- China

- /

- Electronic Equipment and Components

- /

- SHSE:688531

High Growth Tech Stocks To Explore This January 2025

Reviewed by Simply Wall St

As global markets rally with the S&P 500 reaching record highs, optimism is fueled by potential trade deals and AI advancements, while growth stocks have notably outperformed value shares. In this environment, identifying high-growth tech stocks involves focusing on companies that are well-positioned to leverage emerging technologies like artificial intelligence and benefit from favorable policy shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Wuxi Unicomp Technology (SHSE:688531)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Unicomp Technology Co., Ltd. focuses on the research, development, manufacture, and sale of X-ray technology and intelligent detection equipment in China, with a market capitalization of CN¥5.88 billion.

Operations: The company specializes in X-ray technology and intelligent detection equipment, generating revenue primarily from the sale of these products.

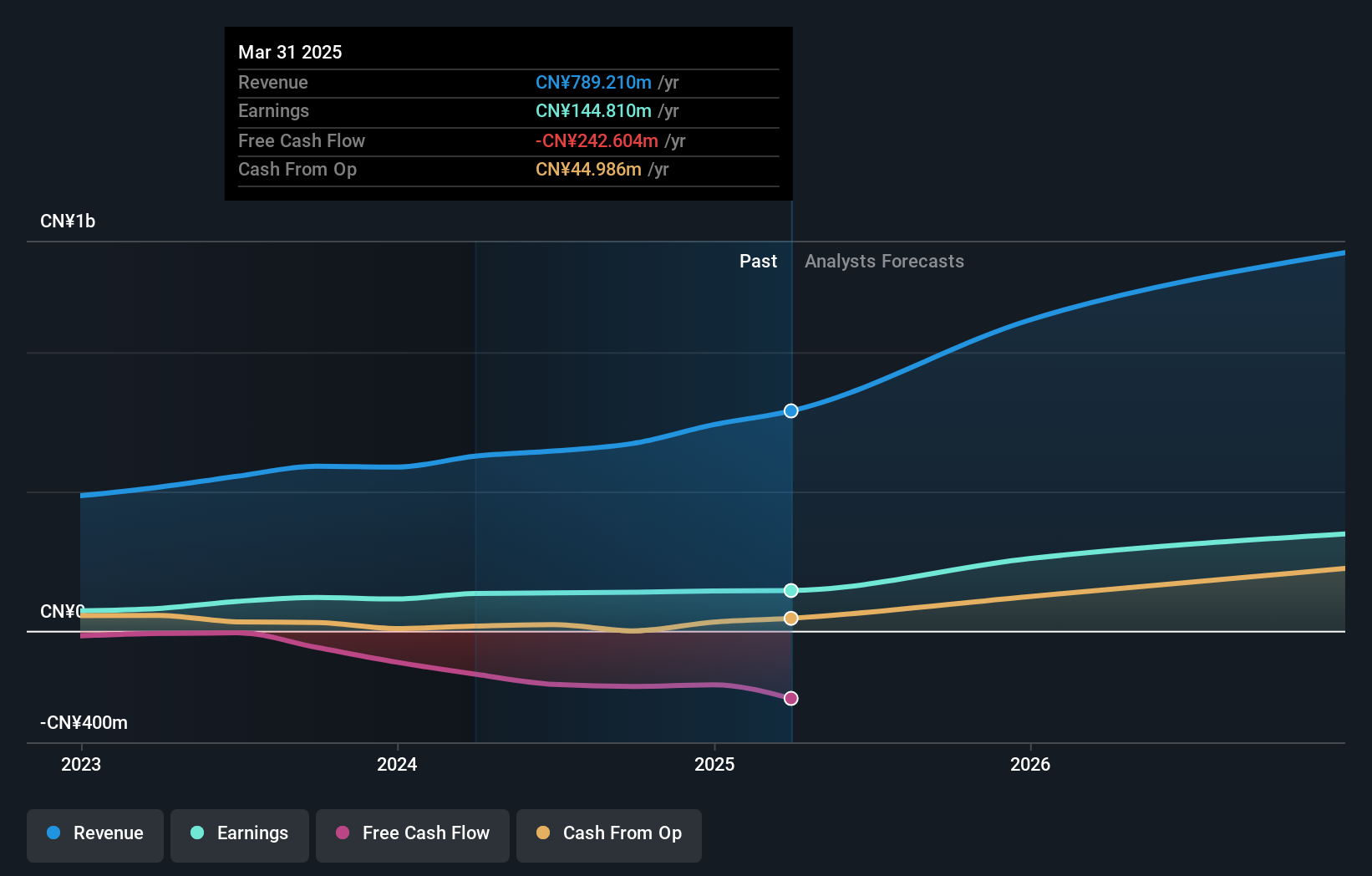

Wuxi Unicomp Technology's recent performance underscores its robust position in the electronic industry, with a notable 20% revenue increase to CNY 511.82 million and a 30% surge in net income to CNY 105.03 million for the nine months ending September 2024. This growth trajectory is complemented by a strategic share repurchase, completing the buyback of over 1.5 million shares for CNY 103.2 million, signaling confidence in its financial health and future prospects. The company's commitment to innovation is evident from its R&D spending trends, which are aligned with its revenue growth, ensuring sustained advancements in technology and market competitiveness.

- Dive into the specifics of Wuxi Unicomp Technology here with our thorough health report.

Learn about Wuxi Unicomp Technology's historical performance.

Dongguan Mentech Optical & Magnetic (SZSE:002902)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dongguan Mentech Optical & Magnetic Co., Ltd. operates in the optical and magnetic components industry with a market capitalization of CN¥4.66 billion.

Operations: The company generates its revenue primarily from the production and sale of optical and magnetic components. The business focuses on leveraging its expertise in these areas to cater to various industrial applications, aiming for efficiency in operations.

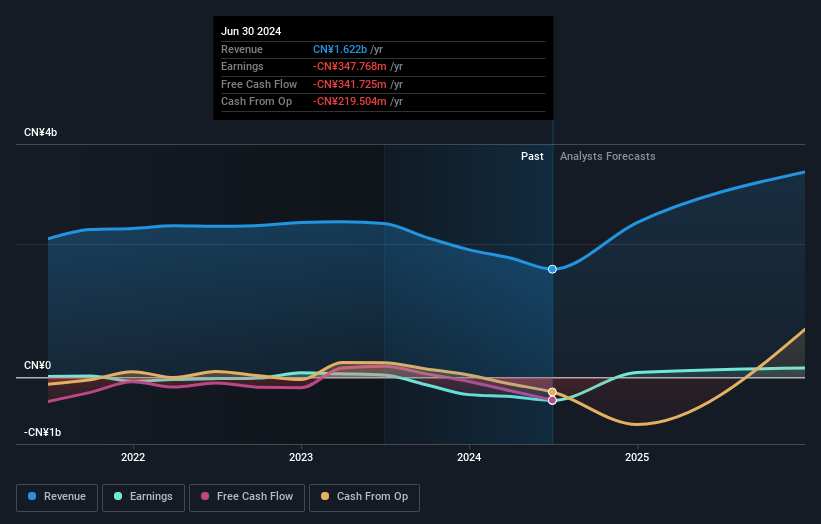

Dongguan Mentech Optical & Magnetic is making significant strides in the tech sector, particularly with its recent entry into the professional cycling market through a strategic partnership with Visma | Lease a Bike Team. This move not only enhances its brand on a global scale but also aligns with its commitment to advancing cycling intelligence technology. Despite currently being unprofitable, Mentech's revenue is expected to grow at an impressive rate of 44.8% annually, outpacing the broader CN market's growth of 13.3%. The company's focus on R&D is poised to bolster future earnings, projected to surge by 159.94% annually, positioning it for profitability within three years and signaling strong future prospects in both technology innovation and market expansion.

Nanjing Wavelength Opto-Electronic Science & TechnologyLtd (SZSE:301421)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanjing Wavelength Opto-Electronic Science & Technology Co., Ltd. specializes in the development and manufacturing of optoelectronic components and systems, with a market capitalization of CN¥5.13 billion.

Operations: Wavelength Opto-Electronic generates revenue primarily from its Laser Systems and Components segment, which contributes CN¥379.25 million. The company focuses on developing and manufacturing optoelectronic components and systems.

Nanjing Wavelength Opto-Electronic Science & Technology Co., Ltd. is navigating a challenging landscape with a recent dip in net income from CNY 42.64 million to CNY 30.82 million, despite an increase in sales to CNY 277 million from CNY 261.55 million year-over-year. This performance reflects a decrease in profit margins from 16.1% to 11.2%. However, the company's commitment to innovation is evident with expected revenue and earnings growth at annual rates of 26.4% and 36.8%, respectively, outpacing the broader Chinese market forecasts of 13.3% and 25%. This growth trajectory, coupled with strategic decisions discussed in their upcoming special shareholders meeting, suggests resilience and adaptability in its operations amidst financial fluctuations.

Next Steps

- Explore the 1231 names from our High Growth Tech and AI Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Unicomp Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688531

Wuxi Unicomp Technology

Engages in the research, development, manufacture, and sale of X-ray technology and intelligent detection equipment in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives