- China

- /

- Aerospace & Defense

- /

- SZSE:300324

3 Asian Penny Stocks With Market Caps Over US$800M

Reviewed by Simply Wall St

Amid escalating trade tensions and fluctuating consumer sentiment, global markets have been experiencing a turbulent period, with Asian markets particularly feeling the impact. For investors exploring opportunities beyond well-known large-cap stocks, penny stocks—despite their vintage connotation—continue to offer intriguing prospects. These smaller or newer companies can present unique growth opportunities when backed by strong financials and robust fundamentals, making them a noteworthy consideration for those seeking potential rewards in uncertain times.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Rojana Industrial Park (SET:ROJNA) | THB4.78 | THB9.66B | ✅ 3 ⚠️ 3 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.12 | THB2.55B | ✅ 4 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.189 | SGD37.65M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.04 | SGD8.04B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$3.15 | HK$1.29B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.95 | HK$45.24B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.02 | HK$643.57M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.09 | HK$1.82B | ✅ 4 ⚠️ 2 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥2.99 | CN¥3.46B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,148 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

HuBei NengTer TechnologyLtd (SZSE:002102)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: HuBei NengTer Technology Co., Ltd operates an ecommerce platform focused on the supply chain of plastic raw materials in China, with a market cap of CN¥7.29 billion.

Operations: HuBei NengTer Technology Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥7.29B

HuBei NengTer Technology Co., Ltd, with a market cap of CN¥7.29 billion, operates in the supply chain of plastic raw materials and recently reported sales of CN¥12.28 billion for 2024 but incurred a net loss of CN¥488.94 million, reflecting profitability challenges. Despite being unprofitable, the company has more cash than debt and its short-term assets cover both short- and long-term liabilities. The board's average tenure suggests recent changes in leadership. Notably, HuBei NengTer completed a significant share buyback program worth CN¥308.6 million, potentially signaling confidence in its valuation amidst ongoing financial restructuring efforts.

- Click to explore a detailed breakdown of our findings in HuBei NengTer TechnologyLtd's financial health report.

- Understand HuBei NengTer TechnologyLtd's track record by examining our performance history report.

Suzhou Victory Precision Manufacture (SZSE:002426)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Suzhou Victory Precision Manufacture Co., Ltd. operates in the precision manufacturing industry, with a market capitalization of CN¥9.29 billion.

Operations: Suzhou Victory Precision Manufacture Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥9.29B

Suzhou Victory Precision Manufacture Co., Ltd., with a market cap of CN¥9.29 billion, operates in the precision manufacturing industry and is currently unprofitable. Although its short-term assets (CN¥2.8 billion) fall short of covering its short-term liabilities (CN¥3.7 billion), the company maintains a stable weekly volatility of 9% over the past year, indicating some degree of price stability. The firm has reduced losses at a rate of 35.2% annually over five years, suggesting progress towards profitability despite a high net debt to equity ratio (49.3%). Its experienced board and management team may provide strategic stability moving forward.

- Take a closer look at Suzhou Victory Precision Manufacture's potential here in our financial health report.

- Assess Suzhou Victory Precision Manufacture's previous results with our detailed historical performance reports.

Beijing Watertek Information Technology (SZSE:300324)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beijing Watertek Information Technology Co., Ltd. operates in the technology sector, focusing on providing information technology solutions, and has a market cap of CN¥6.43 billion.

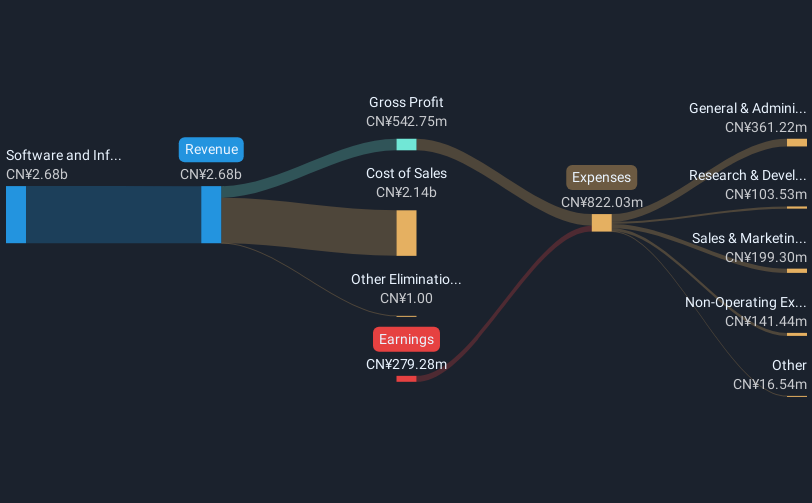

Operations: The company generates revenue from the Software and Information Technology Services Industry, amounting to CN¥2.68 billion.

Market Cap: CN¥6.43B

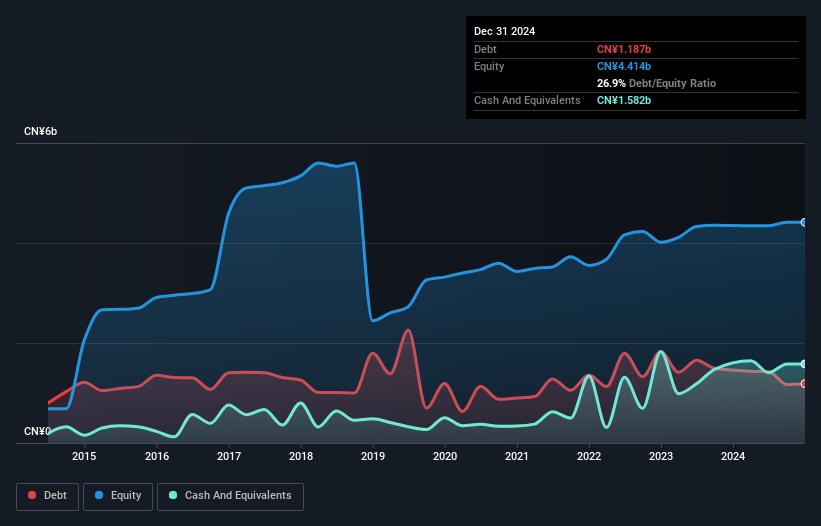

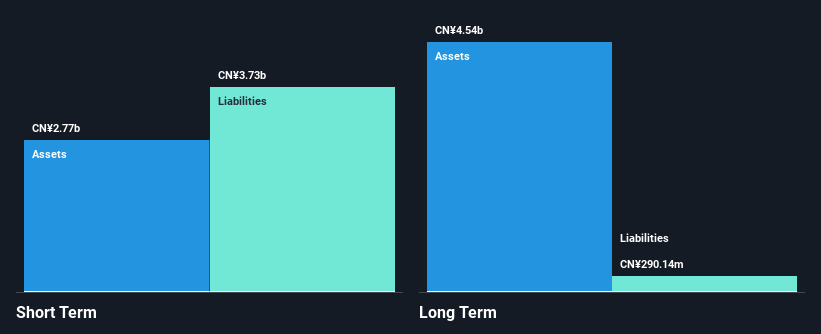

Beijing Watertek Information Technology Co., Ltd., with a market cap of CN¥6.43 billion, operates in the technology sector and is currently unprofitable. Despite this, the company benefits from an experienced management team with an average tenure of 6.6 years and a seasoned board averaging 4.6 years. Its financial position is relatively strong, as short-term assets (CN¥3.4 billion) exceed both short-term liabilities (CN¥2.1 billion) and long-term liabilities (CN¥256.8 million). The firm's cash reserves surpass its total debt, providing a sufficient runway for over a year based on current free cash flow trends despite high share price volatility recently.

- Jump into the full analysis health report here for a deeper understanding of Beijing Watertek Information Technology.

- Learn about Beijing Watertek Information Technology's historical performance here.

Make It Happen

- Jump into our full catalog of 1,148 Asian Penny Stocks here.

- Seeking Other Investments? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Watertek Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300324

Beijing Watertek Information Technology

Beijing Watertek Information Technology Co., Ltd.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives