- South Korea

- /

- Chemicals

- /

- KOSE:A010060

3 Growth Stocks With High Insider Ownership And 92% Earnings Growth

Reviewed by Simply Wall St

In recent weeks, global markets have been marked by volatility, with U.S. equities experiencing declines amid inflation concerns and political uncertainties, while European stocks showed resilience on hopes of interest rate cuts. As investors navigate these choppy waters, growth companies with high insider ownership can offer a compelling proposition; such firms often align management interests with shareholders and may demonstrate robust earnings potential despite broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's review some notable picks from our screened stocks.

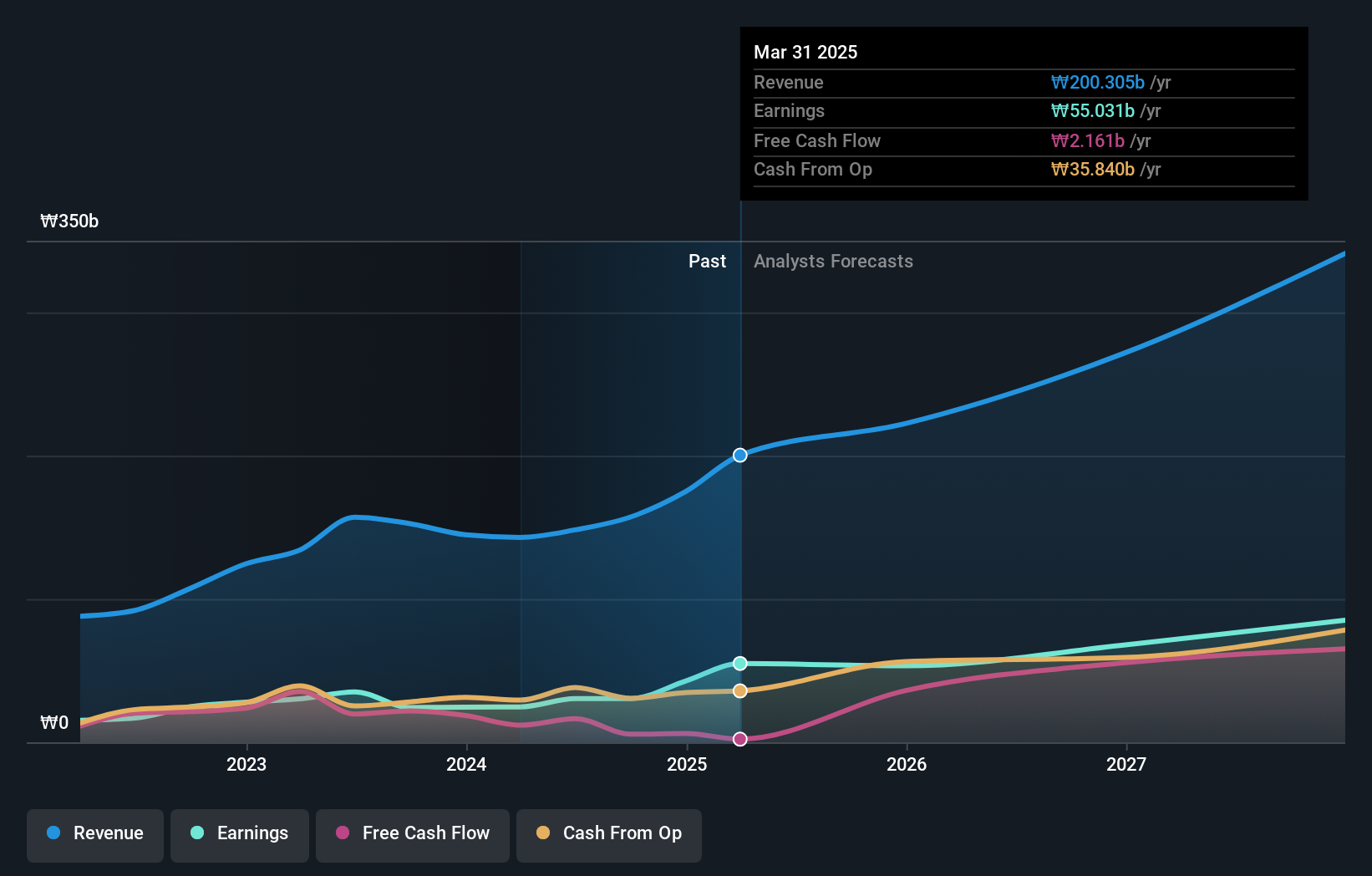

Park Systems (KOSDAQ:A140860)

Simply Wall St Growth Rating: ★★★★★★

Overview: Park Systems Corp. develops, manufactures, and sells atomic force microscopy (AFM) systems worldwide with a market cap of ₩1.67 trillion.

Operations: The company generates revenue from its Scientific & Technical Instruments segment, amounting to ₩157.20 billion.

Insider Ownership: 33%

Earnings Growth Forecast: 36.9% p.a.

Park Systems is trading at 17.1% below its estimated fair value, with revenue forecasted to grow significantly faster than the market at 23.6% per year. Earnings are expected to grow by 36.88% annually, outpacing the Korean market's growth rate of 28.9%. The company recently announced a strategic partnership with Labindia Instruments for expansion in India's burgeoning semiconductor sector, enhancing its presence and influence in this rapidly growing industry.

- Delve into the full analysis future growth report here for a deeper understanding of Park Systems.

- In light of our recent valuation report, it seems possible that Park Systems is trading beyond its estimated value.

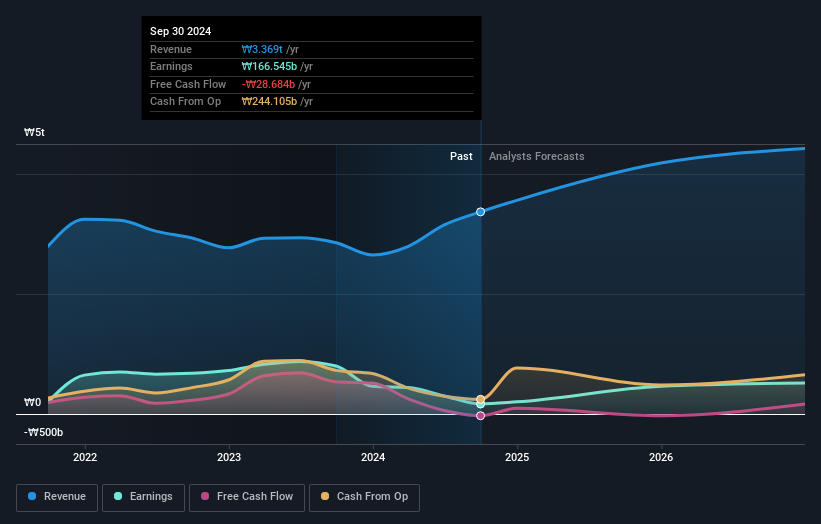

OCI Holdings (KOSE:A010060)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OCI Holdings Company Ltd., along with its subsidiaries, offers a range of chemical products and energy solutions across South Korea, the United States, China, other parts of Asia, Europe, and globally with a market cap of ₩1.50 trillion.

Operations: The company's revenue segments include the Basic Chemical Division with ₩2.26 trillion, the Energy Solution Division with ₩490.19 billion, and the Urban Development Business Sector with ₩567.84 billion.

Insider Ownership: 28.4%

Earnings Growth Forecast: 49% p.a.

OCI Holdings demonstrates characteristics of a growth company with high insider ownership, trading at 86.7% below its fair value estimate. Despite a recent net loss and reduced profit margins, earnings are expected to grow significantly at 49% annually, surpassing the Korean market's rate of 28.9%. The company has initiated a KRW 10 billion share repurchase program to enhance shareholder value and stabilize its stock price, indicating confidence in future performance amid challenging financial results.

- Click to explore a detailed breakdown of our findings in OCI Holdings' earnings growth report.

- Our expertly prepared valuation report OCI Holdings implies its share price may be lower than expected.

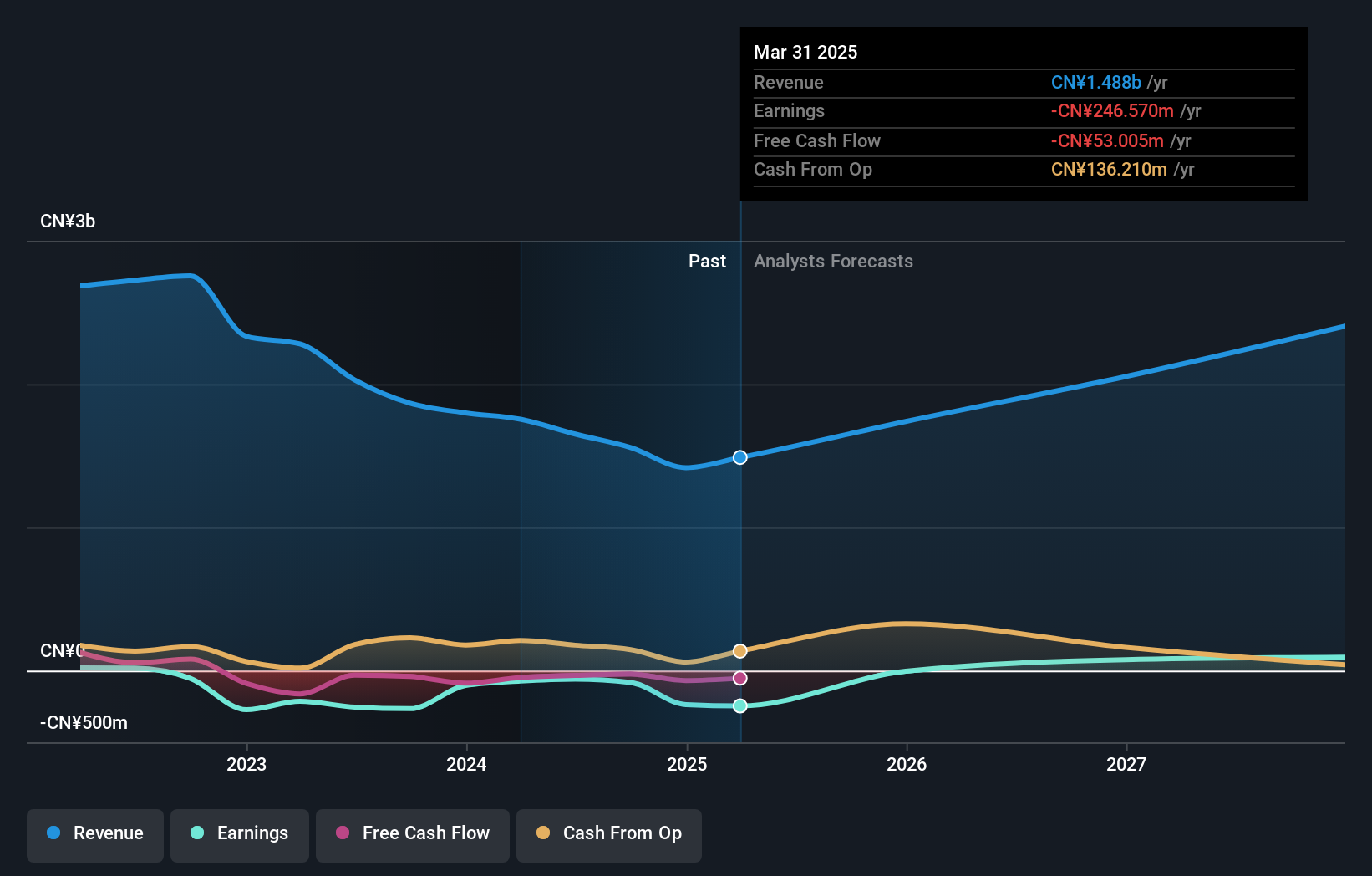

Gosuncn Technology Group (SZSE:300098)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gosuncn Technology Group Co., Ltd. operates in China, offering IoT products and services, with a market cap of CN¥8.99 billion.

Operations: The company's revenue segments are not provided in the text.

Insider Ownership: 19.1%

Earnings Growth Forecast: 92.2% p.a.

Gosuncn Technology Group is forecasted to achieve profitability within three years, with revenue expected to grow at 13.9% annually, outpacing the Chinese market slightly. Despite recent net losses narrowing from CNY 66.84 million to CNY 45.99 million for the nine months ending September 2024, earnings are anticipated to grow substantially at over 92% per year. The company completed a share buyback of approximately CNY 15.4 million, reflecting efforts to enhance shareholder value amidst high stock volatility.

- Click here to discover the nuances of Gosuncn Technology Group with our detailed analytical future growth report.

- Our valuation report here indicates Gosuncn Technology Group may be overvalued.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1442 Fast Growing Companies With High Insider Ownership by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A010060

OCI Holdings

Provides various chemical products and energy solutions in South Korea, the United States, China, rest of Asia, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives