- China

- /

- Communications

- /

- SZSE:300308

Investors Appear Satisfied With Zhongji Innolight Co., Ltd.'s (SZSE:300308) Prospects As Shares Rocket 27%

Despite an already strong run, Zhongji Innolight Co., Ltd. (SZSE:300308) shares have been powering on, with a gain of 27% in the last thirty days. This latest share price bounce rounds out a remarkable 324% gain over the last twelve months.

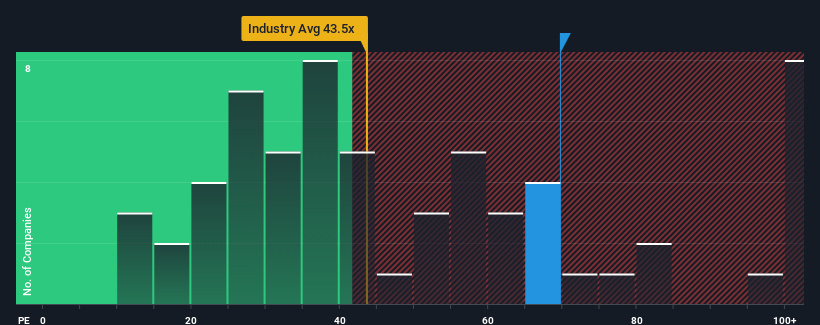

Following the firm bounce in price, Zhongji Innolight may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 69.7x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Zhongji Innolight as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Zhongji Innolight

Does Growth Match The High P/E?

Zhongji Innolight's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 42%. The strong recent performance means it was also able to grow EPS by 97% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 59% each year as estimated by the analysts watching the company. With the market only predicted to deliver 22% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Zhongji Innolight's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Zhongji Innolight's P/E?

Zhongji Innolight's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Zhongji Innolight maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Zhongji Innolight that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Zhongji Innolight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300308

Zhongji Innolight

Researches, develops, produces, and sells optical communication transceiver modules and optical devices in China.

Very undervalued with exceptional growth potential.