- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A006400

High Growth Tech Stocks in Asia with Promising Potential

Reviewed by Simply Wall St

As global markets experience a mix of inflationary pressures and economic growth, the Asian tech sector stands out with its resilience and potential for high growth. In such an environment, identifying promising tech stocks requires a focus on companies that demonstrate strong innovation capabilities and adaptability to evolving market demands.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.23% | 29.66% | ★★★★★★ |

| Gold Circuit Electronics | 20.76% | 25.89% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| Fositek | 30.43% | 37.34% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Marketingforce Management | 27.79% | 111.80% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Samsung SDI (KOSE:A006400)

Simply Wall St Growth Rating: ★★★★☆☆

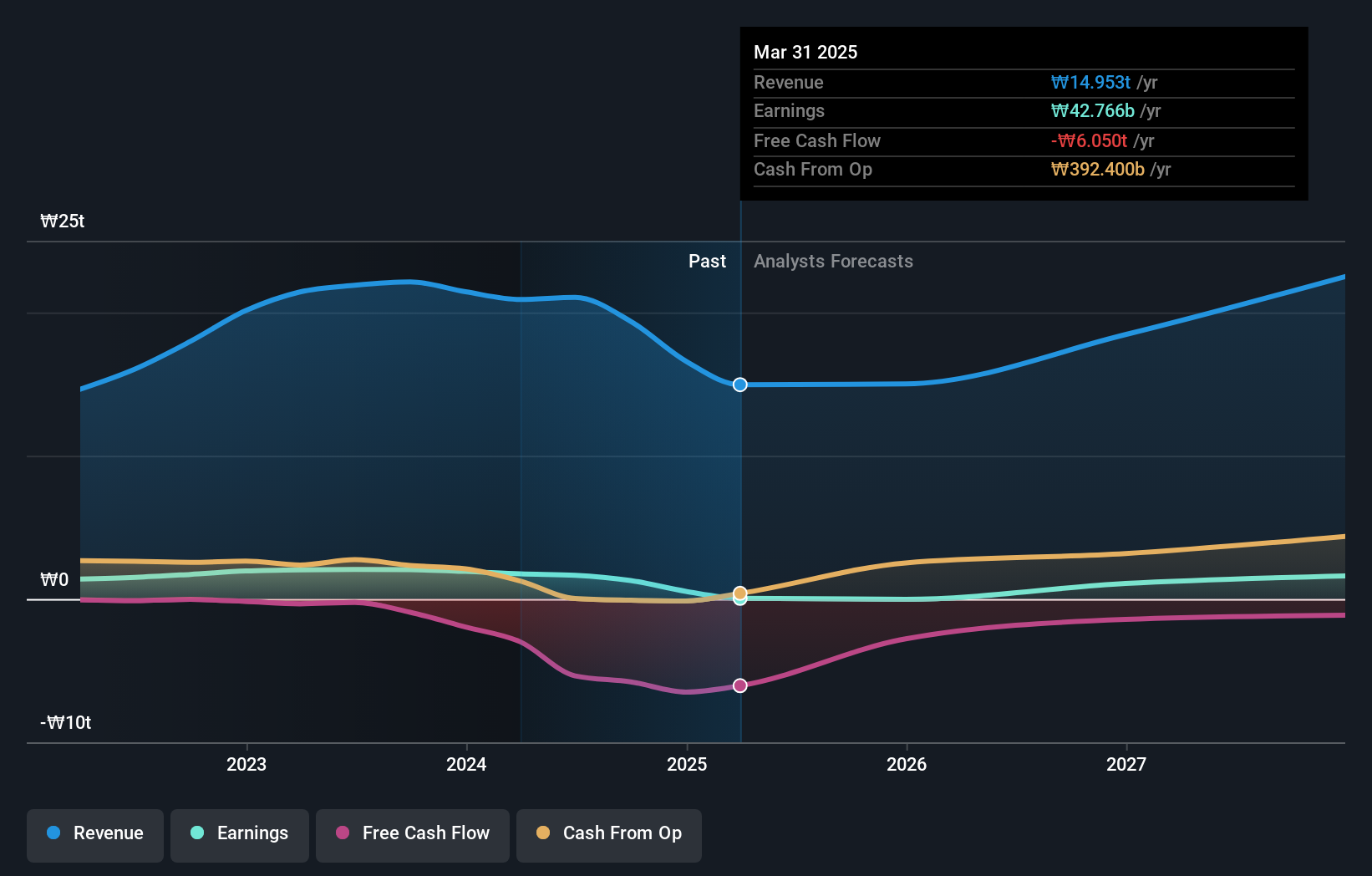

Overview: Samsung SDI Co., Ltd. is a global manufacturer and seller of batteries, operating across South Korea, Europe, China, North America, Southeast Asia, and other international markets with a market cap of ₩14.88 trillion.

Operations: Samsung SDI generates revenue primarily from its battery segment, contributing ₩14.09 trillion, and electronic materials, which add ₩862.47 billion. The company's operations span multiple regions including South Korea, Europe, and North America.

Samsung SDI, a major player in the Asian tech scene, has demonstrated robust growth metrics that underscore its potential in high-growth markets. With an annualized revenue increase of 14.1%, the company outpaces the Korean market average of 6.8%. This financial vigor is complemented by an impressive forecast for earnings growth at 49.8% annually, significantly higher than the broader market's 20.8%. Recent strategic moves include a follow-on equity offering raising KRW 1.65 trillion and participation in several global tech conferences, signaling ongoing expansion and visibility efforts in critical markets.

- Click to explore a detailed breakdown of our findings in Samsung SDI's health report.

Explore historical data to track Samsung SDI's performance over time in our Past section.

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

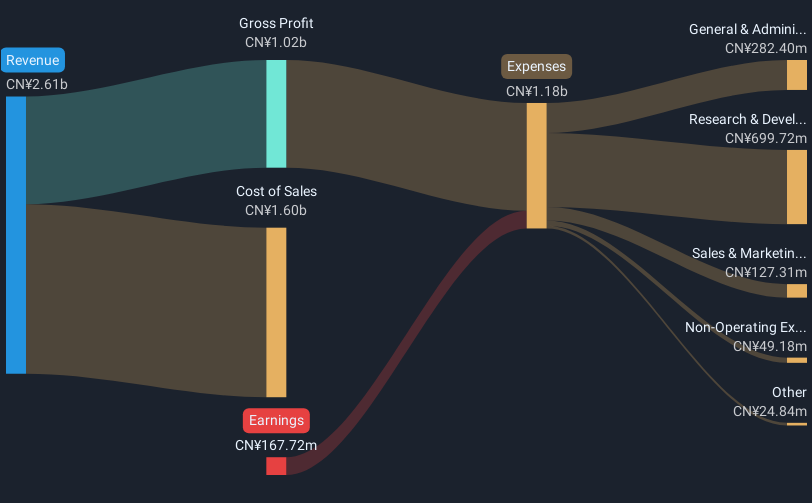

Overview: Wuhan Guide Infrared Co., Ltd. specializes in the research, development, production, and sale of infrared thermal imaging technology across Asia with a market capitalization of CN¥45.57 billion.

Operations: Guide Infrared focuses on the development and commercialization of infrared thermal imaging technology. The company operates primarily in Asia, leveraging its expertise to produce and sell advanced imaging solutions.

Wuhan Guide Infrared stands out in the Asian tech landscape with a notable 23% annual revenue growth, significantly surpassing the Chinese market average of 12.4%. Despite current unprofitability, earnings are projected to surge by an impressive 100.33% annually, positioning the company for a robust financial turnaround within three years. Recent shareholder endorsements for business expansion and amendments to corporate governance underscore strategic agility and responsiveness to market demands, further bolstering its growth trajectory amidst evolving technological landscapes.

- Navigate through the intricacies of Wuhan Guide Infrared with our comprehensive health report here.

Gain insights into Wuhan Guide Infrared's past trends and performance with our Past report.

Co-Tech Development (TPEX:8358)

Simply Wall St Growth Rating: ★★★★☆☆

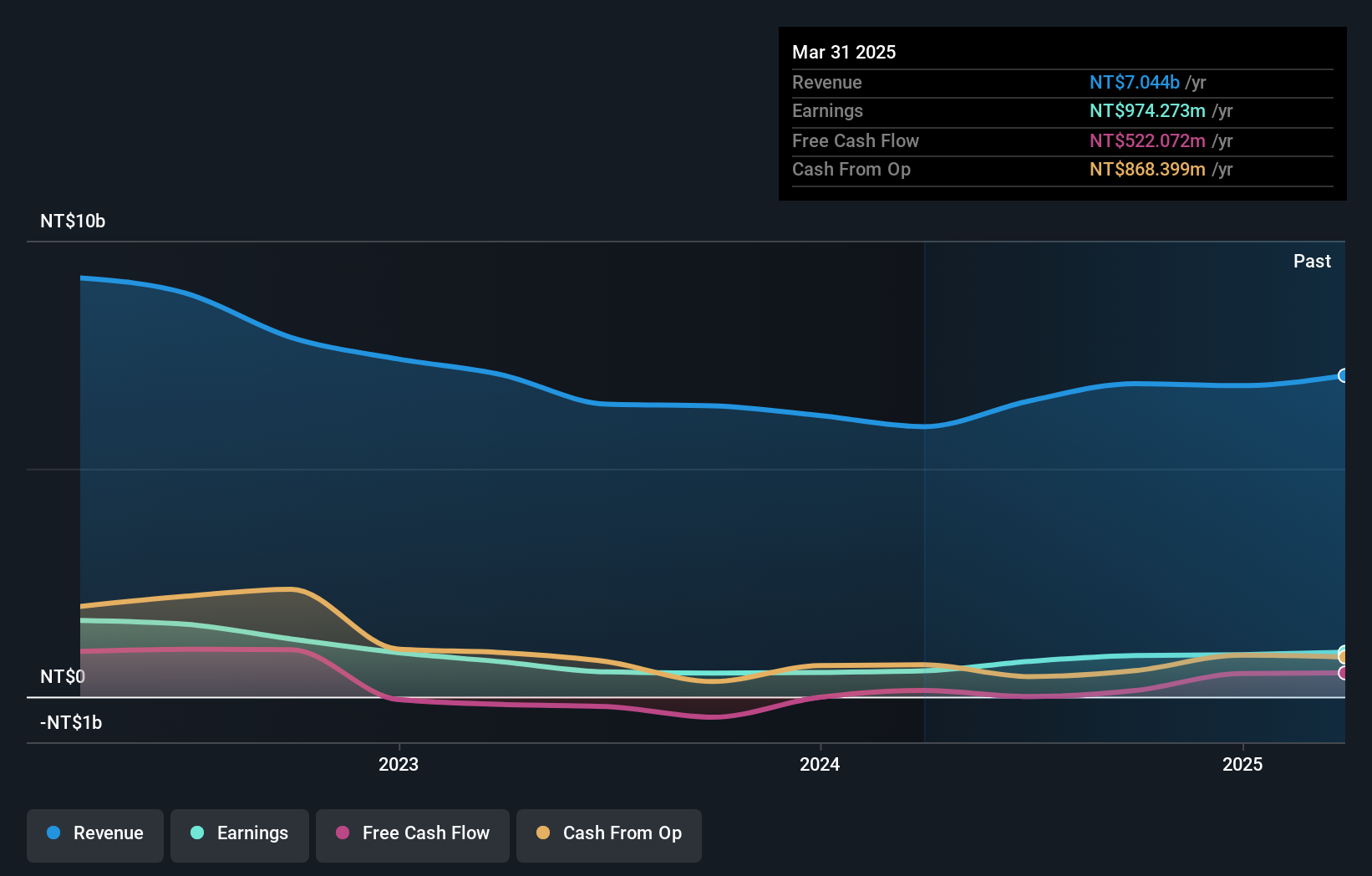

Overview: Co-Tech Development Corporation, with a market cap of NT$24.61 billion, specializes in producing and selling copper foil for the printed circuit board industry in Taiwan and China.

Operations: The company generates revenue primarily from the copper foil segment, amounting to NT$7.04 billion.

Co-Tech Development is navigating a transformative phase with strategic board reshuffles and robust financial maneuvers, signaling agility in its governance and market strategies. With a revenue jump to TWD 1.73 billion, up from TWD 1.51 billion year-over-year, and net income rising to TWD 265 million from TWD 213 million, the firm is on a solid growth trajectory. Notably, its recent share buyback of 170,000 shares for TWD 9.31 million underscores confidence in its financial health and future prospects.

- Delve into the full analysis health report here for a deeper understanding of Co-Tech Development.

Evaluate Co-Tech Development's historical performance by accessing our past performance report.

Next Steps

- Embark on your investment journey to our 480 Asian High Growth Tech and AI Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A006400

Samsung SDI

Manufactures and sells batteries in South Korea, Europe, China, North America, Southeast Asia, and internationally.

Reasonable growth potential slight.

Similar Companies

Market Insights

Community Narratives