- China

- /

- Electronic Equipment and Components

- /

- SZSE:300344

Revenues Not Telling The Story For Cubic Digital Technology Co.,Ltd. (SZSE:300344) After Shares Rise 35%

Despite an already strong run, Cubic Digital Technology Co.,Ltd. (SZSE:300344) shares have been powering on, with a gain of 35% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

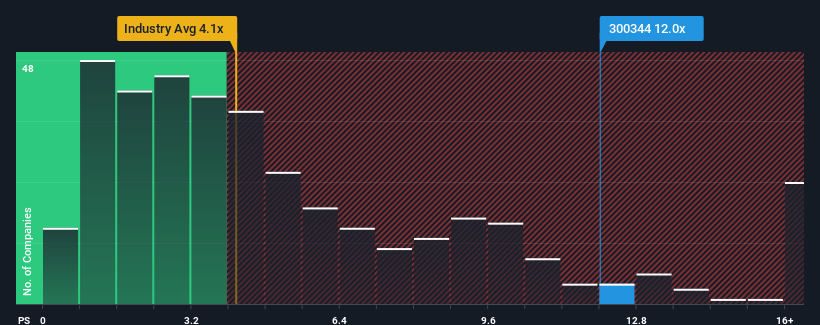

Following the firm bounce in price, Cubic Digital TechnologyLtd may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 12x, since almost half of all companies in the Electronic industry in China have P/S ratios under 4.1x and even P/S lower than 2x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Cubic Digital TechnologyLtd

How Cubic Digital TechnologyLtd Has Been Performing

We'd have to say that with no tangible growth over the last year, Cubic Digital TechnologyLtd's revenue has been unimpressive. Perhaps the market believes that revenue growth will improve markedly over current levels, inflating the P/S ratio. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Cubic Digital TechnologyLtd's earnings, revenue and cash flow.How Is Cubic Digital TechnologyLtd's Revenue Growth Trending?

Cubic Digital TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 16% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 27% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Cubic Digital TechnologyLtd's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Cubic Digital TechnologyLtd's P/S?

Shares in Cubic Digital TechnologyLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Cubic Digital TechnologyLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Cubic Digital TechnologyLtd (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300344

Cubic Digital TechnologyLtd

Manufactures and sells steel frame foamed cement composite boards in China.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives