- China

- /

- Electronic Equipment and Components

- /

- SZSE:002456

Is OFILM Group (SZSE:002456) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies OFILM Group Co., Ltd. (SZSE:002456) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for OFILM Group

What Is OFILM Group's Debt?

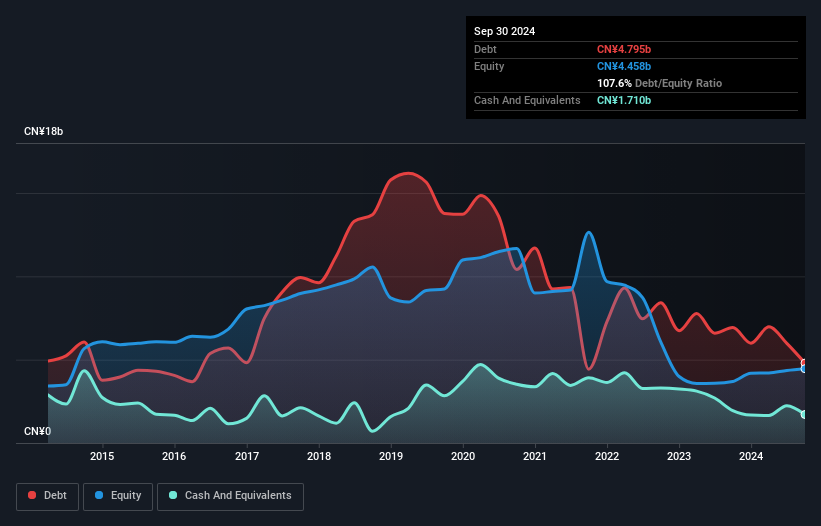

As you can see below, OFILM Group had CN¥4.80b of debt at September 2024, down from CN¥6.92b a year prior. However, because it has a cash reserve of CN¥1.71b, its net debt is less, at about CN¥3.08b.

How Healthy Is OFILM Group's Balance Sheet?

According to the last reported balance sheet, OFILM Group had liabilities of CN¥14.3b due within 12 months, and liabilities of CN¥2.51b due beyond 12 months. Offsetting these obligations, it had cash of CN¥1.71b as well as receivables valued at CN¥7.45b due within 12 months. So it has liabilities totalling CN¥7.62b more than its cash and near-term receivables, combined.

Since publicly traded OFILM Group shares are worth a total of CN¥40.0b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Even though OFILM Group's debt is only 2.3, its interest cover is really very low at 2.3. The main reason for this is that it has such high depreciation and amortisation. While companies often boast that these charges are non-cash, most such businesses will therefore require ongoing investment (that is not expensed.) Either way there's no doubt the stock is using meaningful leverage. Notably, OFILM Group made a loss at the EBIT level, last year, but improved that to positive EBIT of CN¥616m in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine OFILM Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. During the last year, OFILM Group burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

We'd go so far as to say OFILM Group's conversion of EBIT to free cash flow was disappointing. But at least its level of total liabilities is not so bad. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making OFILM Group stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 2 warning signs we've spotted with OFILM Group (including 1 which shouldn't be ignored) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002456

OFILM Group

Engages in the design, research, development, production, and sale of optoelectronic products and technologies in Mainland China and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.