- Hong Kong

- /

- Auto Components

- /

- SEHK:1057

3 Intriguing Penny Stocks With Market Caps Up To US$2B

Reviewed by Simply Wall St

As global markets experience varied movements, with the S&P 500 advancing and small-cap indices like the Russell 2000 outperforming, investors are keenly observing opportunities across different market segments. Penny stocks, though often considered a throwback to earlier market days, still capture attention for their potential value and growth prospects. By focusing on those with strong financials and clear growth trajectories, these smaller or newer companies could offer intriguing possibilities in today's diverse economic landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.19 | MYR334.96M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.595 | MYR2.96B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.875 | £189.41M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.77 | MYR133.38M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$495.14M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.28 | CN¥2.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.93 | MYR308.7M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.58 | MYR2.59B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$126.84M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.095 | £402.8M | ★★★★☆☆ |

Click here to see the full list of 5,782 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Zhejiang Shibao (SEHK:1057)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Shibao Company Limited, along with its subsidiaries, focuses on the research, design, development, production, and sale of automotive steering systems and accessories in the People’s Republic of China with a market cap of HK$9.06 billion.

Operations: The company generates revenue primarily from the manufacture of automobile parts and accessories, amounting to CN¥2.14 billion.

Market Cap: HK$9.06B

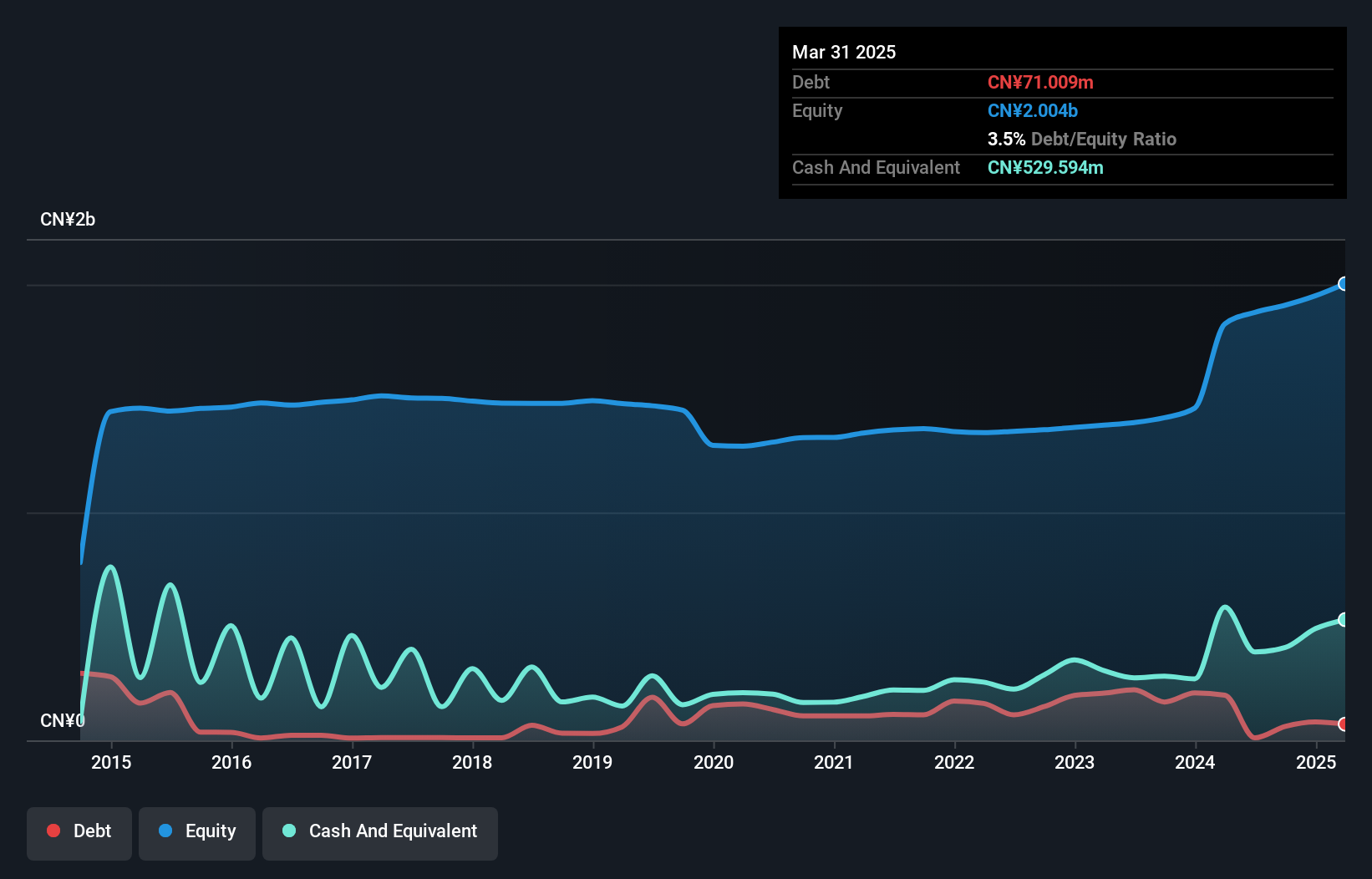

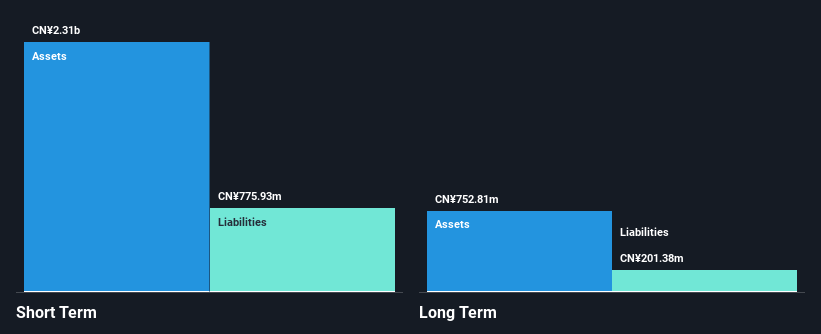

Zhejiang Shibao has shown significant earnings growth, with a notable 257% increase over the past year, surpassing industry trends. Despite a low return on equity of 7.4%, the company benefits from high-quality earnings and improved profit margins, rising from 2.2% to 5.6%. The seasoned management and board bring stability, although share price volatility remains high. Financially robust, Zhejiang Shibao's debt is well-covered by cash flow and interest payments are comfortably managed with EBIT coverage at 147.4 times interest expenses. However, shareholders have experienced dilution in the past year with an increase in total shares outstanding by 4.2%.

- Dive into the specifics of Zhejiang Shibao here with our thorough balance sheet health report.

- Learn about Zhejiang Shibao's historical performance here.

AInnovation Technology Group (SEHK:2121)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AInnovation Technology Group Co., Ltd, along with its subsidiaries, focuses on the research, development, and sale of artificial intelligence-based software and hardware technology solutions in China with a market cap of approximately HK$2.62 billion.

Operations: The company generates revenue of CN¥1.40 billion from its Artificial Intelligence Service segment.

Market Cap: HK$2.62B

AInnovation Technology Group, with a market cap of HK$2.62 billion, focuses on AI-based solutions and reported CN¥1.40 billion in revenue from its AI Service segment. Despite being unprofitable, the company has a strong cash position exceeding its total debt and sufficient short-term assets to cover liabilities. Recent strategic cooperation with China Resources Digital Holdings aims to enhance industrial intelligence solutions through joint R&D efforts. However, earnings for the first half of 2024 show a sales decline to CN¥571.7 million from CN¥923.85 million year-on-year, maintaining a net loss similar to last year's figures.

- Click here to discover the nuances of AInnovation Technology Group with our detailed analytical financial health report.

- Gain insights into AInnovation Technology Group's future direction by reviewing our growth report.

Sanchuan Wisdom Technology (SZSE:300066)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sanchuan Wisdom Technology Co., Ltd. manufactures and sells water meters under the San Chuan brand and has a market cap of CN¥4.33 billion.

Operations: Sanchuan Wisdom Technology Co., Ltd. currently does not report specific revenue segments.

Market Cap: CN¥4.33B

Sanchuan Wisdom Technology, with a market cap of CN¥4.33 billion, has demonstrated financial resilience despite challenges. Recent earnings show a decline in sales and revenue to CN¥728.91 million and CN¥736.83 million respectively for the first half of 2024 compared to the previous year, alongside reduced net income of CN¥44.68 million. Positively, the company maintains strong liquidity with short-term assets significantly exceeding liabilities and more cash than total debt, ensuring interest coverage is not an issue. However, recent earnings were impacted by a large one-off gain and declining profit margins suggest potential volatility in profitability metrics moving forward.

- Get an in-depth perspective on Sanchuan Wisdom Technology's performance by reading our balance sheet health report here.

- Examine Sanchuan Wisdom Technology's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Dive into all 5,782 of the Penny Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Shibao might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1057

Zhejiang Shibao

Researches, designs, develops, produces, and sells automotive steering systems and accessories in the People’s Republic of China.

Flawless balance sheet with solid track record.