- China

- /

- Electronic Equipment and Components

- /

- SZSE:003015

Jiangsu Rijiu Optoelectronics Jointstock Co., Ltd's (SZSE:003015) 26% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

The Jiangsu Rijiu Optoelectronics Jointstock Co., Ltd (SZSE:003015) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term, the stock has been solid despite a difficult 30 days, gaining 21% in the last year.

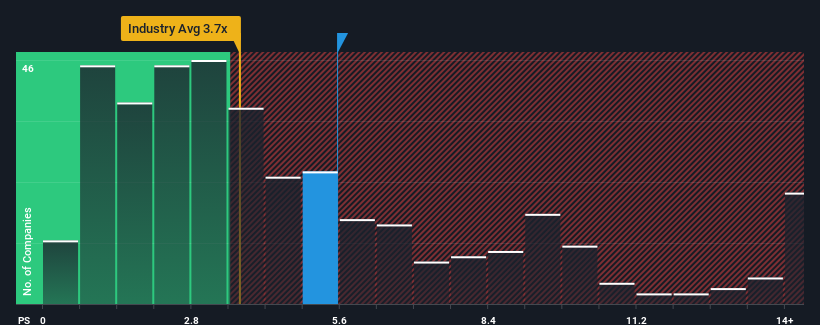

Even after such a large drop in price, you could still be forgiven for thinking Jiangsu Rijiu Optoelectronics is a stock not worth researching with a price-to-sales ratios (or "P/S") of 5.5x, considering almost half the companies in China's Electronic industry have P/S ratios below 3.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Jiangsu Rijiu Optoelectronics

What Does Jiangsu Rijiu Optoelectronics' P/S Mean For Shareholders?

Jiangsu Rijiu Optoelectronics has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jiangsu Rijiu Optoelectronics' earnings, revenue and cash flow.How Is Jiangsu Rijiu Optoelectronics' Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Jiangsu Rijiu Optoelectronics' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 2.8% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 27% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's alarming that Jiangsu Rijiu Optoelectronics' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Jiangsu Rijiu Optoelectronics' P/S

There's still some elevation in Jiangsu Rijiu Optoelectronics' P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Jiangsu Rijiu Optoelectronics revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Jiangsu Rijiu Optoelectronics (1 is a bit unpleasant!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:003015

Jiangsu Rijiu Optoelectronics

Jiangsu Rijiu Optoelectronics Jointstock Co., Ltd.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026