- China

- /

- Electronic Equipment and Components

- /

- SHSE:603583

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets navigate a busy earnings season, with major indices like the Nasdaq Composite and S&P MidCap 400 hitting record highs before experiencing sharp declines, small-cap stocks have shown resilience compared to their larger counterparts. Amidst cautious earnings reports from tech giants and mixed economic signals, investors are paying close attention to high growth tech stocks that can offer potential opportunities in this dynamic environment. In such conditions, a good stock is often characterized by its ability to sustain innovation and adapt to market shifts while maintaining solid fundamentals despite broader volatility.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| TG Therapeutics | 34.69% | 57.41% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.17% | 70.49% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 71.73% | ★★★★★★ |

Click here to see the full list of 1291 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Zhejiang Jiecang Linear Motion TechnologyLtd (SHSE:603583)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Jiecang Linear Motion Technology Co., Ltd. specializes in the development and manufacturing of linear motion products, with a market cap of CN¥7.76 billion.

Operations: Jiecang Linear Motion Technology generates revenue primarily from its linear drive industry segment, amounting to CN¥3.50 billion.

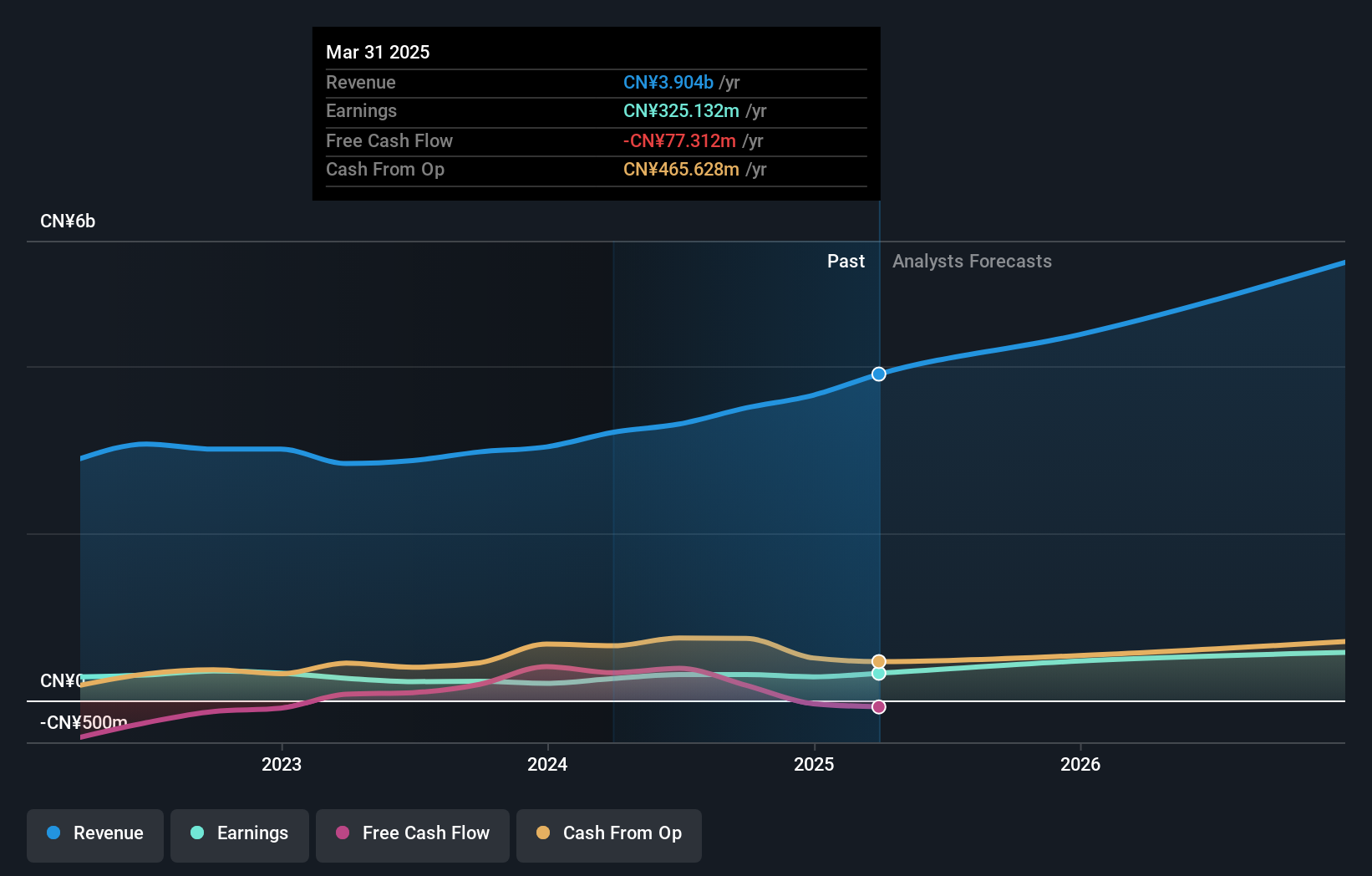

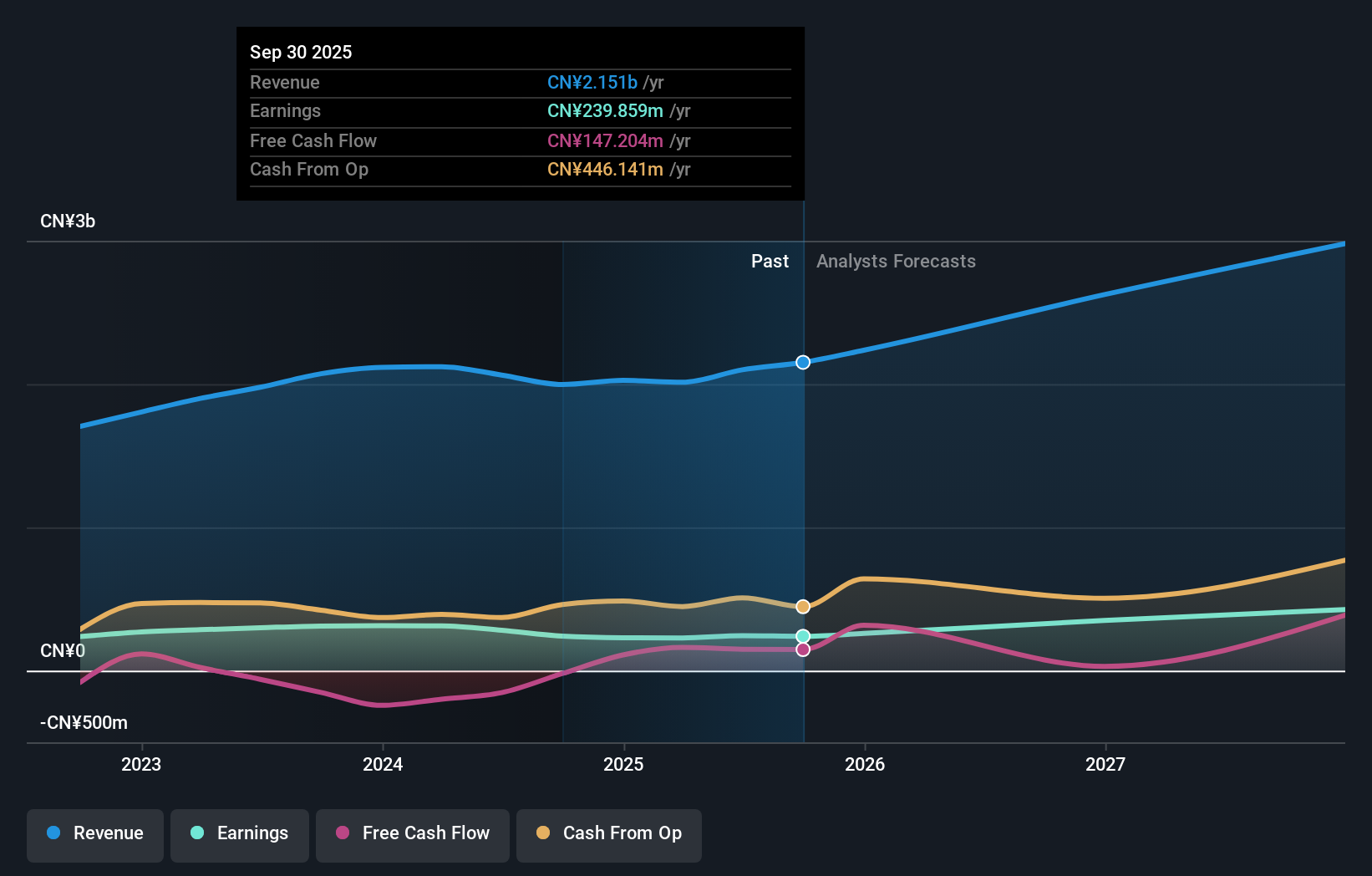

Zhejiang Jiecang Linear Motion Technology Co., Ltd. has demonstrated robust financial performance, with recent earnings revealing a significant year-over-year increase in net income to CNY 293.2 million from CNY 188.43 million and a rise in revenue to CNY 2,567.98 million from CNY 2,101.38 million. This growth trajectory is underscored by an impressive earnings growth rate of 35.3% over the past year, outpacing the electronic industry's average of 1.6%. The company's commitment to innovation is evident in its R&D investments, which have strategically fueled its product development and market expansion efforts, aligning with industry demands for advanced linear motion technologies. Looking ahead, Zhejiang Jiecang is poised for continued success with forecasted annual revenue and earnings growth rates of 17.2% and 27.7%, respectively—both figures surpassing broader market averages in China. These projections are supported by the company's solid operational strategies and increasing demand within their sector, positioning them well within the competitive landscape despite intense market competition.

- Get an in-depth perspective on Zhejiang Jiecang Linear Motion TechnologyLtd's performance by reading our health report here.

Understand Zhejiang Jiecang Linear Motion TechnologyLtd's track record by examining our Past report.

Suzhou Sushi Testing GroupLtd (SZSE:300416)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Sushi Testing Group Co., Ltd. offers environmental and reliability test verification equipment and analysis services, with a market capitalization of CN¥6.49 billion.

Operations: Suzhou Sushi Testing Group Co., Ltd. specializes in providing test verification equipment and analysis services, focusing on environmental and reliability assessments.

Suzhou Sushi Testing Group Ltd., despite a recent dip in sales and net income, is poised for significant growth with revenues expected to increase by 21.4% annually, outpacing the Chinese market's 14% growth rate. The company's strategic emphasis on R&D is evident as it channels substantial resources into innovation—critical for maintaining competitive advantage in the tech sector. Moreover, with earnings projected to surge by 34.3% per year, Suzhou Sushi is aggressively investing back into its core operations, including a recent share buyback of CNY 4.78 million, signaling confidence in its future trajectory and commitment to shareholder value amidst market volatility.

Wuhan Jingce Electronic GroupLtd (SZSE:300567)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Jingce Electronic Group Co., Ltd engages in the research, development, production, and sale of display, semiconductor, and new energy detection systems with a market cap of approximately CN¥16.36 billion.

Operations: The company generates its revenue primarily from the Electron Product segment, which contributes CN¥2.72 billion.

Wuhan Jingce Electronic GroupLtd has demonstrated a robust turnaround, with revenue climbing to CNY 1.83 billion, up from CNY 1.54 billion year-over-year, and transforming a net loss into a profit of CNY 82.24 million. This growth is underpinned by an aggressive R&D strategy, with expenses significantly contributing to its innovative edge in the electronics sector. The firm's commitment to innovation is further evidenced by its projected earnings growth of 33% annually, outstripping the broader Chinese market forecast of 25.9%. These financial dynamics are complemented by strategic decisions such as recent shareholder meetings focused on optimizing project funding methods, showcasing Wuhan Jingce’s proactive approach in strengthening its market position and financial health.

Next Steps

- Click here to access our complete index of 1291 High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jiecang Linear Motion TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603583

Zhejiang Jiecang Linear Motion TechnologyLtd

Zhejiang Jiecang Linear Motion Technology Co.,Ltd.

Undervalued with excellent balance sheet.