- China

- /

- Electronic Equipment and Components

- /

- SZSE:300127

Chengdu Galaxy Magnets Co.,Ltd. (SZSE:300127) Stock Rockets 27% As Investors Are Less Pessimistic Than Expected

Chengdu Galaxy Magnets Co.,Ltd. (SZSE:300127) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

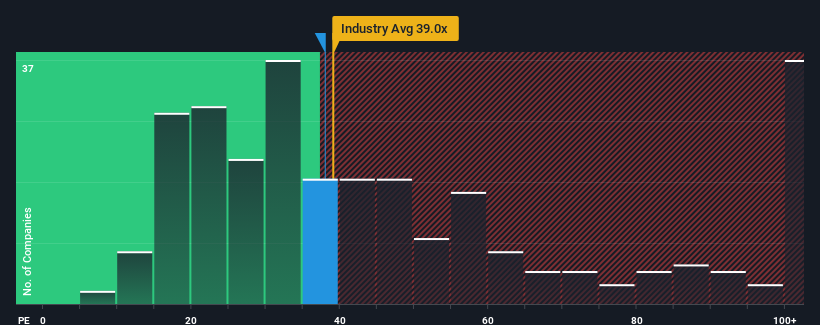

After such a large jump in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 30x, you may consider Chengdu Galaxy MagnetsLtd as a stock to potentially avoid with its 38x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Chengdu Galaxy MagnetsLtd could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Chengdu Galaxy MagnetsLtd

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Chengdu Galaxy MagnetsLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 5.7% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 8.3% overall rise in EPS. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 14% each year as estimated by the only analyst watching the company. That's shaping up to be materially lower than the 20% each year growth forecast for the broader market.

In light of this, it's alarming that Chengdu Galaxy MagnetsLtd's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Chengdu Galaxy MagnetsLtd's P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Chengdu Galaxy MagnetsLtd's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Chengdu Galaxy MagnetsLtd that you should be aware of.

You might be able to find a better investment than Chengdu Galaxy MagnetsLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300127

Chengdu Galaxy MagnetsLtd

Engages in the research, development, production, and sales of a new generation of rare earth permanent magnets - bonded NdFeB rare earth magnet elements worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026