- China

- /

- Electronic Equipment and Components

- /

- SZSE:002600

3 Stocks Estimated To Be Up To 7.3% Below Intrinsic Value

Reviewed by Simply Wall St

In a week marked by volatile economic signals and cautious market movements, global indices have shown mixed results. With major U.S. indexes like the Nasdaq Composite and S&P 500 experiencing fluctuations amid busy earnings reports and economic data releases, investors are keenly observing value opportunities in an uncertain environment. Identifying undervalued stocks can be crucial for investors looking to capitalize on potential discrepancies between market price and intrinsic value, especially when broader market conditions are unpredictable.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥39.04 | CN¥76.89 | 49.2% |

| PharmaResearch (KOSDAQ:A214450) | ₩224500.00 | ₩450874.04 | 50.2% |

| JYP Entertainment (KOSDAQ:A035900) | ₩56700.00 | ₩107368.86 | 47.2% |

| Ingenia Communities Group (ASX:INA) | A$4.70 | A$9.43 | 50.2% |

| BayCurrent Consulting (TSE:6532) | ¥5023.00 | ¥9762.88 | 48.5% |

| EVERTEC (NYSE:EVTC) | US$33.02 | US$65.79 | 49.8% |

| Laboratorio Reig Jofre (BME:RJF) | €2.90 | €5.77 | 49.7% |

| Open Lending (NasdaqGM:LPRO) | US$6.14 | US$12.21 | 49.7% |

| Hunan TV & Broadcast Intermediary (SZSE:000917) | CN¥9.34 | CN¥20.04 | 53.4% |

| Energy One (ASX:EOL) | A$5.56 | A$11.06 | 49.7% |

Underneath we present a selection of stocks filtered out by our screen.

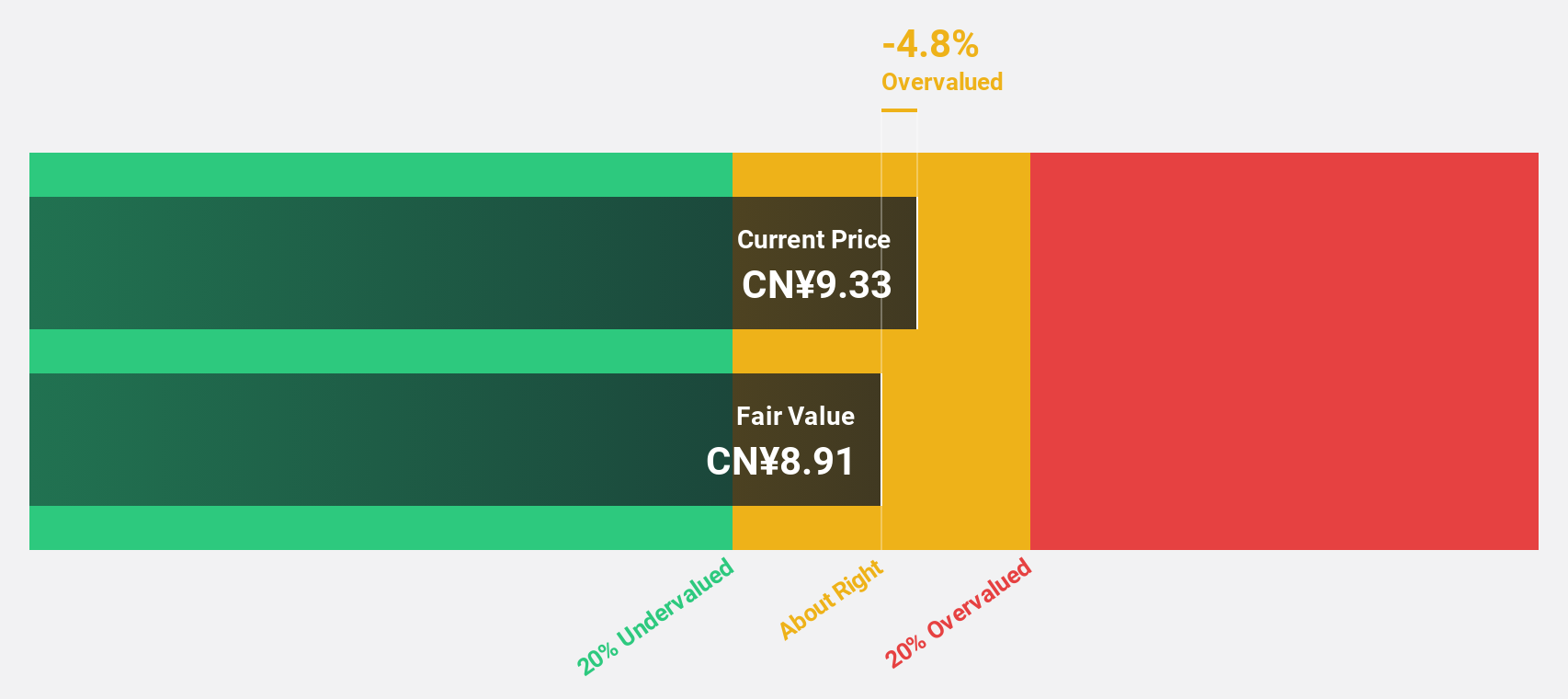

Lingyi iTech (Guangdong) (SZSE:002600)

Overview: Lingyi iTech (Guangdong) Company offers smart manufacturing services and solutions, with a market cap of CN¥59.31 billion.

Operations: Lingyi iTech's revenue is generated from providing smart manufacturing services and solutions.

Estimated Discount To Fair Value: 7.3%

Lingyi iTech (Guangdong) trades at CN¥9.11, slightly below its fair value estimate of CN¥9.83, suggesting it could be undervalued based on cash flows despite recent volatility. The company reported a revenue increase to CNY 31.48 billion for the nine months ended September 2024, although net income declined to CNY 1.41 billion from the previous year’s CNY 1.87 billion, reflecting margin pressures amidst strong sales growth projections and ongoing share buyback activities.

- The growth report we've compiled suggests that Lingyi iTech (Guangdong)'s future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Lingyi iTech (Guangdong) stock in this financial health report.

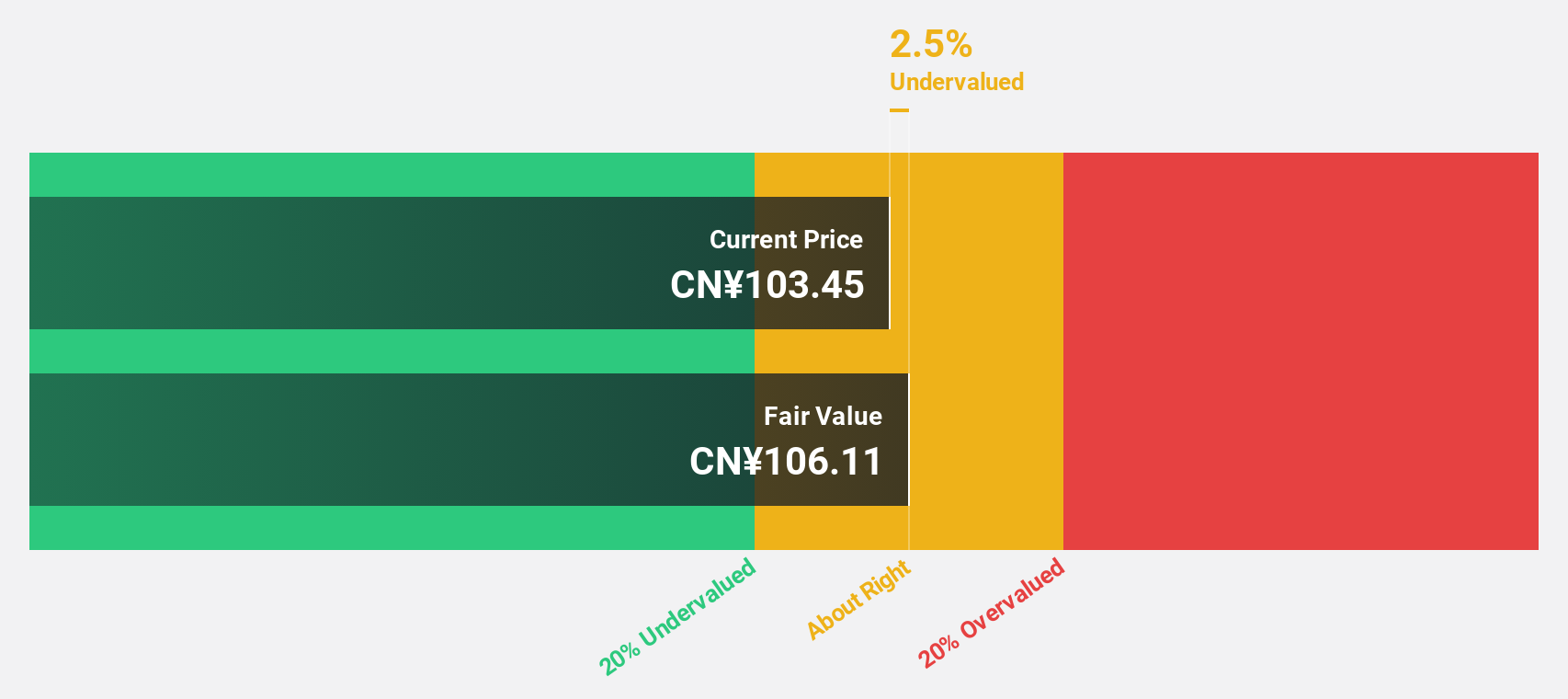

Zhongji Innolight (SZSE:300308)

Overview: Zhongji Innolight Co., Ltd. is involved in the research, development, production, and sale of optical communication transceiver modules and optical devices in China, with a market cap of CN¥158.14 billion.

Operations: The company generates revenue primarily from the sale of optical communication transceiver modules and optical devices within China.

Estimated Discount To Fair Value: 28.0%

Zhongji Innolight is trading at CN¥148.29, below its estimated fair value of CN¥205.83, reflecting potential undervaluation based on cash flows. The company reported significant revenue growth to CNY 17.31 billion for the first nine months of 2024, with net income rising to CNY 3.75 billion from CNY 1.30 billion a year ago, despite recent share price volatility and high levels of non-cash earnings impacting perceived quality.

- Upon reviewing our latest growth report, Zhongji Innolight's projected financial performance appears quite optimistic.

- Take a closer look at Zhongji Innolight's balance sheet health here in our report.

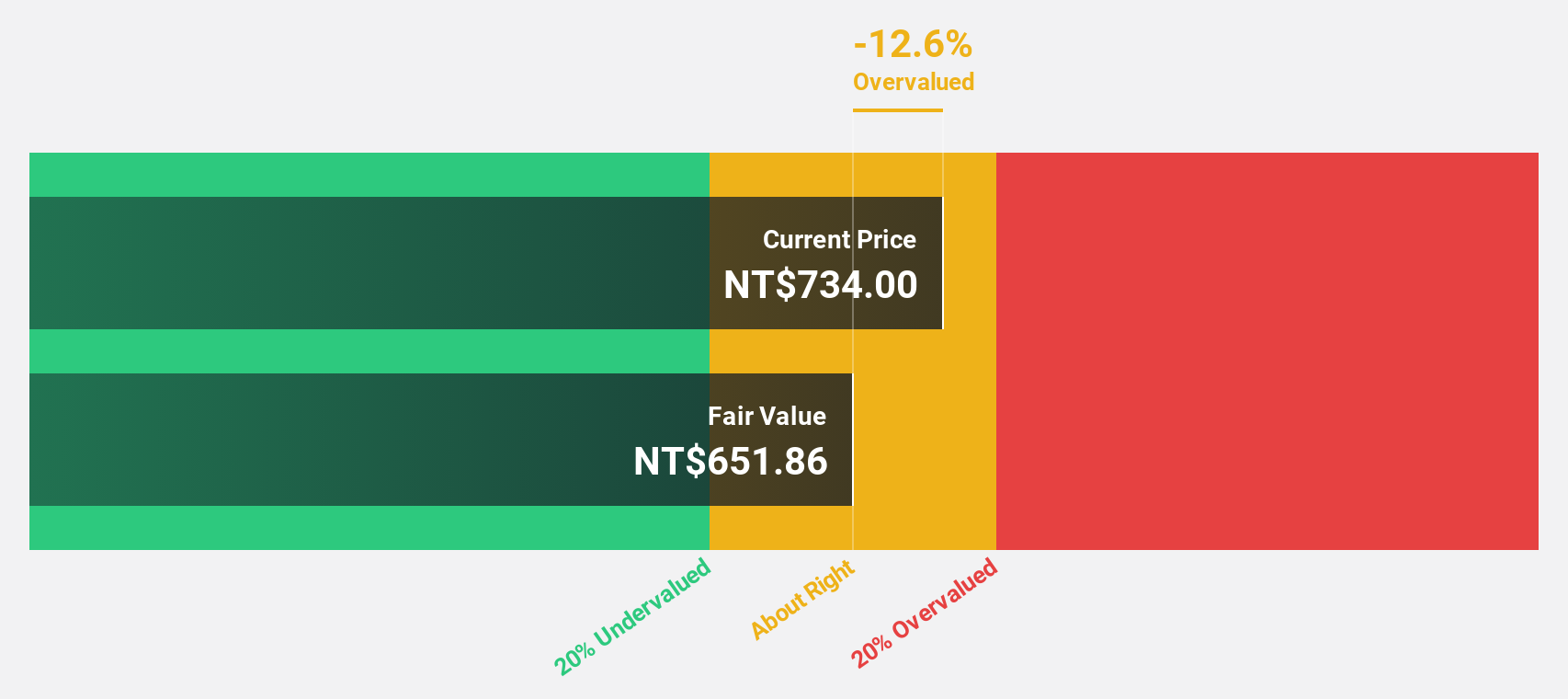

Asia Vital Components (TWSE:3017)

Overview: Asia Vital Components Co., Ltd. offers thermal solutions globally and has a market cap of NT$250.68 billion.

Operations: The company generates revenue from its Overseas Operating Department, which contributes NT$66.65 billion, and its Integrated Management Division, which adds NT$48.87 billion.

Estimated Discount To Fair Value: 16.3%

Asia Vital Components is trading at NT$656, below its estimated fair value of NT$783.35, suggesting undervaluation based on cash flows. The company reported strong earnings growth with Q2 2024 net income rising to TWD 1,947.26 million from TWD 1,201.43 million a year ago and a significant revenue increase. Despite recent share price volatility, the company's earnings and revenue are forecast to grow significantly above market rates over the next few years.

- Insights from our recent growth report point to a promising forecast for Asia Vital Components' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Asia Vital Components.

Seize The Opportunity

- Gain an insight into the universe of 960 Undervalued Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002600

Lingyi iTech (Guangdong)

Provides smart manufacturing services and solutions in China and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026