- China

- /

- Communications

- /

- SZSE:300250

What Hangzhou CNCR-IT Co.,Ltd's (SZSE:300250) 30% Share Price Gain Is Not Telling You

The Hangzhou CNCR-IT Co.,Ltd (SZSE:300250) share price has done very well over the last month, posting an excellent gain of 30%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

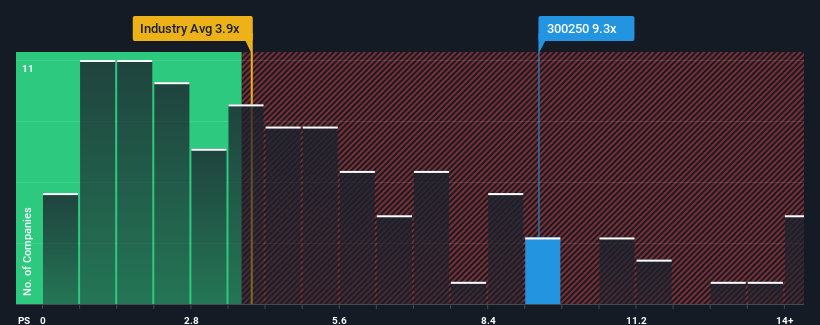

Following the firm bounce in price, when almost half of the companies in China's Communications industry have price-to-sales ratios (or "P/S") below 3.9x, you may consider Hangzhou CNCR-ITLtd as a stock not worth researching with its 9.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Hangzhou CNCR-ITLtd

How Hangzhou CNCR-ITLtd Has Been Performing

For example, consider that Hangzhou CNCR-ITLtd's financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many are expecting an improvement to the uninspiring revenue performance over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hangzhou CNCR-ITLtd's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Hangzhou CNCR-ITLtd?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Hangzhou CNCR-ITLtd's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 31% overall from three years ago. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 42% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Hangzhou CNCR-ITLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Hangzhou CNCR-ITLtd's P/S?

The strong share price surge has lead to Hangzhou CNCR-ITLtd's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Hangzhou CNCR-ITLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It is also worth noting that we have found 1 warning sign for Hangzhou CNCR-ITLtd that you need to take into consideration.

If you're unsure about the strength of Hangzhou CNCR-ITLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou CNCR-ITLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300250

Hangzhou CNCR-ITLtd

Provides digital and intelligent industrial solutions and operations services for government and enterprise markets in China and internationally.

Excellent balance sheet with minimal risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026