- China

- /

- Electronic Equipment and Components

- /

- SHSE:688322

High Growth Tech Stocks to Watch in December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape of shifting interest rates and economic indicators, the technology-heavy Nasdaq Composite has defied broader declines by reaching a record high, underscoring the resilience and potential of growth-oriented sectors. In this environment, identifying promising tech stocks involves looking for companies that demonstrate strong innovation capabilities and adaptability to changing market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1316 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Orbbec (SHSE:688322)

Simply Wall St Growth Rating: ★★★★★☆

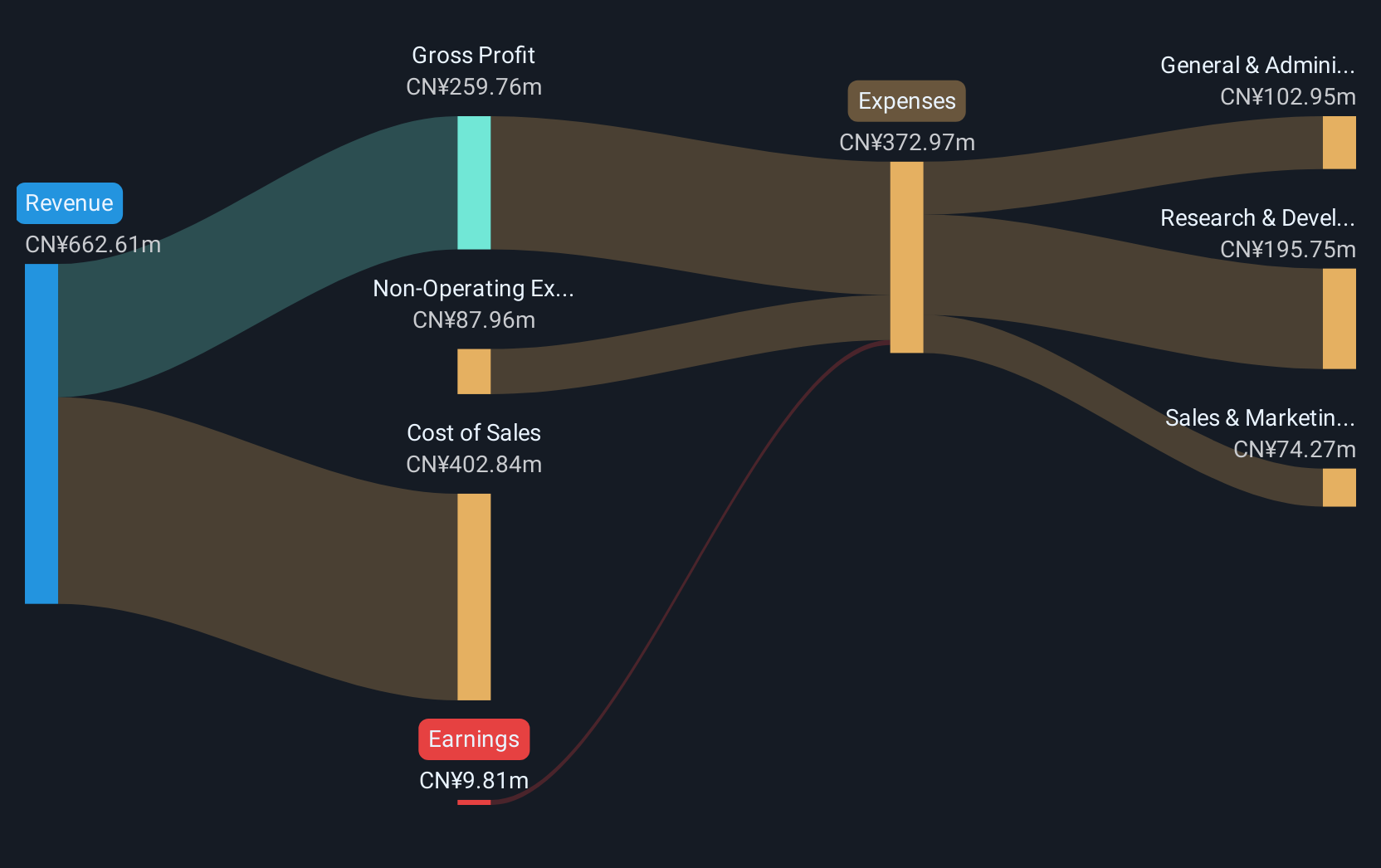

Overview: Orbbec Inc. designs, manufactures, and sells 3D vision sensors with a market cap of CN¥16.76 billion.

Operations: Orbbec Inc. generates revenue primarily through the sale of 3D vision sensors. The company's operations focus on designing and manufacturing these advanced sensor technologies, which are integral to various applications across industries.

Orbbec, amid a challenging tech landscape, has demonstrated promising financial trajectories with its annual revenue growth forecast at 39.9%, significantly outpacing the CN market's 13.7%. Despite current unprofitability, the firm is expected to reverse this trend within three years, with earnings projected to surge by an impressive 123.38% annually. Recent strategic maneuvers include a share repurchase program where Orbbec bought back shares worth CNY 33.83 million, underscoring confidence in its future prospects and commitment to shareholder value amidst improving financial performance highlighted by reduced net losses from CNY 191.94 million to CNY 60.31 million year-over-year.

- Click to explore a detailed breakdown of our findings in Orbbec's health report.

Gain insights into Orbbec's past trends and performance with our Past report.

Wus Printed Circuit (Kunshan) (SZSE:002463)

Simply Wall St Growth Rating: ★★★★☆☆

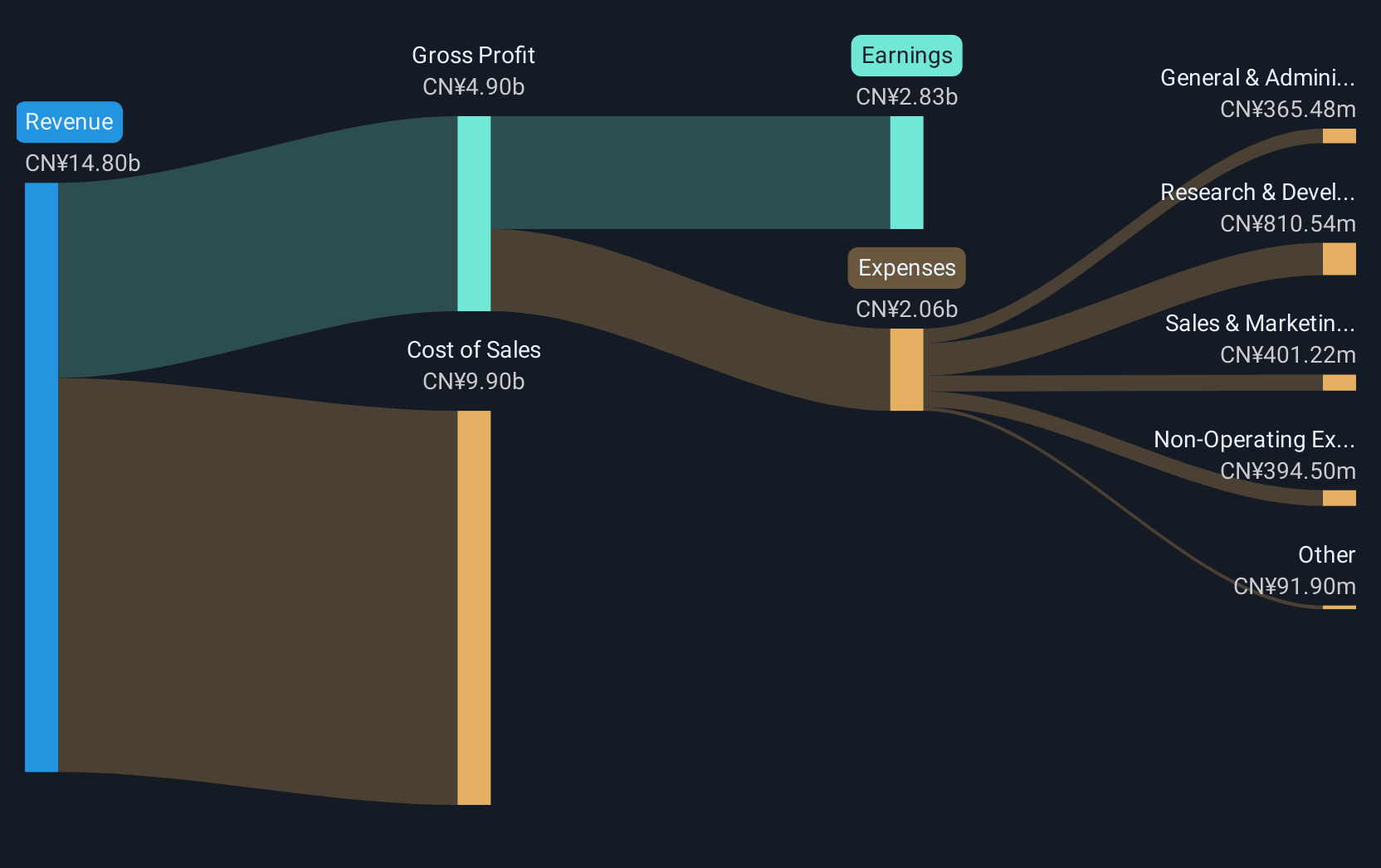

Overview: Wus Printed Circuit (Kunshan) Co., Ltd. specializes in the research, development, design, manufacture, and sale of printed circuit boards in China with a market capitalization of approximately CN¥75.57 billion.

Operations: Wus Printed Circuit (Kunshan) generates revenue primarily from the manufacture and sale of printed circuit boards. The company focuses on research, development, and design to enhance its product offerings in the Chinese market.

Wus Printed Circuit (Kunshan) has demonstrated robust growth, with revenues soaring to CNY 9.01 billion, a substantial increase from CNY 6.08 billion year-over-year, coupled with net income nearly doubling to CNY 1.85 billion. This financial upswing is supported by strategic governance changes and expansion projects as highlighted in recent shareholder meetings. The company's commitment to innovation and operational enhancements is evident from its aggressive revenue growth of 18.5% annually, outpacing the broader CN market's growth rate of 13.7%.

dely (TSE:299A)

Simply Wall St Growth Rating: ★★★★★☆

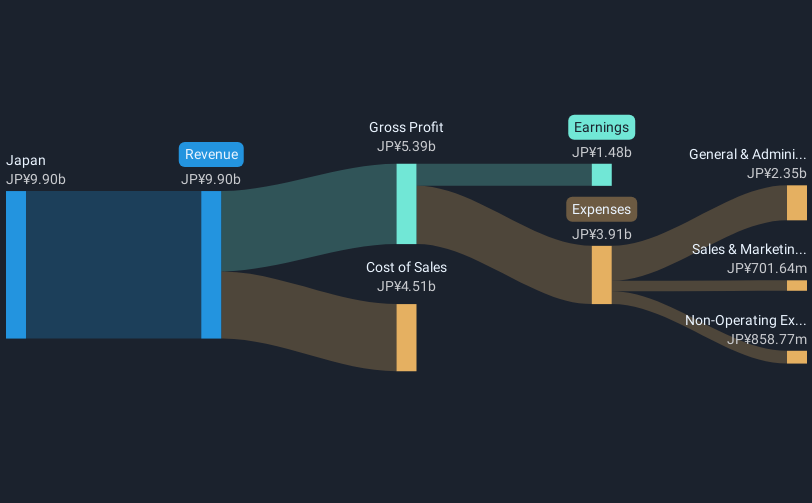

Overview: Dely Inc. is engaged in planning, developing, managing, and operating various smartphone applications and web media with a market capitalization of ¥42.64 billion.

Operations: The company generates revenue through its portfolio of smartphone applications and web media platforms. With a market capitalization of ¥42.64 billion, it focuses on leveraging digital solutions to enhance user engagement and monetization strategies.

Following its recent IPO, dely inc. raised ¥15.15 billion, signaling robust market confidence which aligns with its aggressive growth trajectory in the software sector. Notably, dely's revenue is projected to grow at 26.7% annually, substantially outpacing the broader Japanese market's growth rate of 4.2%. This performance is underpinned by a significant earnings increase of 25.5% per year, showcasing dely’s potential to scale operations and enhance shareholder value effectively amidst a competitive tech landscape.

Seize The Opportunity

- Take a closer look at our High Growth Tech and AI Stocks list of 1316 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688322

High growth potential with excellent balance sheet.