As global markets react to mixed economic signals and heightened investor uncertainty, the focus has shifted towards more stable investment opportunities. Amidst this backdrop, dividend stocks stand out for their potential to provide consistent income and mitigate volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.49% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.57% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 4.37% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.11% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.17% | ★★★★★★ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.51% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 7.50% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.74% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.30% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★★ |

Click here to see the full list of 2252 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Presco (NGSE:PRESCO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Presco Plc operates in Nigeria, focusing on oil palm plantations development, palm oil milling, palm kernel processing, and vegetable oil refining, with a market cap of NGN441 billion.

Operations: Presco Plc's revenue primarily comes from its food processing segment, which generated NGN142.37 billion.

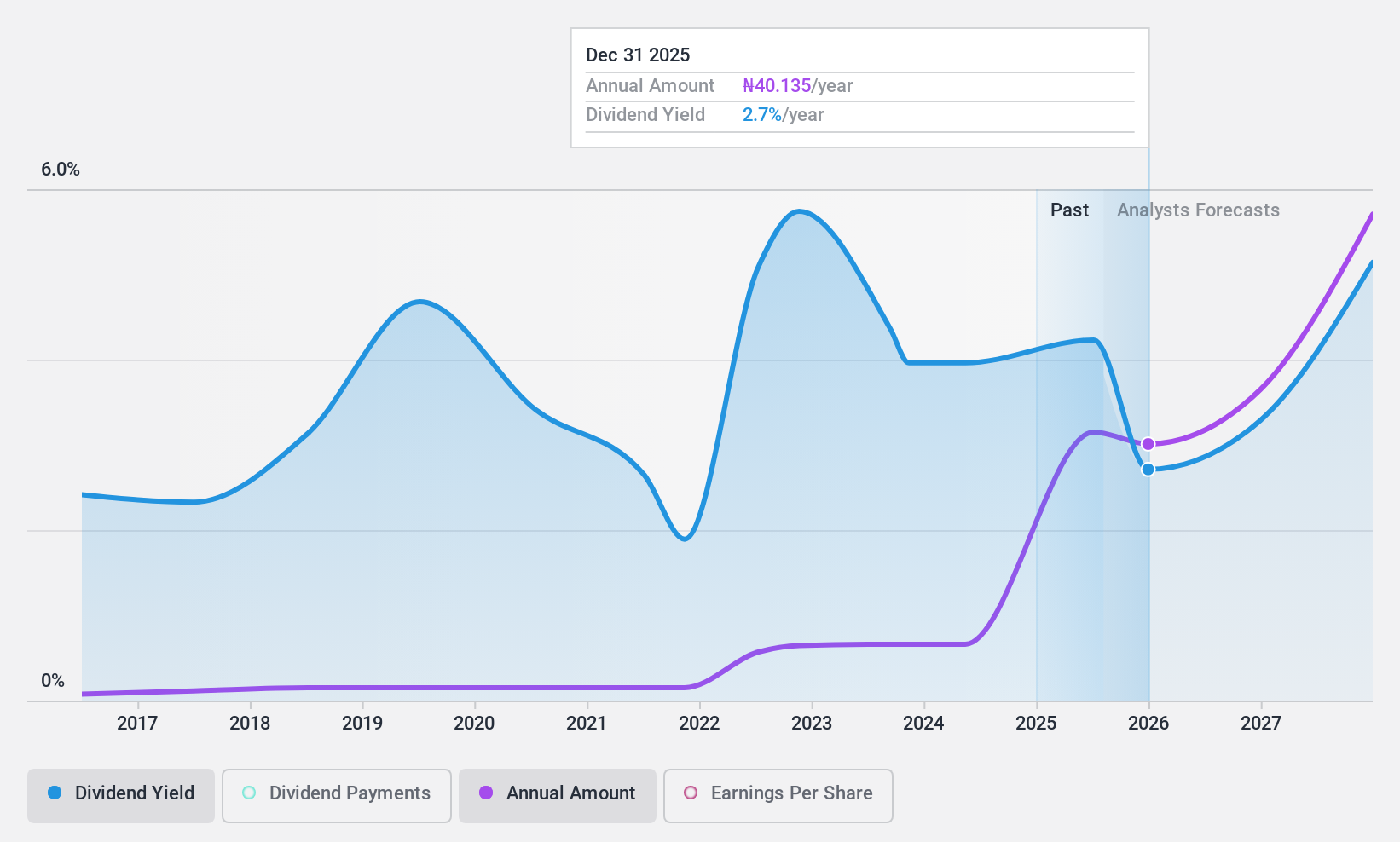

Dividend Yield: 6%

Presco Plc's recent earnings report shows strong growth, with net income for Q2 2024 at NGN 14.82 billion, up from NGN 5.12 billion a year ago. The company's dividend is well-covered by both earnings (payout ratio: 46.4%) and free cash flows (cash payout ratio: 47.9%). Although its dividend yield of 5.96% is below the top quartile in the Nigerian market, it has been stable and growing over the past decade despite high debt levels.

- Dive into the specifics of Presco here with our thorough dividend report.

- Our expertly prepared valuation report Presco implies its share price may be lower than expected.

Comefly Outdoor (SHSE:603908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Comefly Outdoor Co., Ltd. (MOBI GARDEN) specializes in the research, design, development, and sale of outdoor products in China with a market cap of CN¥1.79 billion.

Operations: Comefly Outdoor Co., Ltd. (MOBI GARDEN) generates its revenue primarily from the sale of apparel, amounting to CN¥1.47 billion.

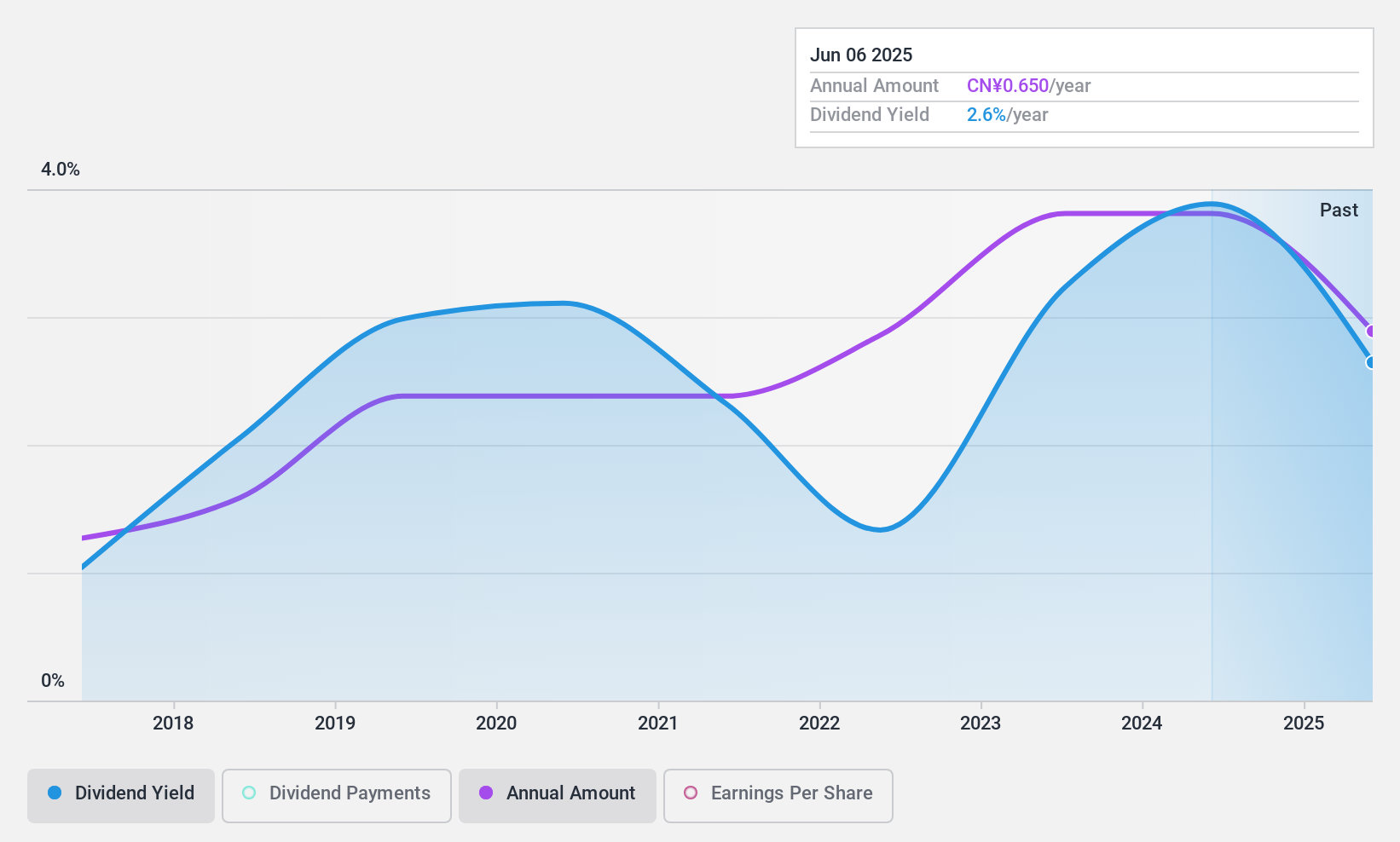

Dividend Yield: 4.1%

Comefly Outdoor trades at 39% below its estimated fair value, with a dividend yield of 4.07%, placing it in the top 25% of CN market payers. While the company has only paid dividends for seven years, these payments have been stable and growing. The dividend is covered by earnings (payout ratio: 72.7%) and cash flows (cash payout ratio: 48.2%), though its track record remains relatively short compared to established dividend stocks.

- Delve into the full analysis dividend report here for a deeper understanding of Comefly Outdoor.

- Our valuation report unveils the possibility Comefly Outdoor's shares may be trading at a discount.

Shenzhen Aisidi (SZSE:002416)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shenzhen Aisidi Co., Ltd. offers digital distribution and retail services both in China and internationally, with a market cap of CN¥11.10 billion.

Operations: Shenzhen Aisidi Co., Ltd. generates revenue through its digital distribution and retail services across both domestic and international markets.

Dividend Yield: 4.1%

Shenzhen Aisidi's dividend yield of 4.06% ranks in the top 25% of CN market payers, though its dividend history is volatile and unreliable over the past decade. Despite this, dividends are covered by earnings (payout ratio: 76.4%) and cash flows (cash payout ratio: 57.9%). The company trades at a significant discount to its estimated fair value, making it an attractive option for value investors despite recent dividend decreases for the year 2023.

- Take a closer look at Shenzhen Aisidi's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Shenzhen Aisidi is trading behind its estimated value.

Seize The Opportunity

- Take a closer look at our Top Dividend Stocks list of 2252 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGSE:PRESCO

Presco

Engages in the oil palm plantations development, palm oil milling, palm kernel processing, and vegetable oil refining businesses in Nigeria and Ghana.

Excellent balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026