- China

- /

- Electronic Equipment and Components

- /

- SZSE:002456

A Piece Of The Puzzle Missing From OFILM Group Co., Ltd.'s (SZSE:002456) Share Price

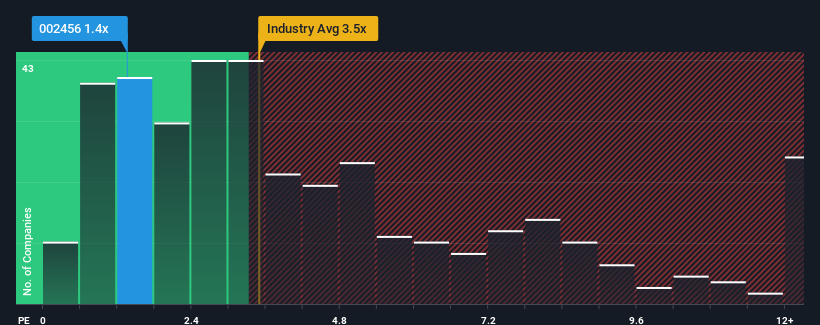

You may think that with a price-to-sales (or "P/S") ratio of 1.4x OFILM Group Co., Ltd. (SZSE:002456) is definitely a stock worth checking out, seeing as almost half of all the Electronic companies in China have P/S ratios greater than 3.5x and even P/S above 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for OFILM Group

What Does OFILM Group's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, OFILM Group has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think OFILM Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is OFILM Group's Revenue Growth Trending?

In order to justify its P/S ratio, OFILM Group would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 45% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 59% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 23% over the next year. With the industry predicted to deliver 25% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that OFILM Group's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does OFILM Group's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of OFILM Group's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 2 warning signs for OFILM Group (1 shouldn't be ignored!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002456

OFILM Group

Engages in the development, production, and operation of optoelectronic devices, system equipment, network, communication components, electronic special equipment, and instruments in China and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives