- China

- /

- Electronic Equipment and Components

- /

- SZSE:002456

Improved Revenues Required Before OFILM Group Co., Ltd. (SZSE:002456) Stock's 32% Jump Looks Justified

OFILM Group Co., Ltd. (SZSE:002456) shareholders have had their patience rewarded with a 32% share price jump in the last month. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

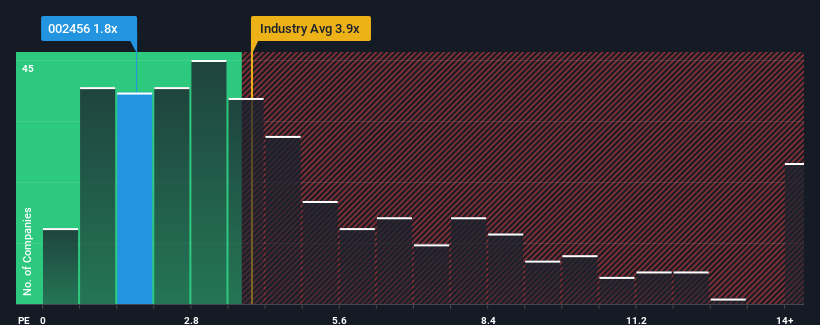

Although its price has surged higher, OFILM Group's price-to-sales (or "P/S") ratio of 1.8x might still make it look like a strong buy right now compared to the wider Electronic industry in China, where around half of the companies have P/S ratios above 3.9x and even P/S above 8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for OFILM Group

How OFILM Group Has Been Performing

With revenue growth that's superior to most other companies of late, OFILM Group has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OFILM Group.How Is OFILM Group's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like OFILM Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 50%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 45% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 22% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 26%, which is noticeably more attractive.

With this information, we can see why OFILM Group is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From OFILM Group's P/S?

Shares in OFILM Group have risen appreciably however, its P/S is still subdued. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of OFILM Group's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware OFILM Group is showing 2 warning signs in our investment analysis, and 1 of those is potentially serious.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002456

OFILM Group

Engages in the design, research, development, production, and sale of optoelectronic products and technologies in Mainland China and internationally.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives