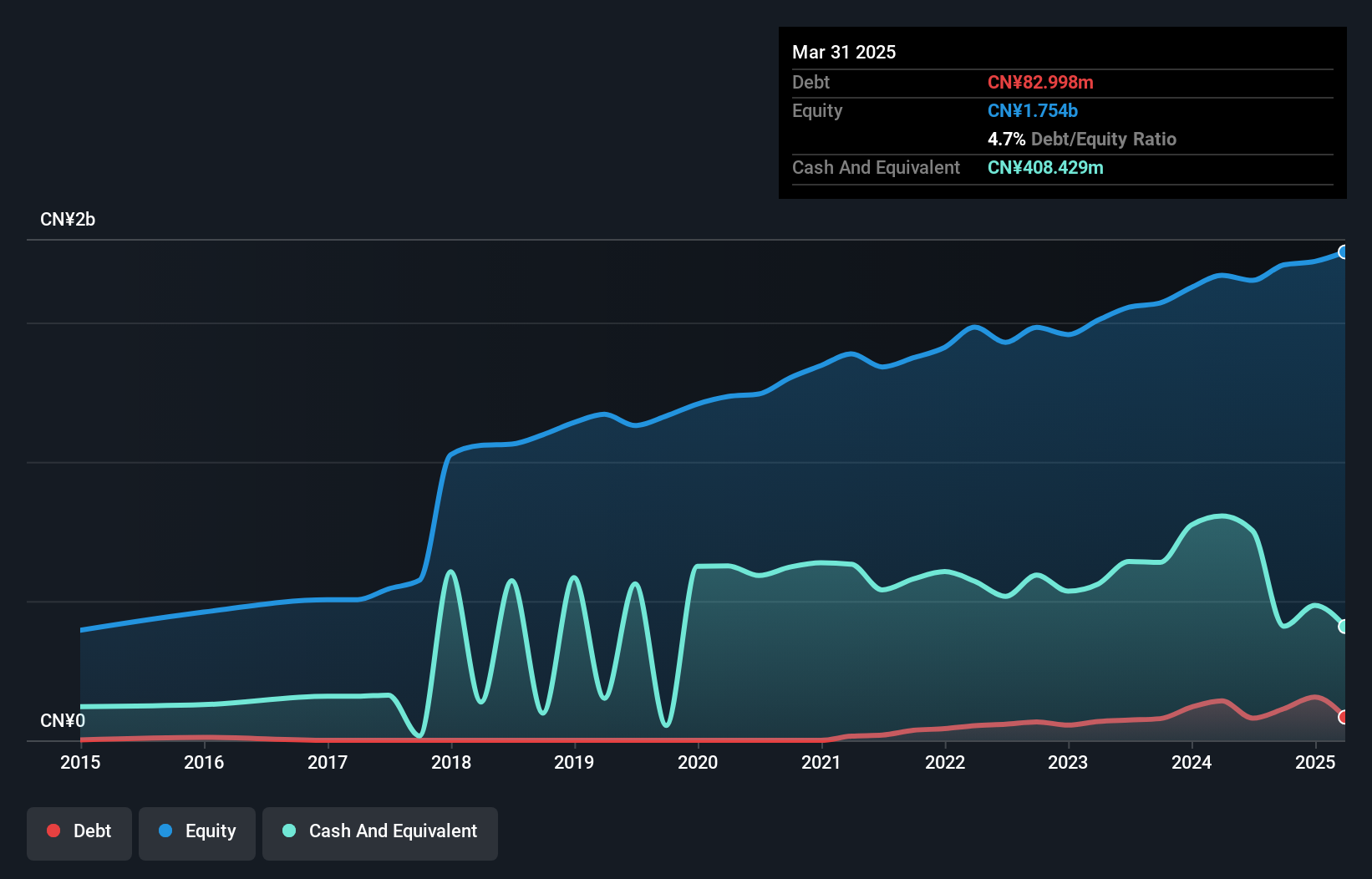

Zhejiang Changsheng Sliding Bearings, a relatively small player in the machinery sector, has shown robust earnings growth of 55% over the past year, outpacing the industry average. The company is trading at a price-to-earnings ratio of 23.5x, which is favorable compared to the CN market's 34.4x. Despite an increase in its debt-to-equity ratio from 0% to 6.6% over five years, it maintains more cash than total debt and covers interest payments comfortably. Recent financials reveal nine-month sales of ¥835 million with net income slightly down to ¥169 million from last year's ¥179 million, reflecting stable operational performance amidst share buyback plans and dividend distributions.

Taking Advantage

- Access the full spectrum of 4733 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Changsheng Sliding Bearings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300718

Zhejiang Changsheng Sliding Bearings

Zhejiang Changsheng Sliding Bearings Co., Ltd.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives