- Japan

- /

- Entertainment

- /

- TSE:5032

Promising High Growth Tech Stocks to Watch in November 2025

Reviewed by Simply Wall St

As global markets navigate a mixed landscape marked by large-cap tech rallies and small-cap index declines, investors are closely watching the Federal Reserve's recent rate cuts and the temporary U.S.-China trade truce for potential impacts on market sentiment. In this environment, identifying promising high-growth tech stocks involves looking for companies that can capitalize on technological advancements such as artificial intelligence while demonstrating resilience amidst broader economic shifts.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 32.28% | 34.82% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.16% | 34.94% | ★★★★★★ |

| Pharma Mar | 26.56% | 58.15% | ★★★★★★ |

| Fositek | 36.94% | 47.79% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| KebNi | 23.66% | 69.18% | ★★★★★★ |

| CD Projekt | 36.72% | 49.58% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Devsisters (KOSDAQ:A194480)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Devsisters Corporation is a South Korean company that develops mobile games both domestically and internationally, with a market cap of ₩446.81 billion.

Operations: The company generates revenue primarily from its mobile game development activities. Its computer graphics segment contributes ₩303.26 million to the overall revenue, indicating a focus on integrating advanced visual elements into its gaming products.

Devsisters' recent strategic maneuvers, including a private placement of bonds raising KRW 39.45 billion, underscore its proactive approach to fueling growth and innovation. With revenue growth outpacing the South Korean market average at 11.9% annually and earnings expected to surge by 21.88% per year, the company is positioning itself robustly within the tech sector. This financial trajectory is complemented by an aggressive R&D stance, as indicated by substantial investment in development sectors that could pivot future market dynamics significantly. Such financial health and strategic R&D investments not only enhance Devsisters' competitive edge but also hint at its potential to sustain momentum in a rapidly evolving industry landscape.

- Click here and access our complete health analysis report to understand the dynamics of Devsisters.

Understand Devsisters' track record by examining our Past report.

Shenzhen Aisidi (SZSE:002416)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Aisidi Co., Ltd. is engaged in digital distribution and retail services both in China and internationally, with a market cap of CN¥15.47 billion.

Operations: Aisidi focuses on digital distribution and retail services, generating revenue primarily from its operations in China and abroad. The company has a market cap of approximately CN¥15.47 billion, reflecting its significant presence in the industry.

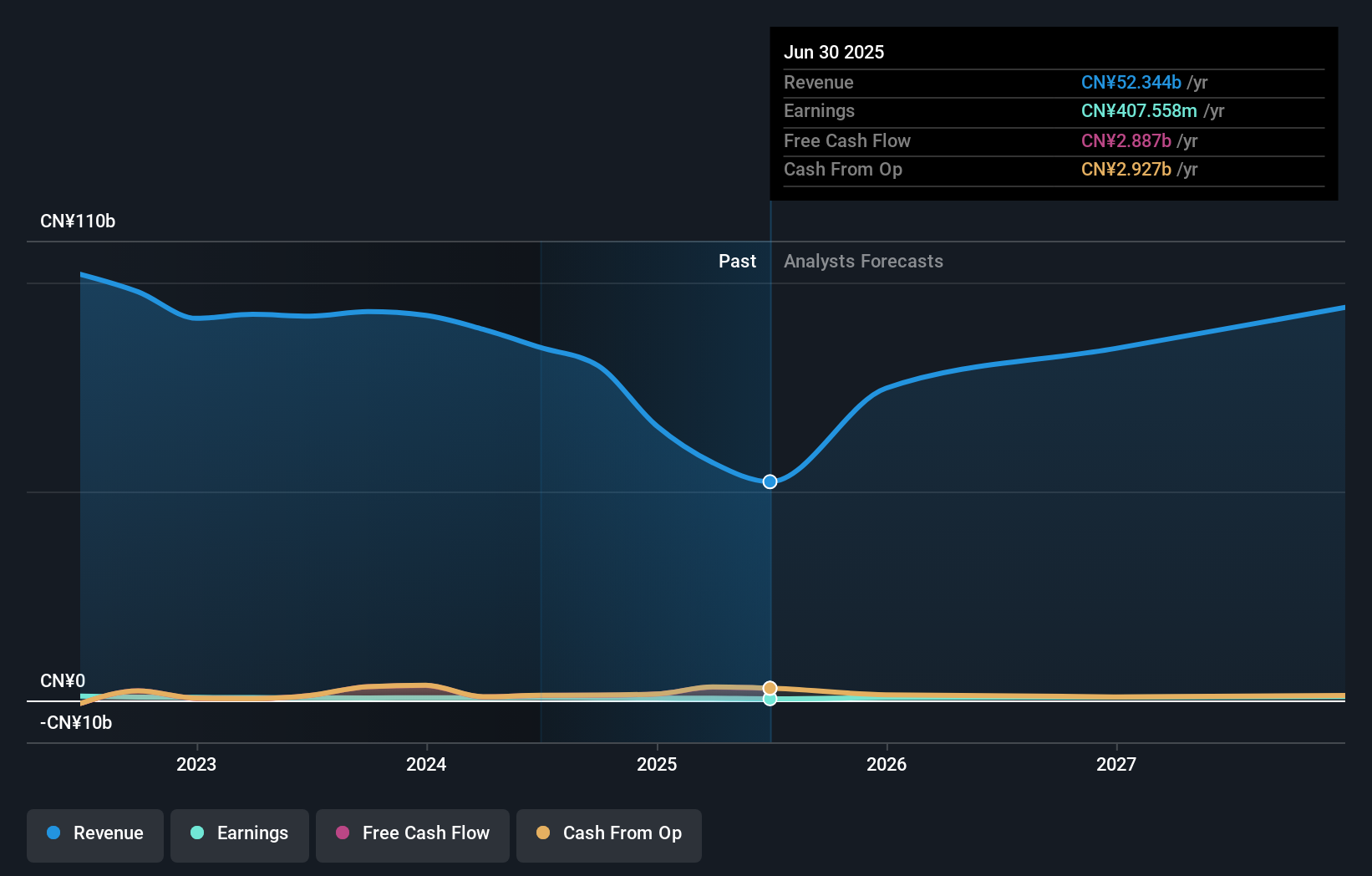

Shenzhen Aisidi, navigating through a challenging fiscal year with sales dropping to CNY 39.33 billion from CNY 57.38 billion, still showcases resilience with an expected earnings growth of 29.8% annually. This contrasts starkly with its recent performance where net income fell to CNY 337.16 million from CNY 524.99 million, reflecting broader market conditions rather than internal failings alone. Despite these hurdles, the company's commitment to innovation is evident in its R&D strategy, crucial for maintaining competitiveness in China's fast-paced tech landscape where annual revenue growth is projected at a robust 22.5%.

- Click to explore a detailed breakdown of our findings in Shenzhen Aisidi's health report.

Examine Shenzhen Aisidi's past performance report to understand how it has performed in the past.

ANYCOLOR (TSE:5032)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ANYCOLOR Inc. is an entertainment company with operations in Japan and internationally, and it has a market capitalization of ¥369.01 billion.

Operations: ANYCOLOR Inc. generates revenue primarily from its entertainment operations across Japan and international markets. The company has a market capitalization of ¥369.01 billion, reflecting its significant presence in the industry.

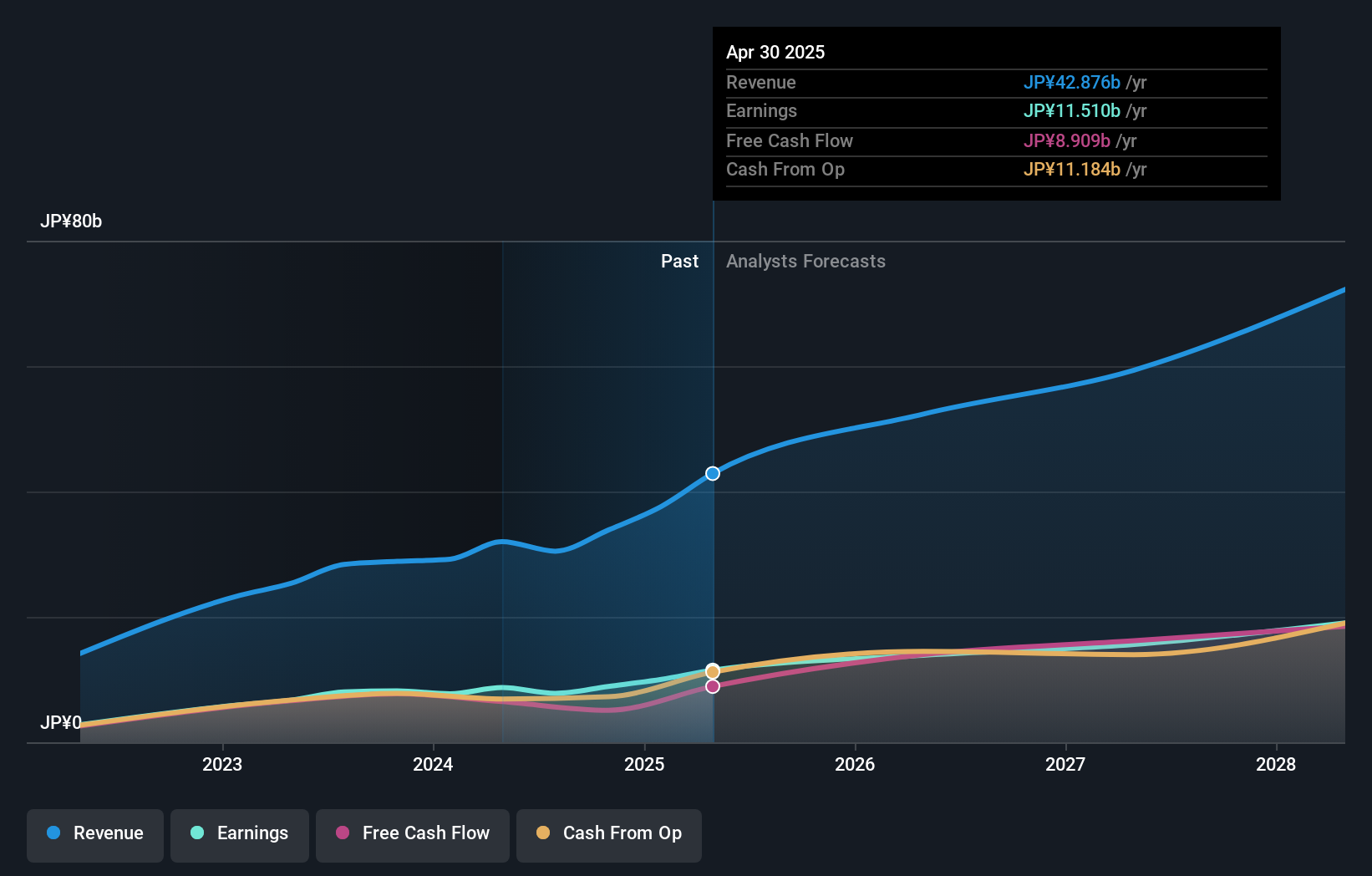

ANYCOLOR Inc. has demonstrated a robust financial trajectory, revising its earnings guidance upward due to successful VTuber anniversary initiatives and merchandise strategies that boosted engagement and revenue. With an annualized revenue growth forecast at 12.3% and earnings expected to rise by 11.6% per year, the company is outpacing the Japanese market's average. Particularly notable is ANYCOLOR's R&D commitment, which remains integral as they continue innovating in the digital entertainment space—a sector driven by dynamic content creation and audience interaction trends. This strategic focus not only enhances their market position but also aligns with broader industry shifts towards immersive digital experiences, suggesting promising prospects for sustained growth.

- Dive into the specifics of ANYCOLOR here with our thorough health report.

Explore historical data to track ANYCOLOR's performance over time in our Past section.

Summing It All Up

- Investigate our full lineup of 234 Global High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5032

ANYCOLOR

Operates as an entertainment company in Japan and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion