- Poland

- /

- Entertainment

- /

- WSE:CDR

High Growth Tech Stocks To Explore In November 2024

Reviewed by Simply Wall St

As global markets experience broad-based gains, with smaller-cap indexes outperforming large-caps and the S&P 500 nearing record highs, investors are keenly observing economic indicators like declining U.S. jobless claims and rising home sales that contribute to positive market sentiment. In this environment, identifying high-growth tech stocks involves looking for companies that can capitalize on technological advancements and maintain robust growth potential amidst dynamic market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Shenzhen Sinovatio Technology (SZSE:002912)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Sinovatio Technology Co., Ltd. offers intelligent management and security protection solutions for communication and information networks, with a market cap of CN¥5.02 billion.

Operations: Sinovatio Technology focuses on delivering intelligent management and security solutions for communication and information networks. The company operates in a specialized market, leveraging its expertise to address the growing demand for network security.

Shenzhen Sinovatio Technology has faced challenges recently, with a reported net loss of CNY 46.96 million for the nine months ending September 2024, contrasting sharply with a net income of CNY 74.11 million in the same period last year. Despite this downturn, the company's revenue growth forecast remains robust at 23.9% annually, outpacing the broader Chinese market's growth rate of 13.8%. This optimism is bolstered by predictions of earnings surging by an impressive 104.65% per year over the next three years, signaling potential recovery and profitability ahead. Sinovatio's commitment to innovation is evident in its strategic R&D investments aimed at driving future growth within the high-tech sector, positioning it well for eventual market rebound and competitive advantage in evolving technology landscapes.

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iSoftStone Information Technology (Group) Co., Ltd. is a company with a market cap of CN¥59.84 billion, specializing in providing IT services and solutions across various sectors.

Operations: iSoftStone generates revenue primarily through its IT services and solutions, catering to diverse sectors. The company's cost structure is influenced by its operational expenses related to the delivery of these services.

iSoftStone Information Technology (Group) has demonstrated a notable ability to scale, with revenues soaring to CNY 22.21 billion, up from CNY 12.83 billion year-over-year, despite a dip in net income from CNY 352.31 million to CNY 75.94 million in the same period. This juxtaposition of revenue growth against profit challenges underscores a strategic emphasis on expansion at the cost of immediate profitability. The firm's investment in R&D is pivotal, maintaining robust funding levels that align with its forward-looking growth trajectory—evidenced by an expected annual earnings increase of 39.3%. Moreover, these investments are crucial as they navigate through technological evolutions and client demands within the tech sector, ensuring they remain competitive and adaptable in a rapidly changing landscape.

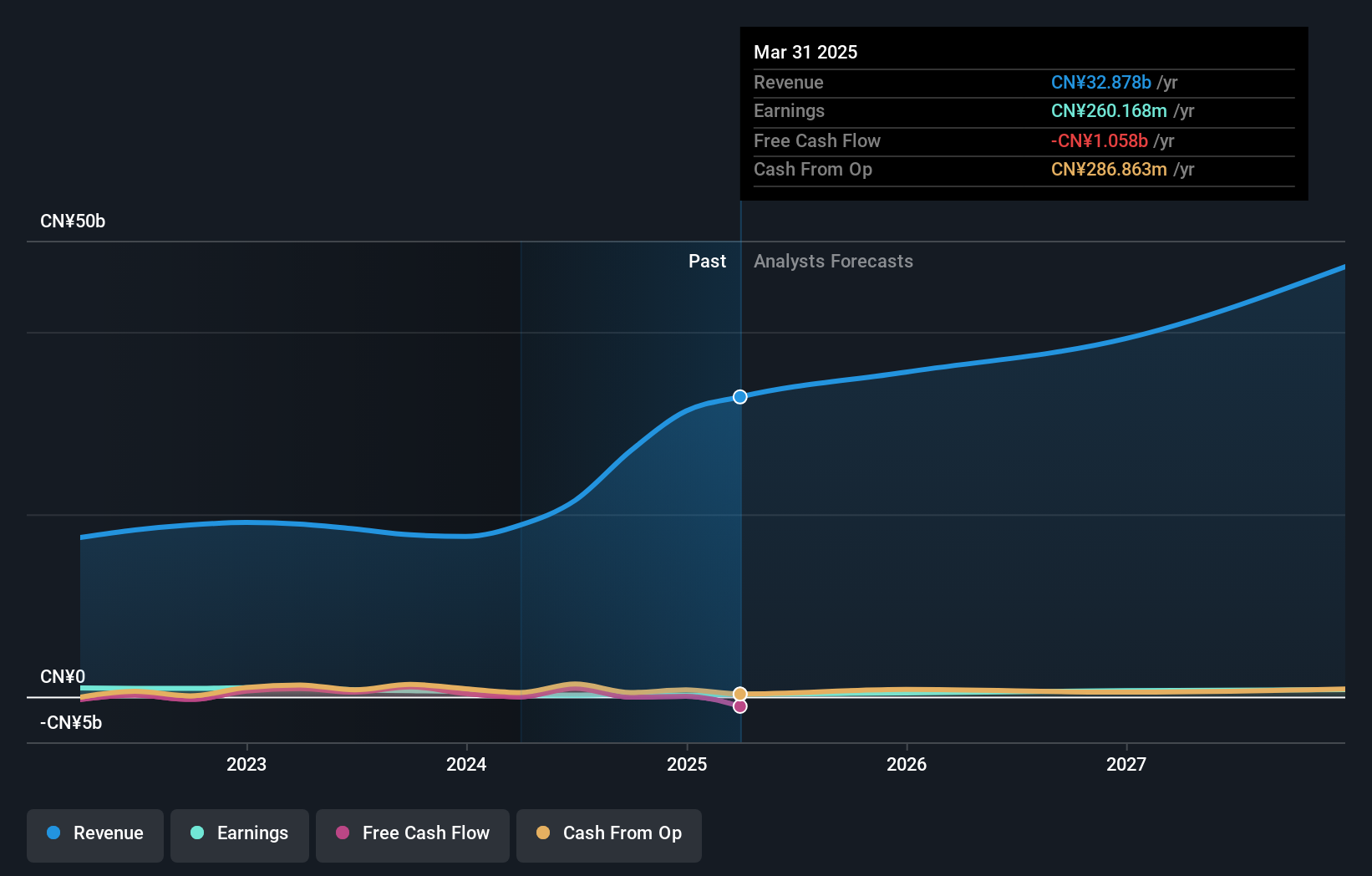

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CD Projekt S.A. is a Polish company that, along with its subsidiaries, focuses on developing, publishing, and digitally distributing video games for personal computers and consoles, with a market capitalization of approximately PLN16.45 billion.

Operations: CD Projekt S.A. generates revenue primarily through its CD PROJEKT RED segment, which contributed PLN 1.14 billion, and GOG.Com, adding PLN 238.12 million, with some consolidation eliminations affecting the total figures. The company's cost structure and profitability are influenced by these segments' performance dynamics.

CD Projekt, amidst a dynamic tech landscape, is charting a growth trajectory with its R&D investments proving central to its innovation strategy. The company's commitment to research has fueled a 19.3% forecasted annual earnings growth, outpacing the broader Polish market's 15.5%. This focus on development is further underscored by revenue projections set to surpass local industry standards by 10.5%, marking an impressive alignment with evolving market demands and future tech trends. Additionally, recent governance reshuffles and strategic meetings suggest proactive adjustments aligning with long-term corporate goals, poised to enhance stakeholder value in an increasingly competitive sector.

- Unlock comprehensive insights into our analysis of CD Projekt stock in this health report.

Gain insights into CD Projekt's historical performance by reviewing our past performance report.

Next Steps

- Click through to start exploring the rest of the 1285 High Growth Tech and AI Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CDR

CD Projekt

Together its subsidiaries, engages in the development, publishing, and digital distribution of video games for personal computers and video game consoles in Poland.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives