- China

- /

- Electronic Equipment and Components

- /

- SZSE:002980

Shenzhen Everbest Machinery Industry's (SZSE:002980) Upcoming Dividend Will Be Larger Than Last Year's

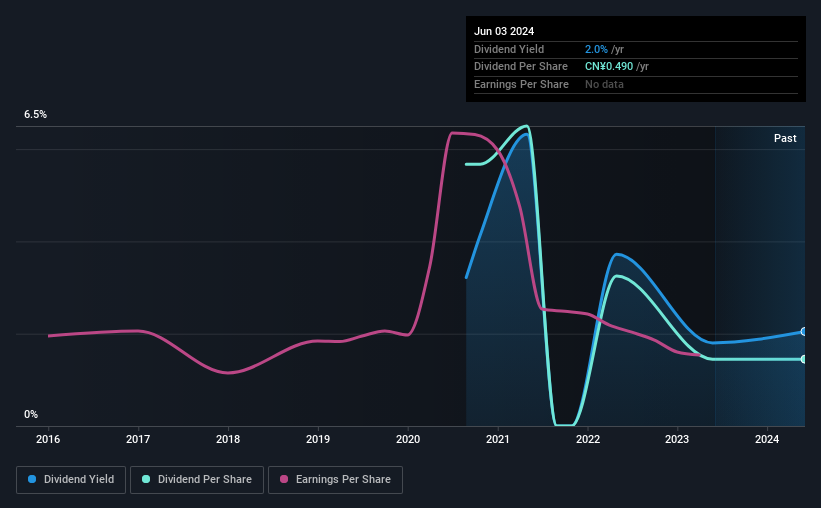

Shenzhen Everbest Machinery Industry Co., Ltd. (SZSE:002980) has announced that it will be increasing its periodic dividend on the 7th of June to CN¥0.60, which will be 22% higher than last year's comparable payment amount of CN¥0.49. This makes the dividend yield about the same as the industry average at 2.0%.

See our latest analysis for Shenzhen Everbest Machinery Industry

Shenzhen Everbest Machinery Industry Is Paying Out More Than It Is Earning

We aren't too impressed by dividend yields unless they can be sustained over time. Prior to this announcement, Shenzhen Everbest Machinery Industry's dividend was comfortably covered by both cash flow and earnings. This means that a large portion of its earnings are being retained to grow the business.

EPS is set to grow by 5.9% over the next year if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could reach 99%, which probably can't continue without starting to put some pressure on the balance sheet.

Shenzhen Everbest Machinery Industry's Dividend Has Lacked Consistency

The track record isn't the longest, but we are already seeing a bit of instability in the payments. Since 2020, the dividend has gone from CN¥1.92 total annually to CN¥0.49. The dividend has fallen 74% over that period. A company that decreases its dividend over time generally isn't what we are looking for.

Shenzhen Everbest Machinery Industry Could Grow Its Dividend

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. We are encouraged to see that Shenzhen Everbest Machinery Industry has grown earnings per share at 5.9% per year over the past five years. While on an earnings basis, this company looks appealing as an income stock, the cash payout ratio still makes us cautious.

Our Thoughts On Shenzhen Everbest Machinery Industry's Dividend

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 5 warning signs for Shenzhen Everbest Machinery Industry (3 are a bit concerning!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002980

Shenzhen Everbest Machinery Industry

Shenzhen Everbest Machinery Industry Co., Ltd.

Excellent balance sheet unattractive dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026