- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600694

Exploring Three Undiscovered Gems For Potential Portfolio Enhancement

Reviewed by Simply Wall St

As global markets experience a rebound, with major U.S. stock indexes climbing higher amid easing core inflation and strong bank earnings, investors are increasingly looking towards small-cap stocks for potential opportunities. The S&P MidCap 400 and Russell 2000 indices have shown notable gains, highlighting the appeal of smaller companies during periods of economic optimism. In this context, identifying undiscovered gems—stocks that may not yet be on every investor's radar but possess solid fundamentals or growth potential—can enhance a portfolio by offering diversification and exposure to emerging market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.18% | 50.86% | 65.05% | ★★★★★☆ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.47% | 61.65% | 67.97% | ★★★★★☆ |

| Kerevitas Gida Sanayi ve Ticaret | 48.40% | 45.75% | 37.51% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Dashang (SHSE:600694)

Simply Wall St Value Rating: ★★★★★★

Overview: Dashang Co., Ltd. operates a chain of department stores, supermarkets, and electrical appliance stores in China with a market cap of CN¥7.50 billion.

Operations: Dashang generates revenue primarily through its department stores, supermarkets, and electrical appliance stores in China. The company has a market capitalization of CN¥7.50 billion.

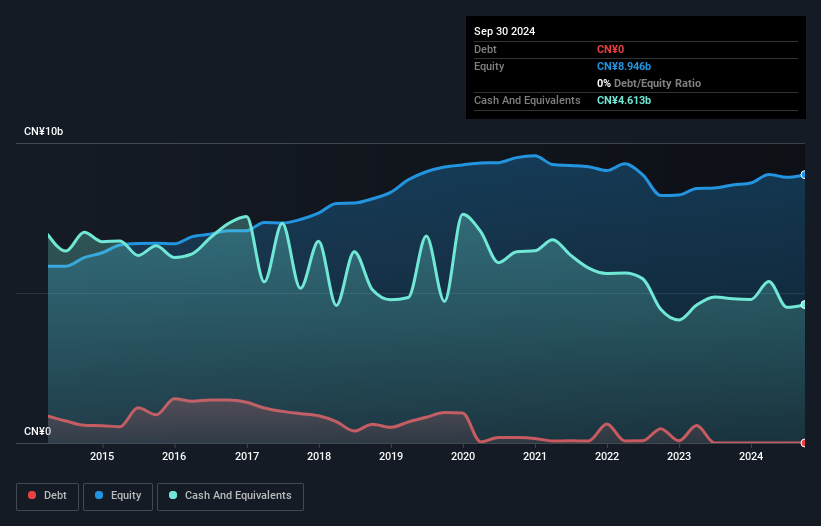

Dashang, a smaller player in the retail sector, has shown notable resilience despite industry challenges. The company's earnings grew by 18.8% over the past year, outpacing the Multiline Retail industry's -5.3%. Trading at 21.6% below its estimated fair value, Dashang appears attractively priced compared to peers. With no debt and high-quality past earnings, its financial health seems robust. Recent reports indicate net income rose to CNY 531 million from CNY 450 million last year, while basic earnings per share increased to CNY 1.7 from CNY 1.44 a year ago, highlighting potential for continued growth and value creation in the future.

- Unlock comprehensive insights into our analysis of Dashang stock in this health report.

Understand Dashang's track record by examining our Past report.

Beijing Lier High-temperature MaterialsLtd (SZSE:002392)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing Lier High-temperature Materials Co., Ltd. specializes in the production and sale of high-temperature resistant materials, with a market cap of CN¥5.51 billion.

Operations: Lier High-temperature Materials generates revenue primarily from the sale of high-temperature resistant materials. The company's financial performance is marked by a focus on optimizing its cost structure to enhance profitability.

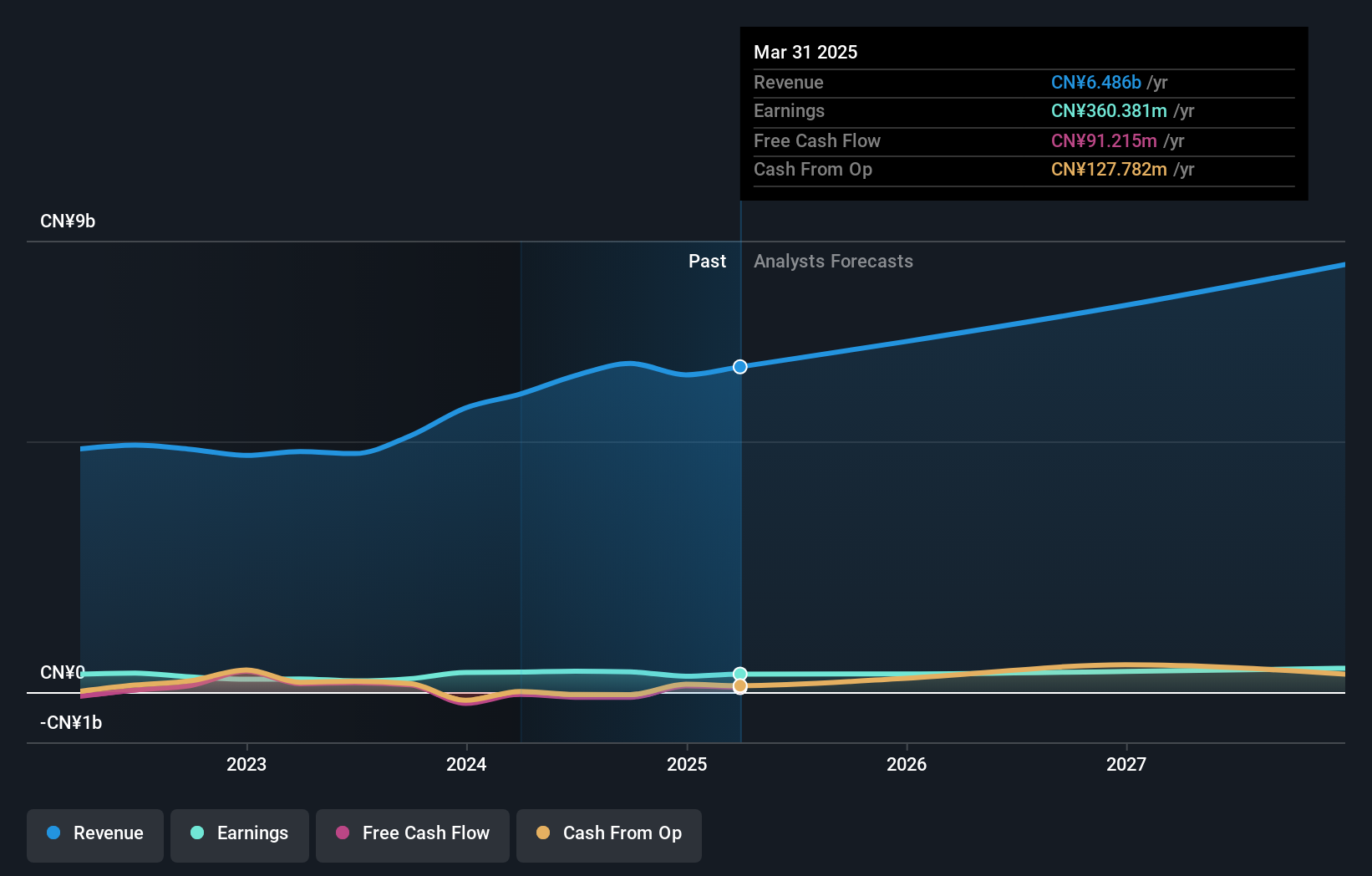

In the bustling realm of niche industrial players, Beijing Lier High-temperature Materials Ltd. stands out with its robust earnings growth of 48.5% over the past year, significantly outpacing the Metals and Mining industry's -2.3%. The company seems to be trading at an attractive valuation with a price-to-earnings ratio of 13.8x, well below the CN market average of 34.3x, indicating potential value for investors seeking opportunities in smaller firms. Despite a rise in debt to equity from 1.3% to 6.3% over five years, it maintains more cash than total debt and has repurchased shares worth CNY 93.91 million recently, reflecting confidence in its financial health and future prospects as earnings are forecasted to grow by 15.11% annually.

Goldcard Smart Group (SZSE:300349)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Goldcard Smart Group Co., Ltd. is a utility digitalization solution provider specializing in smart gas, smart water, and hydrogen metering in China, with a market cap of CN¥5.37 billion.

Operations: Goldcard Smart Group generates revenue primarily from its utility digitalization solutions, focusing on smart gas, smart water, and hydrogen metering. The company's financial performance is highlighted by a net profit margin of 11.5%.

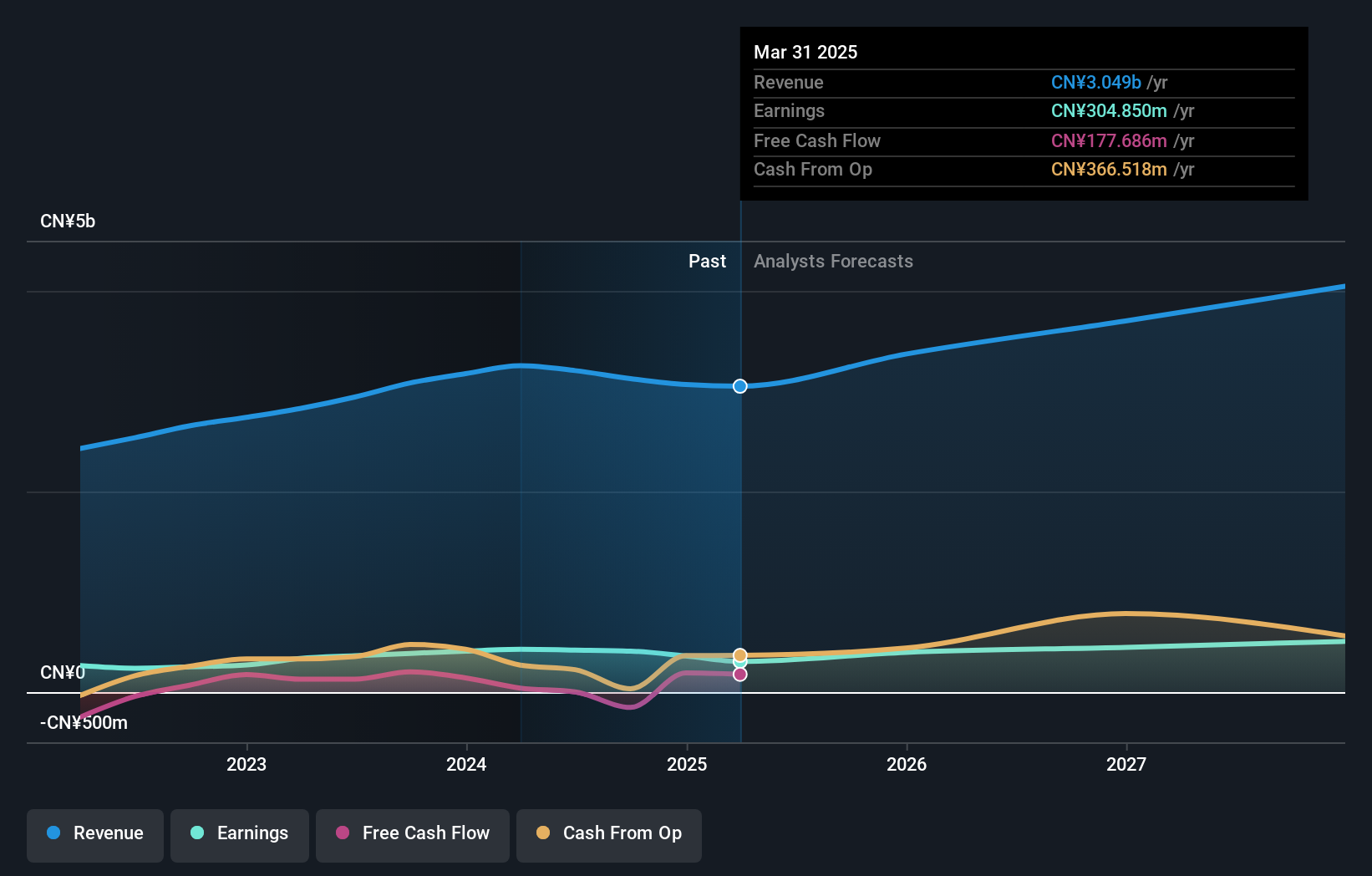

Goldcard Smart Group, a promising player in its sector, showcases high-quality earnings and trades at an attractive price-to-earnings ratio of 13.2x, well below the CN market's 34.3x. Its debt-to-equity ratio has risen from 0.02% to 10.6% over five years, suggesting increased leverage but still manageable given its profitability and interest coverage capabilities. Despite a slight dip in sales to CNY 2.23 billion for nine months ending September 2024, net income held steady at CNY 297 million with basic earnings per share consistent at CNY 0.72, reflecting resilience amidst industry challenges and potential for future growth with new board members elected recently.

Taking Advantage

- Navigate through the entire inventory of 4644 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600694

Dashang

Operates a chain of department stores, supermarkets, and electrical appliance stores in China.

Flawless balance sheet, undervalued and pays a dividend.