As the Asian tech sector navigates a landscape marked by evolving U.S.-China trade dynamics and ongoing economic adjustments, investors are keenly observing how these factors impact growth trajectories. In such an environment, identifying high-growth tech stocks involves assessing companies that demonstrate resilience through innovation and adaptability in response to shifting market conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 24.08% | 28.54% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| ASROCK Incorporation | 28.31% | 29.76% | ★★★★★★ |

| PharmaEssentia | 34.00% | 50.89% | ★★★★★★ |

| Fositek | 34.27% | 44.80% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

CARsgen Therapeutics Holdings (SEHK:2171)

Simply Wall St Growth Rating: ★★★★★★

Overview: CARsgen Therapeutics Holdings Limited is an investment holding company focused on the discovery, development, and commercialization of CAR-T cell therapies for treating hematological malignancies, solid tumors, and autoimmune diseases in China with a market cap of HK$8.93 billion.

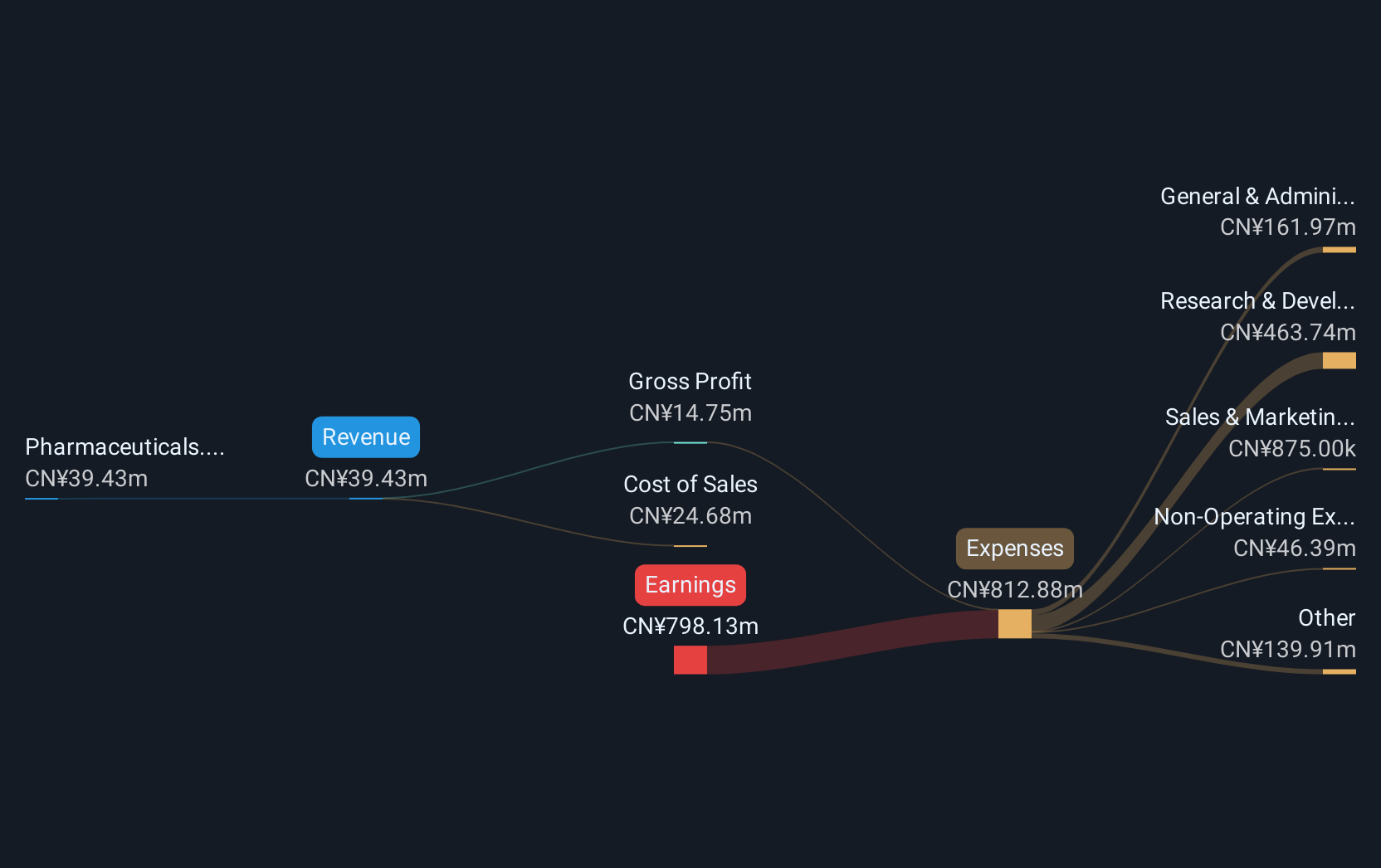

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to CN¥84.05 million. As a developer of CAR-T cell therapies, it focuses on innovative treatments for various medical conditions in China.

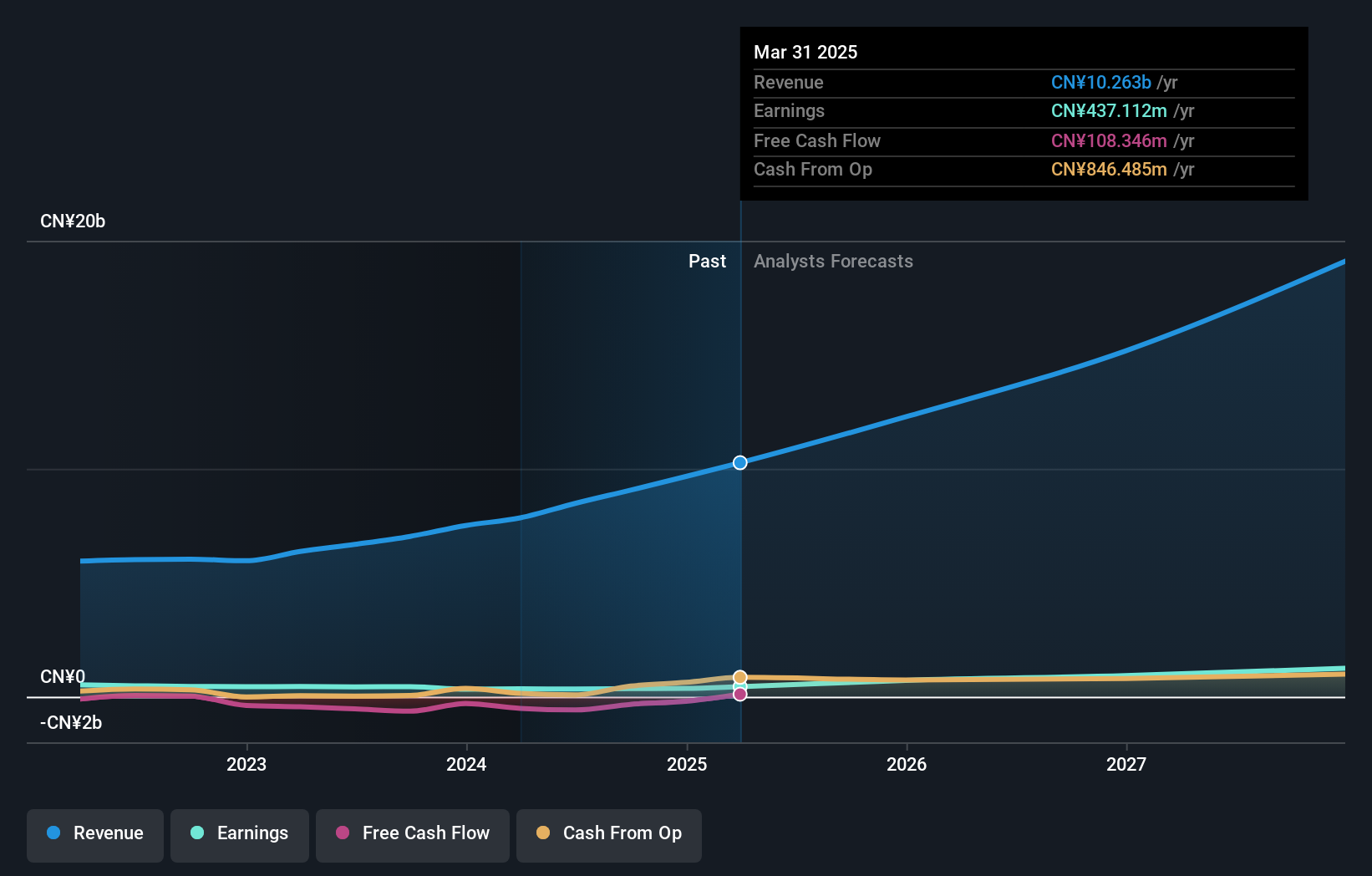

CARsgen Therapeutics Holdings, a trailblazer in the biotech sector, is making significant strides with its proprietary CAR-T therapies. With an impressive annual revenue growth forecast at 100.4%, the company is outpacing the Hong Kong market's average of 8.7%. This growth is underpinned by innovative treatments like CT0596 and CT071, which have shown promising results in clinical trials for multiple myeloma and plasma cell leukemia. Despite currently being unprofitable, CARsgen anticipates profitability within three years, supported by robust R&D investments that are shaping its pipeline of next-generation therapies. The firm's focus on complex malignancies where conventional treatments falter positions it uniquely in high-growth markets, potentially revolutionizing treatment paradigms upon successful drug development and regulatory approvals.

Shenzhen H&T Intelligent ControlLtd (SZSE:002402)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen H&T Intelligent Control Co.Ltd, with a market cap of CN¥46.48 billion, engages in the research, development, manufacturing, sales, and marketing of intelligent controller products both in China and internationally.

Operations: The company focuses on intelligent controller products, serving both domestic and international markets. It leverages its expertise in research, development, and manufacturing to drive sales across these regions.

Shenzhen H&T Intelligent Control Co.Ltd, a dynamic presence in the Asian tech landscape, reported a robust earnings growth of 54.9% over the past year, outpacing its industry's average of 4.2%. This performance is anchored by an impressive annual revenue increase of 21.4%, significantly above the CN market's forecast of 13.7%. The company's commitment to innovation is evident in its R&D spending trends which have consistently aligned with or exceeded sector averages, ensuring sustained development and refinement of their control systems technologies. Notably, recent shareholder meetings have underscored strategic amendments aimed at bolstering corporate governance and operational agility—moves that could enhance future market positioning and financial health amidst volatile tech landscapes.

Zhejiang Meorient Commerce Exhibition (SZSE:300795)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhejiang Meorient Commerce Exhibition Inc. operates in the exhibition and trade show industry, with a market capitalization of CN¥4.11 billion.

Operations: Zhejiang Meorient Commerce Exhibition Inc. generates revenue primarily through organizing and managing trade shows and exhibitions. The company's financial performance is reflected in its market capitalization of CN¥4.11 billion, indicating its significant presence in the industry.

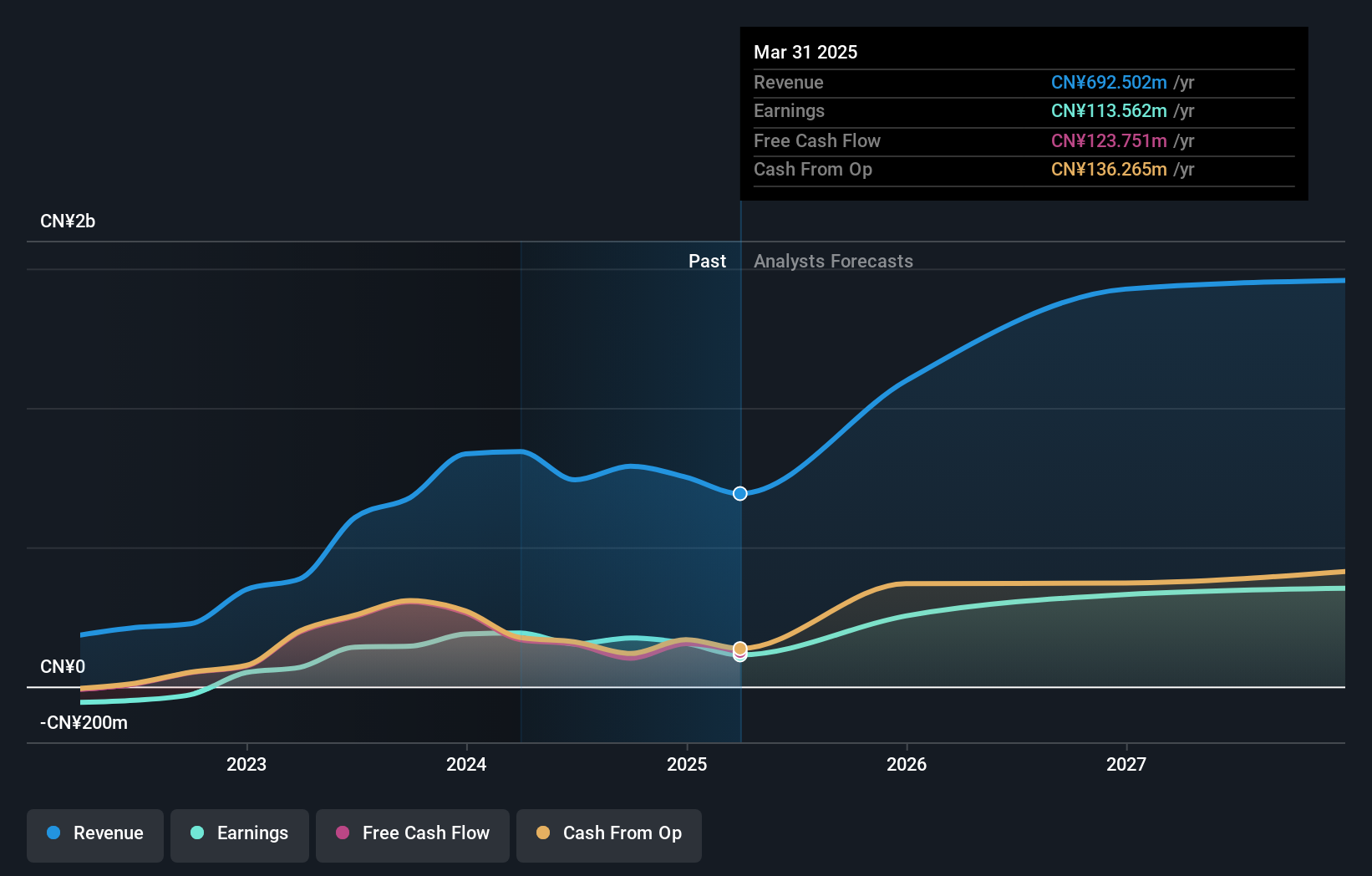

Zhejiang Meorient Commerce Exhibition has demonstrated a notable financial performance, with its revenue forecast to expand by 25.1% annually, outpacing the CN market's average growth of 13.7%. This robust growth trajectory is complemented by an expected earnings increase of 33.3% per year, significantly higher than the market's 26.1%. The company's commitment to innovation and market expansion is further evidenced by its recent shareholder meetings where interim dividends were affirmed and strategic plans for profit distribution were discussed, reflecting a proactive approach in capital management and shareholder value enhancement amidst shifting market dynamics.

- Click here and access our complete health analysis report to understand the dynamics of Zhejiang Meorient Commerce Exhibition.

Learn about Zhejiang Meorient Commerce Exhibition's historical performance.

Summing It All Up

- Get an in-depth perspective on all 187 Asian High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2171

CARsgen Therapeutics Holdings

An investment holding company, engages in discovering, developing, and commercializing chimeric antigen receptor T (CAR-T) cell therapies for the treatment of hematological malignancies, solid tumors, and autoimmune diseases in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives