As global markets navigate the early days of President Trump's administration, optimism around potential trade deals and AI investments has driven U.S. stocks to new highs, with growth stocks outperforming value shares. In this environment of heightened enthusiasm for technology and innovation, identifying high-growth tech stocks involves looking for companies that are well-positioned to benefit from advancements in artificial intelligence and other emerging technologies.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Servyou Software Group (SHSE:603171)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Servyou Software Group Co., Ltd. offers financial and tax information services in China with a market cap of CN¥13.30 billion.

Operations: Servyou Software Group Co., Ltd. generates revenue primarily through its financial and tax information services in China. The company operates within a market cap of CN¥13.30 billion, focusing on delivering specialized solutions to meet the needs of its clients in these sectors.

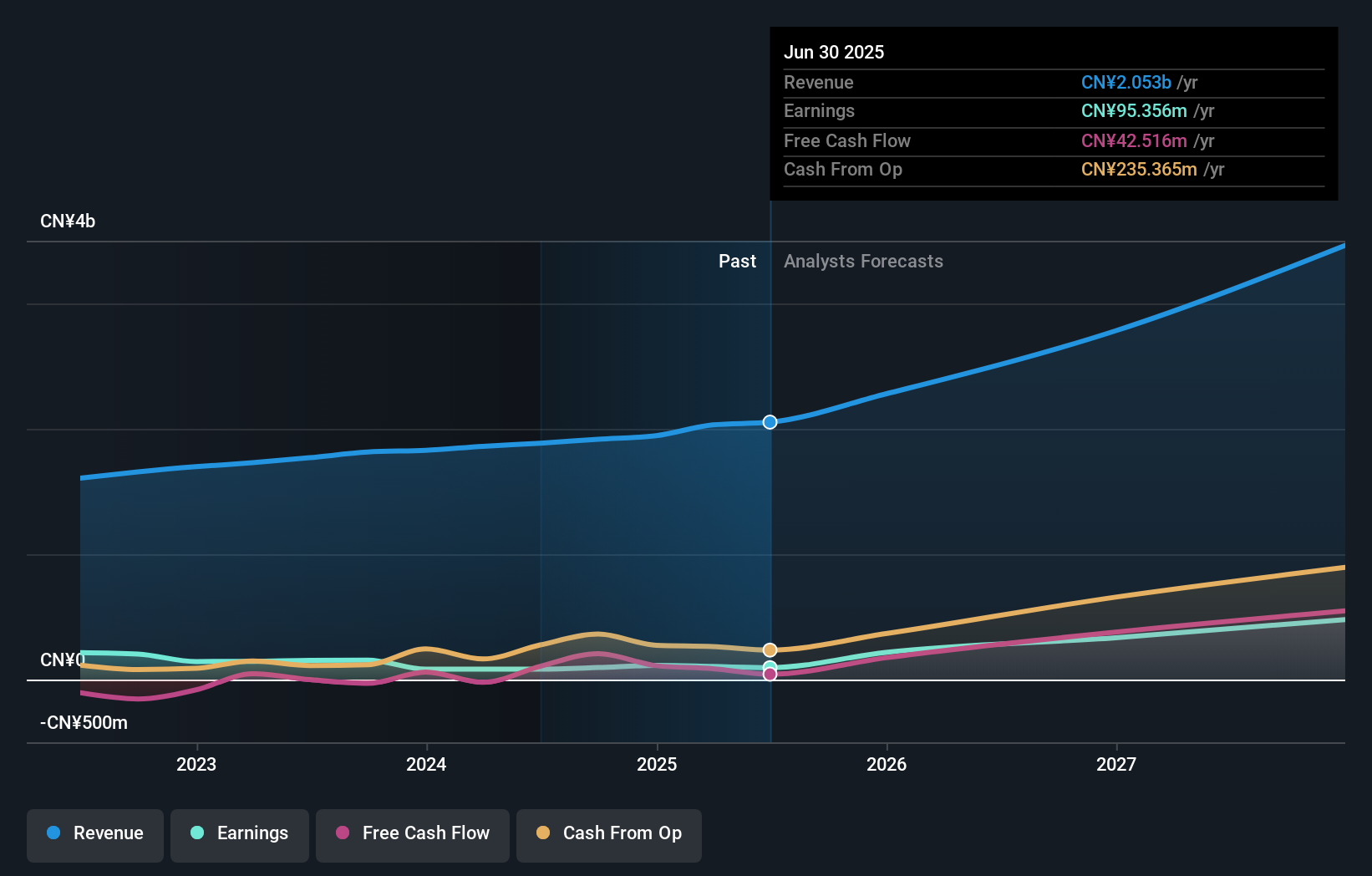

Servyou Software Group, amidst a dynamic tech landscape, is poised for substantial growth with its revenue expected to increase by 20.1% annually, outpacing the Chinese market's average of 13.4%. Despite a challenging year with earnings contraction by 38.5%, future projections are robust, anticipating an earnings surge at an annual rate of 50.9%. This growth trajectory is supported by significant R&D investments that enhance its competitive edge in software solutions. However, it's crucial to note the recent dip in profit margins from 8.6% to 5%, reflecting short-term pressures yet underscoring the importance of strategic investments for long-term gains.

- Unlock comprehensive insights into our analysis of Servyou Software Group stock in this health report.

Understand Servyou Software Group's track record by examining our Past report.

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global provider of algorithms and software solutions in the computer vision industry, with a market capitalization of CN¥19.76 billion.

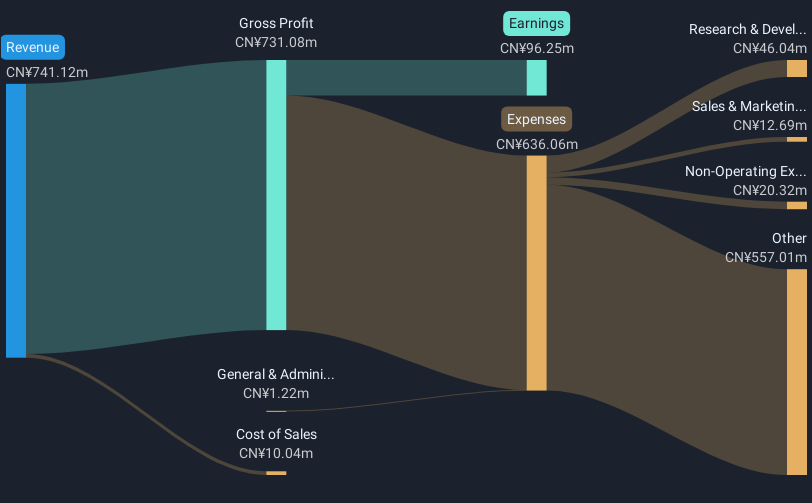

Operations: ArcSoft focuses on developing algorithms and software solutions for the computer vision sector globally. The company generates revenue through its innovative technology offerings, catering to various industries that leverage computer vision applications.

ArcSoft, in the throes of a competitive tech sector, has demonstrated robust financial performance with a notable 30.6% annual revenue growth, surpassing the broader Chinese market average of 13.4%. This growth is complemented by an impressive earnings increase of 43.5% per year, reflecting strong operational efficiency and market demand. The company's commitment to innovation is underscored by its R&D spending trends which align with its strategic goals to enhance product offerings and maintain technological leadership. Recent activities include a significant shareholders meeting and quarterly earnings that have shown continued financial health with revenues up to CNY 573.68 million from CNY 502.81 million in the previous year, suggesting positive investor sentiments and operational momentum moving forward.

- Delve into the full analysis health report here for a deeper understanding of ArcSoft.

Assess ArcSoft's past performance with our detailed historical performance reports.

MeiG Smart Technology (SZSE:002881)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MeiG Smart Technology Co., Ltd. is involved in the R&D, production, and sale of IoT terminals and wireless communication modules globally, with a market cap of CN¥10.48 billion.

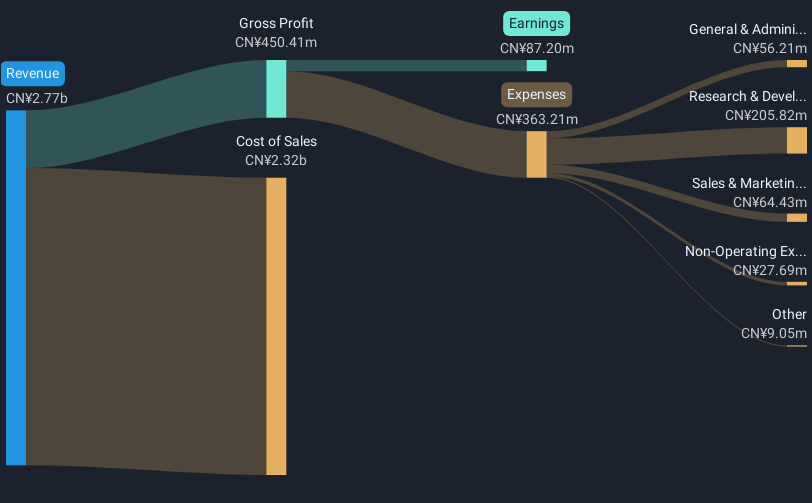

Operations: MeiG Smart Technology focuses on developing and manufacturing IoT terminals and wireless communication modules, serving both domestic and international markets. The company's business model includes revenue primarily from the sale of these products, supported by ongoing R&D efforts to enhance technological capabilities.

MeiG Smart Technology has demonstrated a robust trajectory in the tech sector, with revenue and earnings growth outpacing the broader Chinese market at 19.7% and 33% annually. This performance is bolstered by strategic R&D investments, aligning closely with industry shifts towards enhanced connectivity solutions. Notably, the company repurchased shares worth CNY 10 million recently, reflecting confidence in its financial health and future prospects. These efforts underscore MeiG's commitment to maintaining a competitive edge through continuous innovation and shareholder value enhancement.

Seize The Opportunity

- Explore the 1225 names from our High Growth Tech and AI Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688088

ArcSoft

Operates as an algorithm and software solution provider in the computer vision industry worldwide.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives