- China

- /

- Electronic Equipment and Components

- /

- SZSE:300296

High Growth Tech Stocks to Watch in February 2025

Reviewed by Simply Wall St

As global markets navigate a volatile landscape marked by fluctuating indices and economic uncertainties, technology stocks have faced particular pressure due to emerging competition in the AI sector. Despite this turbulence, investors continue to seek out high-growth tech stocks that demonstrate resilience and innovation, particularly those capable of adapting to evolving market dynamics and technological advancements.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1232 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Hancom (KOSDAQ:A030520)

Simply Wall St Growth Rating: ★★★★☆☆

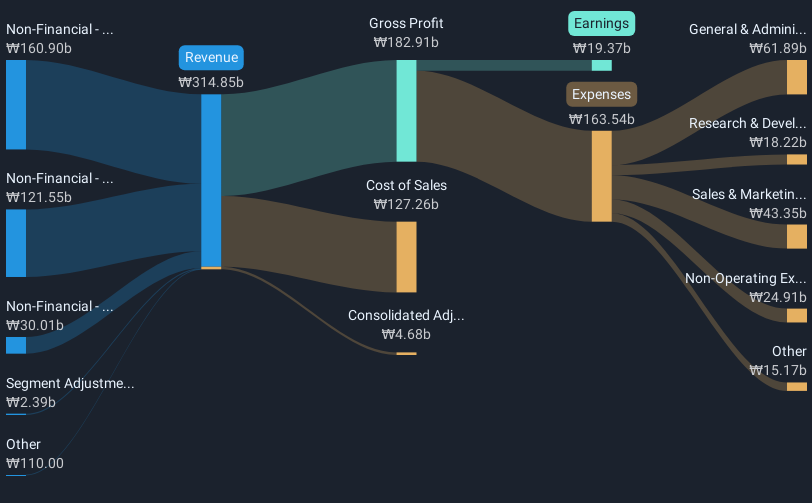

Overview: Hancom Inc. develops and sells office software products and solutions in South Korea and internationally, with a market capitalization of ₩578.87 billion.

Operations: The company's primary revenue stream comes from its Non-Financial - SW Division, generating ₩160.90 billion, followed by the Non-Financial - Manufacturing Sector at ₩121.55 billion.

Hancom's strategic acquisition of a further 2.6% stake in Hancom Inc. for KRW 14.9 billion underscores its aggressive expansion efforts, aligning with an impressive annual earnings growth forecast of 27.1%. This move, part of a broader M&A strategy completed in early February 2025, not only enhances its market position but also leverages its substantial revenue growth at 10% annually—outpacing the Korean market's average. Despite a significant one-off loss impacting last year's financials, Hancom maintains robust growth prospects with earnings that have surged by 81.7% over the past year, significantly outperforming the software industry’s downturn.

- Click to explore a detailed breakdown of our findings in Hancom's health report.

Evaluate Hancom's historical performance by accessing our past performance report.

Hebei Sinopack Electronic TechnologyLtd (SZSE:003031)

Simply Wall St Growth Rating: ★★★★★☆

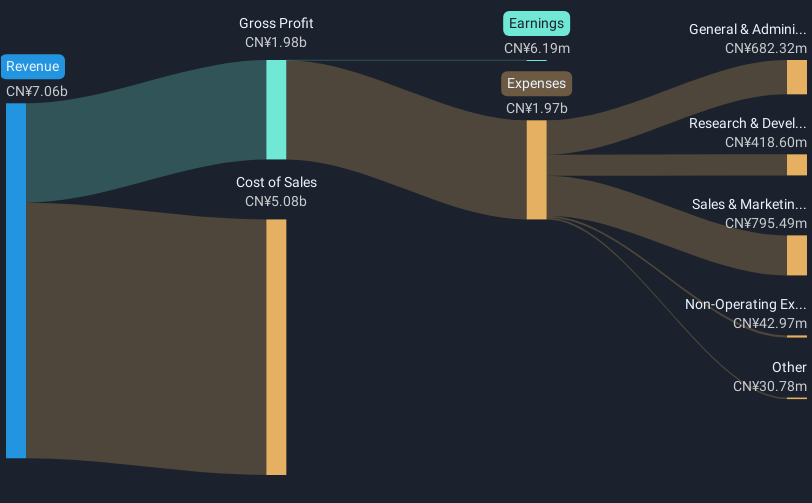

Overview: Hebei Sinopack Electronic Technology Co., Ltd. operates in the electronic technology sector and has a market capitalization of approximately CN¥22.19 billion.

Operations: Sinopack Electronic Technology focuses on the electronic technology sector, generating revenue primarily through its specialized products and services. The company has a market capitalization of around CN¥22.19 billion, reflecting its position in the industry.

Hebei Sinopack Electronic TechnologyLtd. has demonstrated robust growth, with earnings expanding by 15.8% over the past year, outpacing the electronic industry's average of 2.3%. This trend is underpinned by an aggressive R&D strategy, where expenses are closely aligned with revenue growth at 28.5% annually, significantly above the Chinese market average of 13.3%. The recent appointment of Yuan Dasong as an independent director reflects a strategic move to bolster governance structures amidst this rapid expansion phase. With earnings projected to surge by approximately 29.6% annually over the next three years and a focus on high-quality earnings generation, Hebei Sinopack is positioning itself as a formidable competitor in its sector despite forecasts indicating a modest return on equity of 12.7% in three years' time.

- Take a closer look at Hebei Sinopack Electronic TechnologyLtd's potential here in our health report.

Understand Hebei Sinopack Electronic TechnologyLtd's track record by examining our Past report.

Leyard Optoelectronic (SZSE:300296)

Simply Wall St Growth Rating: ★★★★☆☆

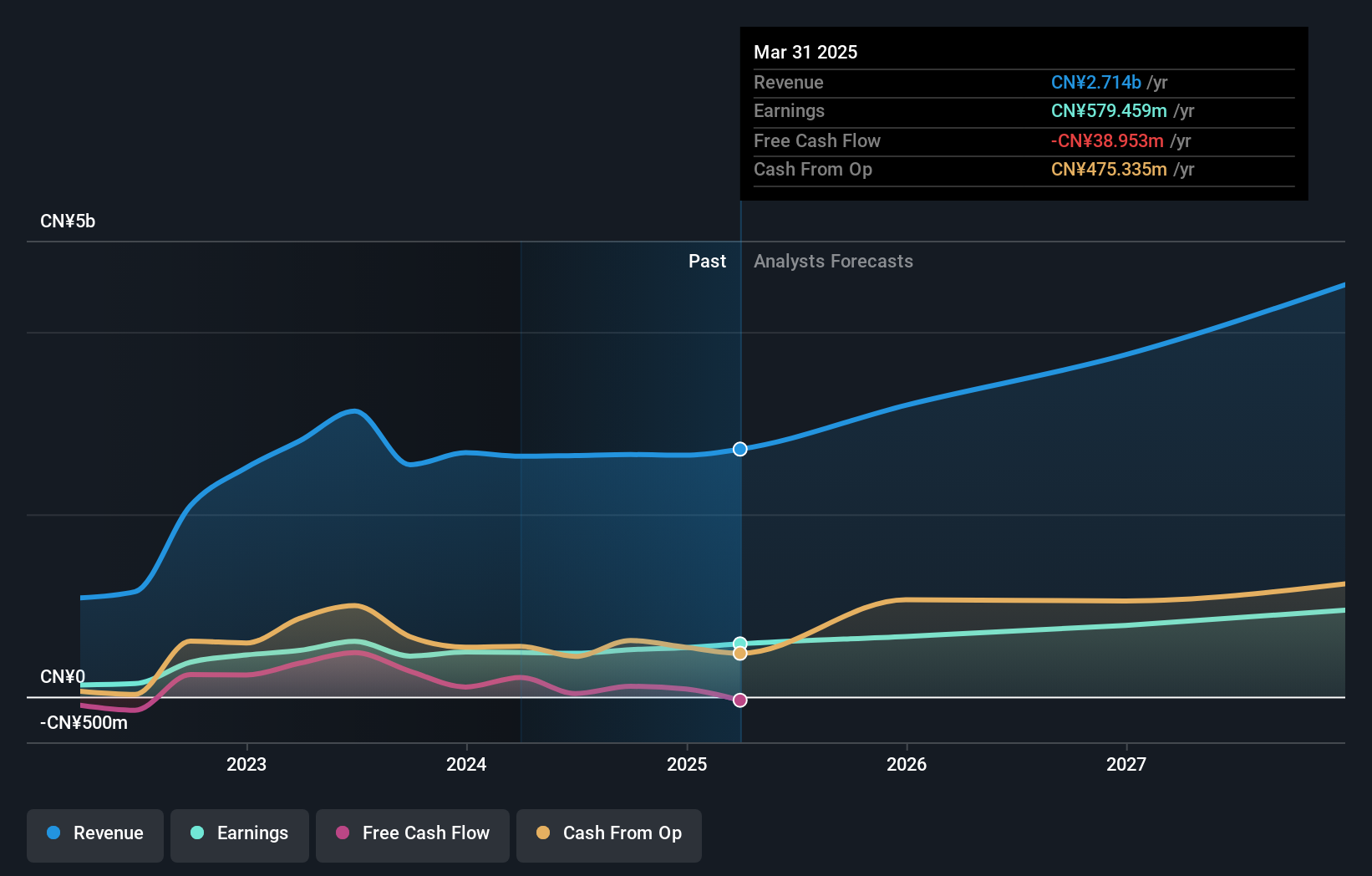

Overview: Leyard Optoelectronic Co., Ltd. is an audio-visual technology company with operations in China and internationally, and it has a market capitalization of approximately CN¥16.07 billion.

Operations: Leyard Optoelectronic generates revenue primarily from its audio-visual technology products and services, catering to both domestic and international markets. The company's business model focuses on leveraging advanced display technologies to serve a diverse clientele.

Leyard Optoelectronic showcases a dynamic trajectory in the tech industry, marked by a 17.2% annual revenue growth and an impressive 71% surge in earnings per year, outpacing broader market averages significantly. This growth is fueled by strategic R&D investments, which account for a substantial portion of revenues, underscoring the company's commitment to innovation and technological advancement. Despite challenges such as a highly volatile share price over the past three months and modest net profit margins at 0.09%, Leyard's aggressive focus on expanding its tech frontier—evidenced by their recent zero-share buyback from their ongoing program—signals robust future prospects in high-growth sectors.

Where To Now?

- Click this link to deep-dive into the 1232 companies within our High Growth Tech and AI Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300296

Leyard Optoelectronic

Operates as an audio-visual technology company in China and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives